Downgrade Call Paid Off, Time To Revisit

After publishing a Sell rating for Johnson Outdoors (NASDAQ:JOUT) in early January 2024, I felt zero regrets about that downgrade (from Buy) after my initial read of JOUT’s 1Q24 earnings release. For holders of the stock, JOUT’s first quarterly update of fiscal 2024 must have been very depressing reading. 1Q24 sales were extremely soft, and management’s commentary regarding segmental performance and market conditions offered little in the way of hope regarding a near-term improvement. Total net sales for 1Q24 came in a whopping -22% below the 1Q23 print. Here’s management’s rather downbeat summary of the quarter’s sales performance:

- Fishing sales declined by approximately 20 percent driven by high retail inventories and lower consumer demand

- Diving sales decreased 8 percent over the prior year quarter, mainly due to a 6 percent negative impact on sales due to foreign currency translation

- Camping revenue declined 49 percent, of which approximately half was due to the sale of the Military and Commercial tents business last year. The remainder was due to high retail inventories and a decline in consumer spending

- Watercraft Recreation revenue declined 50 percent, reflecting continued significant reductions in the overall market demand

Source: JOUT 1Q24 earnings release, page 1.

Being a value investor with contrarian leanings, a company update as bad as JOUT’s 1Q24 result often grabs my attention. The market, however, seems pretty happy to ignore JOUT. The company’s 1Q24 results presentation lasted less than eight minutes, and there was not a single question put to management when the operator opened the line for Q&A. Over the years, I’ve made good money by investing in stocks that are out of favor and under the radar (not every bet of this type has paid off of course). JOUT therefore remains on my watch list.

I find myself wondering if things can really get materially worse for JOUT from here, and if not, is there an opportunity to make a winning bet on stabilisation and an eventual recovery in the company’s operating performance? My downgrade to Sell in January 2024 was a pretty good call; JOUT is currently trading ~12.5% lower than at the time of the rating change. With JOUT due to report 2Q24 numbers in early May 2024, it’s an opportune time to quickly revisit the stock’s rating and consider whether or not the market has priced in too much pessimism.

One (sort of) Bright Spot

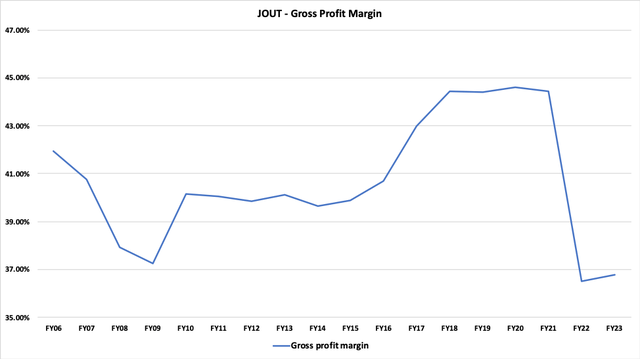

The only bright spot that I could find in the 1Q24 result was that there has been a reduction in material and freight costs relative to 1Q23; these factors helped to improve the gross margin to 38.1% (relative to 1Q23 at 35.2%). It’s worth stating that the expansion in gross margin has been due to external factors, and given JOUT’s recent history I’m not inclined to attribute any credit to management for the margin improvement. During the pandemic boom days, JOUT’s gross margin was around 45%, but it crashed back down to ~37% post FY21. Taking a longer-term perspective (refer to Exhibit 1 below), looking back over JOUT’s history since 2006, there is certainly scope for the gross margin to recover from here, and a long-term assumption of ~40% does not strike me as overly optimistic.

Exhibit 1:

Source: Created by author using data from JOUT financial reports.

Expenses – Action Urgently Needed

In my 4Q23 review, I expressed disappointment at JOUT’s lack of a sense of urgency to aggressively reduce non-product-related costs. In the very short 1Q24 management speech, CFO David Johnson referred to $1.8m lower spend on professional services relative to 1Q23. Professional services fees can be lumpy from one quarter to the next, so I don’t see the $1.8m reduction as evidence of a broader efficiency push. There is still no sign that management is willing to seriously trim costs in order to offset the soft demand outlook for JOUT’s products.

Inventory – Prepare For A Potentially Big Write-Down

I first highlighted my concerns regarding JOUT’s high inventory levels back in November 2022, at which point I wrote:

The main short-term downside risk is that JOUT needs to heavily write-down its expanded inventory balance. Changes in consumer demand and delays in product delivery have the potential to create obsolete/excess inventory. JOUT’s 3Q22 inventory level of $251m is high relative to its market cap (currently ~$550m), implying that inventory write-down risk is material.

