Introduction

Rising rates, sticky inflation, and weakening economic growth are a toxic mix for Real Estate Investment Trusts (“REITs”) and real estate in general.

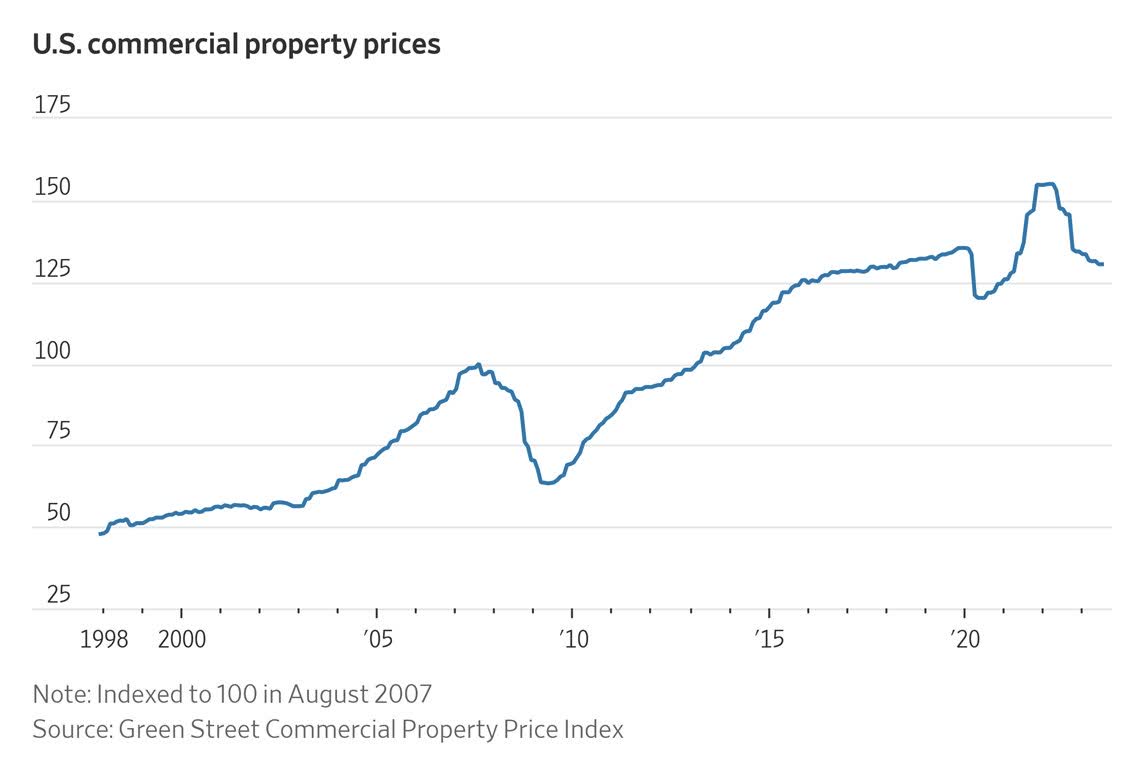

Looking at the chart below, we see that commercial property prices have come down to pre-pandemic levels as dealmaking is becoming less attractive due to higher financing costs.

Also, higher inflation erodes the bottom line of companies with long-term contracts with less-than-decent inflation coverage.

Wall Street Journal

On top of that, slower economic growth puts pressure on occupancy rates and tenant health.

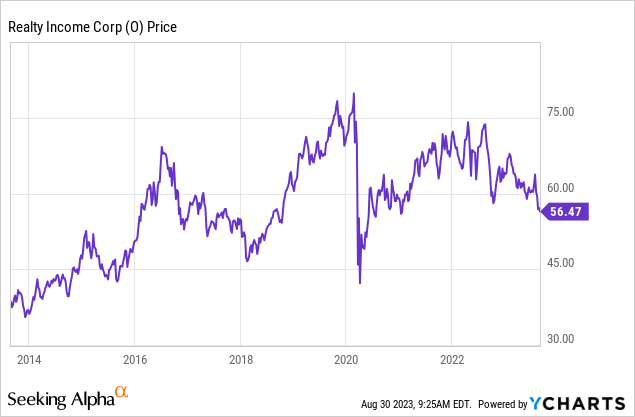

Even the best performers with A-rated balance sheets, like Realty Income (O), are suffering in this environment. Realty Income, which likely has the healthiest tenant portfolio and balance sheet in its segment, is now trading at 2021 levels, with a yield close to 5.5%.

