Since my previous article, Workiva (NYSE:WK) has declined nearly 5% while the S&P has increased by greater than 2%. I predicted Workiva would be flat and thus I rated it a “Hold.” I believe Workiva will continue to decline compared to the overall market and thus I am downgrading to “Sell.”

Let’s dig into the current issues, discuss the Q3 financial results, recent XBRL data quality results, and why I’m downgrading my position.

SEC and XBRL

I think it’s clear the SEC sees the value of Inline XBRL (iXBRL) as rules continue to expand. New cybersecurity and insider trading rules have been published and as I’ve discussed in prior articles rules surrounding ESG are due shortly.

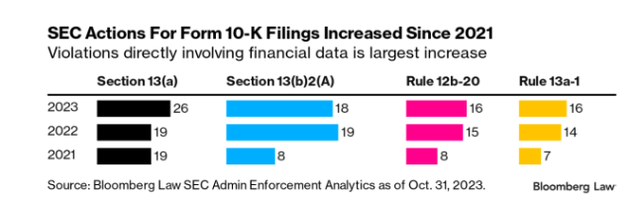

A new article by Bloomberg Law illustrates the SEC is clearly using and reviewing XBRL data as the number of enforcement actions has increased.

Here is a breakdown of the violations in 10K statements regarding underlying rules, Section 13(a), Section 13(b)2(a), Rule 12b-20, and Rule13a-1:

Bloomberg law

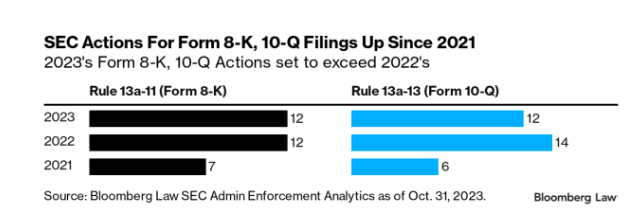

Here is a breakdown of the violations in 10Q and 8K filing regarding underlying rules, Section 13a-11, and Rule13a-13:

Bloomberg law

Although not a huge number of enforcement actions, I would venture to guess this number will continue to rise in 2024 and beyond.

XBRL Quality

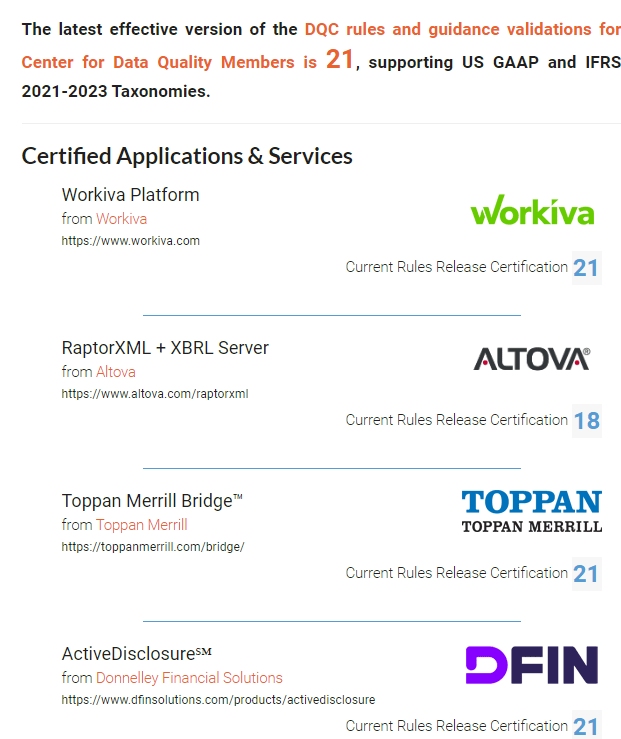

Since my last article, one new set of XBRL rules has been added. Workiva, DFIN, and Toppan Merrill all support the last XBRL ruleset, ruleset 21:

