Main Thesis / Background

The purpose of this article is to discuss the state of both the equity and debt markets as 2024 rolls on. Q1 has been widely positive and that has me smiling. But it also has me wondering how long the “good times” can last. While I am certainly going to continue to ride the bull, I believe it is prudent to hunt for value when markets look stretched – as I feel that are now.

With this in mind, the start of Q2 is a perfect time to get a bit more creative with new positions for cash I have coming in. In this review I will discuss some areas that I think present some value for the time being, and also a few trends that I believe are at risk of petering out. In my opinion this is a helpful cash management exercise and also one that will (hopefully) protect a bit to the downside if the broader market starts to reverse its course.

Where Can One Find Income? Everywhere

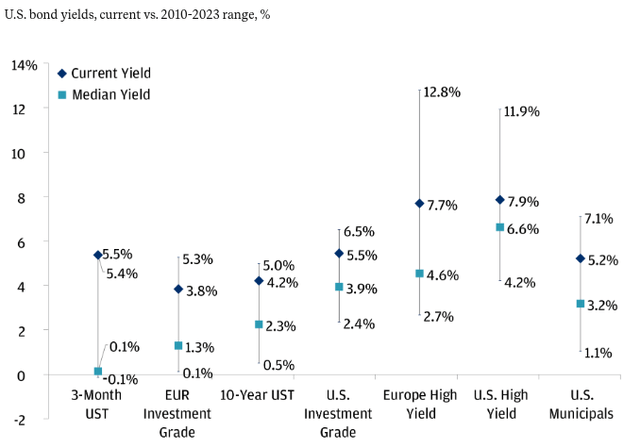

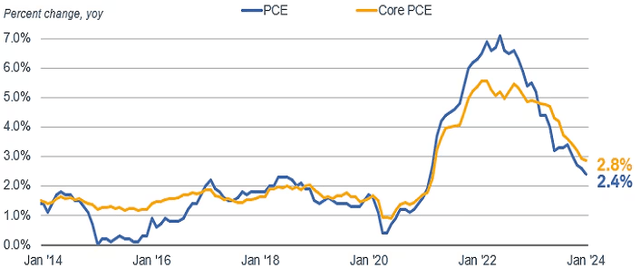

One of the first places for some value at the moment is a story that has been fairly consistent over the last couple of quarters. This is fixed-income – with many sectors offering above average yields based on their own historical patterns. With inflation still stubborn, but rising at a slower pace than it was a year and two years ago, locking in fixed income streams remains a focus of mind.

Of course, “fixed income” means a lot of things. One can invest in treasuries, corporate bonds, municipals, as well as non-US offerings. Whenever there is a plethora of choices it can feel overwhelming. However, the good news is that pretty much anywhere you look right now yields are attractive. While that still means a lot of options exist, it is hard to go wrong with most selections:

Yields (By Sector) (JPMorgan Chase)

I view this reality as support for building and owning fixed-income positions, despite inflation and a Fed that has yet to cut rates. It is very likely in the second half of the year that inflation moderates and the Fed does cut rates. So even though that feels like a long way off, the time to start preparing for it is before that action, not after.

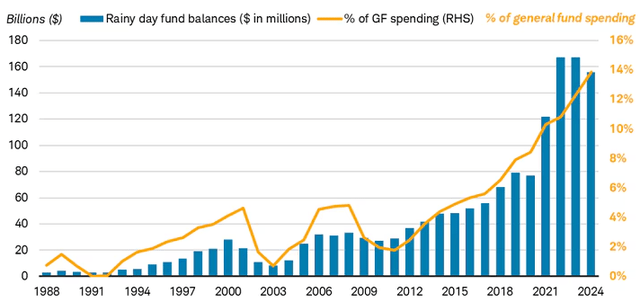

As my followers know, I tend to favor municipals because I am a high-income working professional. I acknowledge this may not be the best option for others – such as retirees, but I stand by my call on munis being a reasonable play here. Yields are high and state and local governments remain in a cash-rich position thanks to excess savings from prior years. While those balances have come down from peaks (on average) they are still elevated historically:

“Rainy Day” Balances (Aggregate) (National Association of State Budget Officers)

As you can see, the credit quality of General Obligation (GO) munis is well supported by cash, and that gives me a lot of comfort going forward, especially if the economy takes a turn for the worse.

