Software stocks have been hammered in recent weeks as investors have grown concerned that generative AI not only might not be the tailwinds they had assumed they would be, but instead might even be long term headwinds. Cloudflare (NYSE:NET) has fallen in sympathy with its tech peers, allowing its valuation to finally return to buyable valuations again. I have been cautious on the stock over the past two quarters as I was concerned that the valuation was pricing in too much growth. The recent volatility in the stock price has addressed those concerns, and now we can focus more on the company’s strong sector-leading top-line growth rates. While NET continues to trade at a premium to tech peers, I view this premium as being deserved on account of the company’s history of strong execution. I am upgrading the stock to a buy rating.

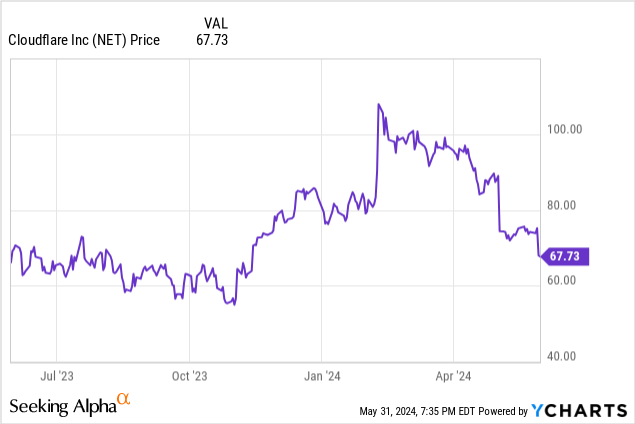

NET Stock Price

I last covered NET in March where I recommended avoiding the stock due to similarities with what I saw during 2021. The stock has underperformed the broader market by around 30%, and it has also underperformed by a similar amount since my December report where I had closed out my bullish position.

That kind of underperformance is substantial and may have created an attractive entry point.

