Overview

I’ve spent the majority of 2024 focusing on asset classes that have a higher risk profile than traditional dividend growth investments. This has included things such as business development companies, closed end funds, and REITs. However, I wanted to now take some time to cover more traditional ETFs that may be geared towards the investor with a much lower risk tolerance. The Capital Group Dividend Value ETF (NYSEARCA:CGDV) is a fund that seeks to produce consistent income level that exceeds the average dividend yield of the S&P 500. They do this by specifically focusing on companies that pay dividends and have the potential to pay dividends.

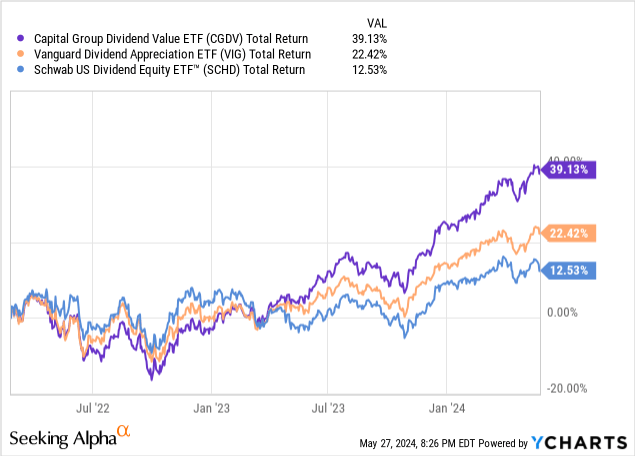

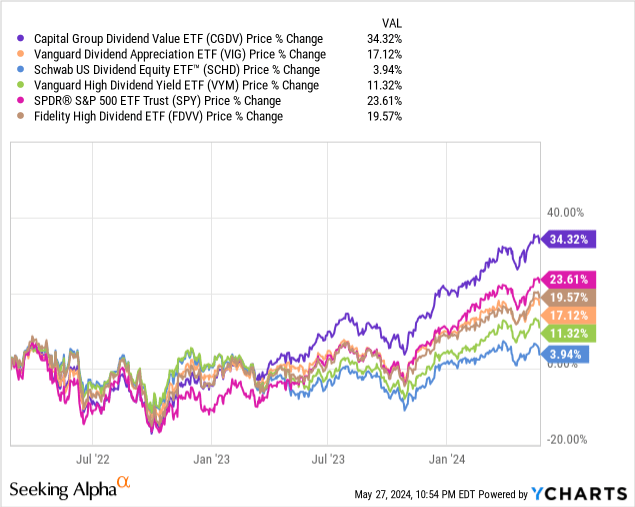

I want to put some emphasis on the second part of that last sentence: companies that have the potential to pay dividends. Since this is part of the strategy, we get the added bonus of a sizeable tech exposure that helps capture more upside price movement than some other dividend focused ETF peers. Taking a look at the total return comparison, we can see that CGDV has outperformed peer ETFs such as Vanguard Dividend Appreciation ETF (VIG) and Schwab’s US Dividend Equity ETF (SCHD). I believe this outperformance gap is due solely to the inclusion of companies that doesn’t necessarily have an established history of dividend payments.

The fund’s history is a short one, with an inception dating back to the beginning of 2022. The fund has a very reasonable expense ratio of only 0.33% and while this is greater than some of the fees of other peer ETFs, the fees have been well worth it so far if we take the performance into consideration. The fund’s strategy is to investment at least 80% of its assets into dividend paying stocks of companies with market caps that are generally larger than $4B. Additionally, the ETF invests 90% of its assets into stocks whose debt securities are rated at least investment grade, offering another layer of safety. First, let’s start this off by diving into what makes CGDV a great ETF.

While the name of this ETF may have the word dividend in it, I believe that CGDV is more suited for the investor looking to achieve the highest level of total return possible. While the dividend growth so far has been strong, we do not have enough of a historical time frame to reference. CGDV has a very low starting yield compared to other dividend ETFs but the lower yield has naturally resulted in higher returns.

