The Schwab Short-Term U.S. Treasury ETF (NYSEARCA:SCHO) is one of many funds that investors flocked to the last several years as the Fed went through the fastest rate hike cycle in history. Those days may now be over. SCHO is a good fund, but from an asset allocation perspective, I’m not convinced it’s worth positioning here now.

SCHO was launched in 2010 and has amassed a total net asset value of over $12 billion. It offers a straightforward, low-cost means of gaining exposure to U.S. Treasury securities, particularly those with a remaining maturity of between 1 and 3 years. This focus on short-term bonds allows the fund to minimize both credit and interest rate risk, making it an attractive addition to a diversified portfolio.

SCHO’s Fund Details

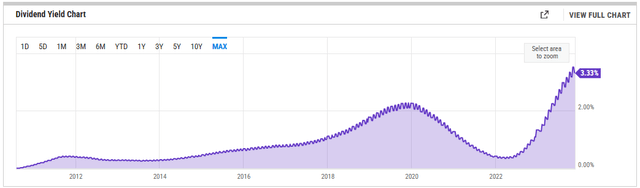

SCHO has a total expense ratio of 0.03%, which is comparatively low for an ETF of its kind. This low expense ratio translates into higher returns for investors. The fund distributes yields monthly and has 98 holdings in total. No surprise – the yield is the highest it’s been in a decade.

YCharts

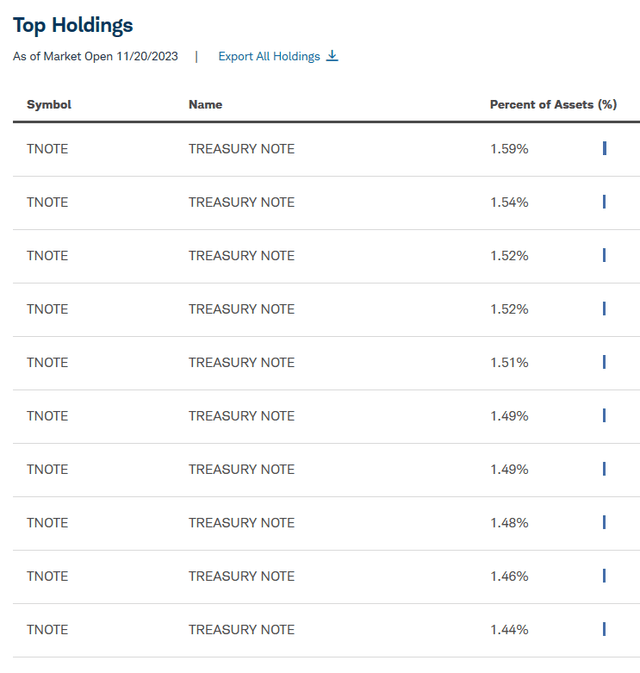

As noted, SCHO invests exclusively in U.S. Treasury bonds with maturities ranging from 1 to 3 years. All Treasury notes, with small percentages. This is a very clean pure-play way of accessing Notes without having to go to Treasury Direct.

Schwab Asset Management

Sector Composition

SCHO’s sector composition is straightforward: 99.9% of the fund’s assets are invested in U.S. Government Securities, with the remaining 0.1% allocated to Other Investment Companies. The latter category represents the fund’s position in money market mutual funds registered under the Investment Company Act of 1940 and may include cash pending settlement.

Peer Comparison

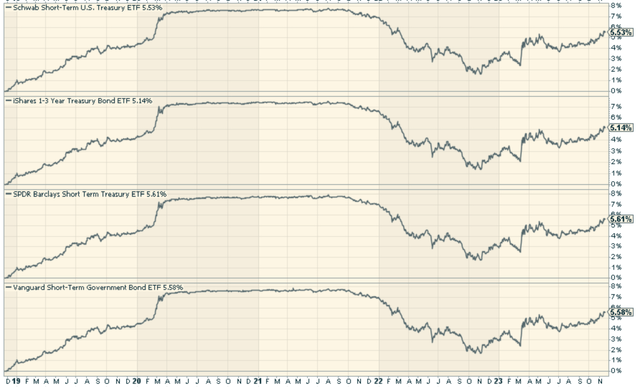

SCHO’s most direct competitors include the iShares 1-3 Year Treasury Bond ETF (SHY), the SPDR Portfolio Short Term Treasury ETF (SPTS), and the Vanguard Short-Term Treasury Index Fund ETF Shares (VGSH).

While all these ETFs aim to achieve similar investment goals, there are notable differences related to their expense ratios, total asset size, average volume traded, and yields. For instance, VGSH, with a total asset size of over $22 billion, has an expense ratio of 0.04% and an average volume traded of 2.5 million. In comparison, SCHO’s expense ratio is lower at 0.03%, but its total asset size is smaller, at $12 billion.

The performance of all has been roughly the same.

StockCharts.com

Pros and Cons of Investing in SCHO

One of the primary advantages of investing in SCHO is its focus on short-term U.S. Treasury bonds. This focus helps to mitigate both credit and interest rate risk, making it a potentially attractive option in the current economic environment.

Another benefit is its low expense ratio of 0.03%, which means higher returns for investors. The fund is also highly liquid, making it easy for investors to buy and sell shares in the stock market.

On the flip side, the fund’s performance is closely tied to the performance of the U.S. Treasury bond market, meaning that adverse economic conditions or changes in U.S. monetary policy could negatively impact the fund’s returns.

Conclusion

In conclusion, the Schwab Short-Term U.S. Treasury ETF represents a viable option for investors seeking exposure to short-term U.S. Treasury bonds. Its low expense ratio, high liquidity, and focus on risk mitigation make it an attractive addition to a diversified portfolio. I’d rather favor duration now given where the Fed is in the interest rate cycle, so while this is a good fund and conservative, there is more potential to make elsewhere in my view.

Read the full article here