NET Stock Key Metrics

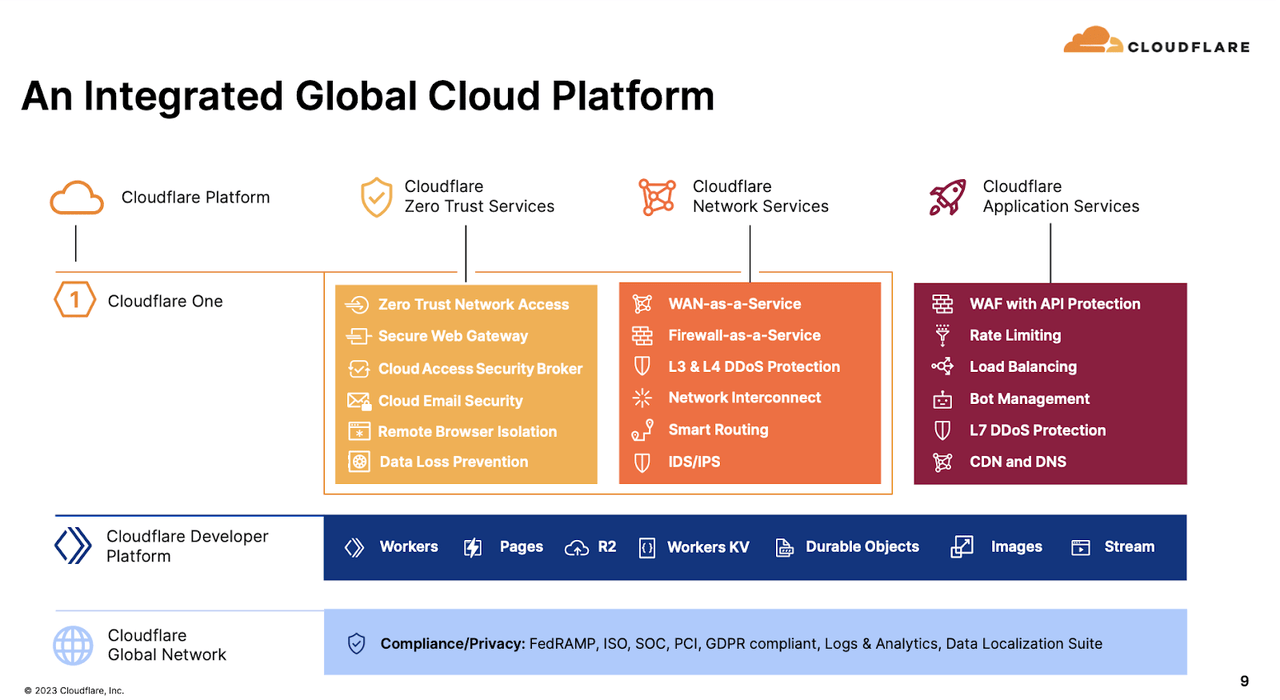

NET is primarily known as a content delivery network, meaning that it helps its customers distribute their content in a fast and secure manner. NET estimates that it is the fastest provider among peers, with speeds as much as 3x faster than close competitor Akamai (AKAM).

2024 Q1 Presentation

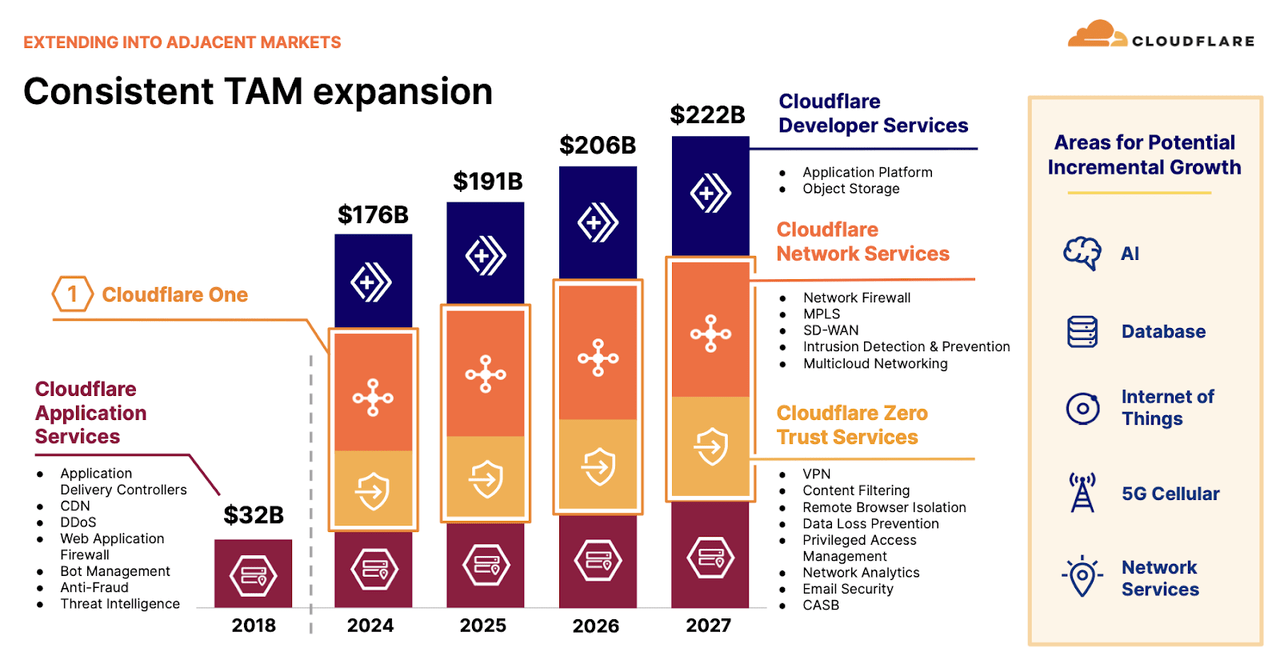

Those unfamiliar to the name might be wondering why the stock trades at a pronounced premium even to tech peers. I view this premium as being due to management having a history of releasing new products to sustain aggressive top-line growth rates. NET has continually expanded its total addressable market over the past several years and benefits from long term secular trends of a faster and more secure internet.