Source: Johnson Outdoors: Oversold On Supply Chain Concerns – Buy

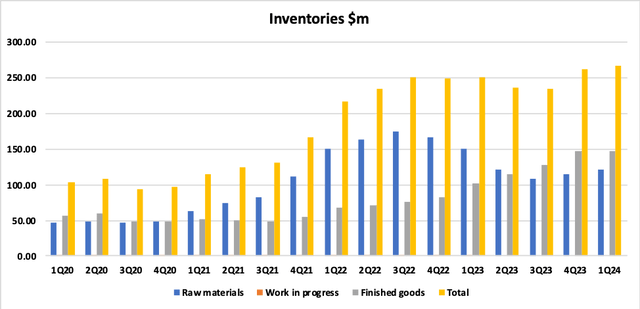

The downside risk (a heavy inventory write-down) that I identified in November 2022 has proven not to have played out – so in that sense I was wrong to label it a short-term downside risk factor. However, as shown in Exhibit 2, JOUT’s inventory levels have subsequently grown even further, and also changed in nature – such that the downside risk relating to inventory is now materially higher.

Exhibit 2:

Source: Created by author using data from JOUT quarterly reports.

In late 2022, JOUT’s inventory was weighted mostly to raw materials. An advantage of holding raw materials rather than finished goods is that excess raw materials can usually be more easily sold thanks to having a wider market of potential buyers than more specific finished goods. So, whilst JOUT’s inventory levels were already worryingly high back in 3Q22, the ~70% skew to raw materials was much less problematic than the current 1Q24 skew of 55% to finished goods. As at 1Q24, JOUT was sitting on $147m of finished goods, at a time when outdoor goods retailers were themselves sitting on high levels of inventory thanks to a period of low consumer demand that shows no obvious sign of improving.

I’m surprised that JOUT hasn’t yet taken its medicine in regard to inventory. It now seems very obvious that the balance sheet values need to be written down. Perhaps JOUT’s auditors haven’t pushed the company’s accountants hard enough on the issue. Also, given that JOUT is effectively a family-owned and controlled business, it may also be true that management and the board haven’t felt much pressure to act on the issue from external shareholders. From my perspective, it appears that JOUT is simply hanging on, just hoping that an improvement in market conditions will save the day. As at 1Q24, JOUT’s total inventory had a carrying value of $267m. The group’s current market capitalisation is around ~$436m. The degree of downside risk associated with high inventory levels (equivalent to ~61% of JOUT’s market capitalisation) is therefore well beyond the level at which I’d be willing to entertain ‘hope’ as a management plan.

Closing Remarks

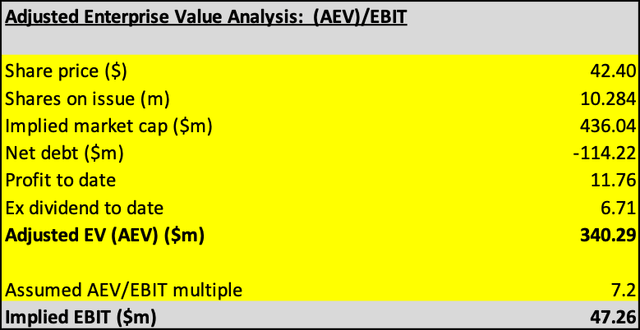

For a small-cap manufacturer of consumer goods such as JOUT, I would typically regard an EV/EBIT multiple in the range of 9x to 11x as representing around fair value. After following JOUT’s progress – or lack thereof – over the last 18 months, I am inclined to think that this stock requires a materially lower fair value multiple. As things stand today, I lean towards a 20% safety buffer to the lower end of my typical fair value range, which implies an adjusted fair value EV/EBIT multiple of 7.2x.

Exhibit 3:

Source: Created by author using data from JOUT quarterly reports.

As per Exhibit 3, adopting an EV/EBIT multiple of 7.2x, the current share price of $42.40 per share (market close April 17, 2024) points to normalized EBIT of ~$47.3m pa being required to support JOUT’s share price. Currently, I lack confidence in the ability of JOUT to generate that level of earnings on a sustainable basis – I therefore conclude this review with a continuation of a Sell rating. That being said, the market does appear to be capturing quite a lot of downside risk for JOUT, and I will remain open to a reassessment after JOUT’s 2Q24 update.

Read the full article here