Investment Rundown

Fracing may not be such a pretty topic to talk about now, given the push for renewables and the general sentiment around emission-producing energy sources. But the fact remains that fracking is a very efficient way of producing commodities and supplying our societies with energy which is only increasing in demand each year as our populations are growing. A company operating in the space is ProFrac Holding Corp (NASDAQ:ACDC) which offers a variety of products and services in the oil and gas sector.

The company experienced some slight drawdowns in the top line in the last quarter and I think this is a temporary issue and not something that will be dragging the company down in the long run. ACDC also managed to generate a significant amount of FCF for the quarter and reduced the debt position as well. Moves like this are why I think that even if there is volatility demand, the fact that ACDC sits in a strong financial position is making the investment case far less risky and ultimately leads to the buy rating I have for them right now.

Company Segments

ACDC is a prominent integrated energy services company operating within the United States. With a robust portfolio of services and products tailored to support the activities of oil and gas companies, ACDC plays a pivotal role in the energy sector. The company operates across three distinct segments, each contributing to its comprehensive offerings, these are Stimulation services, Manufacturing, and Proppant Production.

In addition to its core services, ACDC extends its reach into the energy industry by designing, manufacturing, and marketing a wide range of high-quality equipment and components. These offerings encompass high horsepower pumps, precision-engineered valves, specialized piping systems, swivels, large-bore manifold systems, durable seats, and advanced fluid ends.

Market Opportunities (Investor Presentation)

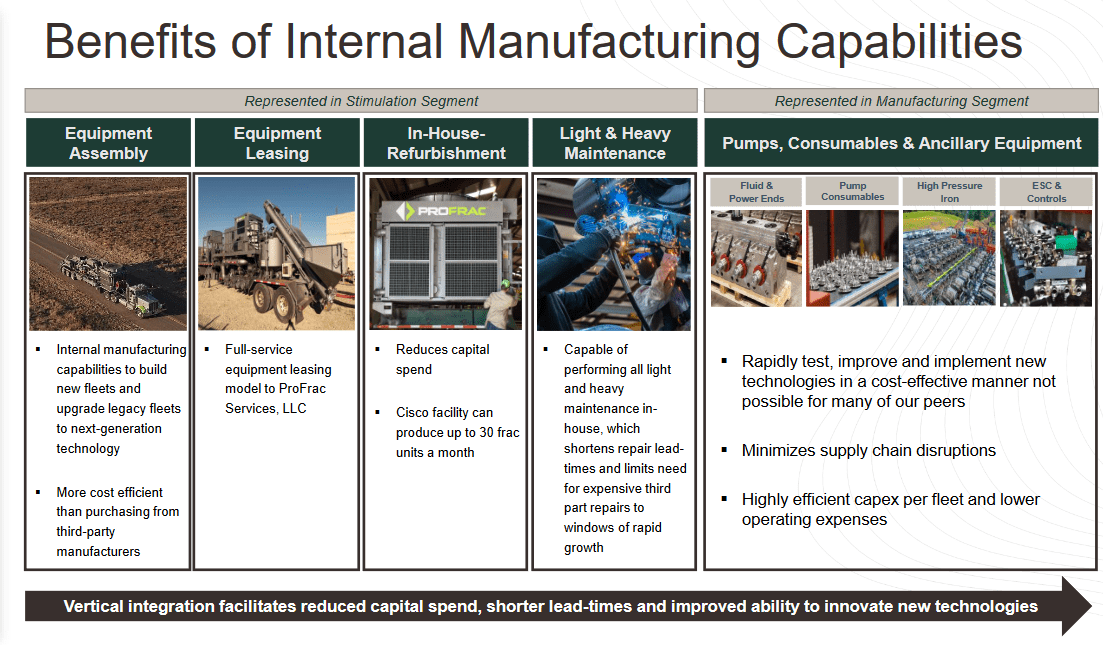

One of the main drivers behind the growth that ACDC has experienced over the last several years has been the in-house capabilities of manufacturing the company. This has significantly cut down on the necessity of important and outsourced work. Ultimately it seems to have led to more sustainable earnings and margins for the company.

Scaling up becomes easier for the company and if the market conditions improve further I think that the floor for margins is somewhere around here, and because of the in-house productions I would predict that they could exponentially grow faster if demand picks up. There have been some events that have made the customer base worried, like the banking crisis that happened earlier this year which made taking on debt seem more risky. But there is also a general push towards renewables which is making investments into emission-producing projects the likes that ACDC works with unappealing to some extent. However, with strong FCF being generated, I think investors still have a lot to gain here.

