As the management of Build-A-Bear Workshop (NYSE:BBW) expected, the latest quarterly results the company released on May 30 were not as good as the ones in the same quarter last year. Despite the fact that management predicted that and reiterated in the last earnings call its guidance for yet another record-breaking year, the market’s response was abysmal, in what seems to be an overreaction, sending the stock down 14% that day and shedding an additional 8.5% since. With a pristine balance sheet, projected meaningful expansion into international markets using only modest capital expenditures, three consecutive years of record-breaking financial results and another one expected this year, the recent price drop seems to offer a compelling entry point. Therefore, I assign a buy rating to BBW.

The Business In A Nutshell

Build-A-Bear Workshop, Inc. was established in 1997 as a mall-based store, and is headquartered in St. Louis, Missouri. The company went public in 2004 and opened its first international franchise in Sheffield, England. BBW offers a special experience combining retail and entertainment in the plush toys space. In Build-A-Bear, children and families can make teddy bears and additional plush toys by stuffing, fluffing, dressing, accessorizing, and naming their own creation. Build-A-Bear has been leveraging its pop-culture and multi-generational enticement to expand its total addressable market by adding offerings beyond plush that would cater specifically to teens and adults.

Financial Results

Build-A-Bear Workshop, Inc. released the results of its first quarter of fiscal 2024 on May 30, 2024. Although compared to the same quarter in the previous fiscal year revenues decreased 4.4% and diluted earnings per share decreased 16.23%, this was expected by management due to non-recurring expenses and timing of expenses recognition. Despite first quarter results, management maintained its full-year guidance, projecting yet another record-breaking year for the company. The company has recently started expanding rapidly into international markets that include Italy, France, South Africa, Colombia, and China, mainly through partner-operated stores and franchises. Expanding through such arrangements, as opposed to opening corporately-managed stores, is less risky as it requires much lower capital expenditures.

Moreover, the company has a pristine balance sheet with a strong current ratio of 1.57, and long-term liabilities comprised almost solely of future expenses in connection with operating leases. In addition, I went back 10 years and its latest 10-K shows its highest shareholders equity and retained earnings in this period, so the company is currently in a good spot. Capital expenditures ratio to net earnings had been fantastic in the last three years, standing at 17.14%, 28.29% and 34.52% in 2021, 2022 and 2023, respectively.

As per the company’s latest 10-K, the growth in capex in 2023 stems mainly from spending on information technology projects and new store openings. In 2023, the company meaningfully accelerated new store openings with 37 new net units that year (in 2022, there were only 9 and in 2021 the number stood at minus 2). Also, Return on Equity has been impressive in the last three years, standing at 50.6%, 40.4% and 40.8% in 2021, 2022 and 2023, respectively.

