Investment Overview – Absci – Another AI-Driven Drug Developer With a Compromised Share Price

Absci Corporation (NASDAQ:ABSI) is a Vancouver-based drug discovery company that IPOed in July 2021, raising ~$230m via the issuance of 12.5m shares at a price of $16. After initially surging to a price of >$30, the stock price embarked on a long bear run, reaching lows of ~$1.2 per share in October last year. Across the past six months, however, it has increased by >250%. Will this momentum be sustained?

In its latest earnings, the Q1 2024 quarterly report, ABSI management discusses its business as follows:

Absci is a data-first generative AI drug creation company that combines AI with scalable wet lab technologies to create better biologics for patients, faster. With the data to train, the AI to create, and the wet lab to validate, our Integrated Drug Creation platform aims to engineer better biologics with design-in functionality and best-in-class properties.

AI-driven drug discovery companies have completed multiple IPOs recently – AbCellera Biologics Inc. (ABCL), based in Vancouver like Absci, raised ~$550m at $20 per share in 2020. Schrödinger raised $232m at $17 per share in 2020. Certara, Inc. (CERT) raised ~$335m in 2020 at $23 per share. Recursion Pharmaceuticals, Inc. (RXRX) raised ~$500m in 2021, at $18 per share. Exscientia raised $510m at $22 per share in 2021.

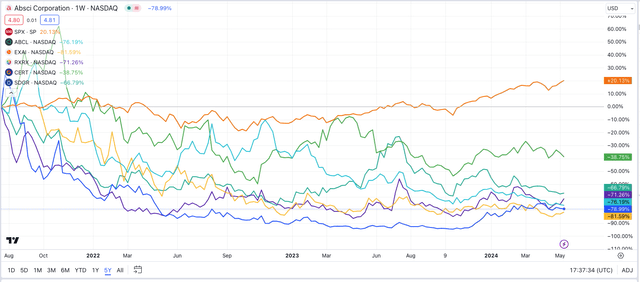

The hype around the potential of AI to transform the pace of drug development – and a bloated IPO market early this decade – was partially responsible for the companies being able to attract so much funding. However, to date, as we can see in the chart below, overall share price performance has been woeful.

AI-driven drug discovery firms – share price performance (TradingView)

Every company mentioned above bar Certara – down nearly 40% – is down >65% since IPO, with three companies’ share prices down >75%. Over the same period, the S&P 500 (SP500) is +20%. There are several reasons for this, I believe.

To date, there are no commercial drugs of any kind on the market that have been developed via AI-driven drug discovery. The thesis is that AI can accelerate the process of evaluating candidates, with supercomputers using neural networks able to learn about molecules and proteins and predict how they might behave.

That is all well and good, but to kick things off, a human being with a profound knowledge of the drug discovery process is required to tell the AI what to look for, otherwise, it is a case of “garbage in, garbage out.” Supercomputers can compare billions, if not trillions, or tens of trillions of possibilities, but when the possibilities are essentially infinite, that renders these numbers irrelevant.

The likes of >$25bn per annum cancer drug Keytruda, >$20bn selling (until 2023) autoimmune drug Humira, and even the GLP-1 agonist drugs developed by Eli Lilly and Company (LLY) and Novo Nordisk A/S (NVO), better known as Zepbound and Wegovy, and tipped to earn hundreds of billions of dollars of revenues over the next decade, were not discovered using AI. In fact, semaglutide, the chemical ingredient in Wegovy, was discovered in scorpion venom.

Nature, and human intuition, still trumps AI in the drug discovery process, as AI-driven drug discovery companies have discovered to their disappointment, and thus to their shareholders’ disappointment. AI is not a cheat code in this field.

There are aspects of the drug discovery process that can be speeded up with the use of AI, but not necessarily dramatically – the clinical trial process still takes years, and billions of dollars to complete, and cannot be speeded up by AI. The pharmaceutical industry essentially deals with human beings, not computers, as it is human beings that fall ill.

Absci’s Recent Bull Run Explained

Nevertheless, all hope is far from lost when it comes to AI-driven drug discovery. Give an AI platform the right information, and it can search for solutions much faster than any human can.

Additionally, companies are beginning to realize that AI on its own is more or less worthless, it has to be combined with what humans already know about developing drugs.