2024 Investor Day Presentation

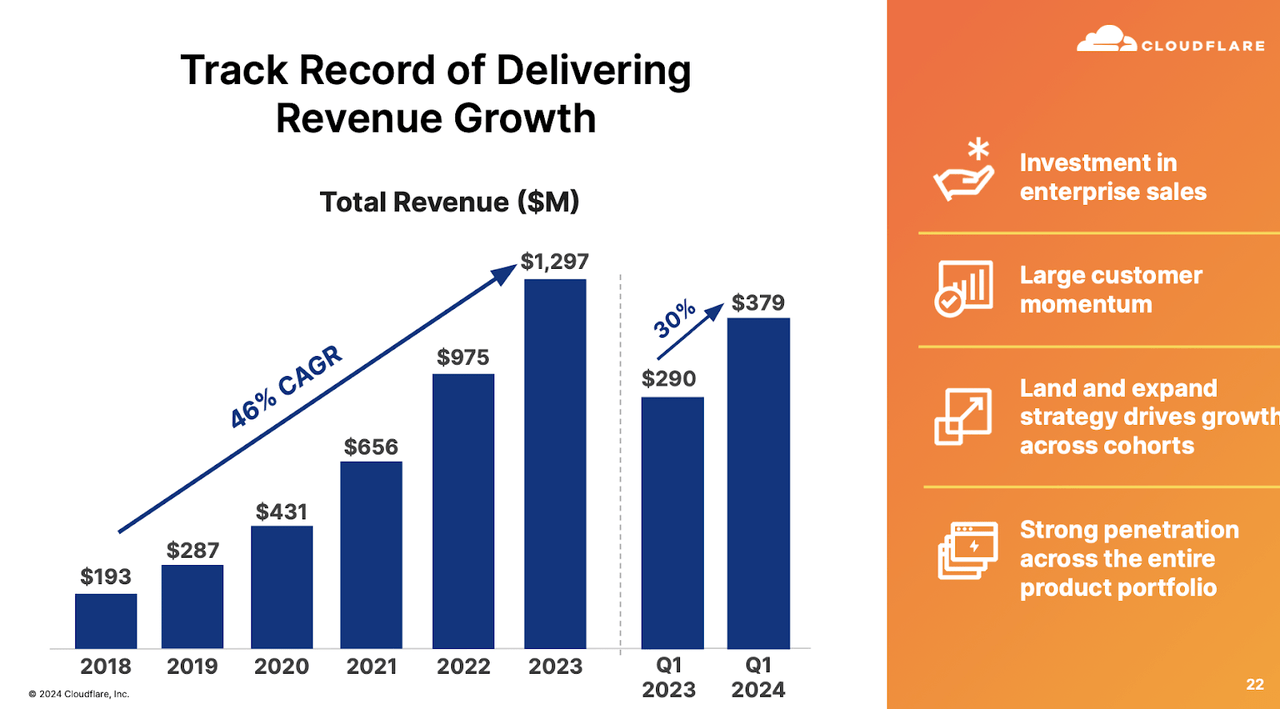

The latest quarter saw NET deliver 30% YoY revenue growth to $379 million, beating guidance for $373.5 million.