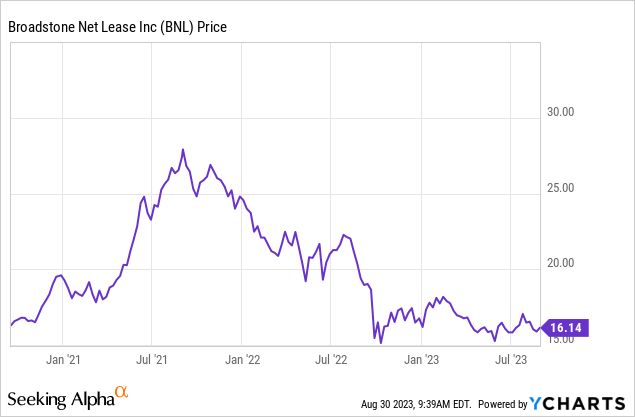

One stock that readers kept bringing up whenever I discussed Realty Income or any of its peers is Broadstone Net Lease (NYSE:BNL), a younger and much smaller REIT with a yield of 7%.

This REIT is trading more than 40% below its all-time high. It has a below-average valuation, a 7% yield, and a well-diversified portfolio with a near-perfect occupancy rate.

In this article, we’ll discuss the risk/reward of this article.

So, let’s dive in!

Diversification And High Occupancy

A net lease company is a company that engages in contracts where a tenant pays a portion or all of the taxes, insurance fees, and maintenance costs.

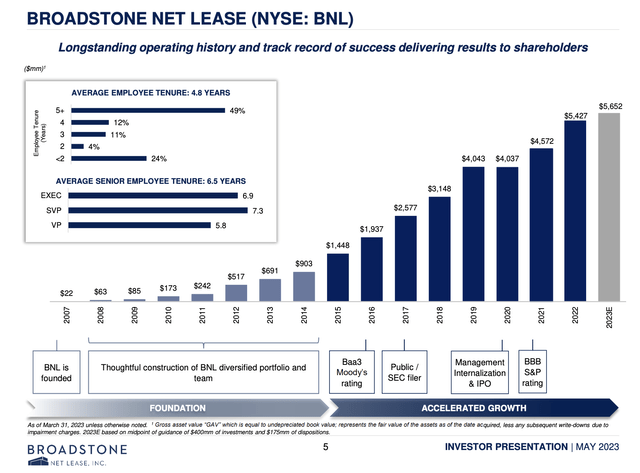

Unlike some of the better-known peers in the REIT space, BNL is very young. The company had its IPO in 2020 after being founded in 2007.

Broadstone Net Lease

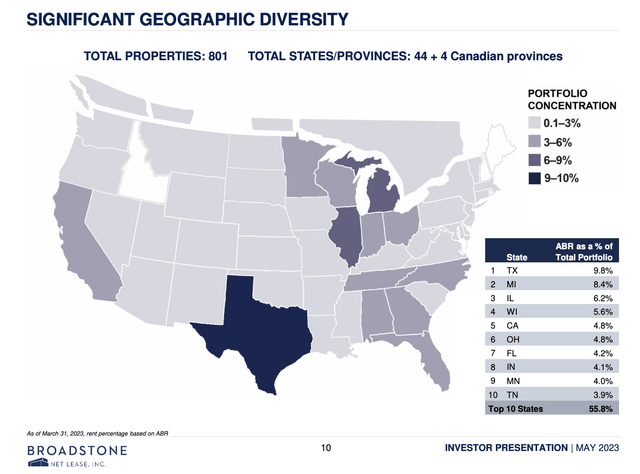

Over the past 17 years, the company has built an impressive portfolio consisting of roughly 800 properties in 44 states and four Canadian provinces.