Portfolio

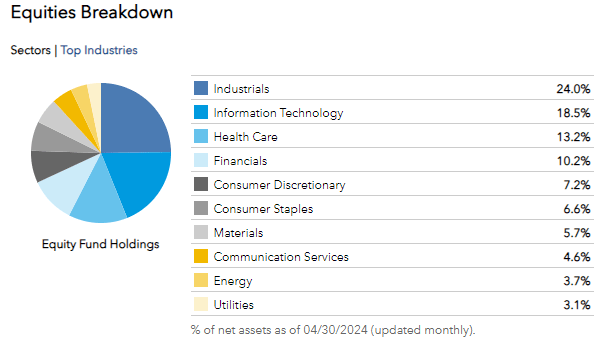

The ETF remains highly diversified with exposure to all industries. We can see a primary focus on industrials as it accounts for 24% of the total portfolio. This is closely followed by technology companies accounting for 18.5% and health care making up 13.2%. This level of diversity is a bit unique as the focus on industrials can offer a bit of stability since that sector as a whole is generally less volatile. Conversely, the large allocation to tech can create more volatility but also provides the chance to get exposure to these growthier companies to contribute to price upside.

Capital Group

Most of the positions are with US based companies, approximately 90%, but we do get some international exposure with little slices of weighting within Europe, Canada, and Latin America as well. There are currently only 50 stocks within this ETF, making it a bit more focused since each individual holding can have larger weight than some alternative funds that hold a few hundred stocks within. Taking a look at the top ten holdings, we can see that Broadcom (AVGO)(AVGO:CA) makes up the largest portion, closely followed by RTX Corp (RTX) at 5.5% and General Electric (GE) at 5.1%. We get a mix of long term dividend growers, some high yielding companies, and companies that have only recently started paying a dividend.

| Company | Percentage |

|---|---|

| Broadcom | 6.5% |

| Rtx Corp | 5.5% |

| General Electric | 5.1% |

| Microsoft | 4.9% |

| Carrier Global | 3.9% |

| Philip Morris International | 3.8% |

| American International Group | 3.4% |

| Meta Platforms | 3.2% |

| Linde PLC | 2.5% |

| Abbott Laboratories | 2.5% |

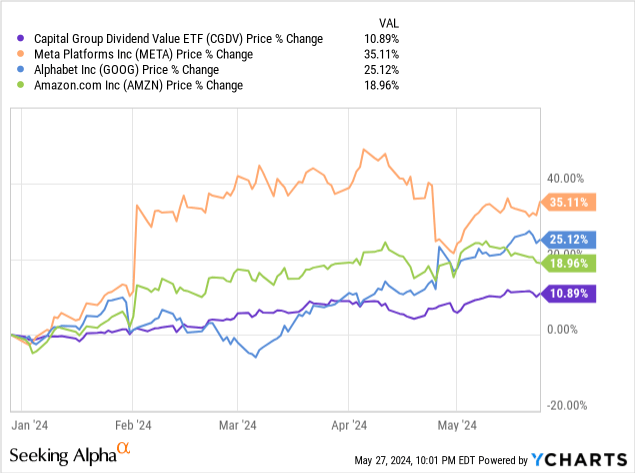

Remember at the beginning of this article when I pointed out that CGDV also invests in companies that have the potential to pay dividends? Well, this means we also get the bonus of the inclusion of companies like Meta Platforms (META)(META:CA) and Alphabet (GOOG)(GOOG:CA) that both initiated their first ever dividends this year! We also get the inclusion of a company like Amazon (AMZN)(AMZN:CA) which does not actually pay a dividend at this moment in time. The combination of these three has the potential to lock in additional upside as they are companies that are more focused on reinvesting their cash back into growth of the business rather than distributing it out as a dividend.

On a YTD basis, they are all up double digits but more important, the inclusion of these companies also means that we are likely to get the addition of more tech based companies like Nvidia (NVDA)(NVDA:CA), which does currently pay a dividend. This concept of being open to add companies that will potentially pay a dividend opens the door for a wide range of holding combinations that can capture additional upside movement that is on par with the greater S&P 500.

The downside of a lot of dividend ETFs is that they tend to focus on well established dividend companies that have long histories of paying out dividends. While this is exactly what these funds are designed to do, there lies a weakness. The weakness is that these ETFs sometimes lack exposure to companies that are also growing their earnings by reinvesting back into the business to fuel expansion, research and development, new innovations, and other growth initiatives. CGDV takes a unique approach and differentiates itself here by allowing room for companies like the ones I just mentioned.