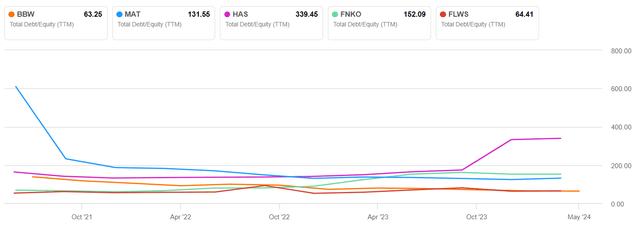

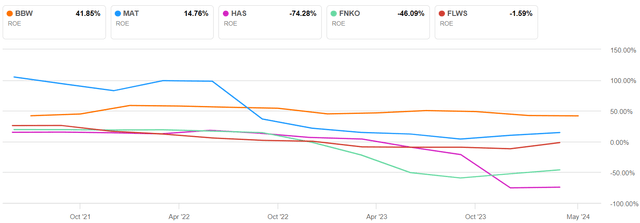

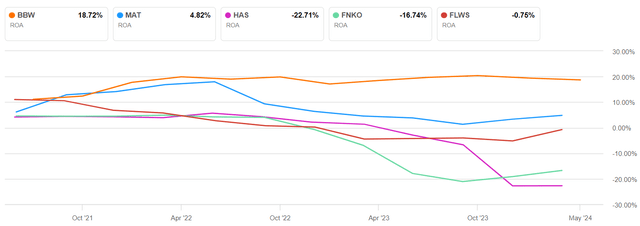

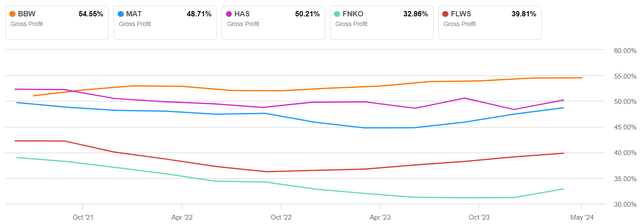

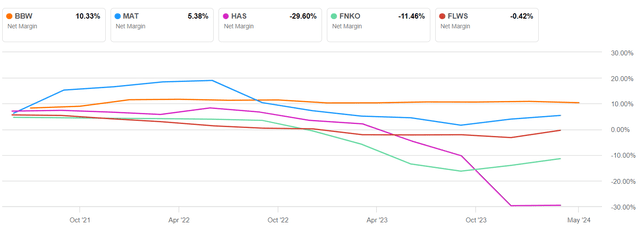

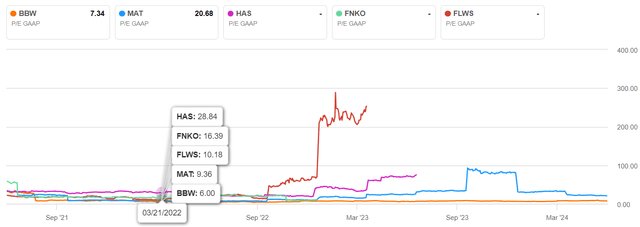

There are no direct competitors to the distinctive offering of Build-A-Bear, but below you will see how strong is the company’s performance relative to its closest publicly-traded peers, suggesting, when added to the data presented above, a durable competitive advantage:

Debt-to-Equity ratio vs peers (SA)

ROE vs peers (SA)

ROA vs peers (SA)

GP margin vs peers (SA)

NI margin vs peers (SA)

PE GAAP vs peers (SA)

According to the company’s Q4 2023 earnings call:

Fiscal 2023 represents the third year in a row of record results for Build-A-Bear. In keeping with this trend and as reflected in our guidance in this morning’s press release, we expect to deliver a fourth consecutive record-breaking year in fiscal 2024.

And continued:

Turning the page to full year fiscal 2023 results, revenues increased nearly 4% to a record $486 million and pre-tax income increased 7% to over $66 million, also a record for the company.

It was further said on the call that:

We continue to expect total revenue to grow on a mid-single-digit basis. This growth is partially driven by the addition of at least 50 net new experience locations with the majority coming through partner-operated expansion both internationally and domestically.

It is important that majority of growth in revenues is expected to come from new partner-operated arrangements rather than franchise arrangements as partner-operated arrangements have significantly higher gross margins, which are quite close to those generated by corporately-managed stores, while presumably requiring much lower capital expenditures than opening a new corporately-managed store.

Buybacks & Dividends

On March 13, 2024, the company adopted a quarterly dividend plan, which shows management’s confidence in the company’s financial results in the foreseeable future. Even though such quarterly dividend payments are subject to market conditions and approval by the company’s board, I view it as quite safe given the company’s strong cash position and its ability to remain profitable even in the face of tough macroeconomic conditions. Moreover, the adoption of a quarterly dividend plan, as opposed to the special dividends announced in 2021 and 2023, signifies management’s confidence in the company’s financial results and resilience moving forward.

Between April 12, 2021 and April 15, 2024, the company reduced its outstanding share count by a decent ~12.5%. Furthermore, the company repurchased a noteworthy amount of stock in the last quarter, representing ~2.4% of the outstanding (the percentage is based on the number of outstanding shares in the company’s latest 10-K). Between April 15, 2024 and June 10, 2024, the company managed to lower its share count by an additional 1.3%, which shows that it continues to aggressively buy back its stock. Such a large scale of repurchases as the company is expected to continue growing its bottom line would have a substantial positive impact on the EPS, which is not expressed in the current low P/E ratio.

Brand Strength

Management is highly cognizant of the importance pertaining to the strength of the company’s brand and is continuously engaged in creative ways aimed at widening its reach and enhancing loyalty to it. The importance of a powerful brand to a business cannot be overstated.

To that end, the company recently launched numerous initiatives. It recently launched a new campaign, ‘The Stuff You Love,’ to celebrate more than 25 years of memories creation across the world. In addition, Build-A-Bear’s first ever animated film named “Glisten and the Merry Mission”, which is based on the company’s top-selling holiday plush collection, was released in collaboration with Cinemark towards the end of 2023. Last month, the movie “IF” that was produced in collaboration with Paramount Pictures and highlights the magic of creation and imagination that Build-A-Bear provides kids and that is illustrated through this film, premiered in theatres.

In the company’s Q4 2023 earnings call, management said that:

…after a multiyear digital transformation effort ranging from a new warehouse management system to the implementation of buy online ship from store abilities, the goal is to accelerate the move to the next step of the company’s digital strategy.

And continued:

With that in mind, we have recently created the new role of Chief Customer and Digital Officer with a single oversight of both website and customer marketing. The position touches all points from digital to in-store, including loyalty and CRM, plus creative and guest services, and is designed to unleash the power of a much more integrated approach to driving the business.

Another important contributor to the brand’s strength and increased awareness is the new location launched early in the second quarter of this year within the famous Galleries Lafayette on Champs Elysees in Paris – one of the world’s most visited areas by tourists.

