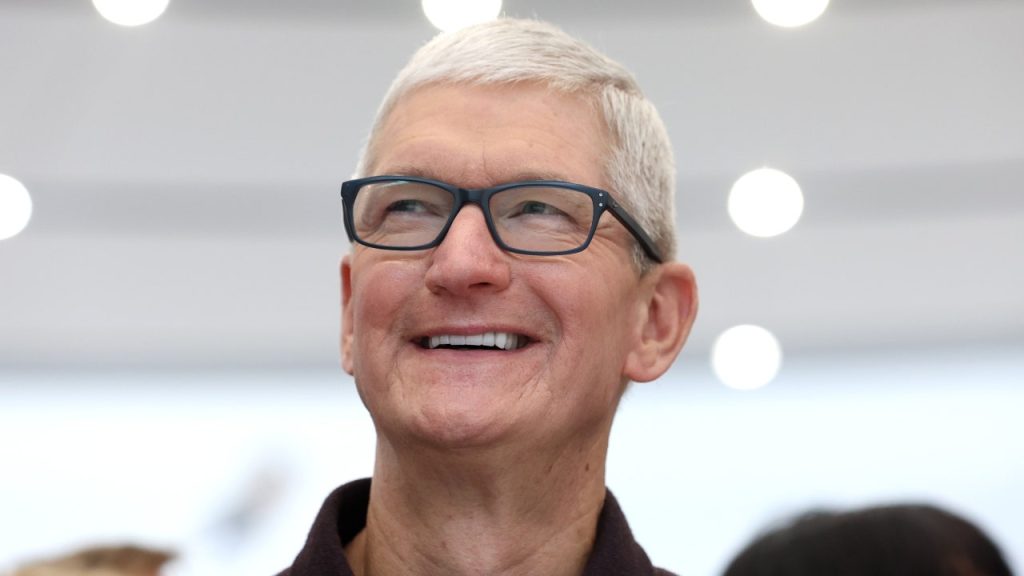

Tim Cook reportedly encountered temporary difficulty early on in obtaining one of Apple’s credit cards.

When the Apple CEO tried to get an Apple Card prior to the payment option’s official debut in 2019, he received a rejection, according to The Information. Resolving it reportedly required an override from the Wall Street bank that the tech company partnered with on the credit card, Goldman Sachs.

Four anonymous sources for The Information apparently attributed Cook’s temporary denial to a measure by credit bureaus to prevent the impersonation of prominent individuals.

The outlet reported Tuesday on the incident in a larger piece about the relationship between Apple and Goldman Sachs. FOX Business reached out to both entities for comment.

APPLE SCALES BACK VISION PRO PRODUCTION PLANS ON DESIGN CHALLENGES: REPORT

The total number of people using Apple Cards has since reached around 10 million, according to The Information.

That comes after Americans began having the option of getting the Apple Card in August 2019. The iPhone maker had revealed it would team up with Goldman Sachs and MasterCard to bring consumers the card in the spring of that year.

The company rolled out the high-yield savings accounts it started to offer to Apple Card holders in April. Those were also offered via Goldman Sachs.

People started 240,000 of the Apple savings accounts in the initial week they were offered, with the accounts seeing a massive amount of funds – $990 million – in the four days after they became available, Forbes reported.

APPLE HITS $3T IN MARKET CAP, BUT CHANGES COULD BE COMING TO ITS CREDIT CARD: REPORT

Apple’s payment services fall under its overall Services segment.

For the second quarter, net sales for the Services segment came in at $20.9 billion, climbing nearly 5.5% year over year.

APPLE’S SECOND-QUARTER REVENUE AND EARNINGS COME IN ABOVE ESTIMATES

Those net sales were part of the $94.84 billion overall generated in the three-month period by Apple, which also has iPhone, Mac, iPad and wearables, home and accessories segments. Its quarter net income was $24.16 billion.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| AAPL | APPLE INC. | 188.46 | +0.81 | +0.43% |

“For Services, we expect our June quarter year-over-year revenue growth to be similar to the March quarter, while continuing to face macroeconomic headwinds in areas such as digital advertising and mobile gaming,” Apple CFO Luca Maestri said in May.

Read the full article here