XBRL US

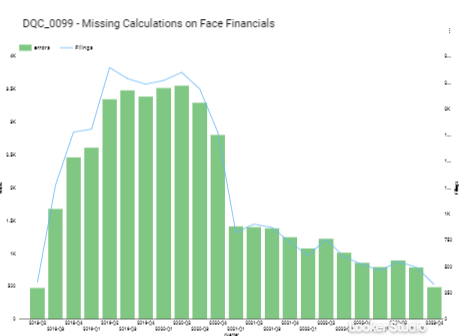

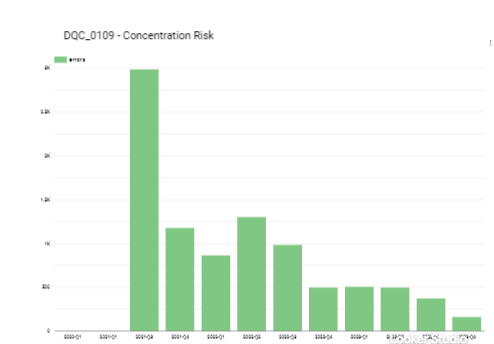

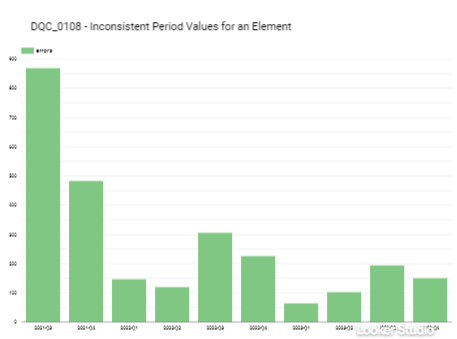

Looking at the overall XBRL industry the trend continues to be positive. The below graphs are all for “newer” DQC rules and like prior articles, the trend is very encouraging as the number of errors continues to decline.

Missing Calculations on Face Financials

XBRL US

Concentration Risk

XBRL US

Inconsistent Period Values for an Element

XBRL US

In this quarterly review of XBRL data quality, I’ve taken a sample of mostly companies I have reviewed previously. The below are the data quality findings for Workiva, Toppan Merrill and DFIN.

Workiva has been providing the XBRL services for the following companies. You can see the following results from the XBRL US website:

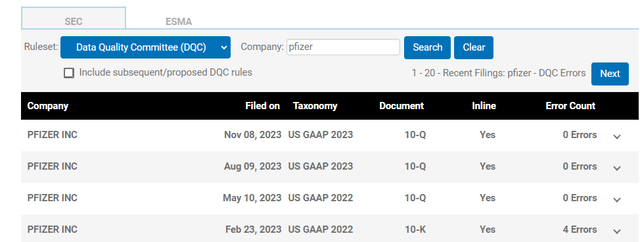

Pfizer (PFE)

XBRL US

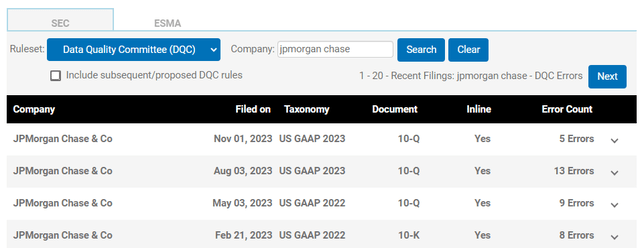

JPMorgan Chase (JPM)

XBRL US

Like last quarter, Pfizer didn’t have any issues in the recent quarter. JPMorgan Chase continues to have XBRL issues as their most recent 10Q filed with more errors. Again, I can’t stress enough the complexities of XBRL. It is very difficult to follow new SEC rules and comply with XBRL data quality standards with an “in-house” model.

Like last quarter, I was unable to find any issues with Toppan Merrill filings. Toppan Merrill has been providing the XBRL services for the following companies and you can see the following results from the XBRL US website:

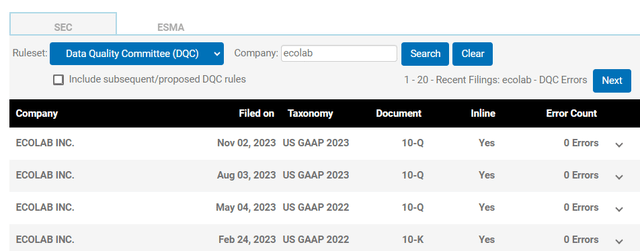

Ecolab (ECL)

XBRL US

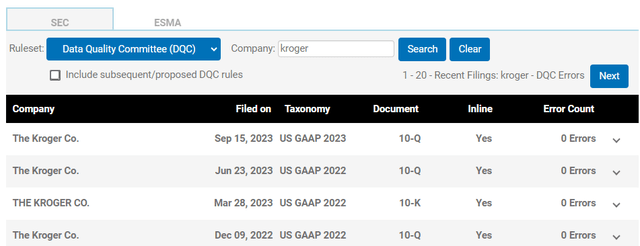

Kroger (KR)

XBRL US

Toppan Merrill continues to have consistent, high quality XBRL data quality results.

