BRK is still attractive despite near-record price

Berkshire Hathaway (NYSE:BRK.B) (NYSE:BRK.A) is a holding in our model portfolio (which is also our real-money portfolio), and we provide regular updates to our investing group members as part of our service. As a result, we receive regular questions and comments from our group members on the stock. In this article, I will compile many of the Q&A exchanges into a coherent thesis. The central issue surrounds its valuation.

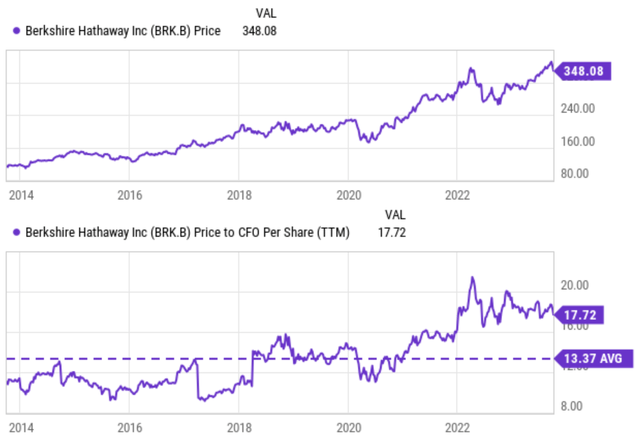

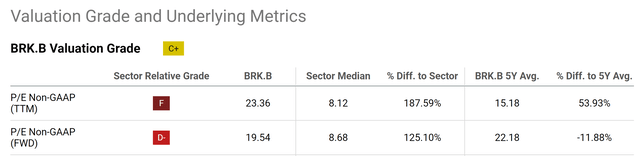

Many investors are concerned about its valuation as the stock prices push near a historical peak level (see the top panel of the first chart below). Its valuation multiples pushed up in tandem. As seen in the bottom panel of the first chart, its P/CFO multiple is reported to be around 17.7x, also near a historical peak level in a decade, and is far above the long-term average. In terms of the P/E ratio, most websites report it to be above 20x (see the second chart below).

In the remainder of this article, I will explain why these reported multiples, like many simple accounting multiples, do not accurately reflect BRK’s true valuation. You will see that the stock’s current valuation is still close or even below the so-called Buffett price, the price Buffett has historically been willing to buy back Berkshire Hathaway shares.

Seeking Alpha Seeking Alpha

The Buffett price

The term “Buffett price” was coined by investors to refer to the price at which Warren Buffett has historically been willing to buy back Berkshire Hathaway shares. Buffett has stated that he believes Berkshire Hathaway is worth at least 1.5 times its book value on multiple occasions. For example, in a 2016 interview with CNBC, he said:

I think Berkshire is worth at least 1.5 times book value. It’s probably worth more than that, but I think 1.5 times book value is a good benchmark.

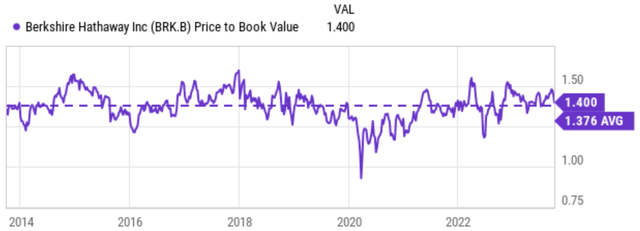

He also put his money where his mouth is. Many of his actual repurchases of BRK shares were made at prices around 1.5 times book value. From the next chart, you can see that the stock is trading at 1.4x times its book value, slightly below the Buffett price.

However, remember that, over the years, BRK has substantially expanded its operations beyond insurance. As such, book value has become a smaller part of its intrinsic value in my value. Once the income from these additional operations is considered, its valuation multiple is even more attractive than on the surface, as to be elaborated on next.