Markets They Are In

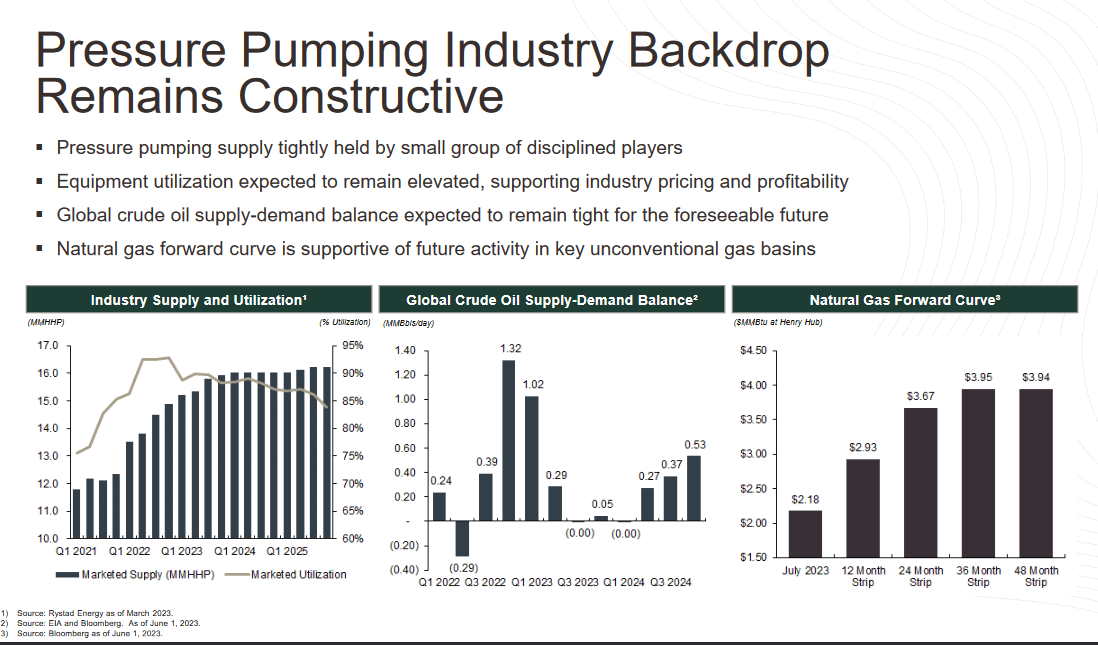

The hydraulic fracturing market has experienced a period of remarkable strength and demand in the last year, contributing significantly to the revenue and profit margins of service providers. However, the sustainability of this favorable market condition remains uncertain. It’s essential to recognize that oilfield services operate within a competitive landscape, akin to commodities, and entry barriers are relatively low.

Market Overview (Investor Presentation)

The fact remains that there is still a lot of demand for oil and gas in the world and servicing these companies will be crucial to keeping operational levels at a high percentage. This should bring a fundamental set of demand for ACDC in my opinion going forward for the next several decades. ACDC is also strategically positioned throughout the US to have access to all the major basins and enable themselves to offer quick and reliable services and products.

Earnings Highlights

Income Statement (Earnings Report)

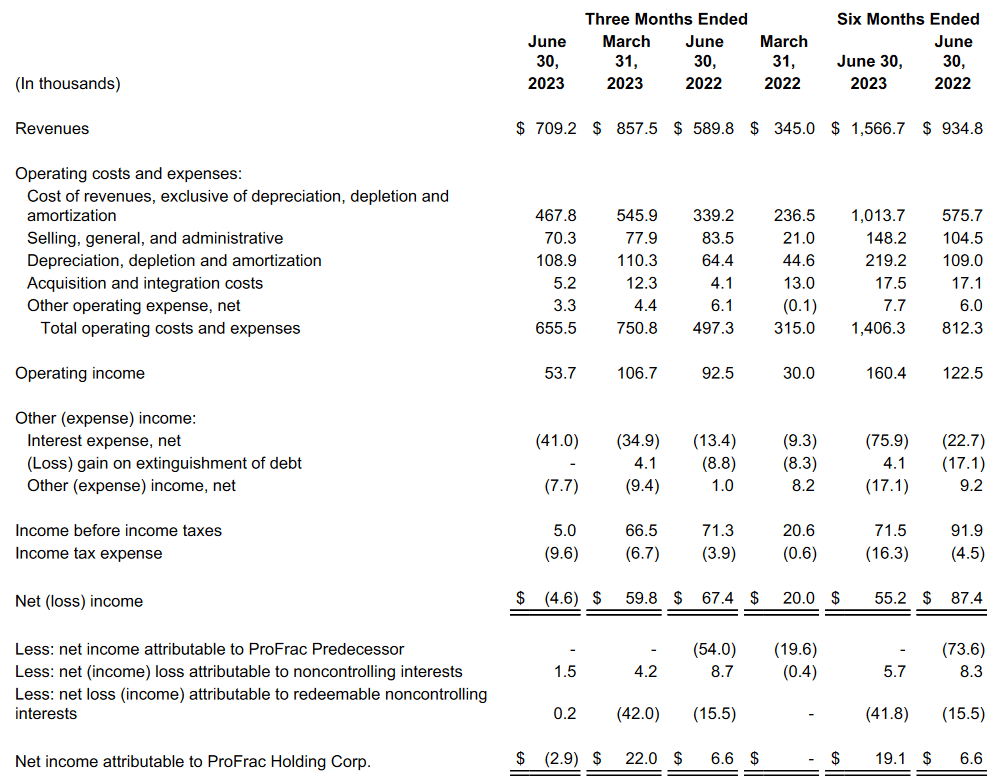

Looking at the last quarter of the company, some things caught my eye. The revenues took a dip from the first quarter of 2023, but are still heavily up from Q2 FY2022, about 20%. This showcases the strong set of demand that ACDC still is experiencing. I think that going forward the company will be able to grow the top line at double digits and possibly the same for the bottom line, depending on how much capital they allocate to buying back shares.

