On our previous coverage of Blackstone Mortgage Trust, Inc. (NYSE:BXMT), we felt that there was no real reason to be long this distressed mortgage REIT. We came to that conclusion by examining the macro setup and the compelling short thesis by Muddy Waters. We felt that the best risk-reward was via a slightly different options trade.

They would, if this level of distress, extended uniformly to multifamily and other assets. We don’t have any reason to believe that, and nor does Muddy Waters present any evidence of that. On the flip side, we have seen enough evidence of our own, even outside of Muddy Waters, to suggest that there will be moderate or even high losses on the office exposure and possibly some on the multifamily side. With equity values being under 20% of asset exposure, we think the odds of equity underperforming over the next 1–2 years are almost 100%. Does that make BXMT a short? Well, if you short, you are on the hook for the 11.1% distribution yield and the 3% in borrowing costs. That 14% hurdle is tough to overcome. If we had to play it, we would use a Ratio Put Spread.

Source: 11% Yield Inside Muddy Waters

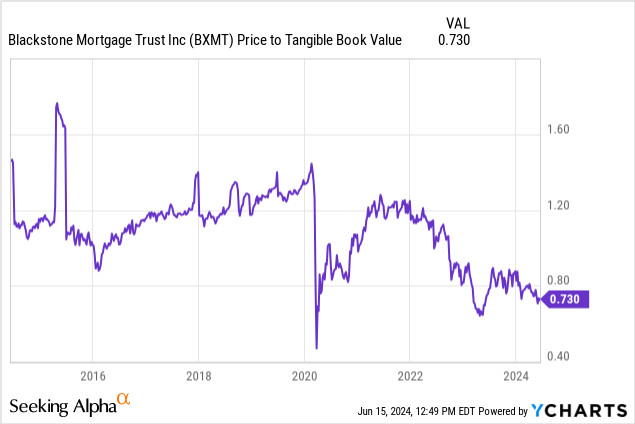

Our warnings to not be seduced by the yield certainly paid off here, and the stock has been a harrowing long play since our previous coverage.

Seeking Alpha

Let’s see how things are going for this company, with the Federal Reserve dialing down expectations for an aggressive easing cycle.

Q1-2024

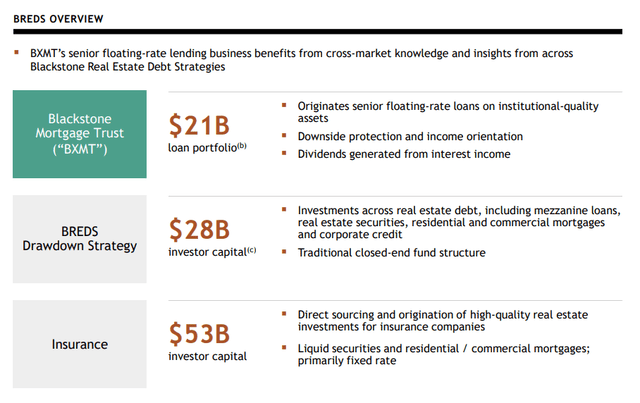

BXMT’s second quarter was rather poor. The REIT’s $21 billion portfolio took more hits as the office sector distress continued to pound on.

BXMT Presentation

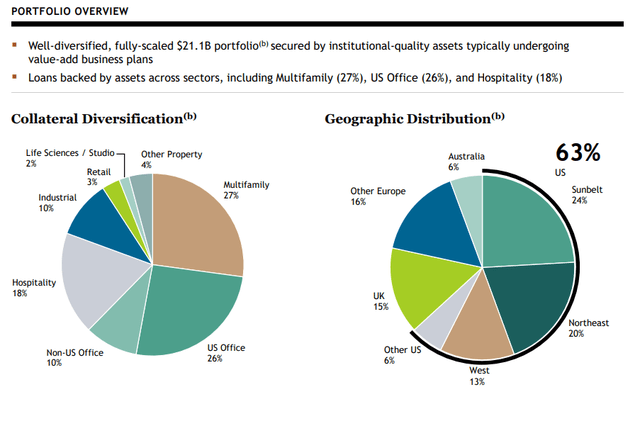

The one great aspect of BXMT’s portfolio though, has been how it has worked to whittle down office exposure. In the US (which is the ground zero for problems, Europe is much better), office sector as a percentage of total fell slightly once again to 26%.

BXMT Presentation

BXMT mentions this proudly in their slideshow, and if there is a happy ending to this story, this is what will make it happen. That $1.6 billion reduction is a huge lifeline.

