Thesis

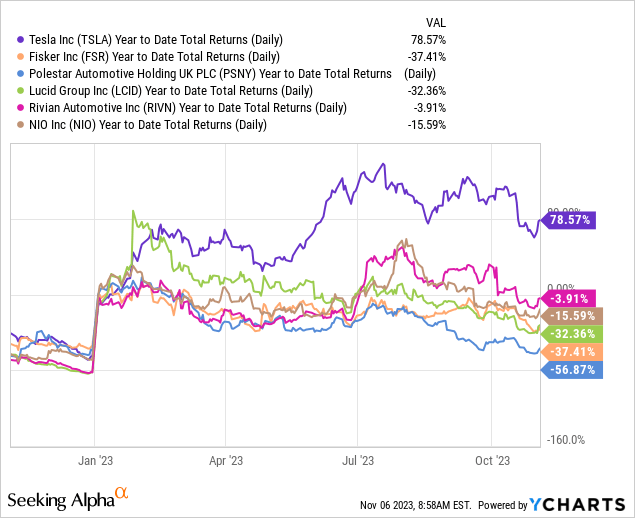

After the disastrous YTD results for most EV companies, it is time to ask if the market is overreacting and if some of the companies are undervalued in terms of their future earnings potential. The economic environment and inflation have made it harder for companies to sell their cars, and some, like Tesla (TSLA), have even begun to lower their prices to combat this. But since Tesla is already much further along than most of their competitors, they can do this, but what about companies like Fisker (NYSE:FSR) that are just starting out and not as well funded?

In my opinion, Fisker remains a high-risk investment that could go either way. It could end up as a 10-bagger, but it could also end up as the opposite. Over the next few chapters, let me explain what I think are the important facts and what we can expect from this week’s earnings release.

What has happened since my last article on Fisker?

My last article on Fisker was just before they started delivering the first cars to customers and there was a lot of uncertainty about whether the cars would actually be delivered and what the reviews would be. At the time, I said that I would hold off on investing and wait for the first reviews of the cars. Since this is now the case, I would like to revisit my thesis and see if anything fundamental has changed.

What does Fisker do and how do they make money?

Fisker is an electric vehicle company that uses an asset-light model as it currently outsources production to Magna Steyr. Competitors own their manufacturing facilities, but Fisker has stated that it will eventually own manufacturing facilities in the future. Therefore, Fisker’s plan is that they can focus on design and their software to get a competitive advantage. Design is often an individual thing, but I would personally say that they have a design advantage in the EV SUV space with their Fisker Ocean. However, in terms of software, they are not the top dog at the moment and have some software problems if you look at the forums on the Internet.

As I mentioned earlier, Tesla has lowered prices on its models and Fisker has done the same with its Ocean Extreme model, which went from $68.9k to $61.49k. However, the other sub-models went up in price. The Ultra from $49.9k to $52.9k and the Sport from $37.4k to $38.9k. So it will be interesting to see how that affects demand for the models and what impact it has on margins.

Since Fisker started shipping its models earlier this year, they are now earning money by working the reservations. With ~67k reservations for the Ocean, they have a strong backlog and demand seems to be there because of its design advantages. However, due to some production problems, they were not able to deliver as many cars as planned and therefore they had to lower estimates several times this year and now guide to 20k to 20k units that will be produced. So the number of cars delivered will be even lower. The parts supply problem seems to be solved, and Magna Steyr is now trying to get to 300 cars per day, or 70,000 per year. To produce more than 70,000 cars would require some smaller investments in CapEx.

With a production between 180 and 300 cars per day, 25 working days in Austria and 3 months left, the production would be between 13,500 (180 x 25 x 3) and 22,500 cars (300 x 25 x 3). This together with the already produced cars shows that they could miss their target of 20k to 23k and their guidance is rather on the high end. If we assume that they produce 20,000 cars this year and deliver about 5,000, that would mean that they have revenue in the range of 5,000 x $70,000 = $350 million from the sale of the cars delivered. The long-term goal is a 95% delivery rate, but since many cars are produced in December and shipping to America, etc. takes about 2 weeks, I think 5k is realistic, maybe a little more. But it will be how many cars they sell and deliver in 2024/2025 and beyond that will have the biggest impact on the share price.

Growth Opportunities For FSR

With plans to launch in Belgium, the Netherlands, and Switzerland at the end of September, there will be sales opportunities in these countries that may be visible on the earnings call. They also plan to start delivering in China in Q2 2024 and they also have plans to bring the Ocean production over to the US to qualify for the tax break. Both of these would dramatically improve the outlook for the company. If Alaska starts production, they will also want to produce the car in their main market, the USA, and the PEAR will probably be built in the USA as well. As an entry-level model with a price tag of $29,9k, the PEAR could be a big seller, depending on how it is received. The Ronin, on the other hand, will only be a sports car to show what Fisker is capable of.

Fisker’s Balance Sheet + Debt Situation

Fisker’s unknown mystery investor with $20 billion AUM is very important for the company’s future. The $170 million senior notes offering, which was completed and raised $150 million for Fisker, was important in providing liquidity. However, it shows that the investor has confidence in the future of the company.

