I am updating my analysis on Humana Inc. (NYSE:HUM) in light of reaffirmed earnings guidance.

I previously rated Humana a buy for the following reasons:

- The market overreacted to decreased earnings guidance pushing the stock below fair price

- A price target of $405 was well-supported by DCF analysis, even without a full recovery to the Medicare Advantage business

- Humana’s Medicare Advantage was still likely to benefit from demographic tailwinds

- CenterWell integrated care was a solid path forward for growth and cost mitigation

Since then, Humana is up over 6% while the S&P 500 rose just over 4%.

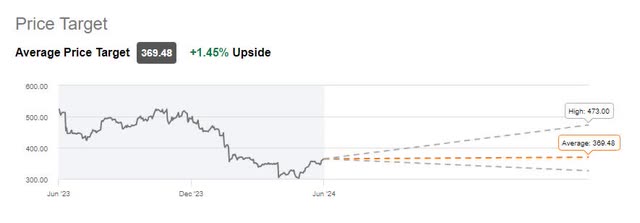

HUM Price Trend (Seeking Alpha)

I continue to firmly believe that the market overreacted to Q4 earnings and decreased guidance, as Humana’s long-term fundamentals are strong. Even with lower expectations for 2024 and 2025, DCF analysis yields a price target of $397, down slightly from my previous target of $405 but still more than 10% upside from today’s pricing. Medicare Advantage remains a long-term tailwind for Humana as demographics move solidly in their favor. In addition, upside for the CenterWell business is not priced in.

With the above in mind, I continue to rate Humana a buy at a price target of $397.

Valuation

I updated my ongoing DCF analysis for Humana based on Q1 results, reaffirmed management guidance, and analyst questions during the earnings call. I made the following underlying assumptions:

- Management generally delivers on guidance

- Unfavorable cost trends impact the business through 2026

- Revenue grows at 8%, with 6% from organic health insurance growth and 2% from growth initiatives primarily in the managed care space

- SG&A costs grow at 4%, slightly ahead of inflation

- Discount rate of 10% based on WACC of 9% plus 1ppt hedge

This DCF analysis yields a price target of $397, 10% upside from today’s pricing

HUM DCF Analysis (Data: SA; Analysis: Mike Dion)

Wall Street’s average price target has come down slightly since my previous analysis. However, it is still signaling upside and the high range provides more upside potential than the low range.

HUM Wall Street Rating (Seeking Alpha)

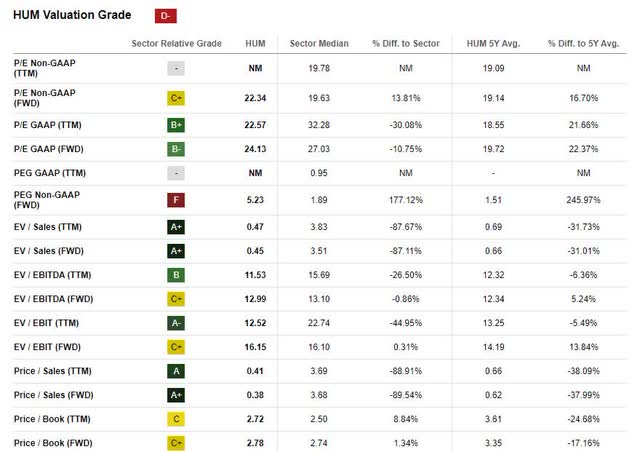

Valuation grade receives an overall grade of D- however I am not sure I agree. Key EV and Price ratios are strong, both relative to the sector and the 5-year historical average. Looking at EV to Sales as an example, HUM is at 0.47 versus the sector at 3.83 and the 5-year average of 0.69.

HUM Valuation Rating (Seeking Alpha)

Medicare Advantage Is A Long-Term Tailwind

Medicare Advantage is certainly facing short-term challenges. Humana sent a letter to CMS responding to the rate notice that sums this up well:

Humana acknowledges CMS’s continued effort to improve the level of detail regarding the methodology and components of the projected USPCCs and growth rates. However, we are concerned that CMS’s proposed growth rate does not accurately reflect utilization increases for covered services. Humana asks that CMS provide additional details on the information and analyses used to draw their conclusions.

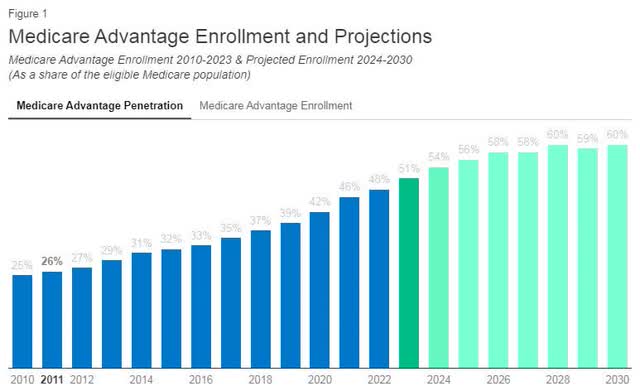

However, I see this as a short-term issue for Humana not a long-term issue. First, penetration of Medicare Advantage is expected to continue growing from 51% today to 60% in the future.