In addition, there is some logic to taking on high yield exposure. While I personally shy away from it in my own portfolio, the absolute yields at present are hard to ignore. This is true in both the US and Europe. With inflation moderation, picking up double-digit yields from those sectors is something worth exploring at least:

Current PCE Figures (US) (Charles Schwab)

The takeaway for me is that with inflation coming down and fixed-income opportunities remaining high, it couldn’t hurt to use this as an opportunity to add or start buying. There is downside risk of course – especially if inflation rebounds and/or the Fed shifts to a more hawkish path. So understand this and don’t get too carried away. But my view is that six or nine months from now we will look back and realize today was a good time to buy.

**I own the VanEck High Yield Municipal ETF (HYD) and IG-rated individual muni issues from North Carolina and California.

I Like Gold And Other Commodities

Another area I believe is set for more gains is precious metals and commodities like oil. These are areas that have performed well of late, alongside equities, but also have a tendency to move in an inverse relationship with stocks. Gold tend to be a safe haven asset and can hold up well when stocks face volatility. So the gains for the metal during an equity bull run have tested this relationship, but I don’t see a major sell-off ahead:

Spot Gold Price (Bloomberg)

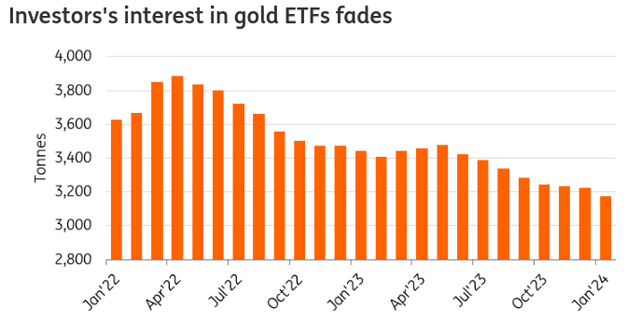

One of the reasons I like this is that gold, despite the run, is actually a contrarian retail play. This may sound counter-intuitive since the price has been rising, but retail investor demand in ETFs that track gold have been steadily falling as the metal rises:

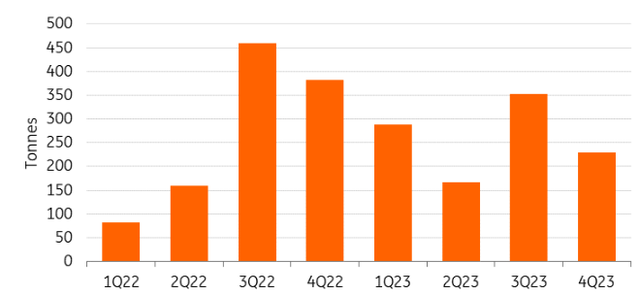

Gold ETF Demand (Global) (ING)

So this gives investors an opportunity to buy-in to a momentum play that is lacking crowd “hype” or irrational support. That seems like a good value to me.

This does beg the question – who is buying? The answer lies with powerful institutions – central banks. Driven especially by emerging market central banks like China, demand has been elevated over the past two years:

Central Bank Allocations To Gold (Global) (ING)

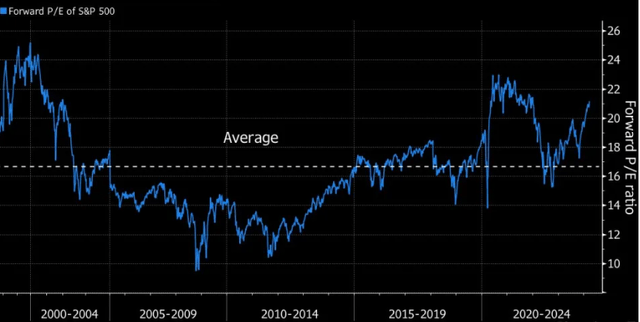

The saying “don’t fight the Fed” has been long used here in the US. But perhaps we need to not “fight the Chinese central bank” either. Personally, I have long used gold as a portfolio hedge and its recent run has been welcome. With equity valuations getting a bit elevated, I see no reason to change course:

Forward P/E (S&P 500) (Yahoo Finance)

The way I see it there is a lot of merit to protecting against an equity draw-down and gold is a great way to do it. This is a time-tested asset class, has drawn in support from powerful sources like central banks, and will benefit from Fed easing in the second half of the year. Sounds like a win-win to me.