Dividend

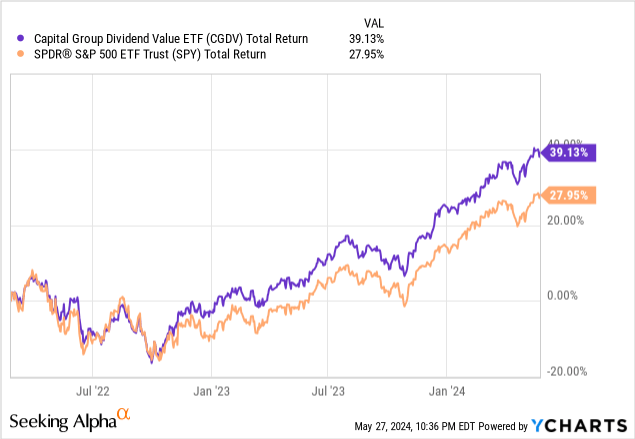

As of the latest declared quarterly dividend of $0.0995 per share, the current dividend yield sits at a modest 1.5%. While a dividend yield of only 1.5% is nothing to get excited about, the fund offers a compelling alternative to a regular S&P 500 fund such as the SPDR S&P 50 ETF Trust (SPY). Taking a quick glance at CGDV’s performance against SPY since inception, CGDV has outperformed by over double digits in total return. For reference, the dividend yield of SPY is only 1.27% in comparison.

So not only do you get S&P 500 beating returns, but you also get a higher yield. This emphasis on companies that pay a dividend also has the natural ability to eventually outpace the SPY in dividend growth over time. Since the history of the fund is so short, we have a very limited data set to estimate off of. However, here is how the annual dividends have grown over the last two years.

- 2022 Annual Payout Amount: $0.3199 per share.

- 2023 Annual Payout Amount: $0.4932 per share.

This growth in annual payout amounts represent a 54.17% year over year growth in the dividend. While it would be a bit naive to expect this kind of growth every single year, this already demonstrates how much potential room the dividend can increase here. Even if CGDV’s dividend only increased at a third of this current rate, it would still indicate a potential CAGR (compound annual growth rate) of 18.06%. For reference, SPY’s dividend has increased at a CAGR of only 6.8% over the last ten year period.

With this in mind, I believe this makes CGDV a great option for investors looking to build a portfolio that’s purpose for dividend growth investing. Since the companies within CGDV are cash flow rich and have a level of prioritization of the dividend, the annual payout amounts should continue to increase here. Additionally, we already have the performance proof that the more focused holdings within CGDV can outperform the greater indexes. As a result, I believe that a long term investment with a continual dollar cost averaging strategy could be a very wise strategy of achieving a total return that’s comprised of both dividend income as well as capital appreciation.

Comparison

I recently put together an analysis on Vanguard’s Dividend Appreciation ETF (VIG) and one of my points was that the tech allocations were a bit lacking since it felt like VIG was missing exposure to companies that didn’t at least have ten years worth of dividend history established. This included having exposures to company’s that pay a dividend, such as NVDA, META, and GOOG. CGDV holds all of these within the fund while also offering a dividend yield that’s quite similar. For reference, VIG’s dividend is slightly larger at 1.7% but the additional income received from equal investments between CGDV and VIG is almost negligible.

It would seem that CGDV captures the price upside of its holdings on a much more efficient basis than lots of these alternative ETFs. However, CGDV has the lowest dividend yield of the bunch. I think that the lower upfront dividend yield is a perfectly fine trade off as long as this outperformance continues. Lots of investors are only looking to achieve the highest level of total return and that’s perfectly fine. For reference, here are the dividend yields of each of these listed peers.

- Vanguard Dividend Appreciation (VIG): 1.78%

- Schwab Dividend Equity (SCHD): 3.4%

- Vanguard High Dividend Yield (VYM): 2.8%

- Fidelity High Dividend Yield (FDVV): 3.1%.

Additionally, CGDV has the lowest number of individual holdings within the ETF. This makes it the most concentrated ETF of the batch, meaning that it may be more suspectable to a higher level of price swings as the movements within the ETF may have a greater influence. Here are the number of holdings within each ETF:

- VIG: 343 holdings.

- SCHD: 103 holdings.

- VYM: 560 holdings.

- FDVV: 123 holdings.

Downside

Since the dividend yield is so low, CGDV may not be a viable strategy for you if you are looking for a stream of income to fund your lifestyle expenses. Perhaps you are nearing or at the retirement phase of your life and you’re looking for an ETF that can provide you with a high level of income so that you can live off the distributions without ever having to sell shares. While this is certainly possible to do, the downside is that it would take a significant amount of upfront capital invested. For example, if you wanted to obtain a dividend income stream of $70,000 to support you during retirement, this would require an investment of $4.67M!

For reference, to generate that same $70,000 income number, you would need $2.05M invested in SCHD. If you have no need for the income now, you can always first prioritize total return through a fund like CGDV. Then at a future point in your life, after you’ve accumulated and let compound interest work its magic over a decade or two, you can shift your focus to prioritize income generation.