BXMT Presentation

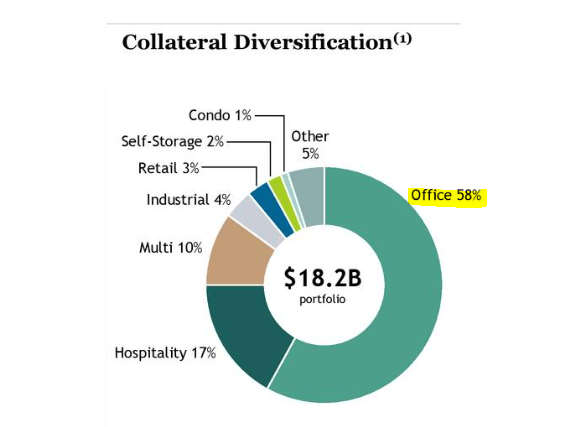

Before we move on, a quick reminder here is appropriate that total office (US and non-US) exposure was 58% in Q3-2020.

BXMT Presentation

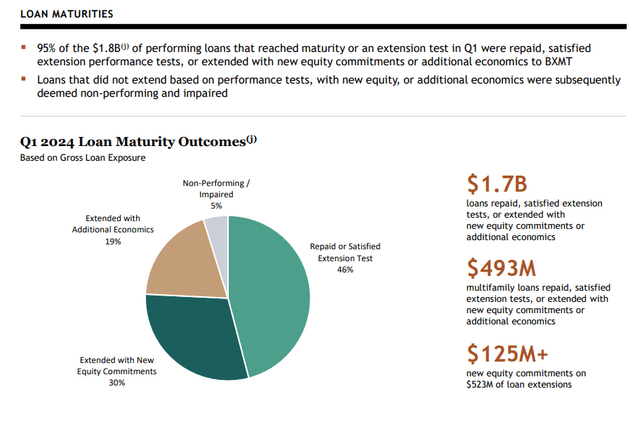

So the good work continues by BXMT, but it is still tough sledding as loans tend to become impaired around maturity.

BXMT Presentation

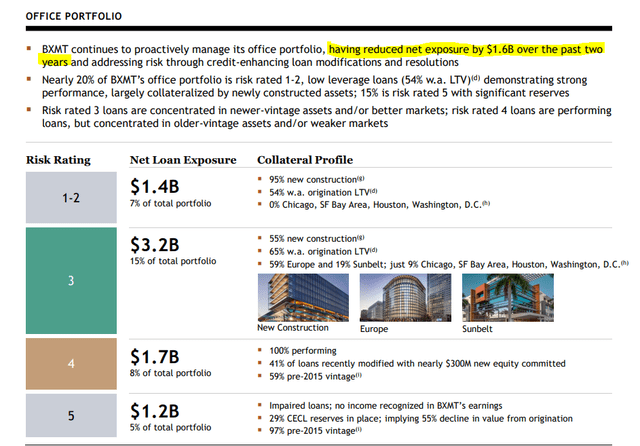

One might not think much of 5% of loans having issues, but that might only happen if you don’t know what a mortgage REIT is. If you do know, you get the idea that the leverage in the system is what makes these companies generate high yields, and it is the same leverage which destroys things on the way down.

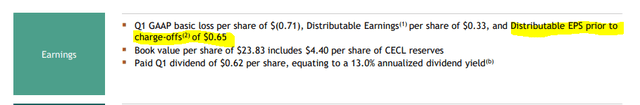

You can see that in the Q1-2024 quarter as well. Distributable earnings per share were apparently at 65 cents per share. That sounds great, as the distribution/dividend was at 62 cents. Of course, as highlighted below, it was before charge-offs.

BXMT Presentation

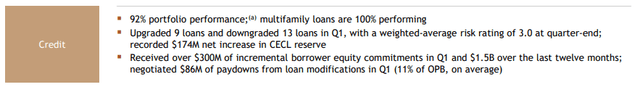

BXMT upgraded 9 loans and downgraded 13. It also recorded another $171 million of CECL reserve. These are coming in like clockwork, and we see them continuing even if the extremely easy credit conditions persist.

BXMT Presentation

Outlook & Verdict

The office sector distress in the US is not yet done. We may be in the fifth or sixth innings and there will be more pain before the bad loans are digested. BXMT’s multifamily has performed a bit better than what we had expected up to this point. BXMT is also trading at a relatively better valuation of 0.73X price to tangible book value.