2024 Q1 Presentation

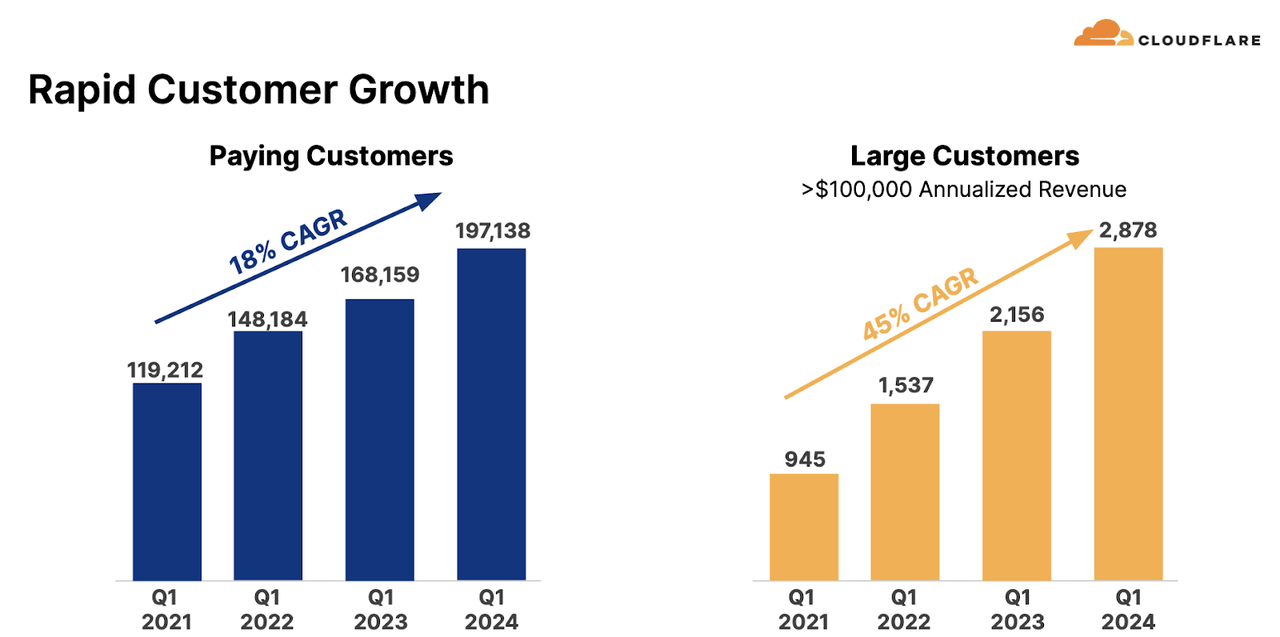

The company has sustained strong customer growth in spite of the tough macro environment, an impressive feat given that many tech peers have struggled to do the same given increased scrutiny on IT budgets.

