MicroVision, Inc. (NASDAQ:MVIS) is a bet on the LiDAR hardware and software solutions market. While MVIS boasts a robust IP portfolio and high-growth potential, it also grapples with concentrated revenue streams, high operating expenses, and shareholder dilution. Thus, I’ll delve into the company’s valuation, offering insights into its high-risk, high-reward profile. In my view, the company is fairly valued, given the highly speculative range of its possible outcomes.

Business Overview

MVIS is focused on LiDAR hardware and software solutions. This positions it to benefit from high-growth sectors such as Automotive, Industrial, Smart Infrastructure, and Robotics. Moreover, MVIS’s recent acquisition of assets from Ibeo may further strengthen its position, particularly in the Advanced Driver-Assistance Systems (ADAS) market. What sets MVIS apart is its robust intellectual property portfolio, holding 735 patents, which is impressive for a publicly traded LiDAR company. This can give the company a competitive edge or make it an M&A target (though I wouldn’t say that’s the investment thesis for now).

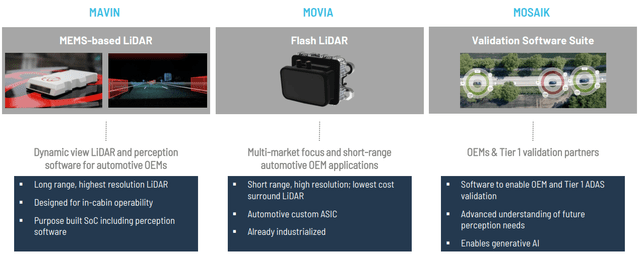

MVIS’s latest earnings slides

MVIS’s product offerings currently include 1) MAVIN, a MEMS-based LiDAR sensor for automotive OEMs; 2) MOVIA, a flash-based LiDAR sensor for industrial applications; and 3) MOSAIK, a sensor validation software platform. Now, MVIS estimates a market size of approximately $88 billion in cumulative TAM through 2030 in the ADAS sector alone. Since the company’s current revenue run rate is roughly a couple million dollars, we can reasonably conclude there’s ample room for growth. However, this is not a guaranteed deal, and so far, MVIS hasn’t hit its stride. Thus, it remains in startup mode, burning cash mainly in R&D and SG&A expenses.

Revenue Sources

MVIS is still very much a work in progress. The company’s revenue streams are not just minimal but also highly concentrated. As of 2023, MVIS had four customers, accounting for approximately 75% of its total revenues. This is a precarious position for any company, but even more so for one with a market cap of around $500 million. To add another layer of complexity, in 2022, the company was almost entirely dependent on a single customer for its revenue.

Moreover, MVIS’s business model relies heavily on a single component supplier. This creates a dual risk, as the company depends on a single supplier and a few key clients. The loss of a major customer or a hiccup in the supply chain could have a disproportionately adverse impact on the company’s financials.

A Financial Tightrope

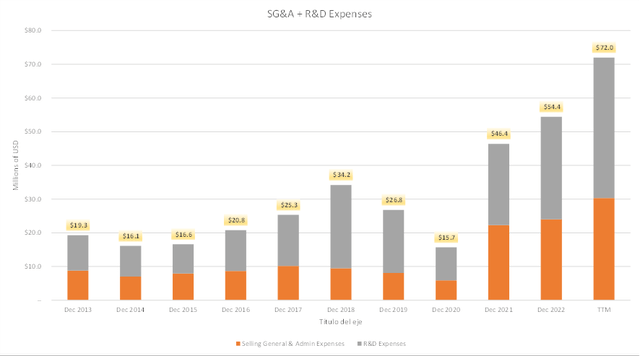

Interestingly, MVIS still operates much like a well-funded startup. Yet, despite its long tenure in the business, the company hasn’t established a solid revenue base. This is particularly concerning when you consider the company’s operating expenses. On average, MVIS has spent approximately $30 million on SG&A and another $40 million on R&D over the last three years. These are not variable costs that can be easily scaled down. In particular, MVIS’s R&D expenses are vital to maintaining its technological competitiveness.

Thus, according to my calculations, the company must generate at least $90 million in yearly revenues to break even in EBIT terms. This is because the company has gross margins of roughly 80% plus $70 million in combined SG&A and R&D. Given its current revenue streams, this target appears to be a tall order, making its financial structure inherently speculative and structurally unprofitable.

Seeking Alpha and Author’s elaboration

The Potential for Exponential Growth

However, it’s not all doom and gloom for MVIS. The nature of its business means that landing just a few big contracts could turn its fortunes around overnight, potentially leading to hundreds of millions in revenues. The key to this moonshot is having the right technology at an attractive cost. In this light, it’s worth noting that MVIS has healthy gross margins that can produce massive profits for investors if it secures contracts with big OEMs.

On one hand, the market’s potential is enormous. Companies like Tesla and Microsoft, among others, desperately need sound LiDAR technology for their products. On the other hand, it also means that, by definition, it’s a space that is attracting significant attention and investment from big tech companies. Hence, MVIS faces fierce competition and will require ongoing, major R&D investments to remain competitive.

