Since Ani Pharmaceuticals (NASDAQ:ANIP) merged with Biosante Pharmaceuticals in 2013, ANIP’s growth has largely been fueled by M&A, the most important of which are the acquisition Purified Cortrophin Gel from Merck & Co., Inc. (MRK) in 2016 and the merger with Novitium Pharma in 2021. The market sees these as drivers of ANIP’s growth, and analyst estimates currently reflect this. However, ANIP’s royalty revenue potential is largely unnoticed. This article looks at two assets approaching FDA new drug application submissions, CG Oncology’s (CGON), Cretostimogene Grenadenorepvec, a bladder cancer treatment and ANIP’s Female testosterone (formerly known as Libigel), that if approved, could potentially generate $415 million in annual royalties, which equates to an additional $21.39 in revenue per share and a $16.90 increase in EPS, based on the current 19.4 million diluted weighted average common shares outstanding and a 21% corporate tax rate.

ANIP keeps their cards close to the vest and rarely mentions future royalty potential, which could start in 2025. ANIP’s merger with Biosante Pharmaceuticals in 2013, included an interest in a number of biotech assets, which have been out licensed to a number of companies for future development, at no further cost to ANIP. Kite Pharma Inc.’s Yescarta, now owned by Gilead Sciences (GILD) was one such asset that generated royalties for ANIP. ANIP historically has only reported on assets it directly controls and does not publish a pipeline. This causes investors to underestimate revenue potential from royalties and milestone payments. Case in point, since the merger in 2013, ANIP minimally referenced Biosante’s licencing deal with Cold Genesys (now CG Oncology) for CG0070 (Cretostimogene). However, as CG Oncology allegedly breached the terms of their Technology Transfer Agreement, ANIP has become much more transparent. ANIP filed legal action against CG Oncology and posted the terms of the deal in their first quarter 10-Q filing. If successful, ANIP could start receiving royalties in 2026 for Cretostimogene, which could eventually generate more than $125 million in royalties per year. ANIP’s female testosterone (Libigel) is another asset included in the Biosante merger, which may start generating royalties in 2025, where royalties could potentially exceed $290 million in annual US sales. International sales would only add to this total. ANIP’s share price does not currently reflect this revenue potential, making ANIP a strong buy, especially for speculative investors.

Cretostimogene (CG0070) Royalty Potential

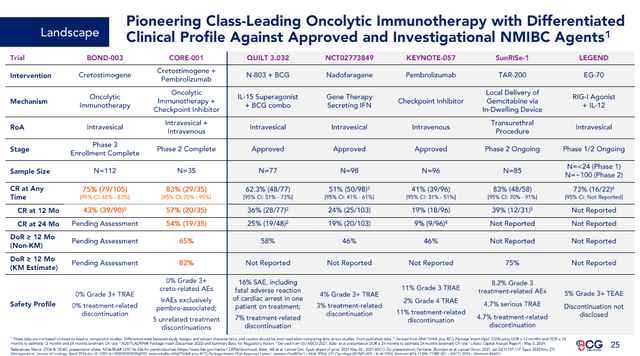

According to CG Oncology’s May 3, 2024, press release, Cretostimogene’s Phase III Monotherapy trial demonstrated a 75.2% Complete Response Rate in High-Risk, BCG-Unresponsive Non-Muscle Invasive Bladder Cancer. Topline data is expected in December 2024. CG Oncology’s June 6, 2024, Investor Presentation presented how Cretostimogene’s Clinical Profile compares with other Approved and Investigational NMIBC Agents.