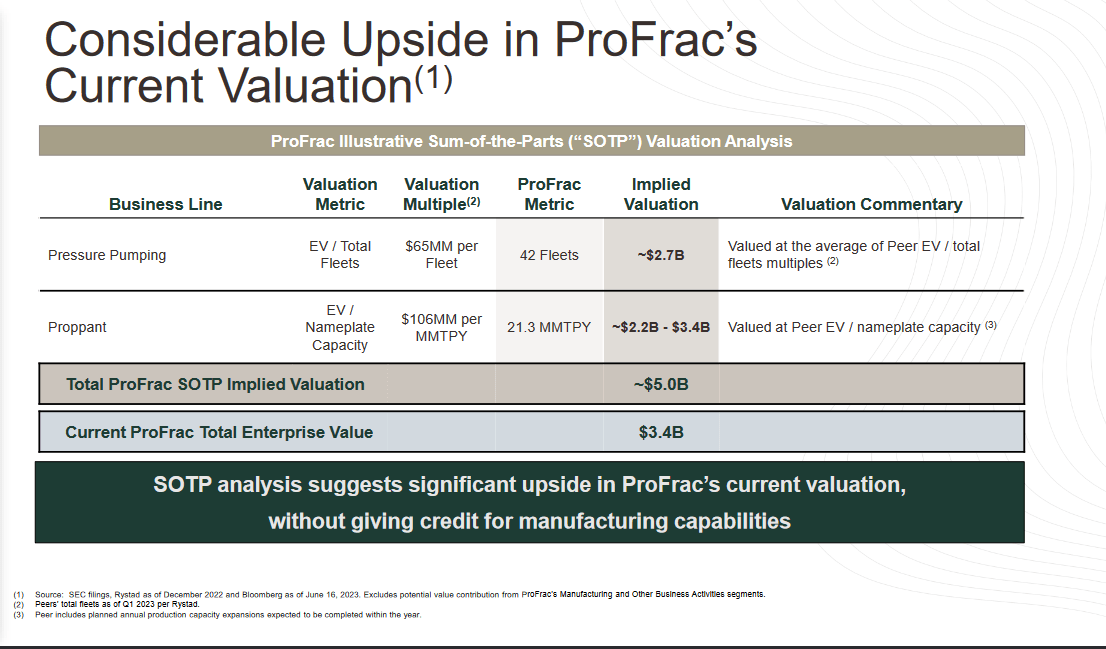

Company Valuation (Investor Presentation)

The company itself sees a significant increase in valuation, but I think that the fact that share dilution has been a common practice has weighed on the share price so far. If this stops then the upside seems very favorable in my opinion. The two business lines of ACDC imply a valuation of around $5 billion, which is far above the $1.69 billion it is at currently. This further extenuate the buy case I have for them and the favorable upside potential I see.

Risks

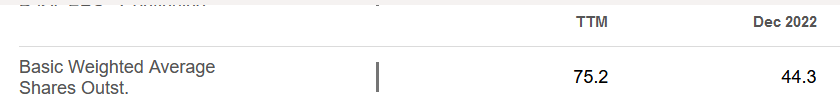

One of the foremost concerns for prospective investors in ACDC at the moment revolves around the substantial dilution of shares. The outstanding shares have grown significantly, currently standing at 54 million, compared to 44 million in 2022. This rapid dilution has likely contributed to the relatively lower valuation that ACDC currently commands in the market.

Outstanding Shares (Seeking Alpha)

It appears unlikely that there will be a significant upward shift in ACDC’s valuation until there are discernible indications that the company intends to curtail the ongoing dilution of its shares. The persistent increase in outstanding shares has, understandably, impacted the market’s perception of the stock. Another factor that could potentially contribute to the current lower multiple is ACDC’s ability to efficiently expand its profit margins. In a competitive market, margin growth is a crucial metric that investors closely monitor. If ACDC faces challenges in optimizing its margins, it may continue to experience valuation pressures. The bottom line doesn’t have that much to fall back on when it’s just above 5.8%. Given that earnings are susceptible to commodity volatility as well, there is a risk that unfavorable pricing conditions could push the bottom line negative.

Final Words

The fracing industry is facing quite a lot of volatility but I think that ACDC has managed very well throughout these times and still showcases itself to be a sound addition to a portfolio. The fact remains that emission-producing energy sources like gas and oil are going to be with us for a very long time and that makes investing in ACDC still very appealing given the exposure and services they provide to such companies. In the long run, I think ACDC will be a strong addition, and this leads me to issue a buy for them right now.

Read the full article here