The company has no state with more than 10% exposure, with Texas leading the pack, accounting for 9.8% of total annual base rent.

Broadstone Net Lease

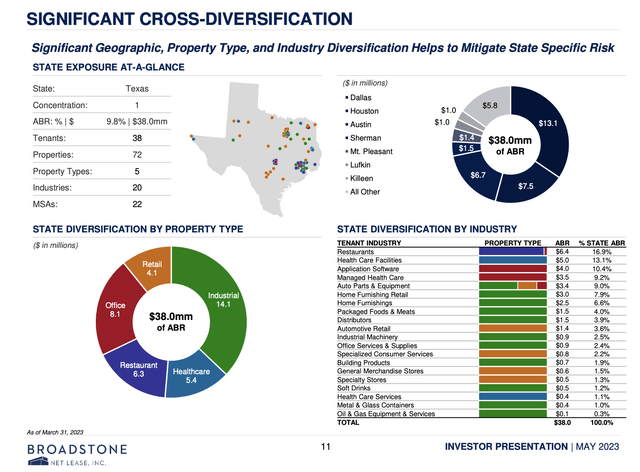

However, even in specific states, the company has cross-diversification.

Looking at Texas, the company has well-diversified sector exposure and no city generating more than a third of total revenues.

Broadstone Net Lease

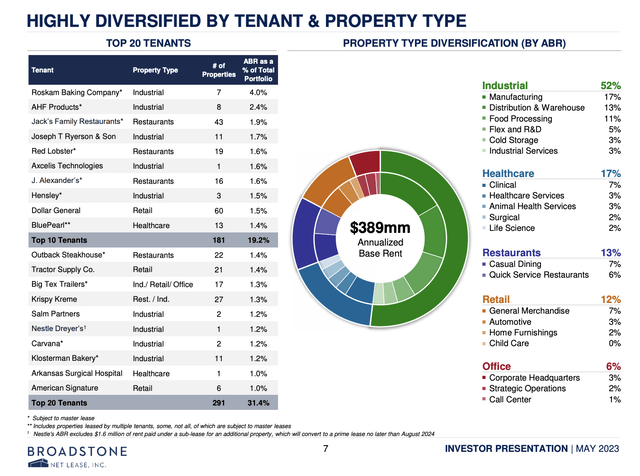

- The company’s largest ten tenants account for roughly 19% of its annual base rent.

- The top ten of its tenants bring this number to 31%.

What’s interesting is the company’s diversification. The company has just 12% retail exposure. Its largest sector is industrial, accounting for slightly more than half of its rent. This includes manufacturing, distribution & warehousing, and food processing, among others.

It also has healthcare exposure (17%), which I am not a big fan of.

While there is secular growth in healthcare, hospital operators have razor-thin margins, which isn’t necessarily something I want to be exposed to.

Needless to say, this isn’t a warning, just a personal note.

Broadstone Net Lease

Looking at the tenant list above, we see some well-known companies, including Red Lobster, Dollar General (DG), Tractor Supply Co. (TSCO), Krispy Kreme (DNUT), and Carvana (CVNA).

None of these companies have more than 4% exposure, with struggling Carvana accounting for 1.2% of total annual revenues.

Furthermore, these tenants come with inflation protection – to a certain extent.

In the second quarter, the company achieved a remarkable 99.9% rent collection rate and a solid 99.4% occupancy rate as of June 30.

Only two properties were unleashed or vacant at the end of the quarter.

Needless to say, the company is actively monitoring the well-being of tenants, especially those more vulnerable to current operational challenges.

Adding to that, the company believes it has solid inflation protection.

