Main Thesis & Background

The purpose of this article is to evaluate the iShares iBoxx Investment Grade Corporate Bond ETF (NYSEARCA:LQD) as an investment option at its current market price. This fund has a stated objective “to track the investment results of an index composed of U.S. dollar-denominated, investment grade corporate bonds”.

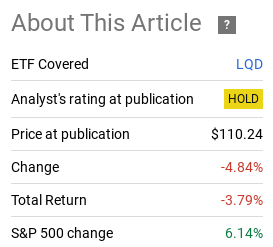

I saw a good buy opportunity for bonds in the later stages of 2023 and that call turned out to be the correct one. However, with respect to IG-rated corporate bonds – and LQD by extension – I thought the opportunity going into 2024 was limited after those gains developed. I didn’t see a scenario where the rise would easily continue, and I suggested investors take some chips off the table as the new year got underway. In hindsight, this cautious outlook has been vindicated as LQD has under-performed in relative terms since that article was published:

ETF Performance (Seeking Alpha)

With the combination of equity volatility over the past couple of weeks and the performance differential between LQD and the broader equity market, I thought it was time to consider IG-rated corporates once again. After all, this is often a good hedge against the stock market and could come in handy if large-cap US stocks continue to face challenges.

However, after careful review, I still don’t love the investment backdrop for IG-rated corporates. LQD has demonstrated weak performance through Q1 and I don’t see that changing in Q2 either. Inflation remains a thorn in the side of bonds as a whole and is likely to keep the Fed from moving on interest rates any time soon. This means the rush to get into bonds that many investors felt was necessary towards the end of last year was a bit premature. There is no real need to rush in, as a lower-rate environment could still be a long way off. This supports my continued “hold” view on LQD – and I will go into more detail as to the reasons why below.

Spreads Suggest Little Upside

To begin this review, I will discuss the attractiveness of current yields relative to history. Simply put, credit spreads have seen further tightening at the beginning of 2024, and in my view, that limits the go-forward opportunity. There is just so much narrowing for spreads that can occur before bonds look overbought, and we may be at that level already:

High Grade Spreads (US Corporates) (Yahoo Finance)

In my view, there just isn’t a real compelling buy case here when spreads are already at a very narrow level. Throughout the past three years, there haven’t been many times when spreads have been tighter, which tells me being patient is probably the prudent move.

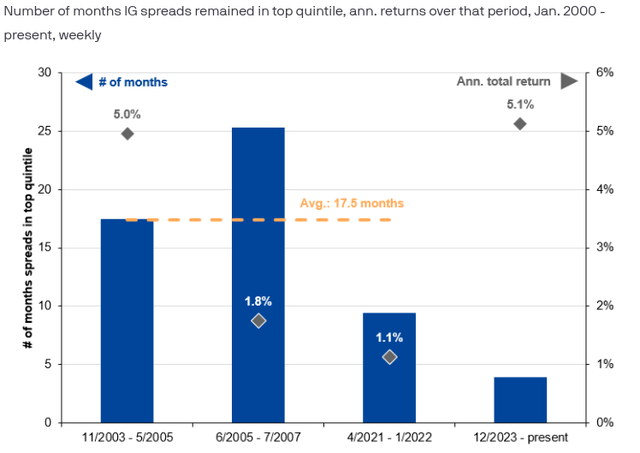

Of course, this is not meant to be alarmist. Just because spreads are tight now doesn’t mean they are going to suddenly widen aggressively (which would cause bond prices to drop and result in losses for investors). Spreads can often remain at tight levels for a long time – so abruptly selling in this environment probably isn’t the wisest move either. In fact, IG-rated corporates can often see tight spreads persist for months at a time using history as a guide:

Number of months IG spreads remained in top quintile (and returns over that period) (JPMorgan Asset Management)

The point I am making here is that there isn’t a real strong buy or sell case at the moment. That is okay, it means stay patient and wait for a clearer signal to emerge. Hence, that rationale for giving LQD a “hold” rating.