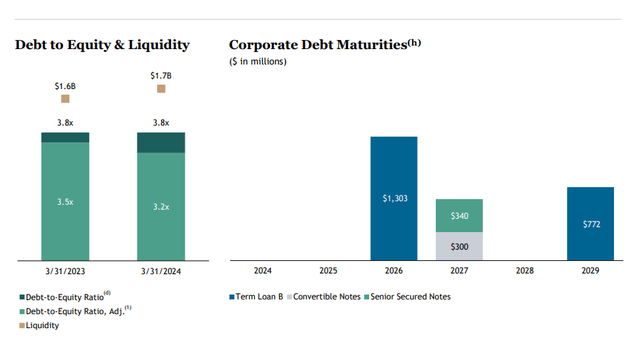

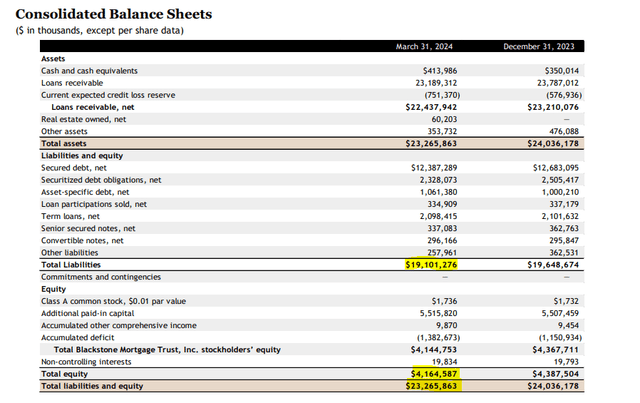

Our readers know that we won’t buy poor assets like Ready Capital (RC) even when they trade at wide discounts, and BXMT fits in the same category today. But the key piece of the puzzle today is that BXMT is still very leveraged. That debt to equity is almost at 4.0X, and it compensates for the relatively lower US office exposure than some other mortgage REITs.

BXMT Presentation

Investors tend not to get the significance of the 3.8X number, so we are showing it on the balance sheet as well. $23 billion of assets, $19 billion of liabilities and $4 billion of equity is what gets us to that 3.8X.

BXMT Presentation

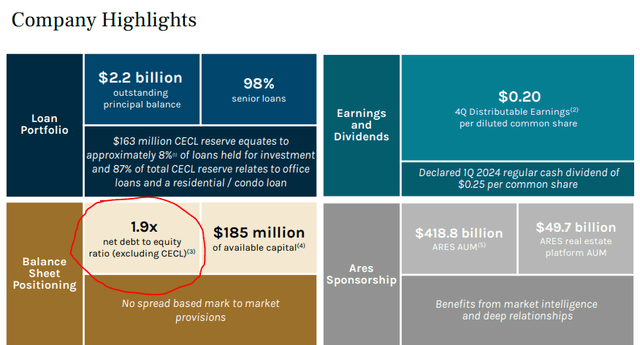

If 3.8X did not make you pay attention, despite two different ways of showing it to you, you should note that Ares Commercial (ACRE), cannot contain its problems at a sub 2.0X ratio.

ACRE Presentation

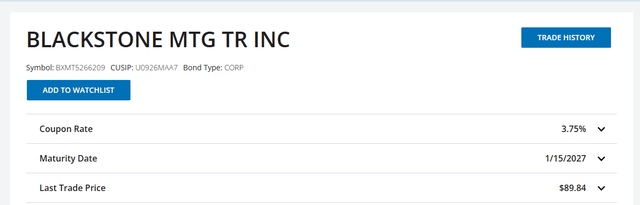

BrightSpire Capital Inc. (BRSP) has delivered negative total returns since its spin-off and averaged 1.0X debt to equity in the last few years. Currently, it is at 1.8X as the wheels keep coming off that wagon. So 3.8X in this area should make you wake up. BXMT’s portfolio quality is far better though, and the that is one reason we are still going with a “hold” versus Sell ratings on the other two. If you really want to play this, we would look for the bonds to provide you with the best opportunity for returns. Currently, BXMT’s 2027 notes, offer an 8.1% yield to maturity.

FINRA

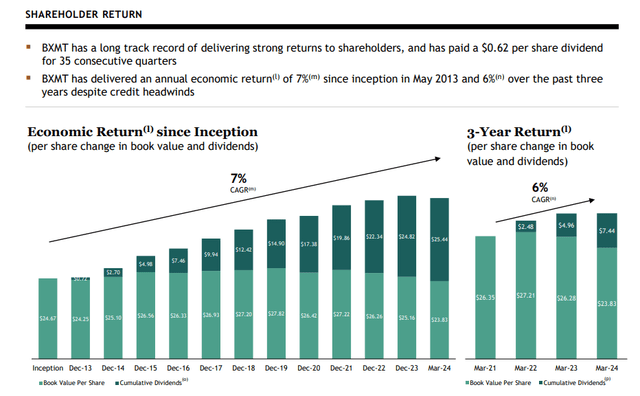

The company’s whittling down of office sector loans provides a high probability of it at least surviving till then. BXMT also shows you a slide in its presentation which strengthens the case for avoiding the common shares and going for the 8% yielding debt. That slide is the one below, where it states the real economic returns it has delivered are 7% per year. It calculates this as the dividends added to the change in book value.

BXMT Presentation

This is actually a pretty sweet measure, and we think more mortgage REITs should start incorporating this in their presentations. AGNC Investment Corp. (AGNC) is one that already does this. Of course, the reason you have made far less money than even this 7% a year is that the stock trades at a wide discount to NAV versus what it did at inception. But regardless of that observation, we think the 8% yield to maturity bonds should outperform the common, despite the latter yielding almost 14%.

Please note that this is not financial or tax advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult a professional who knows their objectives and constraints.

Read the full article here