We continue to view our tenant and industry diversification as a key differentiator for Broadstone, which when combined with top tier annual rent escalations of 2%, provide significant downside risk mitigation benefits, especially in difficult or uncertain markets. – BNL 2Q23 Earnings Call

In the first quarter, 86% of the company’s contracts had fixed rate increases. 12% of its contracts were CPI-linked.

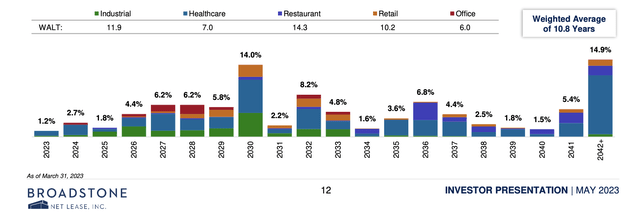

The average weighted contract is 10.8 years, with no double-digit expirations until 2030, when 14% of the company’s leases expire.

Broadstone Net Lease

With that said, I would make the case that the company has higher tenant risk than some of the biggest net lease companies, like Realty Income and Agree Realty (ADC), who tend to lease to bigger corporations.

Hence, in light of economic headwinds, the company is extremely cautious.

In its 2Q23 earnings call, the company mentioned that while it evaluated over $17 billion of potential investments in the year, it remains selective, given market dynamics and risk-reward considerations.

Despite the challenges of the current market, BNL leverages partnerships with current tenants and developers to enhance shareholder value.

The company also uses opportunities to sell assets at good prices.

In the second quarter, the company generated gross proceeds of $168.3 million through strategic asset dispositions, achieving a weighted average cash cap rate of 5.9% on untenanted properties, which is a great deal in this environment.

This approach has not only reduced credit and residual risk within the portfolio but has also provided additional funds to be deployed at favorable spreads.

Based on that context, during the second quarter, investments totaled $64.9 million at a weighted average initial cash cap rate of 7.3%.

The company’s deals also include sale-leaseback, which entails buying properties from companies that need to raise cash. These companies sell the building they own. They receive a large amount of cash in exchange for regular rent.

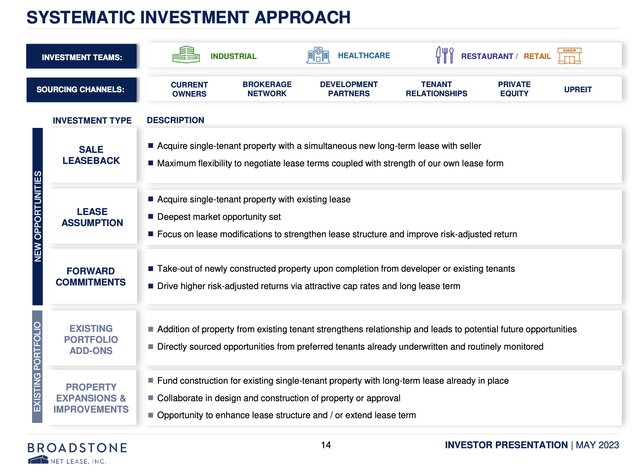

Broadstone Net Lease

Thanks to its cautious approach, the company has a healthy balance sheet.

BNL’s Balance Sheet

The net debt to annualized adjusted EBITDA leverage ratio decreased, reaching 5.0x by the end of the quarter.

The company’s revolving line of credit remained mostly unused, with more than 10% available and a remaining capacity of over $875 million.

So far, the company’s debt structure, consisting mostly of fixed-rate debt, has shielded it from the impact of rising interest rates.

Moreover, the company has no major maturities until 2026 and a BBB credit rating with a stable outlook.