Inflation Hasn’t Gone Away

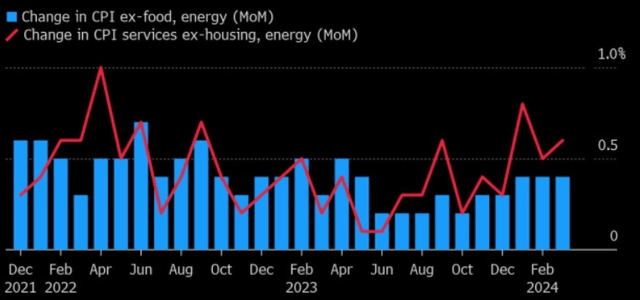

The next topic to discuss is how inflation continues to put pressure on the fixed-income market. Back in 2023 many investors had believed inflation had “peaked” and lower levels of it would be sustained through 2024. This expectation led to the belief the Fed was going to start cutting interest rates – something we know now has not occurred yet. Still, many market participants are optimistic the Fed will embark on this rate-cutting path sooner than later, but I’m not so sure. While inflation has certainly come off its highs, the current levels remain elevated and seem to be sustainable for the time being:

CPI Changes (US) (Bloomberg)

My conclusion from this is the Fed is still not going to have any justification to act in the near term. The futures markets are already pushing out the date of the first cut (in the US and elsewhere) and that limits the gains for bonds in the short term (as rates decline, bond prices rise). The reality is the market got ahead of itself with respect to its outlook for inflation and Fed action and reality should be starting to sink in. Inflation is still too high for comfort, and LQD is not going to get a boost from a dovish Fed right now.

The Fund’s Make-Up Has Gotten Safer With Time

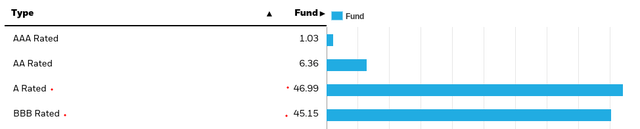

To help balance out this review, I want to focus on a few of the positive attributes of LQD. One trend in particular that has caught my attention is the reversal of the dominance of BBB-rated bonds in the IG market. For much of the last decade, the percentage of triple-B (the lowest quality of bond that can be rated investment grade) was rising. At one point, it was making up half of the total IG corporate bond market.

Today, that number has backed off a bit. The safer, A-rated bonds are back to making up a larger share of LQD’s portfolio than triple-B’s. This means buyers of the fund are getting exposure to a higher-quality basket of securities than they would have over the past few years:

LQD’s Credit Quality (iShares)

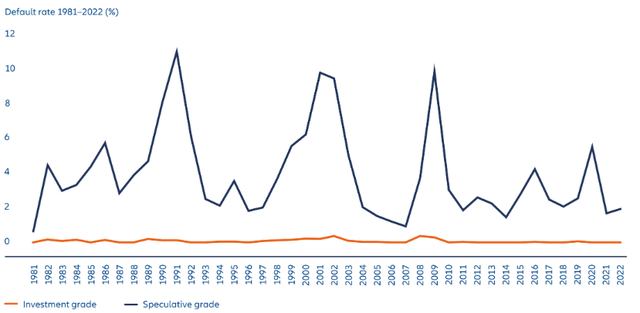

What this means is that readers would be getting a quality fund if they bought LQD. Does that mean positive returns are guaranteed? Of course not. But it does mean one would be buying some stable assets that produce reliable income and have a very low history of defaults – especially when compared against their junk-rated counterparts:

Default Rates By Year and Credit Rating (US) (Allianz)

There is much to like from this graphic if one is focused on quality. IG-rated corporates – which make up the entirety of LQD’s portfolio – are one of the safest asset classes in the market and yield more than treasuries (which are considered “risk-free”). To sum it up, this is still a “steady eddy” sector and one that deserves some consideration under most economic scenarios. While I stand by my call that returns will be limited in the months to come, that is not to say there isn’t an investment case to be made. For those who want income with limited default risk, IG-rated corporates could fit the bill.

Bottom Line

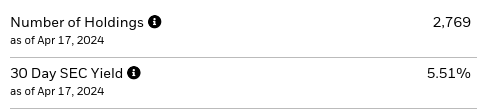

LQD has seen its portfolio improve in quality over time and offers a yield above what savings accounts and treasuries currently offer. That’s the good news:

LQD’s Quick Facts (iShares)

The challenge is that price appreciation is probably limited until we see a more meaningful drop to inflation metrics and the Fed is prompted to act on moving its benchmark rate. From the start of the year through today, that isn’t a scenario that has happened yet, and I don’t see a meaningful catalyst right now to make it so.

Ultimately, with elevated inflation, a reluctant Fed, and narrow spreads, IG-rated corporates have limited opportunity. There is merit to owning them, but I would be careful amplifying any exposure here. This sums up to a continued “hold” rating for me at this time.

Read the full article here