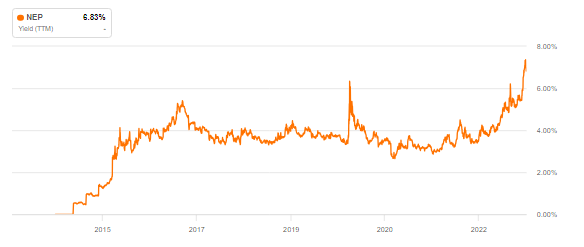

NextEra Energy Partners (NYSE:NEP), once a high-flying dividend stock, has seen its stock price languish amidst higher interest rates. With the stock yielding nearly 7%, dividend investors may be wondering if it is time to “back the truck up” so to speak. Investors may be having trouble adjusting to the reality of the higher interest rate environment, as NEP may face great difficulty in driving growth in such an environment. I discuss how the upcoming debt maturities may further pressure growth rates, making the 7% yield look more expensive than cheap. Past results do not predict future performance – I am doubtful that the company can achieve its aggressive 12% to 15% distribution growth guidance without compromising its already highly leveraged balance sheet.

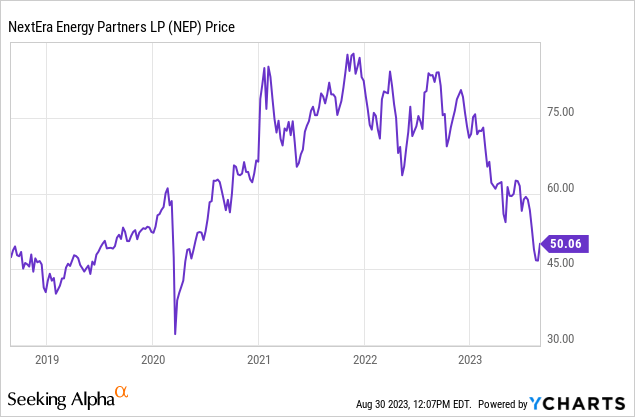

NEP Stock Price

Heading into 2022, NEP was one of the biggest winners in the dividend space, offering a rare blend of yield and growth. The stock has crashed heavily from recent highs due to the higher interest rate environment.

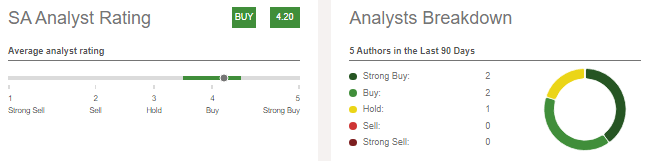

I see that my colleagues have a very bullish view of the stock.

Seeking Alpha

With the stock offering its most attractive valuation ever (in terms of dividend yield), I searched hard for reasons to join the bandwagon – but unfortunately came to the conclusion that downside or at least underperformance appeared more likely here.

NEP Stock Key Metrics

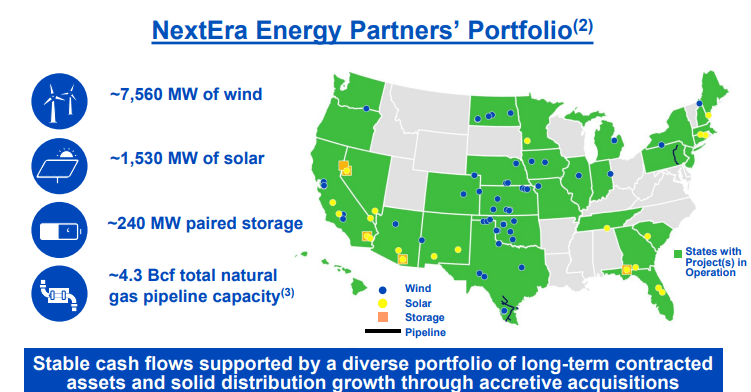

I don’t intend to rehash the business story here – my colleagues have written excellent reports on this already. But here is a quick refresher on the company and recent financial results. NEP is an energy company mainly focused on renewable energy generation. The company does have some pipeline exposure, but it is working on selling off those assets to become a pure-play renewable energy investment.