Seeking Alpha

BRK’s organic operations

In my view, there are two keys to properly valuing BRK. The first one involves understanding the difference between its accounting income and economic income. The second one involves its evolving organic operations. Buffett has emphasized the first point plenty of times. As he reminded us in the 2022 shareholder letter (slightly edited by me):

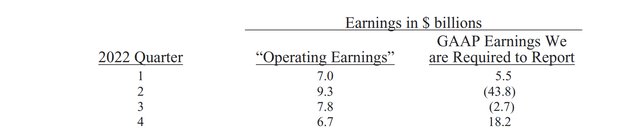

The GAAP figure, absent our adjustment, fluctuates wildly and capriciously at every reporting date. Note its acrobatic behavior in 2022 (see the chart below), which is in no way unusual. The GAAP earnings are 100% misleading when viewed quarterly or even annually. Capital gains, to be sure, have been hugely important to Berkshire over past decades, and we expect them to be meaningfully positive in future decades. But their quarter-by-quarter gyrations, regularly and mindlessly headlined by the media, totally misinform investors.

2022 BRK Shareholder Letter

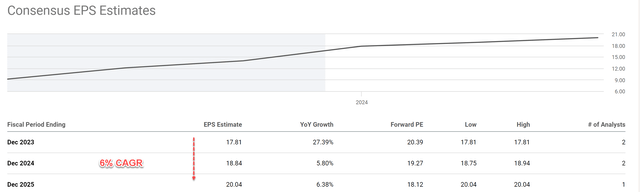

The income from organic operations is, of course, what we should focus on. As seen in the chart above, these earnings totaled $30.8B. If we assume the FWD operation earnings to be $30.8B also, this translates into operation earnings of $14.2 per equivalent B share at today’s share count. This is a conservative assumption in my view as A) it assumed no growth, and B) it ignores the dividend income from its equity portfolio. All told, the Consensus estimates are projecting 6% earnings growth forward and an EPS of $17.8 for 2023, translating into a total income of $38.6B (assuming today’s share count) for 2023 as seen below.

Seeking Alpha

Next, we need to be aware that BRK’s organic operations have evolved quite a bit over the years, and as such, the Buffett price should evolve too. Since more and more income is generated by organic operations beyond its insurance business, my view is that the Buffett price should be adjusted upward. To illustrate my point, consider that:

- Berkshire owns 100% of BNSF and 92% of BH Energy, with total earnings reaching $10.2B in 2022 ($5.9B from BNSF and $4.3B from BH Energy). This is close to 1/3 or 1/4 of BRK’s current operating income.

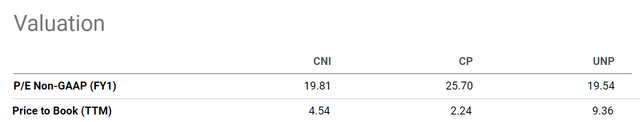

- Both railway and utility/energy stocks are trading with a higher multiple than insurance stocks. For example, large railway stocks such as CNI and UNP (see the chart below) are trading with a P/E multiple of around 20x and a P/B multiple far above 1.5x.

Exactly how much the Buffett price should be adjusted obviously involves a degree of subjective judgement. It depends on which P/B multiple you assign to each part of its operations and how much equity is required to run each part of its operations. And I do not see the point of imposing my judgement on you here. I will just want to iterate that the so-called Buffett price (i.e., 1.5x P/B ratio) should be adjusted upward given the increased role of its organic operations beyond insurance. After all, in investing, it’s much better to be directionally right than precisely wrong.

Seeking Alpha

Risks and final thoughts

There are a couple of upside risks in addition to valuation. BRK has a good history of making significant and accretive acquisitions. I keep seeing this as an integral part of its long-term growth plan. Given its healthy cash coffers, strong solid balance sheet, and long-term thinking, it is in an advantageous position for such acquisitions. Also, its bond reinvestment rates should enjoy a boost as interest rates persist at a high level.

Downside risks largely come from the uncertainties surrounding its insurance business, in my view. For example, an uptick in catastrophes caused by unusual weather could cause negative impacts. BRK has more moving parts than most typical insurers, given the complexity and scope of its business. For example, its Reinsurance Division provides reinsurance to other property/casualty insurers and reinsurers – a division enabled by its deep pocket. Such complexity and scope further add to the uncertainty.

To conclude, the dominating picture I see in the case of BRK is that its valuation is still attractive. On the surface, a P/B multiple of 1.4x is already below the so-called Buffett price. At the same time, we have to bear in mind that BRK has been evolving over the years, and now it has many other organic operations besides its insurance business. When these additional income streams are considered, I believe the Buffett price should be adjusted upward, and thus, its current value should be even more attractive than on the surface.

Read the full article here