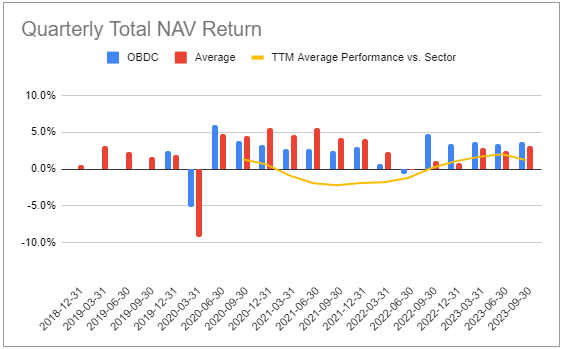

In this article, we take a look at the Business Development Company Blue Owl Capital Corporation. (NYSE:OBDC). The company has extended its terrific run of performance with a +3.6% total NAV return in Q3.

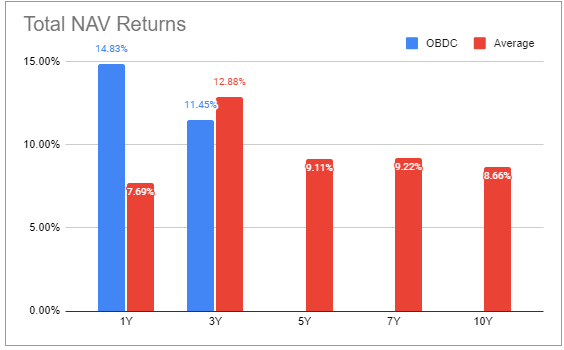

Over the past year, the company delivered an exceptional +15% total NAV return, outperforming the median BDC in our coverage by 7%.

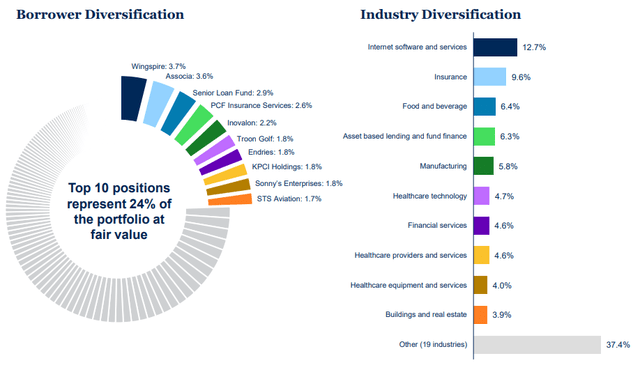

OBDC targets borrowers in the upper middle-market space with a weighted average EBITDA of $186m in the portfolio. Its top sectors are software, insurance, healthcare, and others.

OBDC

OBDC trades at an 11.7% yield and a 7% discount to book. Its net income price yield is 13.6%, roughly in line with the sector average.

Quarter Update

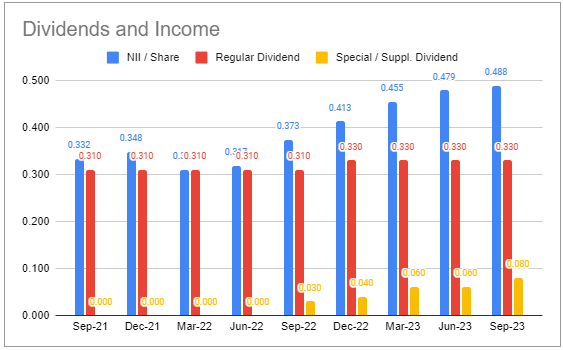

Net income ticked higher by a penny to a new record of $0.49 – the sixth consecutive quarterly rise. The catalyst for the continued rise in net income has been the upward path of short-term rates.

Systematic Income BDC Tool

As we can see from the chart, the pace of rises is clearly stabilizing just as short-term rates have leveled off as well. If the Fed remains on hold from here we wouldn’t expect significant sustained changes in net income over the medium term.