2023 Q2 Presentation

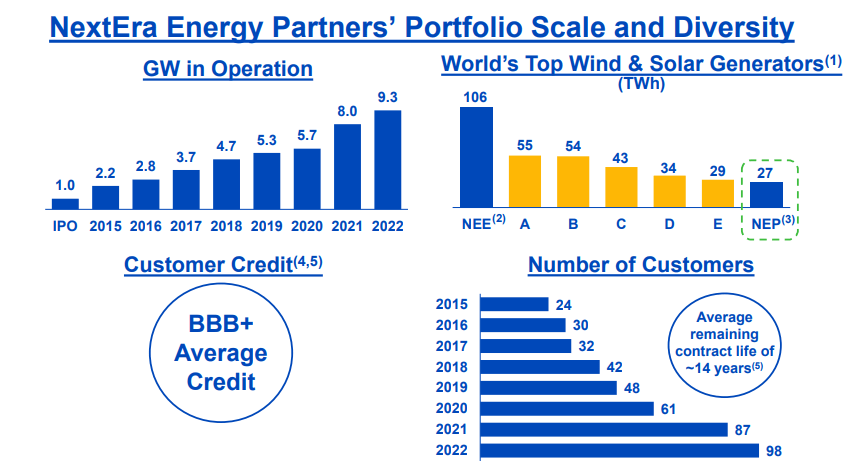

The idea is that its customers sign long-term contracts, agreeing to pay for a base amount of energy generation at a certain price. NEP typically acquires these assets from its parent company NextEra Energy (NEE). In some sense, NEP can be thought of as being quite similar to net lease REITs (‘NNN REITs’) due to the long-term contracts and similarity to sale and leaseback transactions. NEP’s counterparties have an average BBB+ credit rating and the company has increased its customer roster rapidly over the past several years.

2023 Q2 Presentation

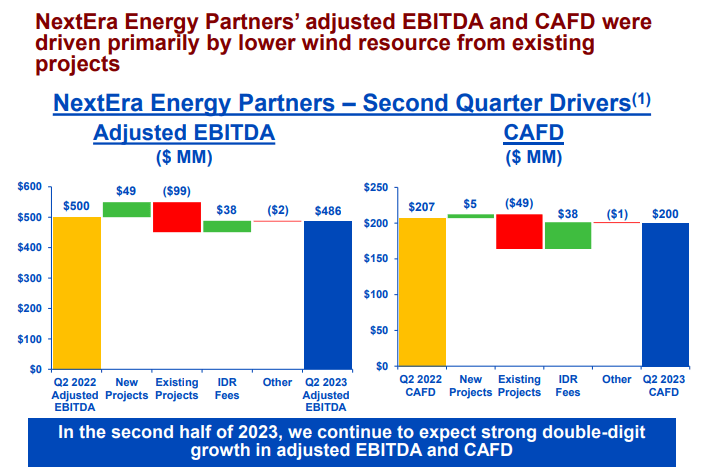

In its most recent quarter, NEP saw both adjusted EBITDA and cash available for distribution (‘CAFD’) decline YOY as growth from new projects was unable to offset declines at existing projects.

2023 Q2 Presentation

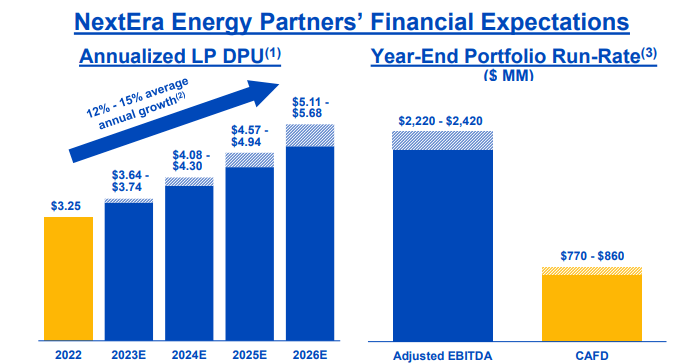

Management expects growth to pick up in the second half of the year, with up to $860 million in projected CAFD for the full year. Management has reiterated expectations for 12% to 15% average distribution growth through 2026, but on the conference call noted that it may be more at the low end of that range.

2023 Q2 Presentation

I suspect that the commitment to the distribution growth guidance is what’s helping many investors maintain their conviction in spite of the growing warning signs from the macro environment.