Cretostimogene’s Clinical Profile Against Approved and Investigational NMIBC Agents (CG Oncology)

According to ANIP’s SEC filings, on February 28, 2024, CG Oncology disputed ANIP’s rights to receive royalties. On March 4, 2024, ANIP began a civil action against CG Oncology, Inc. in the Superior Court of the State of Delaware, claiming that under an Assignment and Technology Transfer Agreement dated November 15, 2010, CG Oncology or any affiliate or sublicensee is liable to pay ANIP a running royalty of 5% of Cretostimogene’s Worldwide net sales. The case now has resulted in a number of counterclaims, including one where ANIP requests, as a possible remedy, the ordering that CG Oncology re-transfer to ANIP all assets from the November 2010 agreement, including without limitation, all data and documentation comprising IND 12154. This matter could take time to resolve. However, it appears that CG Oncology has much more to lose in this case. On May 13, 2025, Goldman Sachs estimated that peak sales for Cretostimogene would reach $2.5 billion and would be launched in 2026. This would potentially generate $125 million a year in royalties for ANIP. This assumes ANIP is successful in their litigation with CG Oncology. By 2031, this could add $5.09 to ANIP’s EPS (less future dilution).

Female Testosterone Royalty Potential

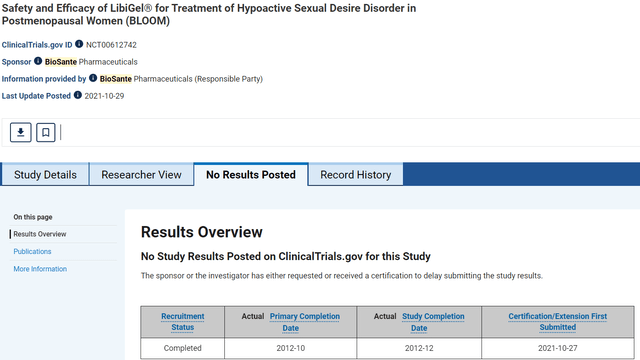

Since ANIP merged with Biosante Pharmaceuticals in 2013, they have not mentioned a potential royalty from CG Oncology in any of their annual filings, until CG Oncology opted to challenge their agreement. Similarly, ANIP has not mentioned Libigel, their female testosterone drug, since their 2015 Annual report. The following screenshots, from the Clinicaltrials.gov website, confirm that a certification request to delay submitting trial results was received for the trial titled “Safety and Efficacy of LibiGel for Treatment of Hypoactive Sexual Desire Disorder in Postmenopausal Women (BLOOM)”

The following is a screenshot from the clinical trial’s results tab, taken May 19. 2024. It clearly states, “The sponsor or the investigator has either requested or received a certification to delay submitting results.”

Clinical Trial Results Tab captured May 19, 2024 (Clinicaltrials.gov)

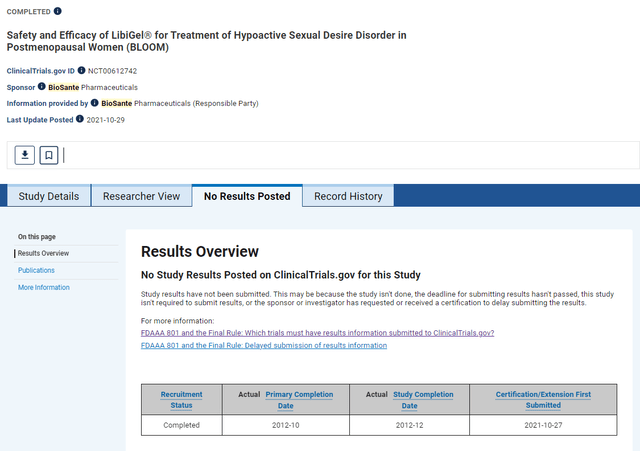

However, the following screenshot is from the results page for the same trial taken June 5, 2024. Even though it has added other reasons for not submitting results, it still points to a pending FDA new drug application.

Trial Results Tab captured June 5, 2024 (Clinicaltrials.gov)

The added reasons for not submitting results do not appear to apply in this case. Therefore, it looks, as previously posted, the delay to submit results was related to a certification of the clinical trial. According to the ClinicalTrials.gov website, “a sponsor, (currently listed a Biosante Pharmaceuticals) or an investigator, (currently listed as Dr. Michael C. Snabes, who according to LinkedIn, is a Senior Medical Director with AbbVie Global Clinical Research and Development), may submit a certification to delay submission of results information if they are applying for FDA approval of a new drug.”

