As I predicted early in 2023 and late last year, the SPDR® Portfolio S&P 500 Growth ETF (NYSEARCA:SPYG) has performed exceptionally well on the back of solid economic and earnings growth. I now anticipate that SPYG is highly likely to extend the uptrend into the final quarter and fiscal 2024. The volatility created by the Fed’s hawkish stance won’t last long due to several reasons, including robust economic growth, low inflation, solid earnings growth outlook, and increasing investor confidence in tech stocks. Therefore, I’m maintaining my buy recommendation for SPYG.

The Uptrend Is Likely to Continue

The US stock market has taken a hit and investor sentiment has been dented by the Fed’s stance of another rate hike later this year along with two fewer cuts in 2024 than previously anticipated. I believe the Fed’s hawkish stance won’t create a significant impact on the economy and stock market because the US economy has already skipped recession, with high prospects of expansion in the following quarters. Moreover, the financial sector is in good shape while overall corporate profitability has started to grow. Inflation plunged to a 3% range from the 40-year high of 9% last year while the unemployment rate continues to hover near lows and job growth is robust. The Fed’s tightening strategy would only help in slowing inflation and preventing the economy from overheating. Therefore, I expect robust economic conditions to offset the impact of high rates and boost investor confidence in risky assets like growth stocks and ETFs.

Another reason for the continuation of the bull run is increasing corporate earnings. In the second quarter, 79% of the S&P 500 companies topped Wall Street estimates. In particular, growth companies impressed investors with their healthy growth trends. 91% of information technology companies, which hold nearly 28% weight in the S&P 500 index, outperformed estimates in the second quarter. The tech sector’s earnings grew 4% in the second quarter, compared to expectations for negative 3.5% growth. Companies in the consumer discretionary and communication sectors were also among the top earnings performers in the second quarter.

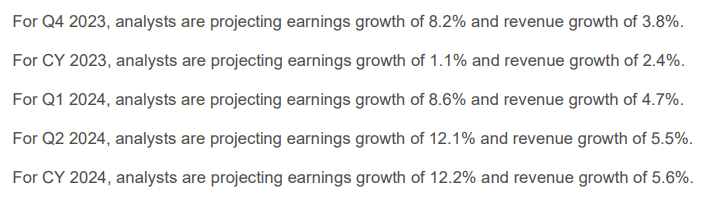

S&P 500 Earnings Forecast (FactSet)

Moreover, the S&P 500’s earnings growth trends are likely to amplify in the coming quarters, thanks to a solid outlook for growth-focused sectors like tech, communication, and consumer discretionary. For fiscal 2023, Wall Street expects the tech sector to generate 3% earnings growth compared to initial expectations for negative growth while consumer discretionary and communication sectors are anticipated to earn 40% and 23% more in 2023 compared to the last year. Furthermore, forecasts indicate that the tech, communication, and consumer discretionary sectors are likely to experience a high double-digit earnings growth in 2024.

Historical data can also help investors understand how the market reacts in various conditions. In the case of inflation, the data show that the stock market performs well in six, twelve, and twenty-four months after inflation peaks. The steady uptrend in the stock market reflects that investor confidence increases when inflation falls. Right now, it appears that history is repeating itself because the stock market has surged nearly 14% since inflation peaked at 9.1% in June 2022. Another critical factor is the stock market’s ability to form long-lasting bull runs following every bear market. In fact, some analysts anticipate the market is in the early stages of the secular bull trend.

SPYG Offers Better Risk-Adjusted Returns In the Bull Run

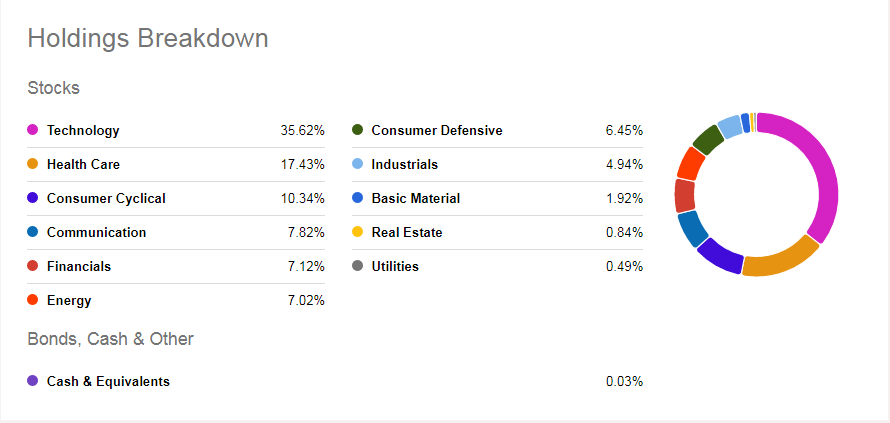

SPYG Portfolio Breakdown (Seeking Alpha)

There are a number of approaches investors can follow to capitalize on the potential bull run based on their risk tolerance. For instance, high-risk investors can fully capitalize on the potential tech-driven bull run by investing in tech-focused ETFs like the iShares U.S. Technology ETF (IYW). Year to date, IYW has generated a total share price return of 41%. On the other hand, investors with moderate risk tolerance can chase growth-focused ETFs. For instance, with roughly 72% of Vanguard Growth Index Fund ETF Shares (VUG) portfolio concentration in the technology, consumer discretionary, and communication sectors, the ETF generated a price return of 28% year to date. It is important to note that ETFs with a higher concentration in technology, communications, and consumer cyclical sectors offer higher returns at a higher risk. As these sectors have high beta, they can also decline faster than the broader market index during downtrends.