**I own the iShares Gold Trust ETF (IAU).

Energy And Utilities Are Buys For Me

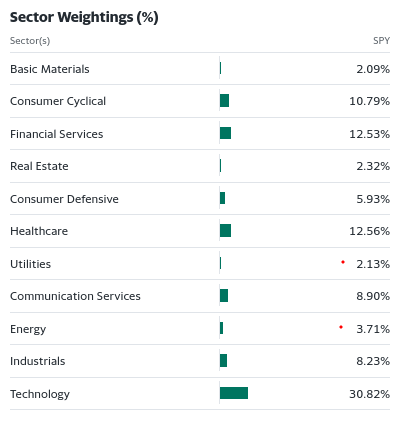

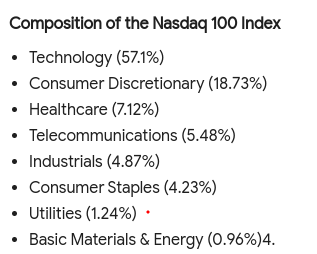

Two other sectors I am upping my exposure in here are Utilities and Energy. The reason is two-fold. One, they continue to be under-represented in the major indices like the S&P 500 and NASDAQ 100. So, on that basis alone, one can make the argument for diversification benefits in any market. This includes the one we are in now given the current weightings of those indices:

S&P 500 Sector Weights (Google Finance) NASDAQ 100 Sector Weights (Google Finance)

This is central to why I generally have exposure to these two sectors. It helps balance out my portfolio and allows me to add to “equities” without buying an index that is heavy in the same handful of stocks that so many are (think Mag 7).

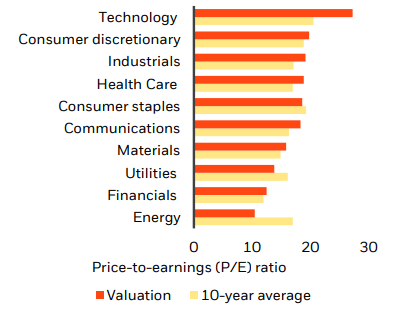

Beyond that, consider the title of this review. I am on the hunt for value. Through this lens it would be easy to tell why I like these two sectors. While many corners of the market are looking richly priced – both in absolution and in relative terms – Utilities and Energy are trading below their 10-year averages:

Sector Valuations (BlackRock)

To sum this up, if one is looking for both value and diversification, then Energy and Utilities should be on their radar. They are certainly on mine and are going to be two areas I definitely add to as Q2 gets underway.

**I own the Vanguard Energy ETF (VDE), the iShares Global Energy ETF (IXC), Vanguard Utilities ETF (VPU), iShares U.S. Utilities ETF (IDU), and one CEF, the BlackRock Utilities, Infrastructure, & Power Opportunities Trust (BUI).

Bitcoin – I’d Be Careful Here

I now want to shift my focus to some areas I would avoid right now. This is just as important – in my view – as determining what you want to own. Knowing what is at-risk or at least outside of one’s risk tolerance is prudent investment management. For me, there are a number of areas that fit this bill in the current climate.

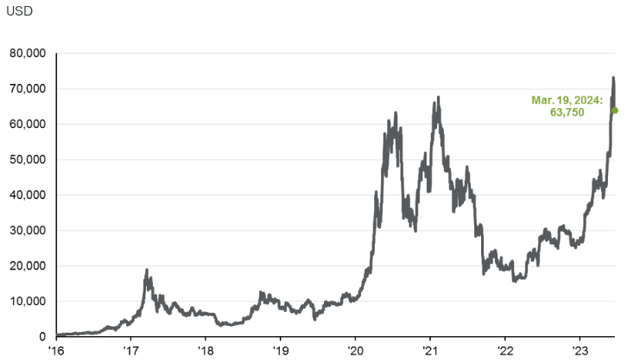

Perhaps the number one “avoid” for me at the moment is cryptocurrency. In particular, this means Bitcoin (BTC-USD). Now, I want to emphasize I am not a long-term bear or non-believer in this sector. There are plenty of those out there and I am not a net-short or constant basher of this idea. In fact, this is an asset class I have warmed up to over time because the frenzy behind it has become impossible to ignore. Crypto as a whole, and BTC in particular, have been the rage of late due to a number of factors: the launch of spot-coin ETFs in the US, declining inflation, hopes for Fed rate cuts, and – perhaps most importantly – growing discontent with traditional forms of banking and monetary systems.

All of these factors (and others) have helped to send BTC to new highs over the past week. While the coin is currently trading (at time of writing) just off those highs around $70,000, this is a tremendous return since my article back in November when I suggested it was a good time to buy. You can see the run-up since then has been consistent and vast:

Bitcoin’s Rise (CNBC)

Of course, this is great news for one who owns it. But for those who don’t – or those who do and are thinking about buying more – this should give them some pause. This includes myself. After this run-up I may be hesitant to sell, but do I really want to plow more of my cash into this asset sitting near its all-time high? My answer is no.

