Investment Thesis

Company Overview

Clorox Company (NYSE:CLX) is a manufacturer and marketer of consumer and professional cleaning, disinfecting, and health products. The company has four reportable segments: Health and Wellness, Household, Lifestyle and International.

Strength and Risks

Clorox has become a household name synonymous with cleanliness and hygiene. The company has several highly recognizable brands in the consumer staples space. They not only include its name-sake Clorox and household cleaning brands, such as GLAD and Fresh Step, but also Burt’s Bees, a consumer favorite in the organic mass-market personal care category. As the company put it in the FY 2023 10k, it “generally competes on the basis of product performance, brand reputation, and recognition, image and price”. The company initiated the IGNITE program in 2019 to revamp the company’s profitability along with underlying value and innovation, technological improvement, and product expansion.

Clorox: Brand Name Recognition (Company Presentation )

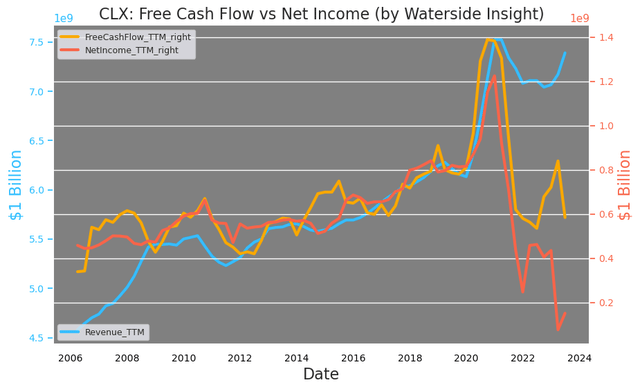

There has been a pandemic-induced sales boost leading its revenue to jump by over 25% in 2020. After the initial surge, its topline has largely oscillated around $7 to $7.5 billion. A clear sign of changed consumer behavior as a result of the pandemic is here to stay. However, its free cash flow and net income have fallen dramatically after the sales dipped a little in 2021. Its TTM free cash flow fell by almost 30% to its historical average and its TTM net income is only one-third of where it was before the pandemic.

Clorox: Free Cash Flow vs Net Income (Calculated and Charted by Waterside Insight with data from company)

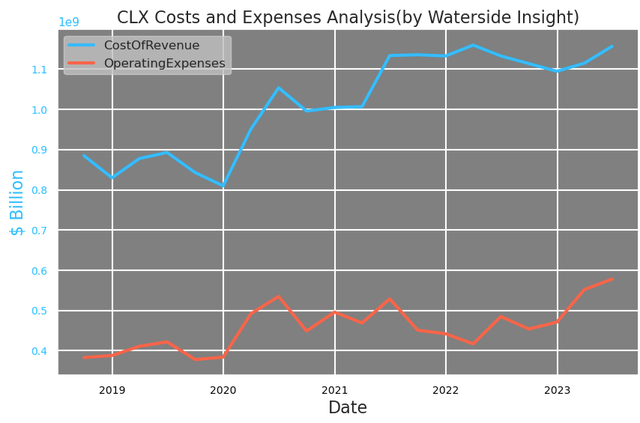

This is partly due to lower sales, but mostly because of its rising costs of products sold and operating expenses. They have grown by almost 40-50% compared to pre-pandemic levels. It will be impossible to improve its net income and free cash flow without cutting costs and expenses.

Clorox: Costs and Expenses Analysis (Calculated and Charted by Waterside Insight with data from company)

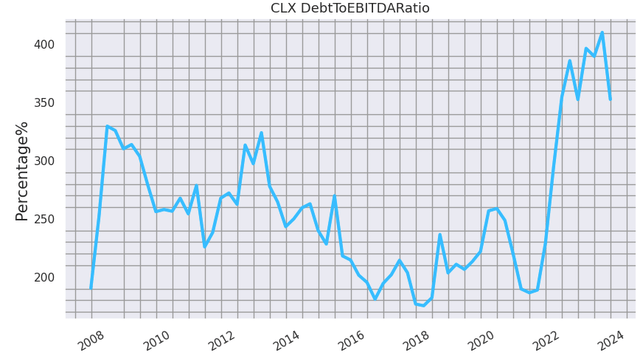

Clorox has quenched its debt-to-equity ratio from 110.8x in 2022 to 13.8x currently, after making a record $1.4 billion debt payment last year. This is a significant progress. However, according to its earnings presentation, the company has a clear debt leverage ratio target, which is 2- 2.5x of debt-to-EBITDA. This ratio currently is hovering around 3.5x. There is apparently more in the de-leveraging process needed ahead for the company.

Clorox: Debt-to-EBITDA Ratio (Calculated and Charted by Waterside Insight with data from company)

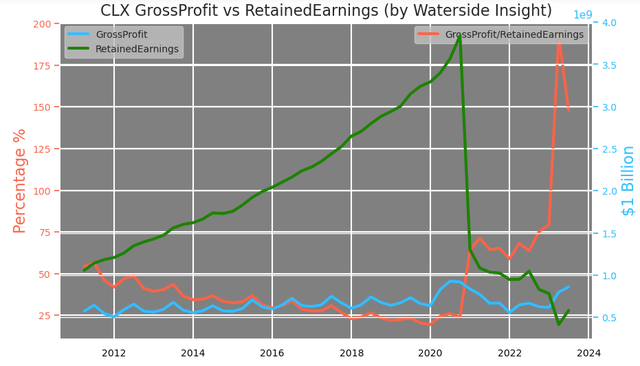

However, the problem is it is retaining some of the lowest levels of earnings in its history after costs, expenses, taxes, and payout to shareholders. Its retained earnings have fallen to be lower than its gross profits for the first time in a long time. Its gross profits are now 1.5x of the earnings it retains.