The company hiked the base dividend by 6% to $0.35. The company has a framework for calculating the supplemental dividend which equals half of the excess dividend. Based on this we expect a $0.07 supplemental declared for Q4, resulting in a total Q4 dividend of $0.42 – an increase of a penny over the total Q3 dividend. This would equate to a total dividend coverage of 117% – leaving the company with additional room for base dividend hikes.

The spillover is $0.26 or about 2/3 of the quarterly base dividend. It will keep increasing given the company only pays out half of the excess dividend.

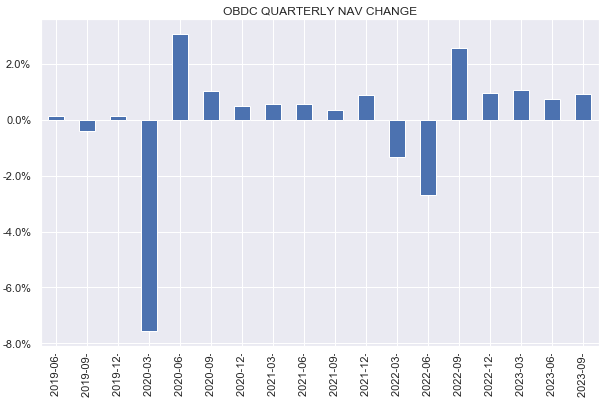

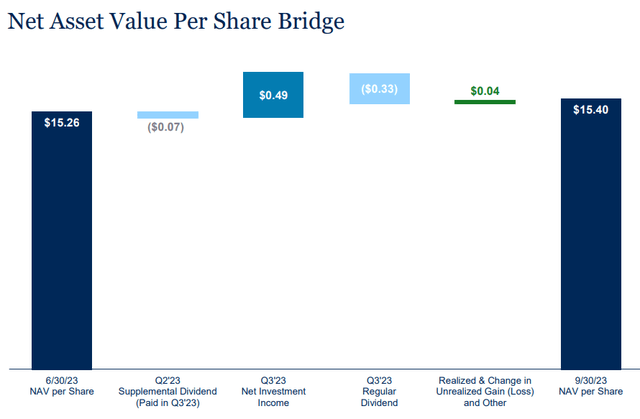

The NAV rose by nearly 1% – the fifth quarterly rise.

Systematic Income

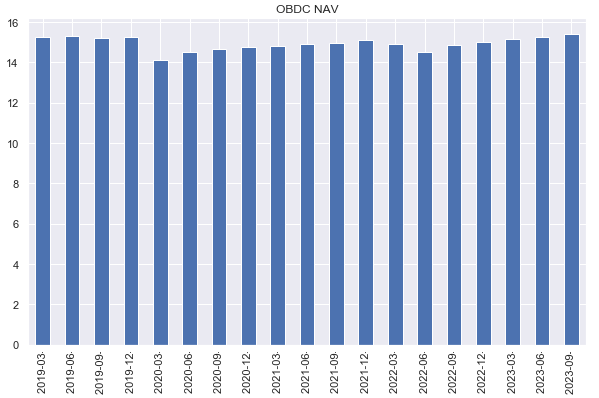

The NAV now stands at a record level since inception – a rare result in the BDC space.

Systematic Income

Retained income is doing much of the heavy lifting in the positive NAV trajectory. Unrealized appreciation pitched in as well, rising $0.04 – a trend we have seen across the sector in the last quarter.

OBDC

Income Dynamics

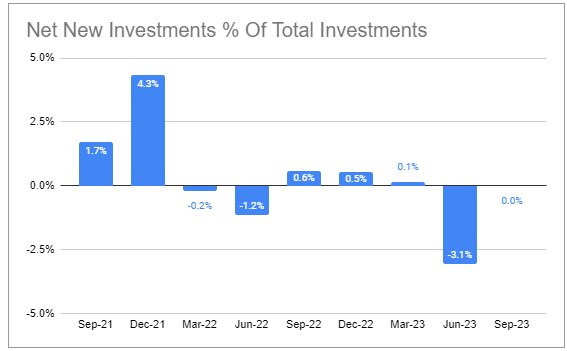

Net new investments were flat as sales and repayments closely matched new fundings.