An undisclosed partner is likely advancing ANIP’s female testosterone drug, with an Assignment and Technology Transfer Agreement is in place. Such a deal has the potential to be much more lucrative for ANIP. Unlike the Cold Genesys deal, where the tech transfer was at the Phase 1 trial stage of development, a Libigel tech transfer agreement would include the fruits of approximately $200 million in development cost, including three phase III trials involving at total of 4,857 participants, which includes long-term safety and efficacy data on women. This included 3,656 postmenopausal women at a higher risk of developing cardiovascular events. In 2011, upon collecting 4,000 patient years of data, Dr. Snabes described in a patent application that a greater number of cardiovascular events were observed in the untreated patient population, claiming that restoring testosterone reduced cardiovascular events in postmenopausal women by at least 71% over expectations. In 2015, during prosecution of the patent application, a claim that restoring testosterone also reduced breast cancer events over expectations was added. This was three years after Biosante Pharmaceuticals had allegedly completed their study. The larger trial was measuring efficacy in treating HSDD. Secondary outcomes for the trial have not been disclosed.

According to the Clinicaltrials.gov website, a certification can delay submitting results for up to two years. The results have been overdue since October 27, 2023. It is unlikely that results will be posted prior to an NDA approval. However, it is worth watching the results page of the trial for confirmation that the results have been submitted, as it could be a sign that an announcement is imminent that will likely propel ANIP’s share price.

In September 2019, the first Global Consensus Position Statement on the Use of Testosterone Therapy for Women was issued recommended using testosterone to treat HSDD. The review leading to this position statement also examined the effects of testosterone therapy on wellbeing, mood, and cognition, musculoskeletal effects, cardiovascular health and breast health in postmenopausal women and found that more research was needed to make an assessment on testosterone therapy’s impact on these areas. ANIP’s testosterone trial results were not available for review when the position statement was issued. However, the release of the results could lead to an update of the position statement and prescribing guidelines.

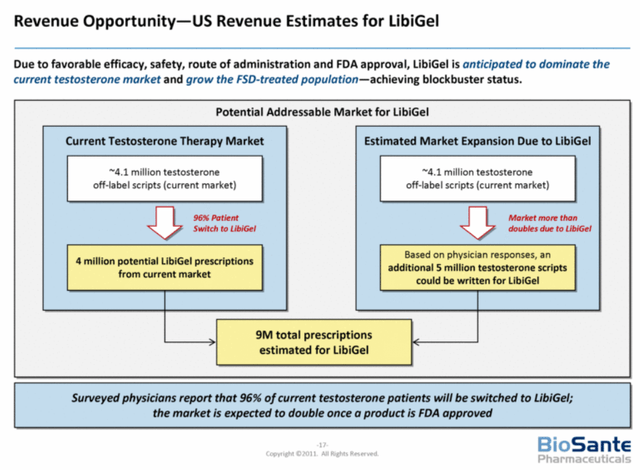

According to the Empirical Analysis Report on Licensing, Phase three 3 trial related deals averaged a royalty rate of approximately 14.5%. In 2011, according to the Biosante and Libigel Market Overview presentation, Biosante estimated that an FDA approved female testosterone drug could potentially generate 9 million prescriptions for treating HSDD alone. At the time, over 4.1 million scripts of testosterone were prescribed off label and 96 percent of physicians surveyed said they would switch their patients from off-label testosterone or compounded testosterone to an FDA approved testosterone drug for women.

Revenue Opportunity for Libigel (Ani Pharmaceuticals Sec Filings)

According to Testosterone Prescribing Among Women in the USA, 2002-2017, the numbers peaked in 2009 and dropped off significantly just as male testosterone prescribing fell when cardiovascular concerns were published. Going from 19 to 4 women per 10,000 being prescribed testosterone.