Medicare Advantage Penetration (KFF)

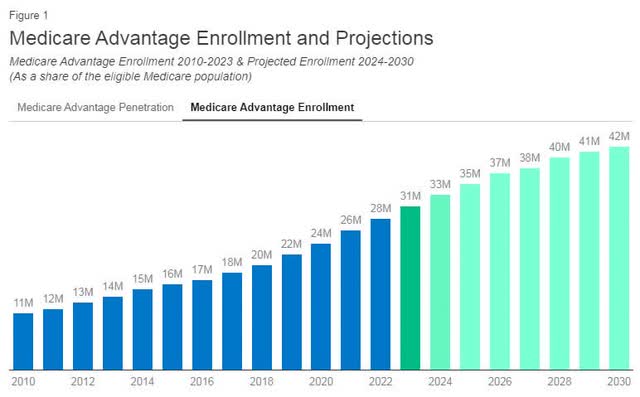

Not only is penetration expected to grow, but the eligible population is growing as well, resulting in Medicare Advantage estimated to grow by over 1 million enrollees annually.

Medicare Advantage Enrollment (KFF)

With growth comes competition, and many other entrants are competing with Humana. However, Humana remains the largest Medicare Advantage provider, with more than 70% of their business in this space. This gives them scale to outperform competitors through ups and downs.

According to a recent report, nearly half of health systems are considering dropping Medicare Advantage plans due to low reimbursements and issues getting paid. Humana is not facing issues on a broad scale and continues to be rated the government’s number one Medicare Advantage provider. Approvals and claims are a key part of the rating, indicating Humana’s strength in this area.

During the earnings call and earnings release, management also repeatedly indicated that sustainable growth and margin discipline were key to their success going forward. I see a situation where competitors start losing customers as health systems drop them, and Humana grows (at a higher margin) as the customers look for a better option.

CenterWell Isn’t Priced In

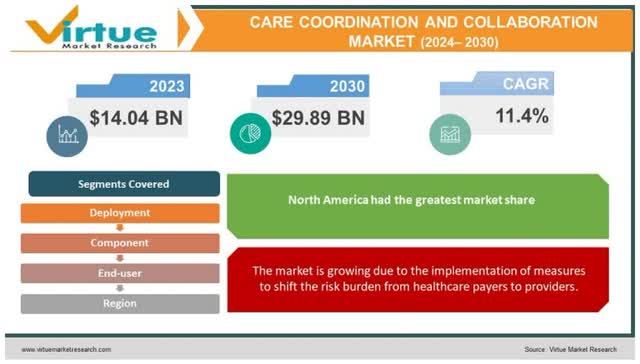

CenterWell is a fantastic growth opportunity for Humana, both from a revenue standpoint as well as a margin expansion standpoint. On the revenue side, the care coordination market is expected to grow at an 11% CAGR through 2030, well above the growth rate I included in the DCF.

Coordinated Care CAGR (Virtue Market Research)

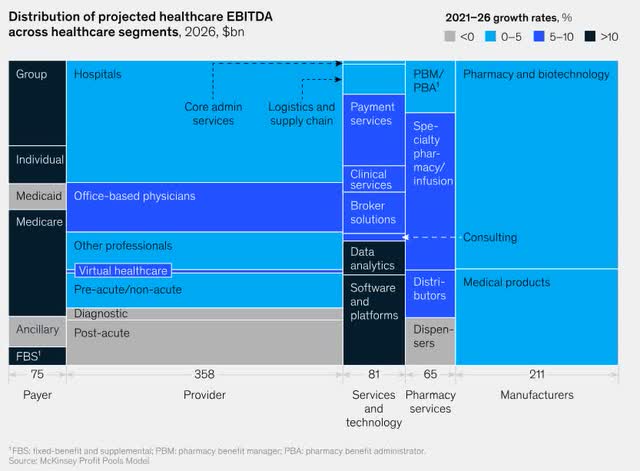

Coordinated care via office-based physicians and virtual healthcare is a high-growth opportunity for EBITDA based on McKinsey’s profit pool study, representing an opportunity to expand margins, doubly so as there is a benefit to serving Humana Medicare Advantage patients at a lower cost in house.

Healthcare Profit Pools (McKinsey)

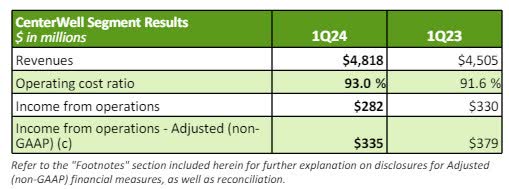

CenterWell has been growing at a steady 7% clip, aside from short-term changes to the Medicare risk model. This means there is additional upside even beyond current performance as their network continues to expand.

CenterWell Financials (HUM Investor Relations)

Downside Risk

The primary downside risk to Humana is political risk related to the Medicare Advantage program. As discussed above, Humana is heavily exposed to Medicare Advantage, which generates more than 70% of its revenue. While there is currently bipartisan support for the program, there is a risk of support going away.

The federal government is also under pressure to lower costs, which led to the challenging rate notice discussed above. Continued pressure on cost could squeeze margins if pricing doesn’t keep up with inflation.

Verdict

I believe that Humana’s current challenges are a short-term blip, and management has set the company up well for long-term growth. Medicare Advantage demographics are a tailwind for the business and combining these tailwinds with the benefits of coordinated care at CenterWell, the upside potential is strong.

Based on current trends and management guidance, my DCF analysis suggests a price target of $396, 10% upside from today’s pricing. While there are risks from any government program, bipartisan support mitigates these risks and the upside potential outweighs the downside.

I continue to rate Humana a buy.

Read the full article here