Thesis

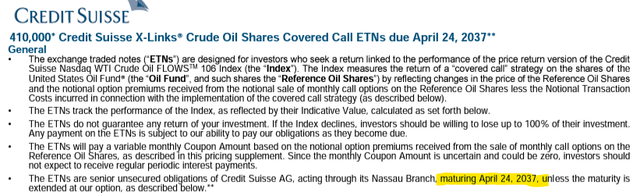

The Credit Suisse X-Links Crude Oil Shares Covered Call ETNs (NASDAQ:USOI) is an exchange-traded note (‘ETN’) from Credit Suisse (now UBS). An ETN is structurally different from an ETF or CEF through its lack of bankruptcy remoteness. In fact, USOI is a bond issued by Credit Suisse, which has an embedded commodities return in it:

ETN Prospectus (Prospectus)

As per its prospectus, “The ETNs are senior unsecured obligations of Credit Suisse AG, maturing April 24, 2037”. With the UBS take-over of Credit Suisse, a retail investor now runs both the embedded commodity risk we will describe shortly, as well as the UBS default risk. We find the UBS default risk to be remote now, but earlier in the year we saw massive outflows from Credit Suisse-named products, essentially on the back of bankruptcy fears.

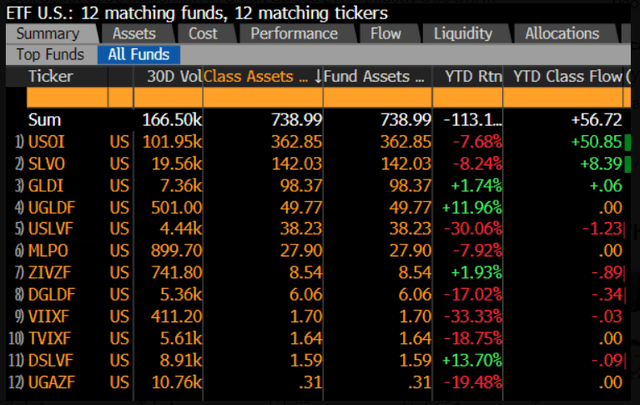

USOI is now the largest legacy CS ETN when measured by fund assets:

CS ETNs (Bloomberg)

You will notice that outside the top-5 ETNs, the fund assets amounts are very small. For example, the Credit Suisse S&P MLP Index ETN (MLPO) now has only $27.9 million in assets, and in fact, CS/UBS might choose to redeem it as per the mechanics of the bond as described in its prospectus.

USOI is a covered call fund that actually outperforms

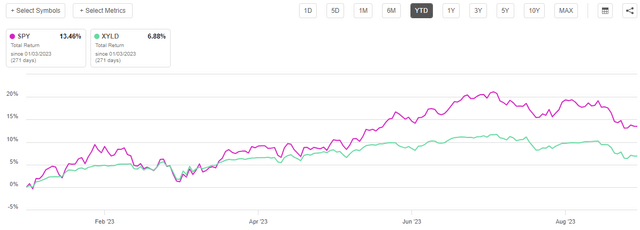

In the covered call funds world most names tend to systematically underperform their reference index. Take for example equities:

SPY vs XYLD (Seeking Alpha)

The Global X S&P 500 Covered Call ETF (XYLD) has spent the last year below the total return levels provided by the index itself. That translates into investors being better off buying the S&P 500 index outright versus XYLD.

The story is different for oil and USOI:

USOI vs USO (Seeking Alpha)

The United States Oil Fund, LP ETF (USO) has consistently exhibited a performance below the one produced by USOI in 2023. That makes a covered call fund more attractive here in the oil space. Please note the above graphs are run on a total return basis, which includes the dividend yield.

Why does a covered call strategy work in the oil space?

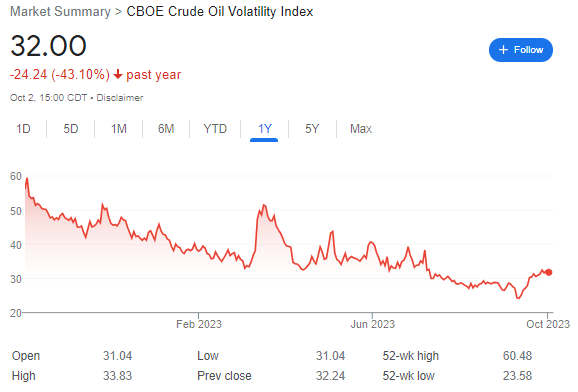

Covered call strategies are dependent on the implied volatility levels present in their respective markets. Writing calls is only profitable from a risk/reward perspective (i.e. giving up a part of the upside) when implied volatility is high, and hence the option premium received is consistent. In the equity space, the VIX has plummeted to levels below 15 and represents a very unappealing place to short volatility. In the oil space, however, volatility is markedly higher:

Oil Volatility (Alphabet Inc.)