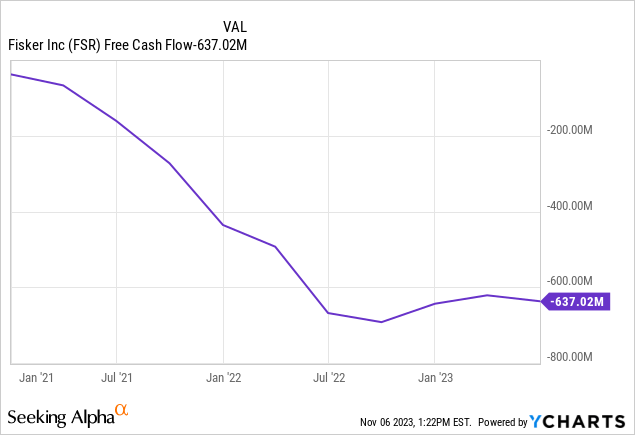

With a negative FCF of about $630 million, the company is burning through cash, and as of their last report, they had only $521 million in cash and cash equivalents. So an investor with enough cash is important to finance growth until Fisker becomes self-funding. On July 23, the Company completed a $7.8 per share offering of $340 senior unsecured notes to an existing investor for gross proceeds of $300 million. So I think we are likely to see more offerings in 2024 to fund growth. If Fisker had difficulties to get fresh money, this would be a big problem.

What to Look For in the Q3 Results

If Fisker were to cut guidance again, it would be a disaster for existing investors. Having already cut from 42k to 20k to 23k because of the parts supply issue, shareholder confidence is relatively low. A further reduction would likely send the stock into another downward spiral.

Furthermore, it will be important to see when production of PEAR and Alaska will start, when they think about first deliveries of these two, and how Fisker will react to the market slowdown and what their measures are. Also, if Magna will reach the monthly capacity of 6k this year and if they plan to invest in additional CapEx to expand capacity.

Competitive Situation

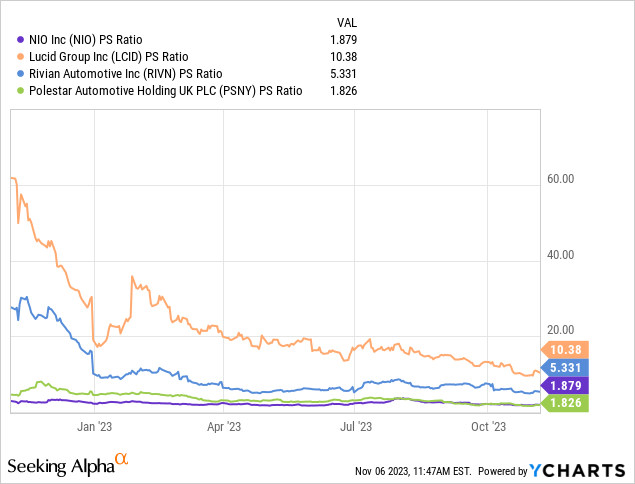

It is a very competitive market with many well-funded companies that have years of experience in the automotive market and startups that have strong investors behind them. In addition, many of the legacy companies have built up distribution networks and contacts over the years that act as barriers to entry in some areas. I also think that competitors like Tesla and even companies like VW and Mercedes are building better cars than Fisker at the moment in terms of technology and software. So Tesla, for example, should trade at a premium to the others. Also, it will be interesting to see if the EV market will trade at a similar multiple to the legacy automakers or if the legacy automakers will start to trade at higher multiples.

FSR Valuation

Fisker also has competition from models like the VW ID, Mercedes EQB or Tesla Y, but I think the above-mentioned companies are a better comparison. So I would say somewhere between a 1.0x to 1.5x Price/Sales multiple for Fisker should be fair given the circumstances and conditions.

If we assume that Magna manages to produce 50k to 70k Oceans next year and they can deliver 75% of the cars we get 37.5k to 52.5k delivered Oceans in 2024. If we now assume an average selling price of $45,000 due to the product mix and possible price cuts in 2024, we get a range of 1.687 to 2.36 billion in sales. This would put Fisker in a range of $1.687 to $2.5 billion for the conservative case and $2.36 to $3.5 billion for the optimistic case. As of today, Fisker’s market cap is $1.5 billion, so if they can deliver on their promises, there is huge upside potential. But if they end up delivering only 20,000 cars in 2024, the downside is not small either. In addition, Magna could expand production in 2024 and perhaps also sell the PEAR or Alaska, which would increase the sales potential even more. In addition, Fisker still has some smaller revenue streams.

Conclusion

Fisker is a very interesting investment with huge upside potential but also things that create a lot of uncertainty, which makes it very difficult for investors. The struggling EV market combined with high valuations and Fisker’s balance sheet and dilution risks are all serious points of concern. High risk, high reward seems to be a very good description. But a small position could be very profitable if the thesis works out and Fisker delivers.

Read the full article here