Systematic Income BDC Tool

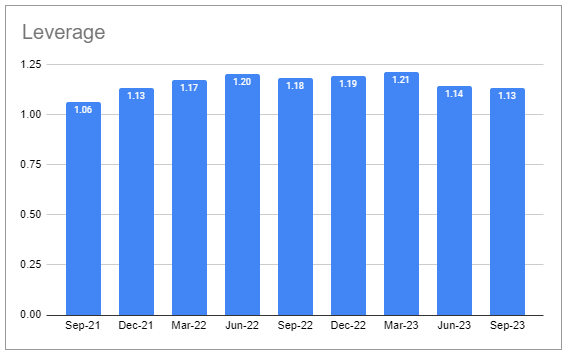

Leverage ticked lower and remains in the company’s target range.

Systematic Income BDC Tool

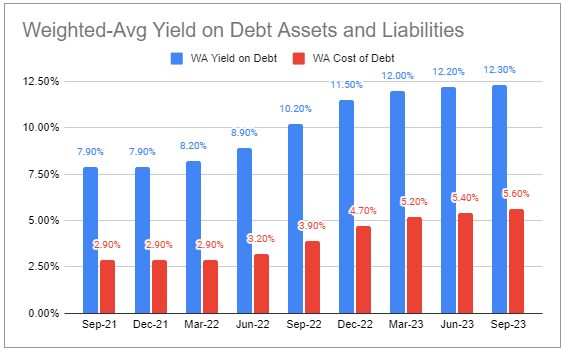

Asset yield increased slightly from a rise in base rates, continuing to level off.

Systematic Income BDC Tool

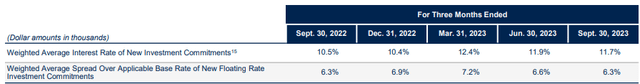

The weighted average rate of new commitments has fallen over the last couple of quarters, despite the rise in the base rate due to the drop in credit spreads. This normalization in spreads is a slight headwind on net income.

OBDC

Portfolio Quality

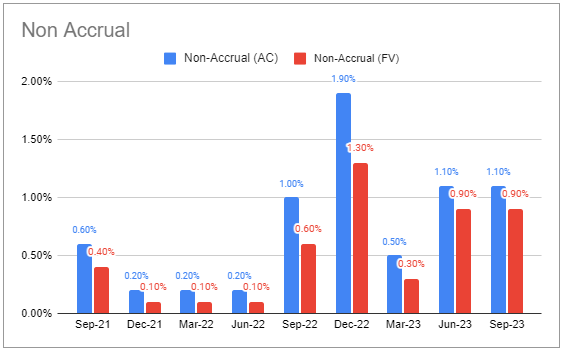

Non-accruals remained unchanged at 0.9% on fair value.

Systematic Income BDC Tool

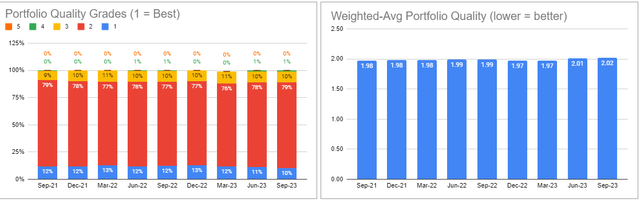

Portfolio quality, as gauged by internal ratings, fell slightly however that was primarily due to companies falling out of the highest rating bucket to the next rating bucket.

