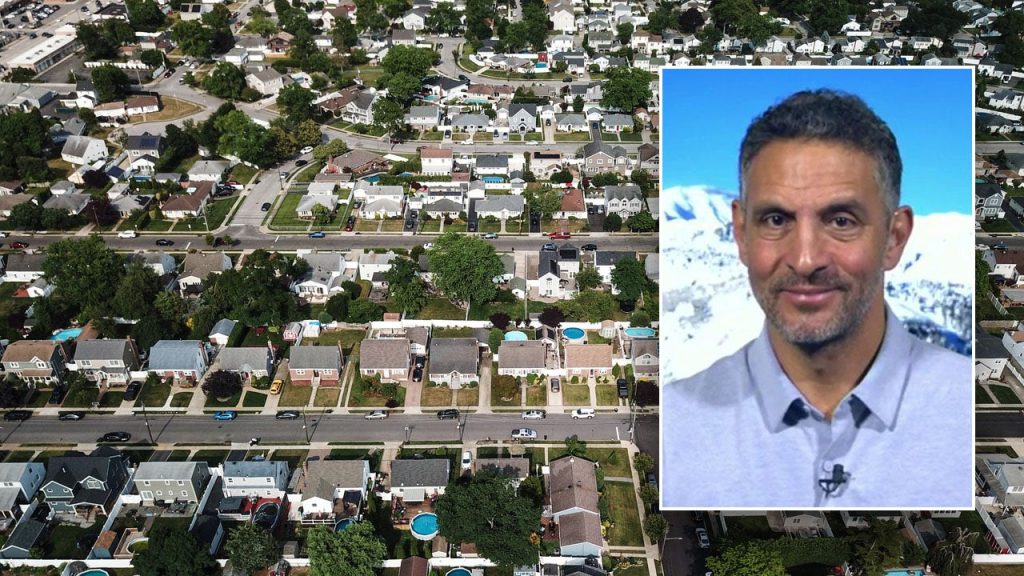

Celebrity real estate agent Mauricio Umansky is sounding the alarm over the “perfect storm of total unaffordability” brewing in the housing market.

Mauricio Umansky, The Agency founder and CEO, reacted to the state of the housing market after the 30-year fixed mortgage rate hit its highest level since early December.

“We’ve got super high interest rates above 7%. Mortgage applications are as low as they’ve been since 1995. And then we’ve got no supply,” he said during his appearance on “The Claman Countdown” Wednesday.

Umansky said we should not expect to see prices drop until we start “seeing some pain and some supply.”

BEVERLY HILLS HOME RENOVATIONS BLOCKED OVER LACK OF AFFORDABLE HOUSING

“Until we start seeing the pain and prices drop, I don’t see the government dropping interest rates. So, we really need to allow the markets to be markets, and for affordability to start happening so that the government starts dropping interest rates again,” he said.

When asked about the reasons behind the lack of inventory in the housing market, Umansky cited a decline in home building, buyers and sellers refusing to move due to their existing home mortgage and hedge funds buying single-family homes.

In December, Democrats introduced the End Hedge Fund Control of American Homes Act. The bill “imposes an excise tax on hedge fund taxpayers that own a certain number of single-family residence[s] in excess of a specified amount.” The effort also “establishes the Housing Down Payment Trust Fund into which tax revenues from this bill shall be deposited to provide grants for down payment assistance to taxpayers purchasing a single-family residence.”

FIRST TIME HOMEBUYERS SHOULD CHECK THESE CITIES PER REALTOR.COM

Despite being a proponent of free capitalism, Umansky suggested that government intervention may be necessary as Wall Street investors continue their single-family home buying sprees.

“The government does have to get involved a little bit and perhaps, you know, figure out some way of limiting the way that the hedge funds are able to do this, because right now in Middle America, they [hedge funds] are just eating up so much product that there’s just no supply hitting the market,” he stressed.

Read the full article here