2024 Q1 Presentation

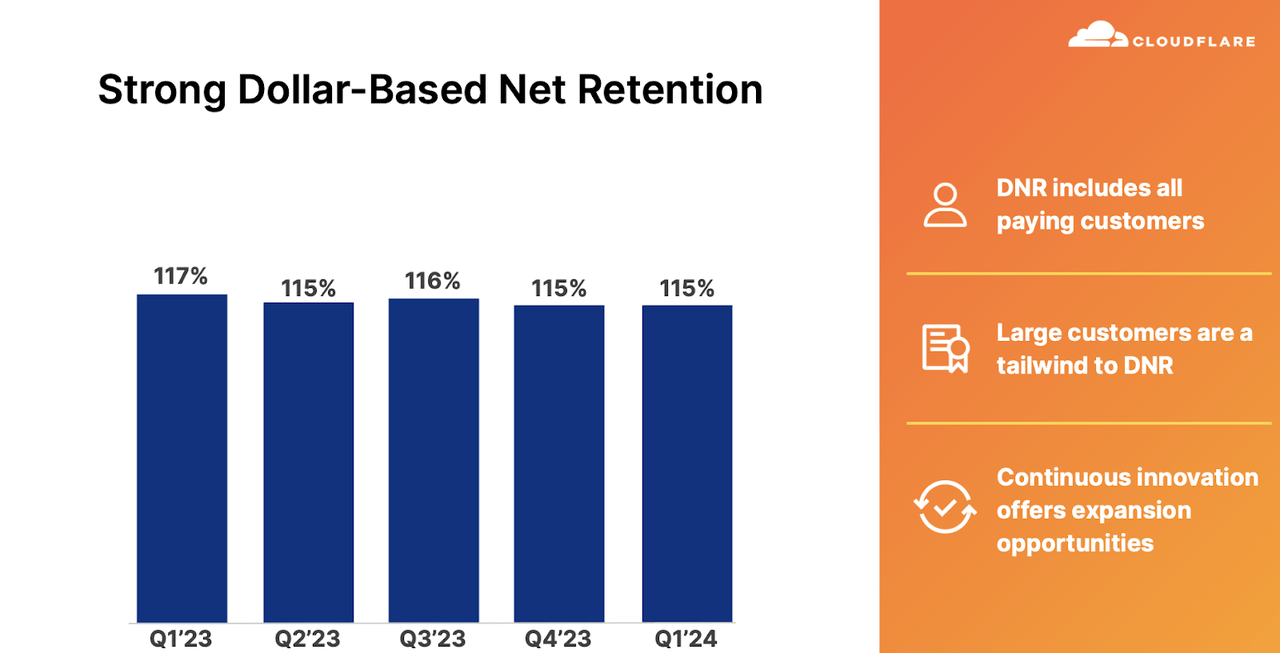

NET has seen its dollar-based net retention rate stabilize in the 115% range. Management had been guiding for 130% net retention rates over the long term just under 2 years ago, but appears to have walked back those ambitious goals.

2024 Q1 Presentation

NET generated $42.4 million of non-GAAP operating income, surpassing guidance for $35 million.