Systematic Income BDC Tool

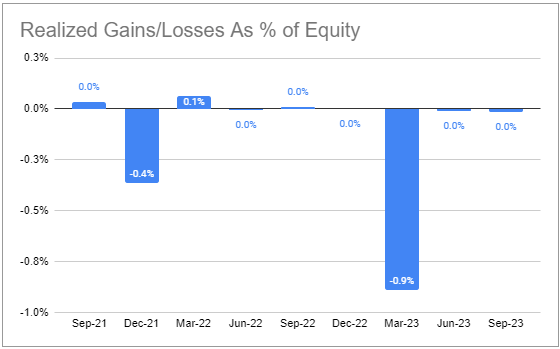

There was a negligible net realized loss. The overall cumulative rate over the last couple of years is quite strong.

Systematic Income BDC Tool

The company maintains an above-average level of floating-rate debt which has been a headwind to net income. Its first bond refinancing is next year however this will not have a significant impact on net income as the bond has been swapped to a floating rate and the yield curve has normalized significantly.

Management mentioned they received several credit amendments this year and equity sponsors have contributed additional capital in 70% of cases which is good to see.

Valuation and Returns

The company continued its streak of outperformance with a fifth consecutive outperforming quarter.

Systematic Income BDC Tool

It has underperformed the sector slightly over the past 3 years but has done exceptionally well over the past year.

Systematic Income BDC Tool

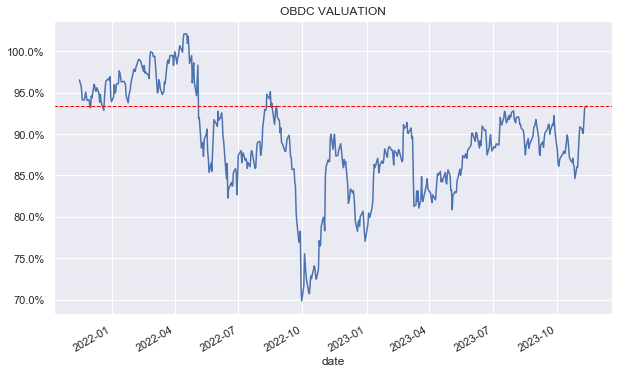

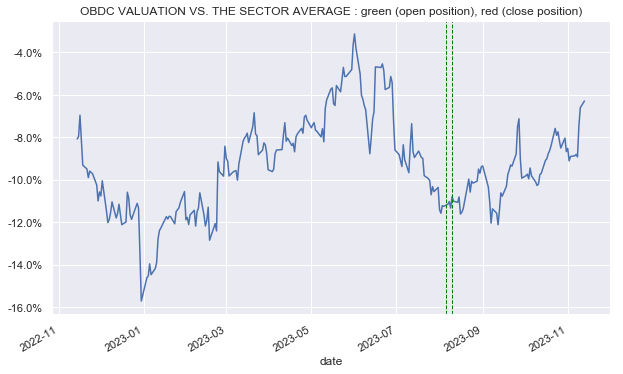

OBDC has traded almost consistently below its NAV since its inception.

Systematic Income

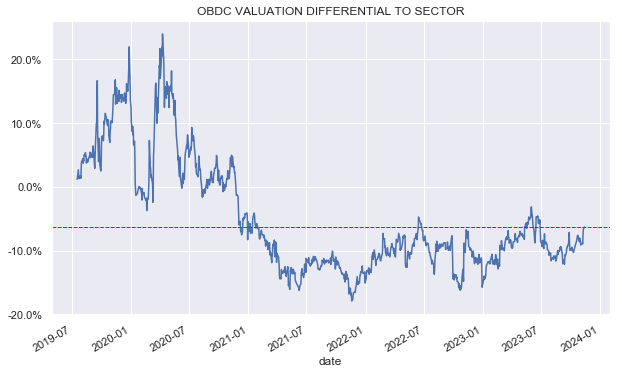

Since 2021, the stock has traded at a discount to the sector average valuation of around 7-15%.

Systematic Income

We added the stock to our Income Portfolios earlier this year at double-digit discounts. Since then it has outperformed the sector by around 5%. We expect this convergence to play out further over the medium term.

Systematic Income

OBDC is one of the few BDCs with a strong track record that trades at a discount valuation to the sector. It remains a Buy in our Income Portfolios.

Read the full article here