There reasons are multi-fold. By one measure, we have seen a massive surge in net buying that is in stark contrast to even the beginning of the year. For example, the iShares Bitcoin Trust ETF (IBIT) run by BlackRock (BLK) monitors weekly inflows – and late February has set records in terms of bringing in capital:

Weekly Inflows (Bitcoin ETF) (Bloomberg)

This suggest to me that the coin is getting too over-bought. When I see mass buying beyond what we normally see, I resist the urge to join the fray. It simply doesn’t entice me when I see euphoric buying or panic selling in any asset, including BTC.

A second reason is the extensive use of leverage that seems to be driving some of these gains. This is a source of major concern for me because it amplifies how at-risk this run-up is. With leverage comes risk and the potential for big swings in both directions. That again is not an environment where I want more exposure:

Interest in Leverage BTC ETF (Bloomberg)

As you can see, investors are piling on the risk in this asset by using leverage. While this has undoubtedly helped fuel recent gains, it has me concerned that any sell-off will accelerate as investors shed leverage. This is not a far-fetched idea, as BTC is already down about 10% from its peak in just over a week – probably due in part to the attributes I just discussed.

The ultimate conclusion I have here is there is more downside risk than upside at the current price. This leads me to the common sense conclusion that now is not a prudent time to buy and I therefore won’t be doing so.

**I own BTC but will not be adding to my position until a correction occurs.

US Consumer Under Pressure

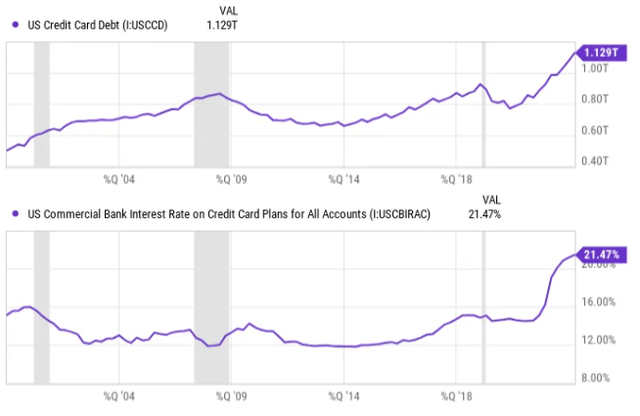

The other “avoid” arena for me is the retail/consumer story. While I do like some consumer discretionary plays that cater to high-end customers, broader and more generic “retail” ETFs are not where I would park my cash for the time being. While they have had a decent run in 2024, I think that is a bit mis-guided as the average American continues to be pressured by rising debt burdens and higher interest rates:

Debt & Interest Rates (US) (Federal Reserve)

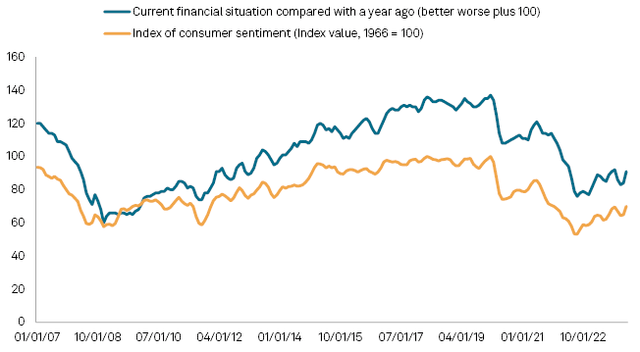

This should partly explain why consumers are not feeling very upbeat right now. While this is just an average of the mood of the country, consumer confidence is well below pre-pandemic levels. This can impact current consumer spending and future spending plans in a meaningful way:

Consumer Sentiment (US) (S&P Global)

What I takeaway from this is a relatively weak consumer mindset and that exists for good reason. The average consumer has debt that has become more expensive compared to what they had gotten used to prior to Fed rate hiking. With inflation still on the horizon and consumers with a ways to go before they get to “current” balances, I think going light on retail exposure is a straightforward thesis.

Bottom-line

March Madness is here and that is certainly a distraction, but not enough so to keep me from finding value in today’s market. As equities roll-on to new highs, I can’t shake the feeling that prepping for a correction is the prudent move. To do so, I will be putting new cash in muni bonds, gold, Energy, Utilities, and other relative safe havens going forward. It is my hope this review offers good food for thought and provides readers with some ideas on where to shelter as the next quarter gets underway.

Read the full article here