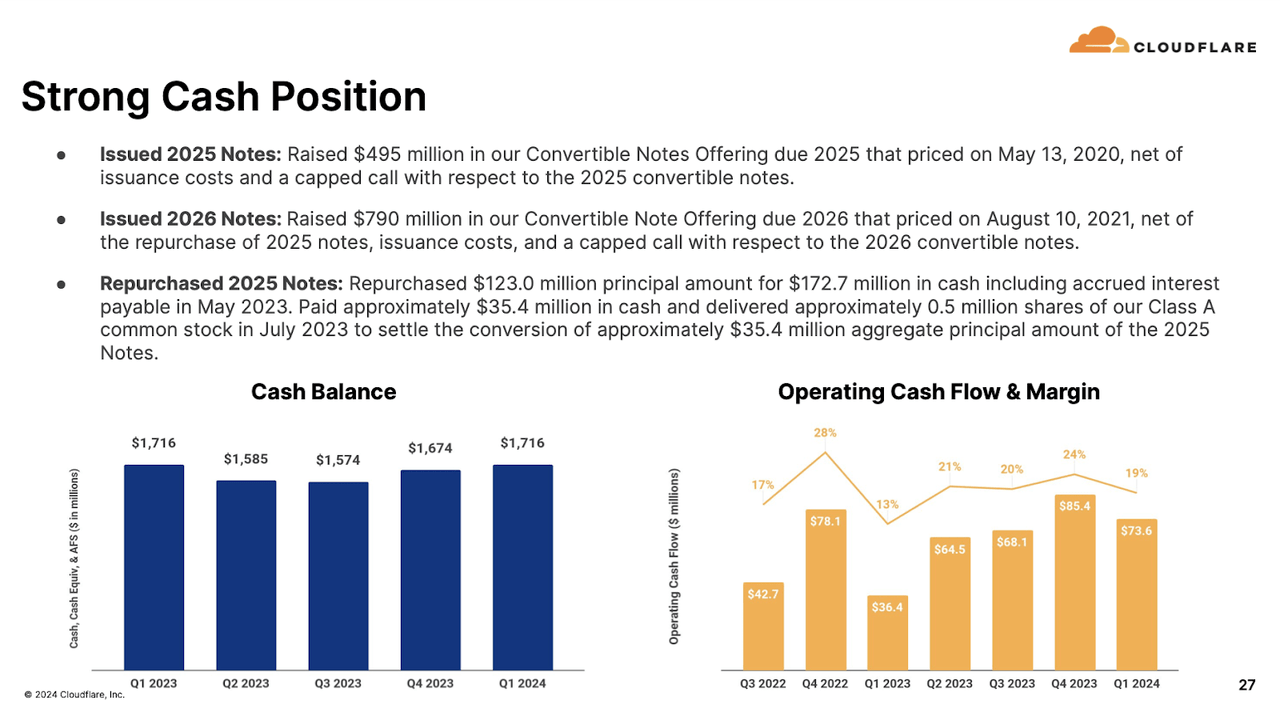

The company ended the quarter with $1.7 billion of cash versus $1.3 billion of debt, representing a strong net cash position. The positive cash flow generation and conservative leverage ratio help instill confidence in the company’s ability to weather any storm.

2024 Q1 Presentation

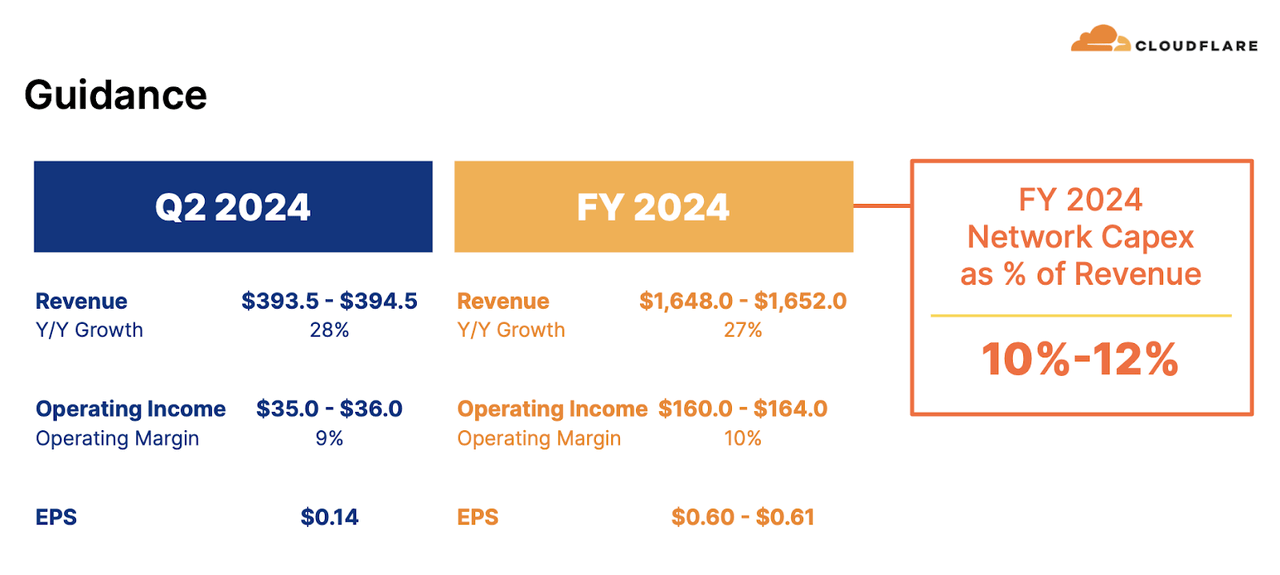

Looking ahead, management has guided for the second quarter to see 28% YoY revenue growth to $394.5 million (consensus estimates call for the same). It is worth noting that management has a long history of surprising to the upside.