Financial Analysis

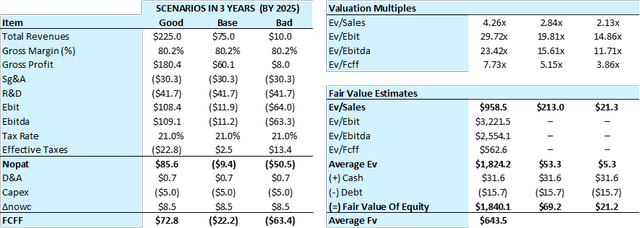

Given the speculative nature of MicroVision’s business model, a scenario analysis is crucial for any serious investor. I’ve identified three possible revenue scenarios for MVIS over the next three years: Optimistic, base, and worst. The optimistic scenario assumes the company secures several large contracts, fully leveraging its technology and market potential. I assume moderate growth for the base case, with MVIS landing a few significant but not game-changing contracts. And lastly, I consider the worst-case scenario minimal growth and continued reliance on a handful of customers. However, it’s worth noting that even my worst-case scenario is optimistic in its own right, projecting revenues of $10 million, a significant jump from the current $1.1 million TTM revenues.

Seeking Alpha and Author’s elaboration

For the valuation, I employed a hybrid approach that combines a sector multiple-based valuation with my MVIS FCFF estimate.

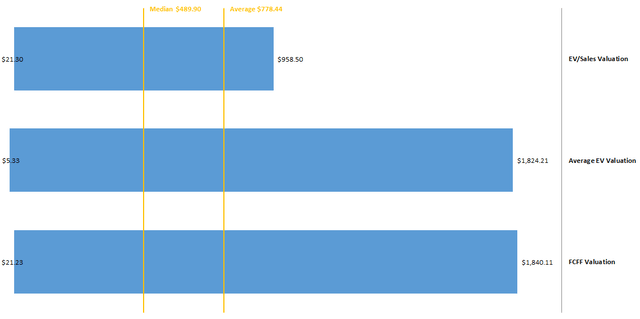

Valuation Results

These estimates produce a wide valuation range, reflecting the company’s high-risk, high-reward profile. I calculated the median and average fair value estimates to interpret these numbers, totaling $489.9 million and $778.4 million, respectively. Given that the company’s current market cap is roughly $500 million, these estimates suggest that MVIS is roughly fairly valued at its current stock price.

Seeking Alpha and Author’s elaboration

Dilution Dilemma

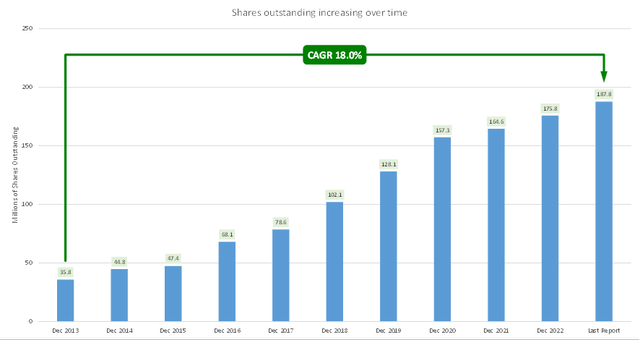

Nevertheless, investors must also consider that until MVIS finds recurring revenues, it’ll continue burning cash, requiring further capital raises. MVIS’s recent announcement of a $35 million At-the-Market equity offering agreement with Craig-Hallum Capital Group underscores the company’s ongoing need for fresh capital. Unsurprisingly, the funds are intended to accelerate ASIC development, build inventory, and advance the company’s go-to-market strategy for its MAVIN and MOVIA products (i.e., R&D).

Seeking Alpha and Author’s elaboration

While the infusion of capital is essential for MVIS, it comes at a cost: dilution of existing shareholders. This dilution is a significant concern, as it undoubtedly continues to weigh down the stock’s price. Moreover, MVIS has been reliant on equity financing to fund its operations, and this trend is likely to continue, given its current financial situation.

Conclusion

MVIS is the quintessential high-risk, high-reward investment. Its robust intellectual property portfolio and innovative LiDAR solutions position it well in a burgeoning market with a projected $88 billion TAM in the ADAS sector alone. However, the company’s concentrated revenue streams and reliance on a single supplier add layers of risk that are hard to ignore. The recent $35 million At-the-Market equity offering highlights another concern: the dilution of existing shareholders, a necessary evil to fuel the company’s ambitious growth plans.

My valuation scenarios suggest that MVIS is roughly fairly valued at its current market cap of around $500 million, but this comes with caveats. The company’s future hinges on its ability to secure large contracts, manage operating expenses, and navigate an exceedingly competitive landscape. Given these variables, MVIS should be, at best, a tiny speculative slice of an investment portfolio, not the whole pie. Investors must weigh the potential for exponential growth against the inherent risks and volatility.

Read the full article here