Meanwhile, an ETF like SPYG can offer better risk-reward because its portfolio is well diversified across all sectors, with 230 growth stock positions. 52% of its portfolio is made up of technology, communication, and consumer discretionary stocks, and the remaining 48% is composed of growth stocks from other industries such as healthcare, financials, energy, consumer defensive, and industrials.

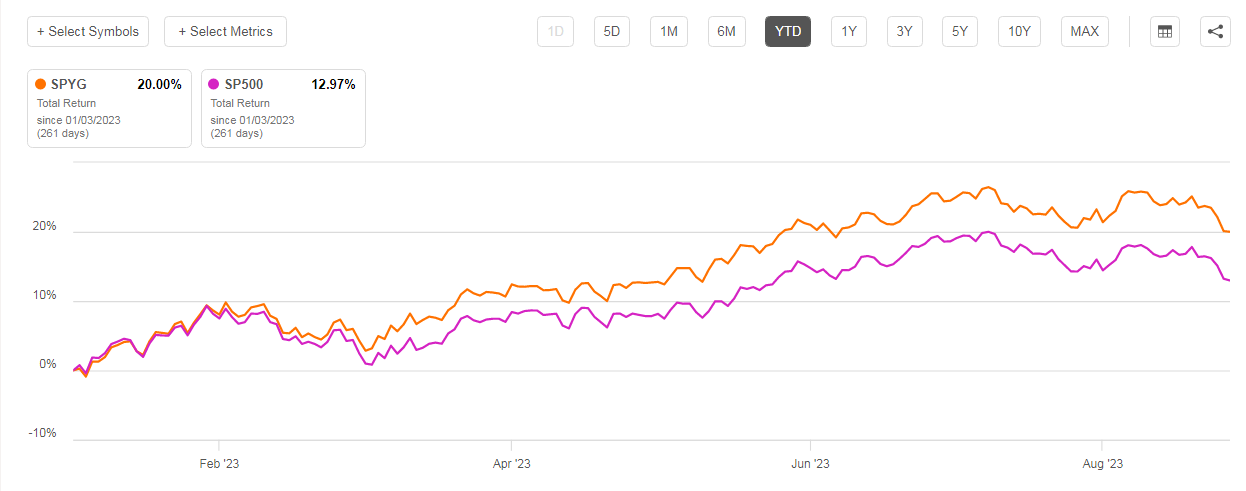

SPYG Total Returns (Seeking Alpha)

Although SPYG’s returns are lower than those of VUG and IYW, investors can still beat the S&P 500 by taking a lower risk. Year to date, SPYG has generated total returns of 20% compared to the S&P 500’s 13%. The ETF’s outperformance is likely to continue if the uptrend extends momentum. Meanwhile, if the stock market faces volatility, its exposure to healthcare, financials, industrials, and consumer defensive sectors would limit the downside.

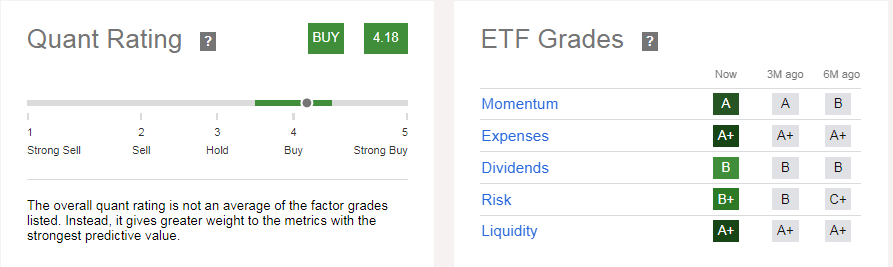

Quant Rating

Quant Rating (Seeking Alpha)

SPYG earned buy ratings with a quant score of 4.18. Although all five factors earned solid grades, an A plus grade on expense and liquidity ratio and a B plus on risk makes it sold ETF to buy and hold. Its expense ratio of 0.04 is very low, which means shareholders will have to pay a low amount in fees compared to the industry median of 0.48%. A plus on liquidity also indicates strong demand for the ETF. In the last three months, SPYG had an average daily trading volume of 1.45 million shares, up from a median of 38K shares and exceeding VUG’s daily share trading volume of 800K. Furthermore, the ETF received a B-plus on the risk factor, confirming my belief that this growth ETF provides a better risk-reward ratio. It has a lower short interest and standard deviation than VUG and the median of all ETFs.

In Conclusion

Despite the Fed’s hawkish stance, I believe that the uptrend that began earlier this year is likely to extend momentum in the final quarter of 2023 and into the following year because economic growth and corporate performance are likely to strengthen investor confidence in growth stocks. Moreover, I believe that SPYG could be one of the best ETFs for investors seeking to outperform the market by taking a lower risk. Therefore, I’m sticking to my previous buy recommendation.

Read the full article here