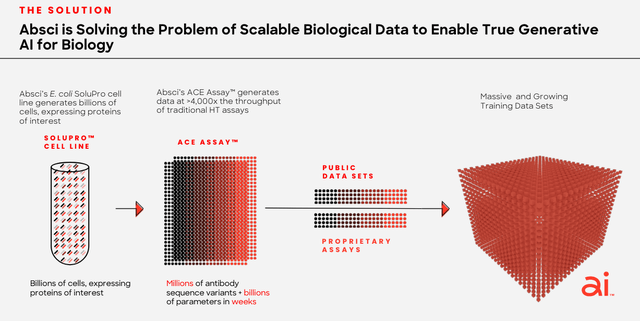

As we can see in the slide below, taken from a corporate presentation, Absci is beginning to understand this, and is adjusting its business model accordingly:

Absci combines biologics with AI (corporate presentation)

In short, before you hit “enter” on the AI macro, use your “wet lab” to give the AI something tangible to work with.

Despite its heavy overall losses, Absci stock is up >280% on a 1-year basis, rising from $1.5 per share to $4.8 per share at the time of writing, although the reasons for the gains are more pragmatic than a shift in its approach to how it uses generative AI.

In November last year, the entire industry was given a boost after Recursion announced a multi-year research partnership with $2.3trn market cap chipmaker NVIDIA Corporation (NVDA) to accelerate drug discovery and development using AI, with Nvidia making a $50m equity investment in Recursion.

At around the same time, Swiss Pharma giant Roche Holding AG (OTCQX:OTCQX:RHHBY) also announced it had teamed up with Nvidia to accelerate drug discovery with AI. Roche also has a partnership in place with Recursion, worth up to $12bn in potential milestone payments, in which it will use Recursion’s AI in >40 of its pipeline programs.

In early December, Absci announced an agreement of its own – with AstraZeneca PLC (AZN) to “deliver an AI-designed antibody against an oncology target.” Although Absci has not disclosed much detail, the deal is believed to be worth up to $247m, including an upfront fee, and research and development (“R&D”) milestone payments, plus royalties on commercial sales, should the candidate ultimately win commercial approval.

Absci also has an agreement in place with another Pharma giant in Merck & Co., Inc. (MRK), which involves collaboration over three targets, and up to $710m in upfront fees, and milestone payments, plus research funding, and tiered royalties on any commercial sales. I wrote about this deal back in 2022, suggesting that Pharma’s interest in AI has in part been driven by the fact that all the “low-hanging fruit” in terms of druggable proteins and targets, has been picked, and patented.

I also suggested that we may have to wait a decade to see if AI really can deliver more best-in-class drugs, and faster, than more traditional methods of drug discovery. In that context, after its recent run-up, how is Absci performing currently?

Q1 2024 Earnings & Business Updates Overview

Absci reported its Q1 2024 earnings on May 14th. The company earned just $0.9m of revenues, compared to $1.3m in the prior year quarter. R&D expenses were $12.2m, and SG&A expenses $8.7m, broadly similar to Q1 2023, and net loss was $(22m), or $(0.22) per share, versus $(0.26) in the prior year quarter. Cash plus short-term investments were reported as ~$160m.

In short, Absci is not picking up major milestone payments from any of its partners – revenues across the past four years have been $4.8m, $4.8m, $5.7m, and $5.7m, while net losses have been $(49.5m), $(103.2m), $(104.9m), and $(111m). In most industries, these figures would not support a market cap valuation of $545m – the current value of Absci – but clearly the market is hopeful a breakthrough of significance is imminent.

This feeling is not actually borne out by current progress. At present, the company does not have any clinical stage assets, its most advanced drug candidate being ABS-101, which targets TL1A, a member of the tumor necrosis factor family which is a well-known target for inflammatory diseases. The indication for ABS-101 is inflammatory bowel disease. Absci calls this market “large,” and “underserved.” It is certainly large, but I’d question if it were underserved – due to its size, most major Pharma companies have drugs targeting the indication, including AbbVie’s Humira, and multiple generic versions of the drug.

Absci points to the fact that it has been able to develop ABS-101 in just 14 months, and at a cost of just $5m, whereas management believes a traditional pharma may have taken up to three years, spending $30m – $50m per annum. On its Q1 2024 earnings call, management referred to the candidate as “best in class,” and as having a “potentially superior product profile, including demonstrated high affinity, high potency, favorable developability, and extended half life.” In its earning press release, management suggests its ability to “bind both the TL1A monomer and trimer, could potentially lead to differentiated clinical efficacy.”

