All stated amounts are in Canadian dollars except where otherwise stated.

Dear readers,

Over 4 years ago, I sold my stake in Medical Facilities Corporation (OTCPK:MFCSF), a monthly (at the time) paying dividend company out of Canada. They had reported 4Q19 in my last article and changed their payout model to a quarterly, as opposed to a monthly, sort of payout model. While the company has seen significant change since in the short term, I will argue that it has not yet recovered to levels where I held it – but to be frank, I sold my relatively small stake at a loss.

Stake size doesn’t matter in the context of my analysis. Whether I lose in a $1,000 or $1,000,000 position shouldn’t matter to you – because any loss or any profit is equally unacceptable or great, since you as a reader may have entirely different sizing.

I said at the time when I sold and forecasted the distribution cut that:

This contributor’s interpretation is that the company will cut the distribution if they see that the current level, over the long term, is unmanageable given the profit from their facilities.

(Source: “Medical Facilities Corporation: A Good Example Of Why Valuation Matters.”)

I then went on and explained why this “broke” the model for me, and why I sold.

Now, remember that this is a very small business. No more than $200M. And this article, given my current rating, obviously isn’t me going into this business again. But it warrants my attention when the company may be recovering because it does in fact mean that from a financial point of view, I might have been wrong to sell my stake.

Medical Facilities Corporation – A revival of the post mortem

Post mortem might be a bit strong given that we did not see bankruptcy, but I did sell my entire stake – so, in that sense, it “died.” My logic for investing in the company at the time was, and I don’t mind admitting this, the high monthly-paid dividend. At the time, I was focused on reaching/maintaining a high continuous level of overall income, and at the time investments like these were crucial in this.

That is no longer the case.

My mistake, to be clear, was not looking deeply enough at the company beyond the dividend and near-term appeal, because any company can have that. But I want a longer-term appeal than that.

DR, as the native ticker on the TSE, is a self-styled “Best-in-class” operator with a number of hospitals in 8 states that DR manages together with physician involvement. The company also manages a JV, MFC Nueterra, that provides operational support and procurement benefits to further increase efficiencies.

DR IR (DR IR)

The company’s offering is an appeal to Patients, to Surgeons, to Payors and to Investors – theoretically, at least. Obviously, some things did not work out in the past, as the company had to radically change its payout and its operational specifics.

However, the theoretical upsides for the mentioned parties are not wrong in the least. The reviews for the hospitals managed by DR would suggest that there is good customer service, efficient scheduling and the like – all of which DR claims. I also believe that in today’s modern world, Surgeons are likely to want a say in management decisions, and I view it as likely motivating for these if there is an ownership stake involved.

For the payors, efficient billing as the hospital is part of a larger organization is an advantage here – and the theoretical upside for investors is obviously a strong fundamental company with a growing competitive dividend.

However, the drawback here is that the dividend cannot be considered “competitive” at below 4% given we get over 3.5% from a savings account, and a sub-$300M company with this history cannot exactly be called fundamentally stable.

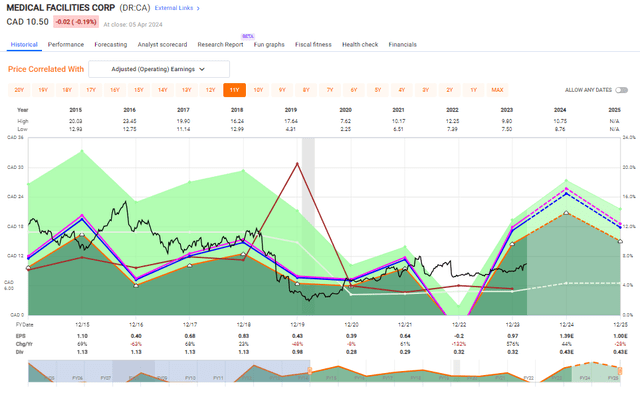

Medical Facilities Corp Valuation (F.A.S.T graphs)

So, the company’s upside or argument is defeated a bit by its own measure as I see it, also lacking any institutional IG rating. Also, part of the company’s journey back towards the top, with a 100%+ total RoR in around 4 years, has been the buyback of significant amounts of shares during times of very poor returns and low valuation – so take these returns with at least a bit of salt.

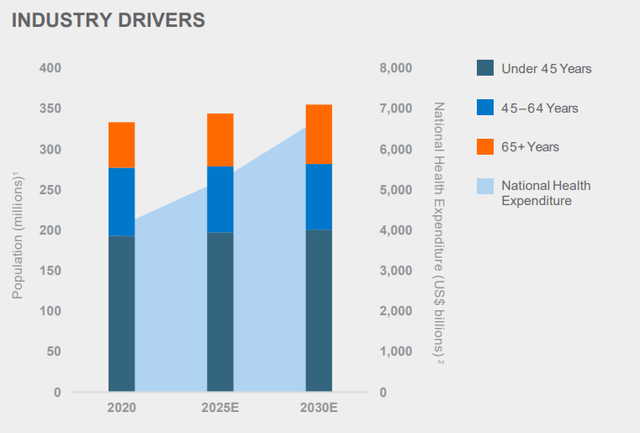

Medical Facilities, despite not being a managed care community, is a play in large part with the growing age demographic of an increasing amount of 65+ individuals. This is also what the company calls for as part of its upside, aside from superb ratings in its various facilities.

Medical Facilities Corp (Medical Facilities Corp IR)

With 4 specialty facilities and 5 ASCs and now below 1x net debt/equity, the company has turned its fortunes around. LTM net debt/EBITDA is now below 1.1x as well, which really is a bit of a turnaround. The company now manages over $445M USD in 2023 revenues, of which it gets over $65M USD in operational income and over $85M USD in EBITDA for the full year. This leaves the company’s 3%+ dividend fully covered.

