One of the best performing companies, from a share price appreciation perspective, over the past year or so has been Miller Industries, Inc. (NYSE:MLR). For those not familiar with the company, it focuses on the production and sale of towing and recovery equipment. Since I last reiterated my “Buy” rating on the stock in early February 2023, shares are up 94.4% compared to the 24.2% rise seen by the S&P 500. Even better, since I first rated the company a “Buy” in March 2022, the stock is up 104.3%. That dwarfs the 14.3% increase seen by the broader market over the same window of time.

This move higher has not been without a cause. Revenue, profits, and cash flows, have all increased nicely year over year. It is fair to question just how much additional upside could be on the table. But the fact of the matter is that, when you consider how far the company has come in such a short window of time, it’s not difficult to imagine even further increases moving forward. This is not to imply that we will see a comparable amount of upside. That is unlikely because the easy money has already been made. But absent something unexpected occurring, I do think optimism is warranted.

Of course, as investors, it’s incumbent upon us to be flexible. As new data comes in, our assessment of the picture should change. Sometimes, this will be for the better. Other times, it will be for the worse. It just so happens that management is expected to report financial results covering the first quarter of the 2024 fiscal year after the market closes on May 8th.

Unfortunately, analysts have not provided any guidance on the matter. However, there are certain metrics that investors would be wise to pay attention to as earnings near.

Massive upside achieved

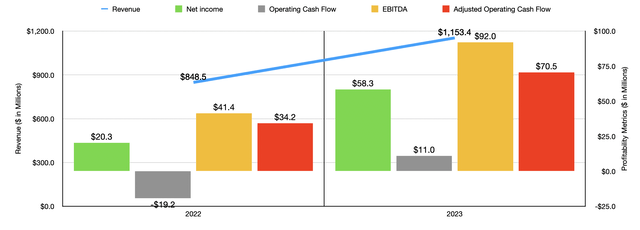

As I mentioned already, the past year or so has been particularly pleasant for shareholders of Miller Industries. Revenue during the 2023 fiscal year, for instance, came in at $1.15 billion. That’s an increase of 35.9% compared to the $848.5 million generated one year earlier. This move higher, according to management, was driven by higher production volumes that the company chalked up to supply chain improvements and strong customer demand. Although not as significant, it seems pricing increases also contributed to some of this. But of course, management did not provide any assessment of the impact of price increases.

Author – SEC EDGAR Data

On the bottom line, the situation looked even better. Net profits nearly tripled from $20.3 million to $58.3 million. While the increase in revenue for the company was instrumental in achieving this, an undeniably big impact came from some margin expansion. Notably, the firm’s gross profit margin managed to increase from 9.7% to 13.2%. While this may not seem like much, when applied to the revenue generated last year, that’s an extra $39.9 million in pretax profits for the firm. Supply chain stabilization permitted higher deliveries, which management attributed to the improvement.

Naturally, other profitability metrics moved higher as well. Operating cash flow went from negative $19.2 million to positive $11 million. Adjusted operating cash flow more than doubled from $34.2 million to $70.5 million. And finally, EBITDA generated by the enterprise rose from $41.4 million to $92 million.

Author – SEC EDGAR Data

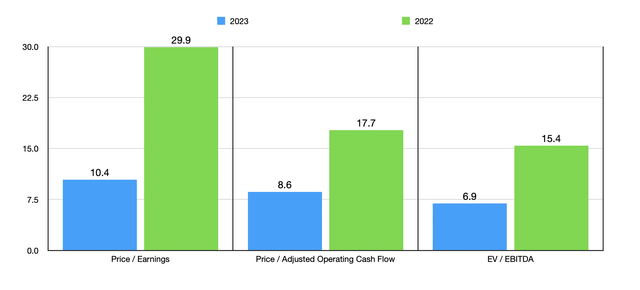

All things considered, this is a rather impressive showing for the company. It also has helped to make the company more appealing from a valuation perspective. As an example, I would like to point to the chart above. In it, you can see how shares are valued using results from 2023 and from 2022. The stock has gotten a lot cheaper even though its share price has moved up. Now, in the table below, you can see the firm compared to five similar enterprises. On that basis, shares aren’t exactly cheap. But they are far from expensive, with only two of the companies cheaper than it using each of the three valuation approaches.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Miller Industries | 10.4 | 8.6 | 6.9 |