Although volatility as measured by the CBOE Crude Oil Volatility Index has come down substantially in the past year, it is still above 30. This translates into option premiums received for writing calls being rich from a risk/reward perspective. As a personal rule of thumb for writing calls, we would never do it for volatility levels below 25. It just does not pay.

A high dividend yield

The Seeking Alpha platform indicates a 24% dividend yield for USOI:

Dividend Yield (Seeking Alpha)

However, do note that from a pure price perspective, the ETN is mostly flat on the year. The fund basically distributes the option premiums it makes on the written call portion, premiums which can vary depending on the level of implied volatility and interest rates in the market:

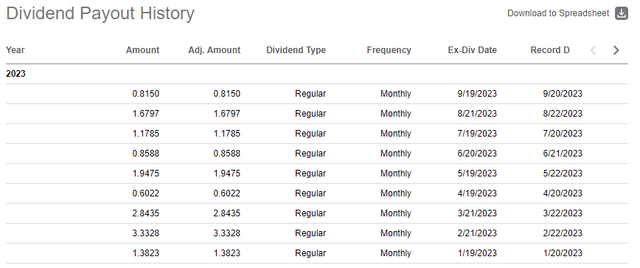

Dividend History (Seeking Alpha)

You can see from the above historical table of paid dividends the close correlation with the oil implied volatility. At the beginning of the year, when implied volatility levels were high, the fund paid very consistent monthly dividends. The figures have come down as volatility has subsided.

The 24% figure the platform quotes is the trailing twelve-month one (please note TTM in the parenthesis), which is obtained by adding the dividends for the past twelve months and dividing by the current fund price. If volatility stays at current levels, the dividend yield figure is going to come down.

USOI Holdings

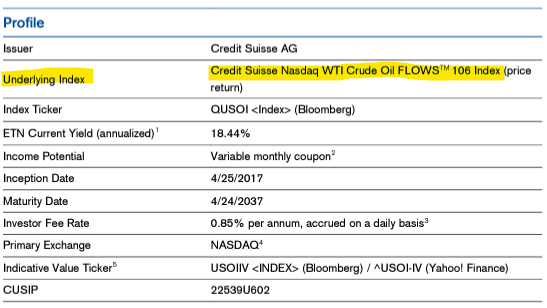

The fund is designed to follow a CS covered call oil index:

Index (Fund Report)

As per its definition, the Index engages in the following:

The Credit Suisse Nasdaq WTI Crude Oil FLOWSTM 106 Index (the “Index”) seeks to implement a “covered call” investment strategy by maintaining a notional long position in Reference Oil Shares while notionally selling call options on that position on a monthly basis that are approximately 6% out-of-the-money (i.e., strike price is 106%). The notional net premiums received (if any) for selling the calls are paid out at the end of each monthly period as a Distribution. The Index’s strategy is designed to generate monthly cash flow in exchange for giving up any gains beyond the 106% strike price

In the definition above, the ‘Reference Oil Shares’ are shares of the United States Oil Fund ETF:

The ETNs may pay a variable monthly coupon based on the notional option premiums, if any, generated by the Index’s hypothetical monthly sale of call options on the shares of the United States Oil Fund, LP (such shares the “Reference Oil Shares”).

In essence, USOI sells monthly covered calls on USO that have a 6% upside only. The ETN gives up any monthly moves in USO above 6%. A slow, steady increase in the price of oil is beneficial for USOI, while violent moves (both on the upside and downside) lead to worse-off results.

As a reminder, USO holds WTI futures, staggered across a number of maturity tenors, in order to create a total return profile as closely correlated with spot WTI as possible.

The moves in USO this year have been ideal for USOI. Oil has moved steadily, both on the downside and upside, thus creating an ideal environment for USOI’s covered call strategy to harvest volatility-induced premiums. Please note from the above graphs that mid-year when USO had -10% drawdown, USOI did not breach a negative total return figure due to its call option premiums.

Outlook for Oil

As we have described in a number of articles as of late, we are bullish oil into the year end, feeling that it is well supported on the supply side by OPEC. A range-bound or bullish oil outlook is positive for USOI, setting it up to continue to outperform a pure oil fund like USO, which experiences decay if oil prices stay put.

We do not think we are going to have a recession this year, and while going through a minor correction currently, oil will continue to perform into December. USOI is the best instrument outside pure equities to take advantage of that view.

Conclusion

USOI is an exchange traded note from Credit Suisse (now UBS). The fund provides for both the embedded return of an oil-covered call strategy and the default risk associated with the issuing entity.

The ETN provides for a monthly 6% out-of-the-money covered call writing strategy on the USO WTI oil fund. USOI has done extremely well this year, consistently outperforming USO and being up over 23%. The fund disburses all the option premiums it makes, hence while its price is fairly unchanged for the year, its dividend yield is extremely high.

Given the high level of implied volatility in the oil space, we expect USOI to outperform USO into year-end, with the ETN being a much better choice to express a range bound or bullish view on oil. We are therefore a Buy for the name for the remainder of 2023, taking advantage of the current shallow correction in oil prices.

Read the full article here