2024 Q1 Presentation

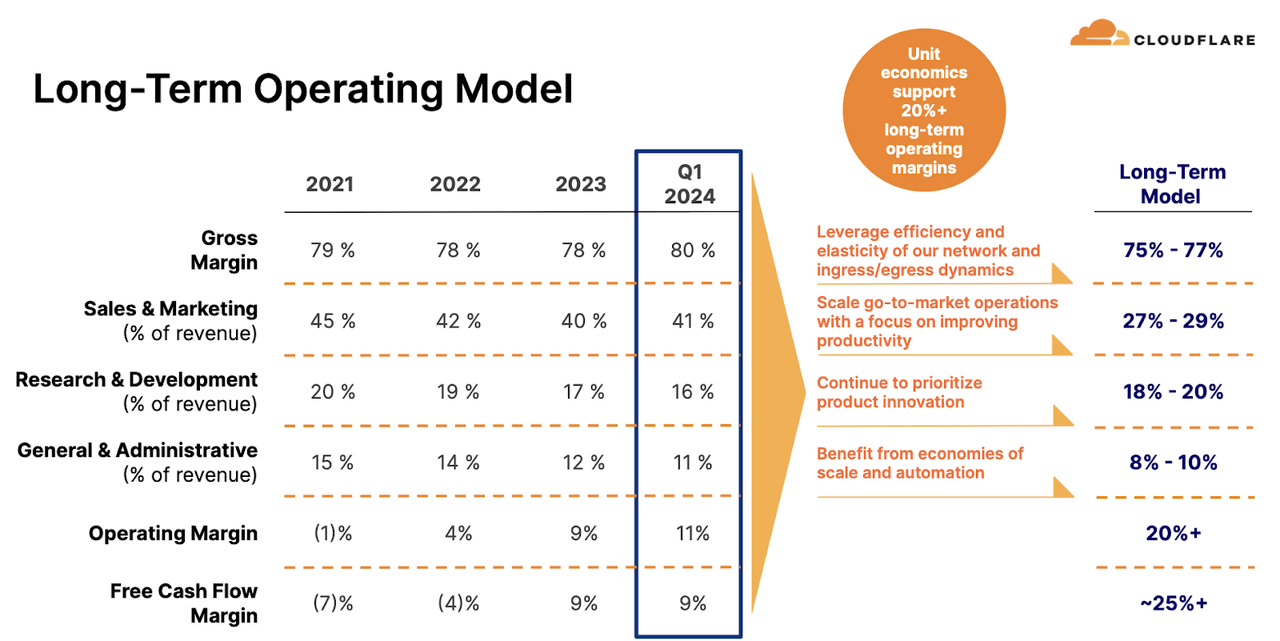

Management continues to guide for at least 20% operating margins over the long term, representing a substantial lift from the current 11% margin.

2024 Q1 Presentation

On the conference call, management reiterated their belief that their dollar-based net retention rate has stabilized from their prior decelerating trends. Management noted that remaining performance obligations grew 40% YoY to $1.343 billion and crucially, current RPOs grew 31% to $940.1 million. RPOs may be beginning to have less relevance for this company given its increasing push into usage-based products, but the high YoY growth rate is still promising and may be indicative of the company’s ability to sustain such aggressive top-line growth moving forward.

Is NET Stock A Buy, Sell, or Hold?

Even after falling 10% over the last two days and 24% over the past month, NET is still trading at among the highest valuations in the tech sector, with its stock trading at 14x this year’s sales.