The Juicy BNL Dividend & Valuation

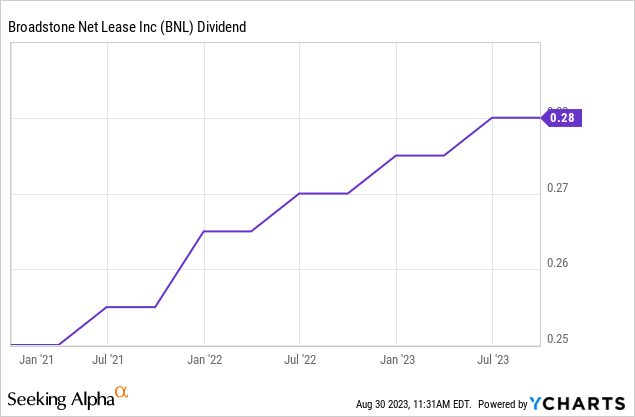

Currently, BNL shares pay $0.28 per share per quarter. This translates to a yield of 6.9%.

Since its IPO, the company has consistently hiked its dividend. In total, since 2021, the dividend has been hiked by 12%.

The company aims for an AFFO (adjusted funds from operations) payout ratio in the mid-to-high 70% range to offer an attractive yield compared to its industry peers.

This brings me to the guidance.

As of the second quarter, the company’s per share guidance for 2023 remains unchanged, with an AFFO range of $1.40 to $1.42 per share.

I’m bringing this up for three reasons.

- Despite industry challenges, the company was able to maintain its full-year guidance.

- The full-year guidance implies a 79% payout ratio, which is at the higher end of the company’s target range. In other words, I expect dividend growth to slow down quite a bit until growth improves.

- The company is trading at 11.5x the midpoint of this guidance.

The median sector valuation is 14.5x forward AFFO.

This means that BNL is trading at a 26% discount, which is a lot for a company that has no major struggles.

Realty Income is trading at 14.2x NTM AFFO.

The current consensus price target is $20, which is 23% above the current price. This would align with a return to the median sector valuation.

I do agree with this.

Nonetheless, I’m not extremely into this company for a few reasons. By opting for a lower yield, investors get a company like Realty Income or Agree Realty.

I prefer these tenant bases a bit more. Again, BNL isn’t buying risky assets and engaging with high-risk tenants, but if I want retail and industrial exposure, I want tenants that have a bigger moat.

Also, an 80% payout ratio is a lot, which doesn’t make me very comfortable.

In other words, there are pros and cons here. It really depends on what you’re looking for in a REIT and how much risk you’re willing to take. Among the higher-yielding REITs, BNL is certainly one of the best.

Hence, I will give the company a Buy rating. It’s just not a high-conviction rating.

Takeaway

In a landscape marked by rising rates, persistent inflation, and economic softening, the REIT and real estate sectors are dealing with challenges.

Commercial property prices, driven by elevated financing costs and limited deal allure, have returned to pre-pandemic levels.

The surge in inflation has particularly dented firms with extended contracts lacking solid inflation coverage. This pressures even top-tier players like Realty Income, trading at 2021 levels with a 5.5% yield.

Broadstone Net Lease is a young REIT with a diverse portfolio boasting a 7% yield.

Its strong occupancy rates, tenant diversification, and prudent asset management stand out.

However, a higher tenant risk and an 80% payout ratio pose considerations.

BNL offers a promising choice for yield-seekers willing to manage some trade-offs, earning it a cautious Buy recommendation in a landscape that demands more prudent risk management.

Pros & Cons

Pros:

- Diversified Portfolio and High Occupancy: BNL’s extensive, well-diversified portfolio maintains an impressive 99.4% occupancy rate, showcasing stability even in challenging times.

- Inflation Protection and Reliable Income: Tenants with inflation-protected leases contribute to a solid 99.9% rent collection rate, ensuring steady income.

- Financial Strength: BNL’s balanced debt structure and BBB credit rating provide financial stability, while its 6.9% yield is attractive for investors.

- Discounted Valuation: Trading at 11.5x forward AFFO, BNL offers potential upside as it moves toward sector norms.

Cons:

- Tenant Risk and Payout Ratio: Higher tenant risk and an 80% payout ratio might raise concerns about future dividend growth potential (in this environment).

- Industrial and Retail Moat: BNL’s moat for industrial and retail exposure could be less robust compared to larger players.

Read the full article here