On the other hand, to really see the dividend growth over time and get a better yield on cost, you’d likely have to stick around with CGDV for over a decade to see any meaningful dividend growth. I know that the name of this ETF has the world dividend in it but don’t be fooled: you have to be a long term holder to get an impactful level of dividend income. Therefore, if you don’t have time on your side, you’re likely better off with a more income focused fund that prioritizes income generation over total returns or capital appreciation.

Valuation & Outlook

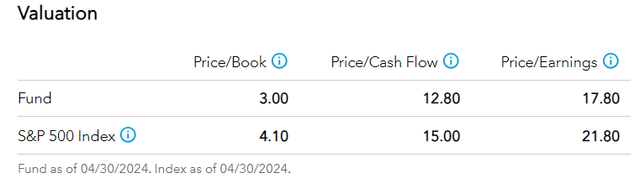

Although the fund is already outperforming the S&P 500 since inception and is up over 10% for the year, CGDV still looks quite attractive from a valuation standpoint. When comparing the valuation metrics against the S&P index, I believe that additional upside is likely going forward. For instance, the price to book ratio sits at 3x, which is below the S&P’s price to book ratio of 4.1x. Additionally, the average price to earnings ratio sits at 17.8x, undercutting the S&P’s price to earnings ratio of 21.8. Since CGDV tracks a lot of the same holdings at has a blended style between value and growth, I think the comparison here is totally fair.

Capital Group

Additionally, CGDV has a lower standard deviation than the sector median. For reference, the current standard deviation sits at 14.3x compared to the sector’s 15.33x. This outlooked is also reinforced by the fact that Seeking Alpha’s Quant gives CGDV a Buy rating. This is determined by the low risk factor, great momentum so far for the year, low fees, and average daily volume of shares traded sitting higher than the sector median. I believe that CGDV reaching $40 per share isn’t too far-fetched when we consider the effects that interest rate cuts may have.

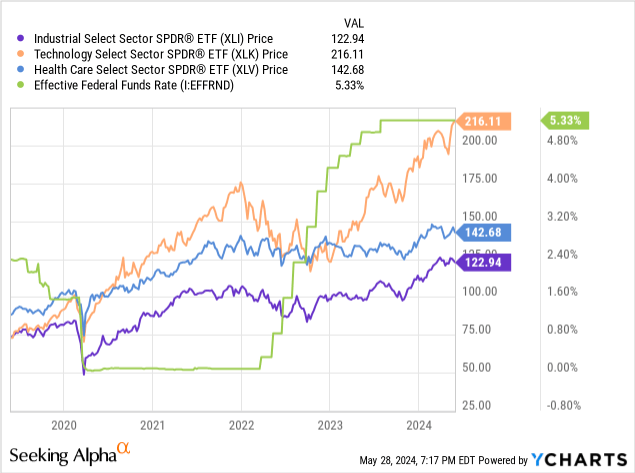

As interest rates are cut, this is likely to increase the rate at which companies are able to expand and grow their operations through increased volumes of lending since debt capital will be cheaper to obtain. When debt becomes more affordable to maintain for these companies, we are likely to see increased funding go towards the new research and development of products or services. In turn, this concept has the chance to fuel further expansion and higher valuation.

Taking a look at the Tech (XLK), Health care (XLV), and Industrial (XLI) sectors, we can see how they all took a dip to the downside once rates started to rapidly rise in 2022. These sectors make up the top 3 holdings of CGDV. While tech has been able to triumph through these rate changes and provide superior returns, the growth of the industrial and health care sectors have been weighed down by the rise in rates. These industries are very capital intensive and depend on affordable debt financing to fund growth.

The outperformance is like to continue because the ETF has to put a better emphasis of the evaluation of holdings since there are so much less of them compared to S&P ETFs or peer dividend funds I have previously mentioned. This smaller concentration of holdings means that more price movement is captured during strong bull runs and there are a lesser amount of sub-par companies holding the price back. A big vulnerability of ETFs that hold several hundred stocks within is that you inevitably get exposure to those poor performing companies alongside the good.

Takeaway

Capital Group’s Dividend ETF is a great fund that captures a high level of total returns while outperforming dividend focused peer ETFs such as VIG and SCHD. While the upfront yield is the lowest of the batch, CGDV’s income growth has the potential to grow at a high rate as it has already done over the last two years. The portfolio remains highly diversified and the inclusion of companies such as META, GOOG, and AMZN helps the ETF capture more price upside compared to peers that exclude these companies because of their lack of dividend history. The fact that CGDV’s strategy can include companies that have the potential to pay a dividend, opens the door for a lot of different growth opportunities over the years as the portfolio can shift strategies at any time.

Read the full article here