Is NEP Stock A Buy, Sell, or Hold?

At first glance, NEP looks like an outright steal, trading at its highest distribution yield ever at around 7% while management is guiding for at least 12% forward growth.

Seeking Alpha

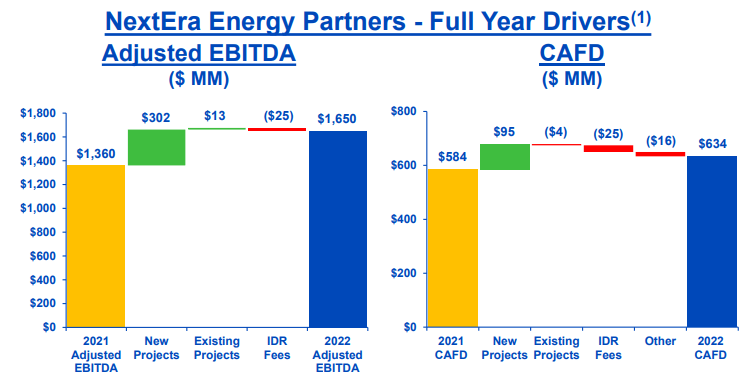

But that is not the right way to look at it. Instead, investors should be asking how believable the guidance is. Consider that essentially all the cash flow growth in 2022 came from new projects. With NEP seeing declines at existing projects this year, it is clear that we should not be expecting growth, if at all, from existing projects, at least not on a consistently recurring basis. This is one way in which NEP differs from NNN REITs which typically have annual lease escalators (and thus can post some growth even without external acquisitions).

2022 Q4 Presentation

The stock currently yields just shy of 7%. Based on the high end of CAFD guidance, NEP will generate around $4.52 in CAFD per share in 2023 (for those checking the math, I note that the market cap commonly reported is not including the units owned by NEE). The stock is trading at a roughly 9% CAFD yield. Property, plant, and equipment increased by $3.5 billion from 2021 to 2022, implying around an 8.5% yield on new acquisitions. The acquisition yield is even lower if we compare 2022 results with those from 2019 at around 6.8%.

That calculation suggests that funding new acquisitions through retained cash flow will not create excess shareholder value. Another way to put it, if NEP only used retained cash flow to fund new acquisitions, then the best that shareholders could hope for is around 2% growth. Issuing stock to fund acquisitions may be dilutive or only mildly accretive, at best.

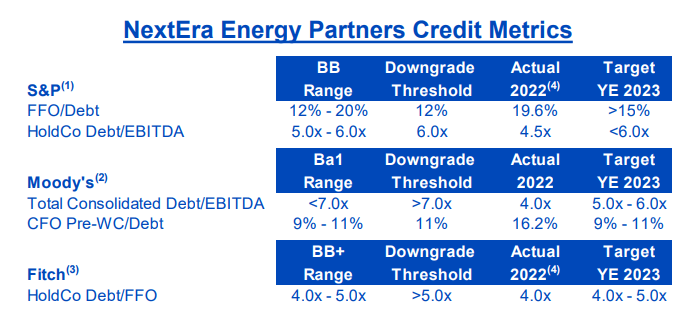

But with management still committing to their 12% distribution growth guidance, that implies that they may be looking to issue debt to fund acquisitions. I note that NEP has $6.3 billion in long-term debt and management expects to be near the high end of S&P’s metrics by the end of the year. In other words, I don’t see much capacity here from a debt perspective to fund accelerated acquisitions.