DFIN has been providing the XBRL services for following companies. You can see the following results from the XBRL US website:

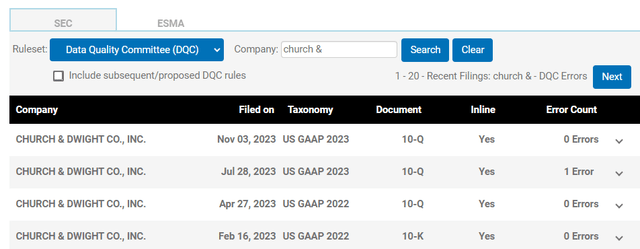

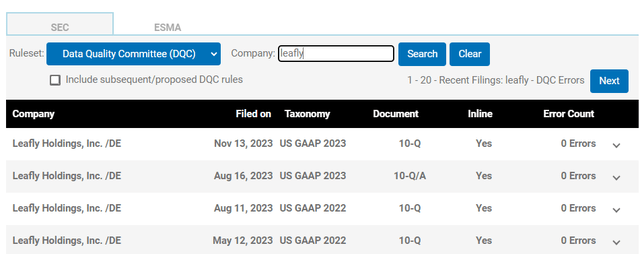

Church & Dwight (CHD)

XBRL US

Leafly (LFLY)

XBRL US

DFIN had good results in the current quarter with only one issue with Church & Dwight from their Q2 10Q 2023 filing.

AI and Partnerships

On the Q3 2023 earnings call, company management mentioned generative artificial intelligence [AI] and how Workiva plans to incorporate it. Workiva has been working closely with Google, Microsoft, and Amazon to create generative AI that can differentiate Workiva from competitors and deliver higher win rates in the future. On the call, CEO Julie Iskow stated, “We believe that every one of our Workiva solutions can deliver expanded value to our customers with generative AI by harnessing best-in-class large language models embedded directly into our platform.”

On this earnings call, I thought Workiva’s management team really emphasized the work of their partners, many of which are public accounting firms and technology companies. The company stated they are transiting lower-margin setup and consulting XBRL professional services to partners.

In one of my prior articles, I discussed the allocation of resources and perhaps the wrong emphasis current and prior Workiva leaders made regarding capital allocation. To me, Workiva has always been focused on technology advancements while accuracy and quality were put on the back burner. This earnings call reeked of “buzz words.” As an accounting professional, I’m not sure I’d be comfortable knowing my financial documents were set up and tagged for iXBRL by an unknown partner. As I’ve discussed above the SEC is cracking down on XBRL quality and companies, especially those using Wdesk, continue to file with errors. I would not want to risk having my financial documents set up by an inexperienced third party.

Financials

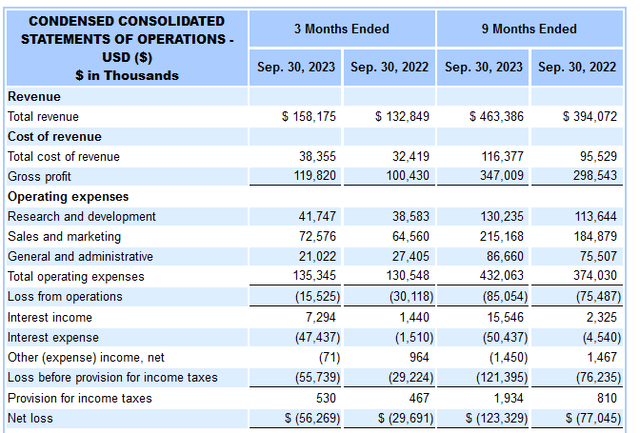

Workiva generated revenue of roughly $158 million in Q3 2023 which is an increase of nearly 19% compared to Q3 2022. Most of this revenue was generated from subscription and support revenue and revenue from professional services accounted for the rest. Subscription and support revenue was roughly $143 million, an increase of 21% compared to prior year’s third quarter. New logos and account expansion helped drive this growth. Professional services revenue was roughly $15 million for the quarter, which was up 3.5% compared to the prior-year third quarter.