Today, Biosante’s prescription estimates of nine million seem high. However, armed with the cardiovascular and breast cancer event reducing benefits and updated prescribing guidelines, it is possible that a number of other indications may eventually be approved. According to “A cardiovascular safety study of LibiGel (testosterone gel) in postmenopausal women with elevated cardiovascular risk and hypoactive sexual desire disorder“, with 79% of the 3656 participants enrolled, 67.9% of participants suffered from Hypertension and 64.7% of participants suffered from Dyslipidemia, while 21.0% of participants suffered from Diabetes Mellitus. If efficacy was not being measured for these indications, the results may still provide information in developing future trials.

Armed with the new safety data, the first FDA approved testosterone drug for women and assuming an estimated prescription price of $500, testosterone sales might be able to recapture four million off-label scripts Biosante referenced in 2011. If so, ANIP might be looking at royalties of $290 million per year from US sales alone. Royalties from international sales, added indications or a US based co-promotion deal might further increase revenue. These royalties could eventually add $11.80 to EPS (less future dilution) over time.

FDA Supports Approving a Safe Female Testosterone Drug

In 2016, the FDA Office of Women’s Health Research Program awarded special funding to Lai-Ming Lee, PhD/CDER for Cardiovascular Risk of Testosterone Treatment in Women. The research would assess the Framingham General Cardiovascular Risk Score, which predicts the 10-year risk of all cardiovascular events, as a tool in developing Phase 3 trials. On May 31, 2011, Biosante announced that they had completed enrollment for the Libigel trial. The certification to delay submitting results was requested October 27, 2021, a little over 10 years after the last patient was enrolled. It is possible that the results will include 10 years of safety data.

Current Undervaluation

Since CG Oncology has an enterprise value of $1.76 billion, ANIP’s 5% stake in Cretostimogene sales is arguably worth more than $88 million. Additionally, since Cretostimogene royalties add $88 million in value to ANIP, female testosterone with royalty estimates of $290 million would be worth well over $204 million in valuation. When combined, ANIP is currently undervalued by at least $292 million or $15.05 per share, arguably more, as the first female testosterone drug is likely closer to approval and royalties have gross margins of 100%.

Risk

ANIP’s royalty projections are not without risk. ANIP’s litigation with CG Oncology could take some time to work its way through the courts. The courts could rule in CG Oncology’s favor. ANIP has yet to announce a deal regarding female testosterone. It is unknown when or if ANIP will make an announcement. Cretostimogene and/or female testosterone may not gain FDA approval. ANIP is projected to grow consistently based on their generics, branded drugs, and rare disease drug portfolio. However, investing based solely on the royalty potential is speculative.

Conclusion

ANIP has developed into a sustainable, profitable biopharma company. Over the last nine quarters, they have under promised and overdelivered. ANIP does not post a pipeline of drugs under development, internally or externally. This handcuffs analysts on properly estimating their future revenue potential, especially when assessing royalty potential related to late-stage drug trials. Litigation with CG Oncology has exposed one such deal. However, they have yet to promote a deal for female testosterone, even though clinical trial updates point to an NDA being in the works, which should prove more lucrative for ANIP. Based on Goldman Sachs’ Cretostimogene sales estimates, ANIP could start receiving royalties in 2026, eventually reaching $125 million. Ideally, for ANIP shareholder’s, ANIP would submit the NDA for female testosterone themselves. However, their R&D expenses do not reflect this possibility. Therefore, as with CG Oncology, there is likely a technology transfer agreement is in place with an undisclosed company, who will be filing the NDA. Recapturing the testosterone market that previously saw 4.1 million off-label prescriptions issued to women could generate $2 billion in revenue. Assuming a 14.5% royalty rate, and a launch in 2025, female testosterone could possibly generate $290 million in royalties, which does not include royalties from international sales or added indications. According to Key factors to improve drug launches, on average, peak sales of new drugs are achieved in less than five years. Therefore, by 2031 the two drugs combined could generate royalties more than $21.39 per share (less dilution) Which should add approximately $16.89 (less dilution) to ANIP’s EPS. Arguably, ANIP should be trading at $81.79, if not higher, once investors realize the royalty potential, making ANIP a strong buy as it is currently undervalued by at least 22.5%.

Read the full article here