Clorox: Gross Profit vs Retained Earnings (Calculated and Charted by Waterside Insight with data from company)

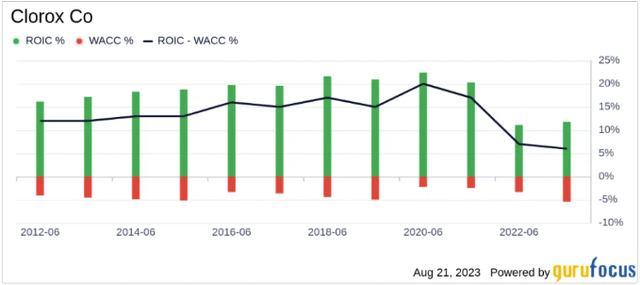

In fact, its return on invested capital is only exceeding its weighted average cost of capital by about 5%, down from the double digits it used to see most of the time during the past ten years.

Clorox: ROIC% vs WACC% (Guru Focus)

Making large debt payments will mean the company won’t be able to grow its total equity and the value of the business. And such a trade-off is necessary. In order to truly normalize its balance sheet sustainably, Clorox will need to not only cut costs but also raise debt payments, which doesn’t leave much room for equity growth. The normalization from its ballooning balance sheet in the past three years, whether it be the sales or the costs, has only begun. Even by its own standard, there are ways to go before its financial conditions get back to normal.

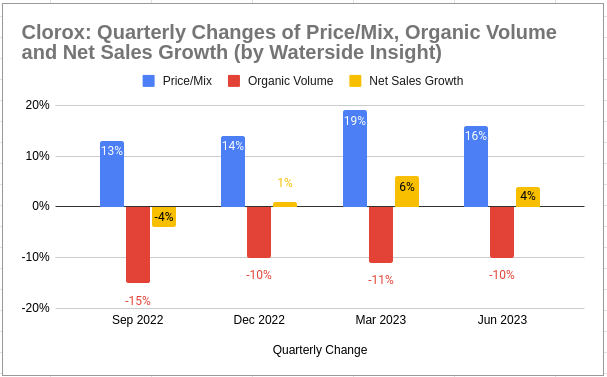

Clorox has had four quarters of consecutive organic sale volume decreases. The rise of net sales becomes more reliant on price increases. The company reported over 80% of sales from the US, which has a weakening consumer sentiment according to the latest reading by the Conference Board. Even without the concern of balance sheet normalization, the company could be under pressure to cut costs and prices, which could in turn push the marginal growth of net sales into the negative.

Clorox: Price vs Volume (Calculated and Charted by Waterside Insight with data from company)

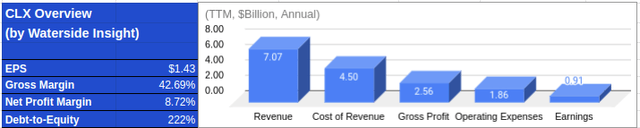

Financial Overview

Clorox: Financial Overview (Calculated and Charted by Waterside Insight with data from company)

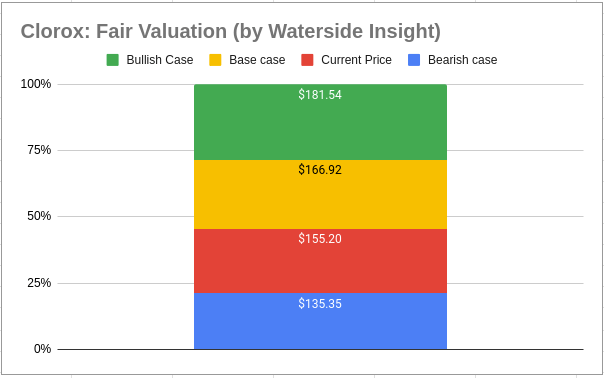

Valuation

Based on our analysis above, we use our proprietary models to assess Clorox’s fair value by projecting its growth ten years forward. We use a cost of equity of 4.54% and a WACC of 6.81%. In the base case, the company faces a decline in growth in FY 2024, which starts in Q3 of 2023. The normalization in its growth and balance sheet take several quarters with better growth coming in later years. It was priced at $166.92. In the bullish case, it is able to spread out the normalization in the next two or three years with better topline support, it was priced at $181.53. In the bearish case, more near-term downside risks to its cash flow come not only from debt reduction or cost cutting but from the regression of topline growth; it was priced at $149.62. The current stock price reflects a certain degree of bearish sentiment from the investors. However, there may be more downsides to come.

Clorox: Fair Valuation (Calculated and Charted by Waterside Insight with data from company)

Conclusion

Facing pressure to cut costs and debt while maintaining its sales, Clorox may not be able to grow its equity in the near term. Although it was able to make large debt repayments without impacting shareholders’ returns, this necessary process has only begun and still has a long way to go. Even though overall consumer staples could provide some resilience, it is not in the category that could see price increases for much longer in my view. The company is more vulnerable to the near-term price pressures. Its stock is not at an expensive valuation, but we think the downside hasn’t fully played out yet. It will be a hold at the current situation.

Read the full article here