Summary

Readers may find my previous coverage via this link. My previous rating was a buy, as I believed Dover Corp. (NYSE:DOV) would continue to see better-than-expected segment profit performance. I am reiterating my buy rating as I believe that DOV’s acquisition has positioned them well to capture growth in the future with government support and a push for hydrogen, as well as rules for high GWP refrigerant restrictions that will take effect in the near future.

Valuation

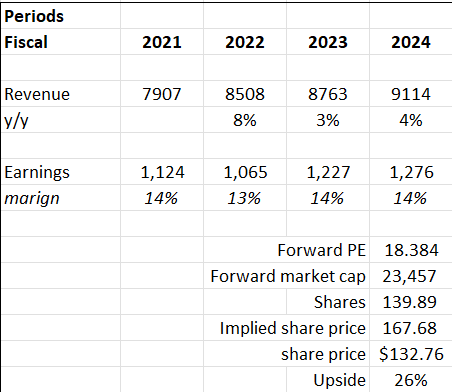

Based on my view of the business, I anticipate a 3% growth in DOV’s revenue for FY23, followed by 4% revenue growth for FY24, aligning with the general market consensus. This projection is influenced by its robust third quarter results, which show strong book-to-bill ratios and margins. In addition, I believe DOV’s strategic decision to purchase FW Murphy is a good move, as it creates synergies between the two companies and positions DOV well to capture the growing hydrogen market, which is backed by the government. Lastly, I believe DOV’s dominance in the CO2 market also positions them well for growth due to the EPA’s rule, which will be in effect from 2027 onwards.

Based on author’s own math

Peers overview:

Factset

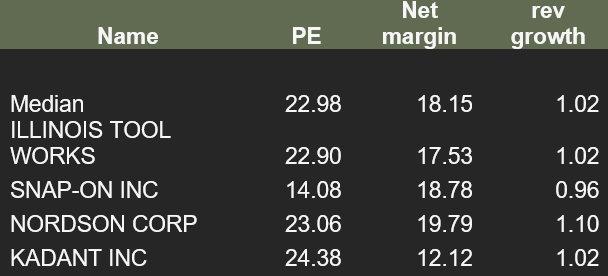

DOV now trades at 14.22X forward P/E, which represents a ~38% discount to the peer’s median. In terms of growth outlook, DOV’s 3% is higher than peers’ median of 2%. Although it has a lower net margin of 13.16% vs. peers’ median of 18.15%, its better growth outlook and slightly lower margin cannot justify a discount of 38%. To be conservative, I give a 20% discount instead. At 18.38x forward P/E, my model indicates an upside of 26%. Given the strength of DOV as discussed above and my analysis of DOV against its peers, I maintain my buy rating for DOV.

Comments

DOV reported strong results for the third quarter of 2023. Although consolidated revenue decreased by 2% during the quarter, a better lead time and robust shipments against its longer-dated orders resulted in a book-to-bill ratio of 0.93, despite bookings declining 4% organically year over year. As a result, although its backlog has decreased, it is still higher than it was before the pandemic. The biopharma mix was more than offset by broadly based productivity and portfolio improvements, driving segment margins up to 21.7%, a record since the Apergy spin. For the quarter, adjusted EPS increased by 4% to $2.35. Additionally, strong execution, cost containment measures, and favorable price/cost dynamics more than made up for lower volumes.

In the quarter, DOV purchased FW Murphy for a lower valuation multiple than it was able to obtain when it sold De-Sta-Co, and the after-tax proceeds from that sale more than covered the cost of FW Murphy, leaving a sizable amount of balance sheet capacity available for further capital deployment options. These two transactions are expected to decrease its exposure to the automotive and Chinese markets while improving the overall quality of its portfolio through margin growth and recurring revenue uplifts.

In my opinion, the purchase of FW Murphy is an excellent strategic decision. FW Murphy enhances its current position in the reciprocating compression industry with a complementary product offering. FW Murphy took advantage of the increasing demand for sophisticated remote monitoring and real-time optimization solutions from clients looking to cut expenses, increase uptime, and minimize emissions. Together with DOV’s industry-leading clean technology and its position as leader in valve and sealing technology for alternative energy applications, such as hydrogen, the FW Murphy acquisition presents a strong value proposition in a global market where energy transition investments are expected to generate significant demand.

The recent announcement of $7 billion in federal funding for multiple regional hydrogen hubs has generated a great deal of interest in hydrogen. In my opinion, I believe DOV is in a good position and is ready to reap the benefits of this deal, as Dover’s 2021 purchase of Acme, a provider of liquid hydrogen flow control components and turnkey hydrogen refueling sites, solidified the company’s standing in the hydrogen industry. This growing and government-backed hydrogen market serves as a catalyst for DOV, and I believe it is well positioned to capitalize on hydrogen’s rapid expansion.

As of January 1, 2027, all newly installed refrigeration systems must meet the EPA’s final rule under the AIM Act, which mandates compliance with lower Global Warming Potential [GWP] requirements. In my opinion, DOV’s CO2 system sales should increase as a direct result of this regulation as CO2 is an efficient refrigerant (GWP of 1) and is classified as a safety group A1 refrigerant. This stems from DOV’s strong market positioning in the European CO2 market, where its annual growth rate has averaged in the high double digits. In addition, DOV is the first to introduce this technology to the United States, where it presently holds a technological advantage and has the most installed base and diverse product offerings.

Risk & conclusion

One downside risk to my buy rating would be unforeseen setbacks or delays in the government’s decision-making process. If the government decides to reduce or stop these initiatives due to unforeseen circumstances such as unsustainable government spending or a change in government that decides to stop or roll back on these initiatives, it will lead to a change in market sentiment for DOV as their outlook will turn uncertain. In such a scenario, I would expect DOV’s valuation to contract, leading to a lower share price.

In conclusion, DOV reported strong third quarter results with a strong book-to-bill and backlog still above pre-pandemic levels. In addition, total segment margins are still growing on a year-on-year basis, which translates to EPS growth. I believe DOV’s purchase of FW Murphy is an excellent decision, which will position them well to capitalize on hydrogen’s rapid expansion. Lastly, its strong dominance in the CO2 market also positions it well for future growth, as governments around the world are aiming to reduce the use and reliance on harmful GWP refrigerants. With double-digit upside potential as well, I maintain my buy rating for DOV.

Read the full article here