Client count continues to rise as well as Workiva finished Q3 2023 with 5,945 clients, which is an increase of 404 customers compared to Q3 2022. For the current quarter, the company added 85 net new customers. Retention remains outstanding as Workiva had a net revenue retention rate of 112% for Q3 2023 which is greater than 107% in Q3 2022.

Management noted that larger subscription contracts have continued to increase as Workiva had 1,561 contracts valued over $100,000 per year, which is an increase of 24% compared to Q3 of 2022. The number of contracts valued at over $150,000 per year totaled 851, which is up 26% compared to the prior year. The number of contracts valued at over $300,000 per year totaled 296, which is up 38% compared to Q3 2022.

However, Workiva continues to post net losses as the company’s operating expenses continue to rise. As you can see below, Workiva’s operating expenses increased in both the three and nine-month ending periods in 2023 and the company posted larger net losses this quarter and YTD compared to the prior year:

SEC.gov

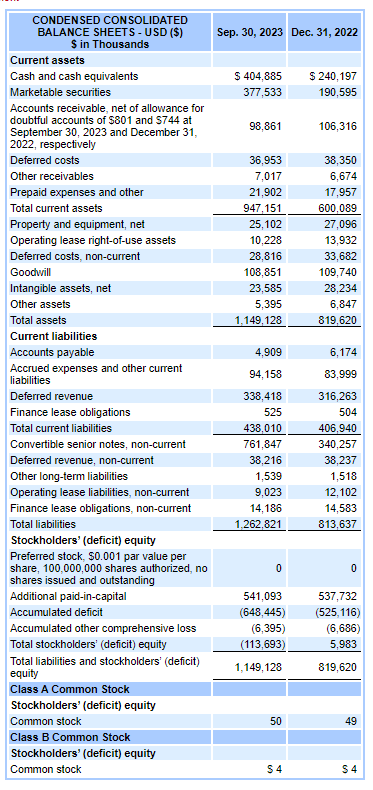

From a Balance Sheet perspective, the company has roughly $405 million of cash and enough current assets to cover its current liabilities. However, the company did increase its debt this year as its convertible senior notes jumped to over $760 million as you can see below:

Balance Sheet

Regarding capital allocation metrics, Workiva has far from desirable five-year returns as ROE is roughly -41%, ROCE is -43% and ROIC is roughly -15%. I would like to see these figures turn positive.

Lastly, there have been numerous insiders selling stock as you can see from SEC filings.

Valuation

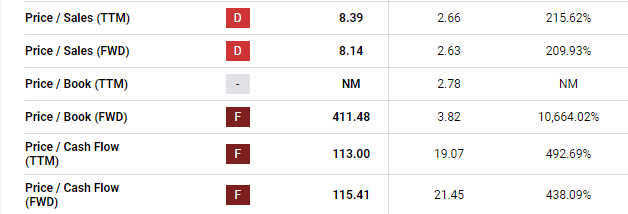

Workiva has yet to achieve profitability and is an expensive stock. As you can see from the below valuation metrics from Seeking Alpha, the overall value grade is a “F.” Workiva is higher than the sector median for many of these metrics such as the price to book and price to cash flow metrics illustrated below:

Seeking Alpha

Given the current prices to sales of 8.39 I think a more attractive entry would be closer 7.28 which the company obtained in the second quarter last year.

Conclusion

Despite the continued revenue growth, Workiva continues to remain unprofitable as net losses continue to mount and the company seems unable to reduce operating expenses.

Workiva continues to file with XBRL errors which I find concerning as the SEC is clearly scrutinizing XBRL data and sending more out more violations. Additionally, for those in financial reporting using Wdesk I’d be worried these partnerships would drop XBRL quality as this is a niche skill set.

Again, I think there is a capital allocation issue as the company is increasing its debt and spending more on operating expenses while not focusing on shareholder returns (as the metrics above illustrate) or becoming profitable.

Lastly, from a valuation perspective, the company remains expensive and it seems management feels that way as well considering various individuals sold stock within the last month.

Once the SEC establishes ESG mandates that may help Workiva gain more clientele as this is a key growth driver for the company. However, in this macro-environment with higher rates and lower IPO and SPAC activity, I don’t foresee Workiva’s stock beating the market in the near term. In the long term, I’m still concerned with Workiva’s XBRL accuracy and the growing net losses.

Read the full article here