2023 Q2 Presentation

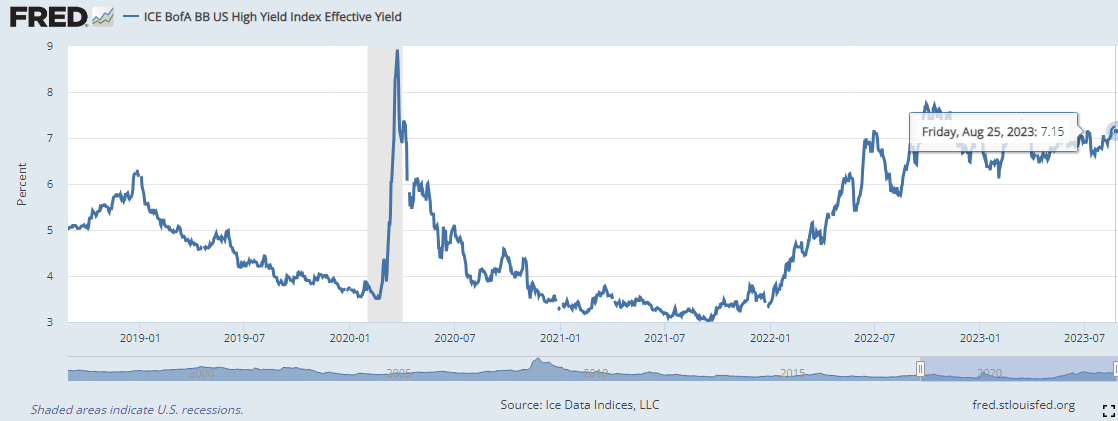

What’s more, the average yield for BB-rated issuers hovers around 7%.

St. Louis Fred

Unlike in past years where NEP might have enjoyed higher investment spreads as well as the ability to ramp up leverage, the path forward looks more challenging. Between NEP’s high leverage load and the high cost of capital, I struggle to see how NEP will come remotely close to generating 12% cash flow growth on a sustainable basis. Yes, NEP could in theory sustain solid distribution growth in the near term by elevating its payout ratio, but that cannot be sustained over the long term.

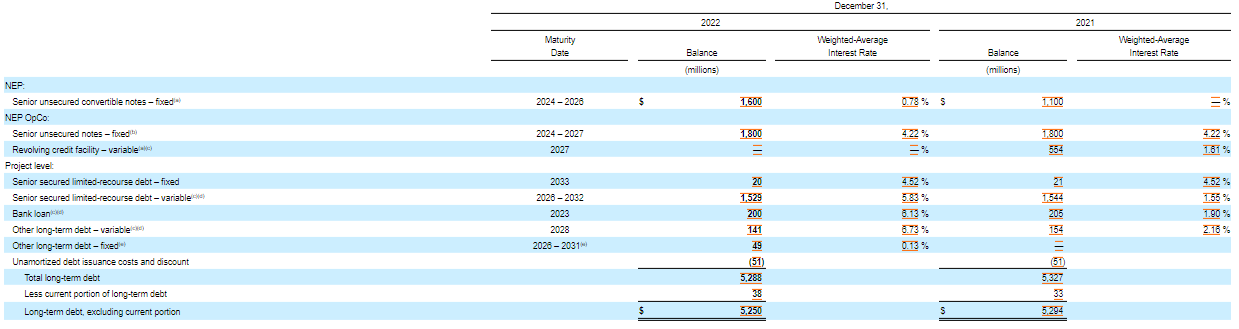

There’s yet another issue. NEP is set to see around $3.4 billion of debt mature through 2027. These debt securities were initially issued with very low interest rates.

2022 10-K

Assuming a 7% interest rate is used on new debt to refinance these maturities, that would lead to roughly $150 million in extra interest expense, which would make up over 17% of full-year CAFD guidance. Averaged out over four years, that implies around 4% of annual drag that may hold down growth rates. I wouldn’t be surprised if interest expense headwinds alone are able to keep CAFD growth rates very close to zero (let alone far away from 12%).

Where does that leave us? NEP looks like a 6.7% yielding stock with poor growth prospects. Yes, a 6.7% yield is higher than the stock has yielded historically, but forward growth rates aren’t likely to resemble those of the past. If anything, this is a name which may present further downside to around 8%, as that would be more in line with expected returns from the broader market (and many other high yielders are hovering around that level). Perhaps one might want to buy NEP due to views that interest rates might fall. However, there are arguably more compelling ways to express such a view, and one mustn’t rule out the possibility that NEP continues to trade at a discount due to investors now realizing that the company is so exposed to rising interest rates. Is this a short? At these valuations, I see a greater case for underperformance rather than an outright implosion. It is possible that many investors are OK with a flat 6.7% yield, at least long enough to make financing a short unreasonable. With the downside at around 14% (excluding the dividend), the risk-reward does not look favorable for short positions. I rate NEP with a neutral rating as the high yield is more than offset by poor growth prospects.

Read the full article here