The primary risk/s I see for this business is the payor mix. The company remains heavily Medicare/Medicaid-exposed, with 40% here, and less than 50% in Private insurance. I believe the Medicare/Medicaid “hits” will be the heavy ones over the coming few years, and while the company’s asset mix is a positive one, the macro impacts in the healthcare industry remain to be seen. We’ve only started to see the impacts with the declines in businesses like Humana (HUM), which is down over 40% in a single year – and we’ll see where this turns around.

Why were they down? The outlook for Medicare advantage, among other things.

DR continues to buy back plenty of shares – over 1.15M during 2023, with over 4.6M bought back since late 2022.

As I said, DR has managed the impressive feat of turning around its fortunes and is now in a position of growth. The problem or risks that I have here is that there are many companies in positions of growth, and this does not necessarily make this company buyable. My original appeal in the company was based on the company’s high dividend – but now it pays less than Valeo, a French automotive quality play that I recently reviewed again.

My issue is that why should I “BUY” a company like this, a micro-cap stock, that barely yields 3.1% in an environment where I could literally get better than that from any savings account?

Let’s see if valuation shows us some saving grace.

Valuation for Medical Facilities Corp – Some upside, just not enough

In my last article, I made a case for this company being worth barely $4/share. Given that the company trades at $10 now, and the likelihood of $4 seems very remote, I now view this as an incorrect forecast. I am “upping” my price target, especially given the 2024E outlook of further growth – but I’m not “going crazy” here.

My new share price estimate for this company is $6.5/share.

Why?

Because the company is small, unrated, and with a sub-par dividend. It’s not “worth” a very high multiple, as I see it. This is especially true in this case since DR.UN does not hit targets all that well – and by well, I mean accurately.

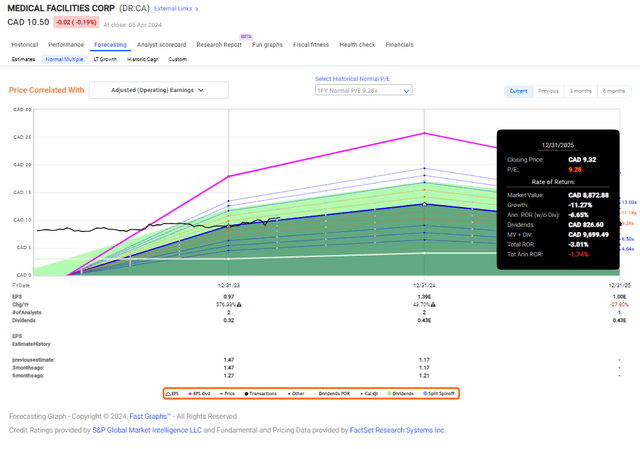

DR.UN forecast (F.A.S.T graphs)

As you can see, even a coin toss is potentially more positive than this company’s forest estimates and accuracy. The company certainly does have positive upside potential. But here’s how I see the valuation and where the company should go.

Because of the relative uncertainty and instability of this business and its past as well as leaning on a growing, aging demographic where we’ve already seen pressure in other parts of the healthcare segment, I would view this company’s valuation very unfavorably. This also includes the lack of any solid credit rating.

I would, because of that, not go above or to a double-digit P/E, and would forecast DR.UN at the 1-2 year average of 9-10x P/E. But for my point, you could easily forecast it at 11-13x P/E as well, if you like – the result would be the same. At none of the mentioned forecast multiples does DR.UN on a 2024E basis, reach a 15% annualized or above. And that is completely unacceptable for an investment of this risk/reward profile. If I were to put my money to work in this sort of investment, I would want 100-200% in a relatively short time at a good potential. That’s what I can get in some other investments I am currently making, notably Valeo.

This sort of return simply does not cut it.

Medical Facilities Upside (F.A.S.T graphs)

You’re worth more than that, and so am I.

I want to emphasize that it’s far more important to you as an investor to not lose money than it is to invest in 15% instead of 8% RoR. What I mean to say by this is that loss-making investments take far longer to recoup from, and taking risks – including one such as this – is something that only should be done, as I see it, if you’re already fairly “set” in terms of your own personal safety.

This was one of the major mistakes I made when investing early on. I did not know enough about what I was buying, and I wasn’t able to properly calculate and dial in my risk tolerance and the relative risk of the investments I did make. I was lucky – very few of my early investments resulted in a loss. But this was due to sheer luck of timing a dip in the market and then selling at the uptick. It could have just as easily gone the other way around.

Then it was a matter of step-by-step improvements and knowledge. Now, I’m at a stage where I believe I know fairly well the risks I am taking, and more importantly, not taking.

That is why, despite everything, I continue to view this company as a no-go and a “HOLD” here.

My thesis for DR for 2024E is as follows.

Thesis

- Medical Facilities Corporation is a business with the idea of partnering with physicians and surgeons to manage various specialty care institutions around North America, focused on the U.S.

- The company has been through multiple iterations, including being a high-yielding monthly payor that failed to hold onto this trend and had to cut down its dividend not only in yield but also went back from its monthly to a quarterly dividend model. The company instead of increasing its distribution focuses on share buybacks given the very pressured valuation at this time.

- Despite what can be argued to be an attractive overall valuation, I do not view Medical Facilities Corporation as a “BUY” here – there are far better alternatives out there. At the current yield, I would “BUY” the company, barring no deterioration of fundamentals, at $ 6.5 CAD for the native DR.UN ticker.

Remember, I’m all about:

1. Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

This company fulfills maybe 1-3 of my criteria depending on how you choose to apply them, and I do not view it as justifying an investment in any case here.

This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here