Seeking Alpha

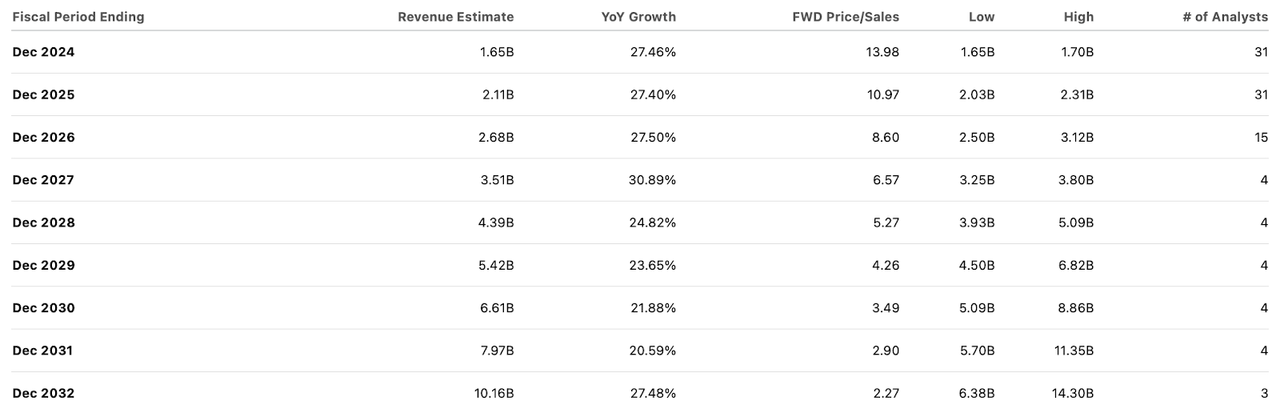

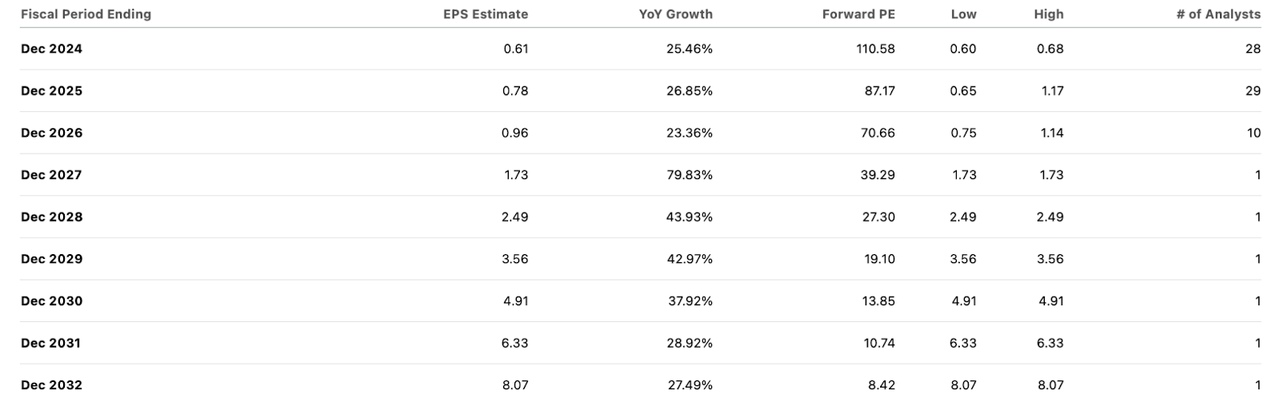

Consensus estimates call for the company to sustain rapid top-line growth and to eventually deliver operating leverage, culminating in rapidly rising earnings.

Seeking Alpha

I expect the company to sustain at least 30% net margins over the long term, if not much higher. I can see the stock trading at 26x earnings upon maturity, justified by (at that time) a high single-digit top-line growth rate and (the current) net cash balance sheet. That equates to around an 8x sales multiple. However, I can see the stock sustaining at least a 10x sales multiple as long as it is sustaining over 20% top-line growth. If the company can sustain around 25% top-line growth over the next 4 years (below consensus), then the stock is currently trading at around 5.6x 2028e sales. That suggests around 15.5% annual return potential over the next 4 years, which I argue is appropriate given the company’s strong history of execution, even if it is admittedly at the lower end of my targeted hurdle rate for a stock of this risk profile.

NET Stock Risks

The main risk here is arguably valuation. If NET were to trade more in-line with peers, then the stock might fall considerably, especially in light of the recent volatility in the software sector. I also admit that it is uncomfortable to see peer AKAM generate low single-digit top-line growth in spite of generating only $4 billion in revenue. It is possible that NET might see top-line growth decelerate more rapidly than expected as it scales. It is unclear if generative AI might also become a source of headwinds for the company, even if the vast majority of its business is not based on headcount.

NET Stock Conclusion

While many readers might be understandably hesitant to invest in the tech sector following the 2022 tech crash, I have the differing view that the tech sector’s strong fundamental performance following that crash has proven the long-term attractiveness of their business models. I view the recent volatility as being a solid buying opportunity, especially for high-quality names like NET. I am upgrading NET stock from “hold” to buy.

Read the full article here