I believe that the aerospace and defense industry has the potential to show market outperforming returns, and many stocks that I cover can outperform the markets. I believe that Astronics Corporation (NASDAQ:ATRO) has the same potential. However, since I assigned a buy rating to Astronics, the stock has been performing more in line with the market. In this report, I explain why I believe that this company has the potential to outperform.

Astronics Margins Expand On Sales Growth

Astronics

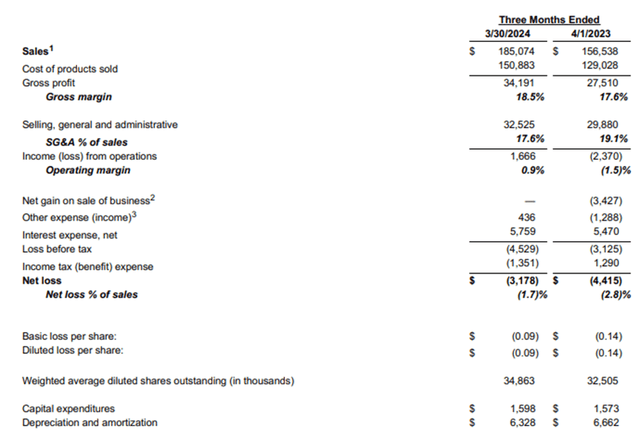

In the first quarter, sales grew by 18.2% to $185.1 million, which exceeded the company’s own guidance that indicated $170 million to $175 million in sales. Aerospace sales increased 20.7% to 163.6 million while Test Systems booked $21.4 million in sales, indicating 2.4% growth. Looking a bit deeper into each segment, I observed that aerospace sales growth was firmly supported by the commercial and military market, with growth rates of 28.9% and 21.4%.

By product line, we saw significant growth in Electrical Power & Motion sales as well as Structures, with sales growth of 55.5% and 35.1%. Lighting & Safety sales grew 14.3% while the other lines, namely Avionics, Systems Certification and other sales, saw sales decline. Test segment sales growth was 2.7%, but the sales last year benefited from a $5.8 million liability reversal. Adjusting for this, sales would have grown 42% and total sales would have been up 22.8%.

Gross margins increased from 17.6% to 18.5% driven by a combination of volume and price increases. SG&A grew by 9% and was mostly driven by a reinstatement of a bonus program that added $3.6 million to the expenses. Overall, operating income margins increased from -1.5% to 0.9%. Adjusted EBITDA gives a somewhat better representation of the year-on-year improvements in margins. Last year’s Q1 results included the deferred liability recovery and a net gain on sales of business, as well as an equity investment write-off, and those one-off items remained absent this year, resulting in EBITDA margins increasing from 3.9% to 10.3%. Applied to operating margins, this would have resulted in expansion from -17% to 0.9%. I believe that the volume and price-driven margin expansion is apparent when assessing the margins.

What Are The Risks And Opportunities For Astronics?

I generally discuss risks and opportunities in one section for the simple reason that a decreased risk can provide an opportunity, and a decreased opportunity can be seen as a risk. For Astronics, things are looking quite good, I believe.

Backlog stood at $612.5 million, of which $511.8 million is expected to ship in 2024. So, that is a very front-loaded profile and also reflects strong near term demand. The book-to-bill ratio was 1.21 with the aerospace book-to-bill ratio being 1.13 and 0.93 for the Test Systems segment. Over the past twelve months, the aerospace segment has seen book-to-bill ratios exceeding 1, while the book-to-bill for the Test Systems segment was below one. From there, we can already expand on several risks and opportunities.

The Test Systems segment has a bit of a challenge getting the book-to-bill ratio above one. Astronics has positioned for $200 million to $300 million contract opportunity. The contract once awarded will run for four to five years. Astronics is currently going through the audit and in the best-case revenue contribution would be in the range of $8 million to $10 million for 2024. Not being awarded the contract by mid-year or commence work by mid-year puts some pressure, but it obviously also provides a sales opportunity. However, the Test Systems segment remains underutilized and, as a result, the company has initiated a cost restructuring that will cost $1.1 million but result in $4.4 million in annual cost savings.

The opportunity in the aerospace segment is quite evident, and that is the continued strength in aftermarket demand as well as higher production rates on production of airplanes. Astronics has opportunities on OEM furnished equipment and buyer furnished equipment, so there is a lot of upside when considering that production rates for many programs are running at 60% of the targeted production rates. The risk mostly centers on the Boeing 737 production rate. Astronics has been producing at 35 per month, in line with Boeing’s official production rate, but going forward the expectation is that the average rate will be around 20 per month. This differential of 15 units and projected towards year-end would result in $11.5 million in sales at risk.

For 2024, sales of $760 million to $795 million are targeted, and Astronics has its internal forecasts set at the high end of the range. Taking the Radio test program and the Boeing 737 MAX rate out, we would get to $773.5 million in sales, which is right at the midpoint of the guided range. Overall, I am not too concerned about the risk profile and I believe that significant margin expansion opportunities exist, driven by volume growth in aerospace leading to better fixed cost absorption.

Even with the Boeing 737 program, the risks are largely contained to the sales directly to the OEM, as the expectation is that any buyer-furnished equipment that Astronics is contracted for will still be delivered, but for retrofit/aftermarket purposes rather than line fit in Renton. The reduction in the Boeing 787 production rates has little impact as most of the contracted value is locked up in BFE, and the standard equipment value contracted by the OEM is even lower than the standard equipment value of the Boeing 737 MAX. Coupled with a lower rate, the impact is also much smaller.

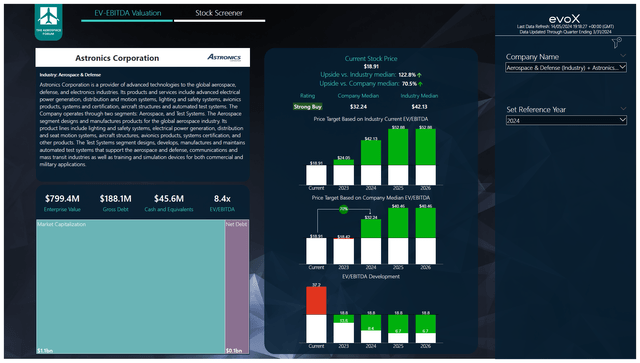

Astronics Stock Is Upgraded

The Aerospace Forum

I have processed the balance sheet data and forward projections for EBITDA and cash flows for Astronics and observed that driven by the strong first quarter and continued strength, expectations for free cash flow and free cash flow have materially increased. Combined with the lower stock price compared to the price at publication of my previous Astronics report, we see increased upside at 70% with a price target of $32.24, which would bring the stock price back to the range we saw pre-pandemic. I believe that also makes sense, as we are seeing strong demand and revenue also in line with pre-pandemic levels. As a result, I am upgrading the stock to Strong Buy.

Conclusion: Astronics Has Its Risks, But Long-Term Drivers Are Strong

Astronics has some potential risks in the form of the Boeing 737 MAX production rate and the timing of the U.S. Army Radio Test program. However, I do believe the long-term trends are strong, and we are already seeing significant margin growth driven by volume. The first quarter showed results above expectations and has also resulted in higher expectations from analysts for the remainder of the year. Taking all dynamics into consideration as much as possible, I believe Astronics Corporation stock is a strong buy.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here