| Westport Fuel Systems (WPRT) | 6.9 | N/A | 17.7 |

| Commercial Vehicle Group (CVGI) | 4.1 | 5.2 | 4.8 |

| Manitowoc (MTW) | 11.5 | 7.2 | 5.6 |

| Douglas Dynamics (PLOW) | 20.4 | 11.5 | 10.7 |

| Astec Industries (ASTE) | 29.6 | 35.8 | 12.2 |

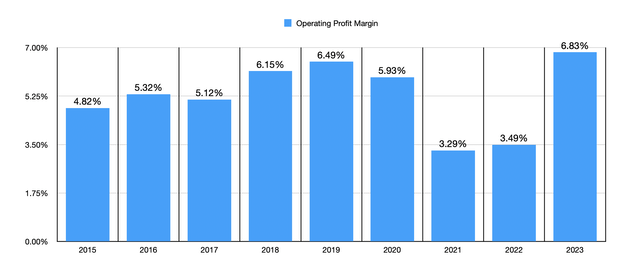

Whenever I see a big improvement like this, I have to ask myself whether the increase is temporary or part of a new normal. To not ask this and delve into it is to invite value traps. The good news for those who are bullish about the business is that this actually appears to be a reversion to how things were before the pandemic. By management’s own admission, the business has struggled with inflationary pressures and supply chain problems recently. In its 2023 annual report, the company even acknowledges that it continues to see significant pressure on global supply chains. They also mentioned that inflation could continue to cause issues when it comes to foreign currency fluctuations that impact the company.

If you look at the chart below, however, it seems the worst is probably behind us. That chart shows the operating profit margin of the company from 2015 through 2023. Up through 2019, the picture was gradually improving year after year, with margins widening. The pandemic brought with it two very difficult years in 2021 and 2022. But now, with supply chain issues improving, and the company finally regaining pricing power, margins have rebounded to levels that are actually above what they were before the pandemic. It’s not unthinkable that margins could decrease slightly to match what they were back then. But that would be only a small inconvenience compared to what the firm had seen in the prior couple of years.

Author – SEC EDGAR Data

There are also some other things working in the company’s favor. For starters, in early April, management announced a new $25 million share buyback program. They also boosted their quarterly dividend by 5.6% in the last quarter. Both of these show that management is confident in the company’s financial condition.

There could also be a catalyst that could help shareholders. In March of this year, the company publicly responded to a letter put out by Advisory Research, which has a stake in Miller Industries. That letter called for the company to form a special committee to conduct a strategic review process. This could result in a sale of the business, a part of the business, or even restructuring activities aimed at creating shareholder value. However, Advisory Research ultimately revealed to management that its end goal was to see the company sold. Management, citing the company’s success over the past year or so, concluded that it is “proud of the current state” of the business. While I think the firm is right about this, you never know what kind of major transactions could come through the pipeline.

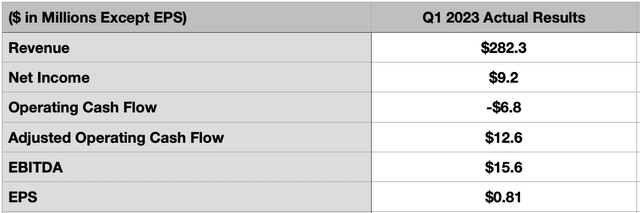

Although I don’t expect anything to occur currently, any big development likely would come when earnings are released. And it just so happens that management is expected to announce financial results covering the first quarter of the 2024 fiscal year after the market closes on May 8th. Analysts have not provided any estimates of revenue or earnings. But in the table below, you can see how financials were during the first quarter of 2023. Considering how performance has been over the past year or so, and the fact that backlog for the company remains near all-time highs, I wouldn’t be surprised if revenue, profits, and cash flows, are all higher year over year.

Author – SEC EDGAR Data

Takeaway

Based on the data provided, I believe that Miller Industries remains an attractive opportunity. I do think the easy money has been made. However, the stock is cheap enough, particularly on an absolute basis, to warrant additional upside in my book. Given these factors, and others, such as the new share buyback program, I believe that a soft “Buy” rating makes sense right now.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Read the full article here