Absci is looking for a Pharma partner to help develop its most advanced drug after the company itself has guided it through Phase 1 studies – an Investigational New Drug (“IND”) application – allowing in-human studies to begin – could be submitted to the FDA this year, and management hopes to produce a Phase 1 interim data readout by the second half of next year.

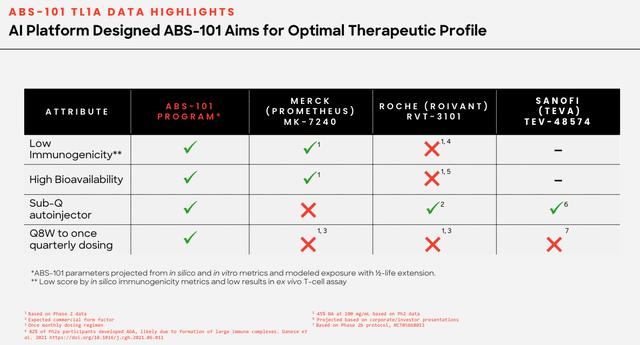

ABS-101 – potential best in class (corporate presentation)

As we can see above, Absci compares its candidate favorably with e.g. Merck’s candidate MK-7240, which it acquired as part of its $10.8bn takeover of Prometheus Biosciences, and Roche’s RVT-1301, which it acquired via a $7.1bn takeover of Televant last year.

MK-7240 has delivered positive data from a Phase 2 study, while RVT-1301 is Phase 3 ready, making them substantially more derisked than ABS-101, which still has it all to prove in the clinic.

Meanwhile, Absci is developing two further drug candidates, ABS-201, and ABS-301, indicated for dermatology and immuno-oncology respectively – targets have not yet been disclosed.

The company expects to burn through ~$80m of cash this year – and says it “believes its existing cash, cash equivalents, and short-term investments will be sufficient to fund its operations into the first half of 2027.”

Final Thoughts – Is Absci’e Recent Upward Momentum Sustainable? The Case For Further Upside Seems Lukewarm

Based on the fact Absci has no assets in the clinic, a single IND submission in play, a cash burn of $80m per annum, and only $160m of near-term assets, as mentioned previously, if this were any other industry, it would be difficult to justify Absci’s recent gains or its $550m market cap valuation.

On a more positive note, the partnerships with AstraZeneca, Merck, and a third partner, Almirall, at least bring the prospects of milestone payments into play, although the way deals are structured, milestones for earlier stage development are minimal, and get larger the further an asset progresses through the clinic. The time to discovery and cost benefits of Absci’s AI are another key selling point; however, there is not yet any clinical data to suggest that the candidate developed, ABS-101, is a genuinely “best-in-class” candidate. I wonder if Pharma would prefer to develop AI in-house, and own the process, as opposed to contracting it R&D out to a third party?

As such, it is difficult to see how Absci will generate any meaningful revenues in the coming quarters, or even years, given how immature its existing candidates are. At present, seemingly, its partners are free to walk away from collaborations without making any milestone payments.

Drug discovery is renowned for being a “feast” or “famine” industry, where at any given time, a combination of wet lab research and AI modelling can uncover a drug candidate with genuine “blockbuster” (>$1bn per annum revenues) potential that will attract a Big Pharma partner, milestone payments in the triple-digit millions, and after the clinical trial process is complete, an approvable, marketable drug that can compete in ultra-competitive markets.

Presently, such a scenario seems a long way off for Absci. It almost seems ironic that an approach that is supposed to eliminate risk comes with a business model characterized by a high level of risk – “We may make a breakthrough, we may not.”

All things considered, it is tough to recommend Absci as a promising investment opportunity, despite the recent enthusiasm of the market. That is not to denigrate some work the company is doing – for example, with its candidate ABS-301, the company is studying a “novel immunosuppressive target” that is “independent of known immune checkpoint inhibitors.”

While the research seems valid and intriguing, were it not for the “AI” tag, Absci Corporation’s value in the marketplace would likely not support a market cap valuation much above $250m, based on my experience researching non-AI based biotech companies and their pipeline.

I would therefore award Absci a “Hold” recommendation based on its ability to potentially attract more partners with a promise to develop drug candidates faster, and at a lower cost.

This claim remains relatively unproven, and a more realistic assessment of value would lead to me giving a “Sell” recommendation. However, as we all know, the market is not rational, and the “AI” tag applied to Absci probably adds a spurious $250m – $300m to the company’s value.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here