Valuation

Calculation with estimates based on current stock price

|

stock price now |

Year |

Buybacks |

outstanding shares (YE) |

NI growth |

NI ($) |

Ave. # of outstanding |

EPS |

Dividend growth |

Dividend per share |

Yield per share |

Exp. return on Equity |

Ave. stock price |

Sum spent on buybacks |

Sum spent on dividends |

NI minus SH returns |

% of NI returned to SH |

||

|

$25.23 |

2024 |

5.00% |

13,590,406 |

2% |

$54,056,940 |

13,948,048 |

$3.88 |

– |

$0.80 |

15.36% |

10.00% |

$30 |

$21,458,535 |

$11,158,438 |

$21,439,967 |

60.34% |

||

|

2025 |

3.50% |

13,114,741 |

3% |

$55,678,648 |

13,352,573 |

$4.17 |

10% |

$0.88 |

16.53% |

10.00% |

$50 |

$23,783,210 |

$11,750,265 |

$20,145,174 |

63.82% |

|||

|

2026 |

3.50% |

12,655,725 |

3% |

$57,349,008 |

12,885,233 |

$4.45 |

10% |

$0.97 |

17.64% |

10.00% |

$60 |

$27,540,957 |

$12,472,906 |

$17,335,145 |

69.77% |

|||

|

2027 |

3.50% |

12,212,775 |

3% |

$59,069,478 |

12,434,250 |

$4.75 |

10% |

$1.06 |

18.83% |

10.00% |

$70 |

$31,006,527 |

$13,239,990 |

$14,822,961 |

74.91% |

|||

|

2028 |

3.50% |

11,785,328 |

3% |

$60,841,562 |

11,999,051 |

$5.07 |

10% |

$1.17 |

20.10% |

10.00% |

$80 |

$34,195,770 |

$14,054,249 |

$12,591,543 |

79.30% |

Calculation with estimates to find fair stock price

|

Fair stock price |

Year |

Buybacks |

outstanding shares (YE) |

NI growth |

NI ($) |

Ave. # of outstanding |

EPS |

Dividend growth |

Dividend per share |

Yield per share |

Exp. Return on Equity |

Ave. stock price |

Sum spent on buybacks |

Sum spent on dividends |

NI minus SH returns |

% of NI returned to SH |

||

|

$38.50 |

2024 |

5.00% |

13,590,406 |

2% |

$54,056,940 |

13,948,048 |

$3.88 |

– |

$0.80 |

10.07% |

10.00% |

$30.00 |

$21,458,535 |

$11,158,438 |

$21,439,967 |

60.34% |

||

|

2025 |

3.50% |

13,114,741 |

3% |

$55,678,648 |

13,352,573 |

$4.17 |

10% |

$0.88 |

10.83% |

10.00% |

$50.00 |

$23,783,210 |

$11,750,265 |

$20,145,174 |

63.82% |

|||

|

2026 |

3.50% |

12,655,725 |

3% |

$57,349,008 |

12,885,233 |

$4.45 |

10% |

$0.97 |

11.56% |

10.00% |

$60.00 |

$27,540,957 |

$12,472,906 |

$17,335,145 |

69.77% |

|||

|

2027 |

3.50% |

12,212,775 |

3% |

$59,069,478 |

12,434,250 |

$4.75 |

10% |

$1.06 |

12.34% |

10.00% |

$70.00 |

$31,006,527 |

$13,239,990 |

$14,822,961 |

74.91% |

|||

|

2028 |

3.50% |

11,785,328 |

3% |

$60,841,562 |

11,999,051 |

$5.07 |

10% |

$1.17 |

13.17% |

10.00% |

$80.00 |

$34,195,770 |

$14,054,249 |

$12,591,543 |

79.30% |

*NI stands for Net Income

*SH stands for Shareholders

Explanation to my assumptions:

The company had three consecutive years with growing revenues and growing profitability. Management expects this year to be the fourth record-breaking year, both in the top and the bottom lines. Furthermore, the company is in a strong financial position with a current ratio of 1.57 and no long-term debt other than primarily lease liabilities.

I used what I believe to be conservative assumption for the following: buybacks this year at a rate of 5% of the outstanding shares. Around 3.5% have already been repurchased this year, and we are not even halfway through it. 3.5% for the rest of the years included in the projection seems conservative too, based on the company’s rate of repurchases in the last three years and how profitable I expect it to be.

The company’s meaningful profitability in the last three years allows it to allocate capital to various initiatives (some of which are described under the title “Brand Strength” above) and growing its footprint worldwide; hence I believe an average annual growth of 3% in net income is a conservative assumption. Easing inflationary pressures which would, given no change in course, lead to a gradual reduction in interest rates, which would likely start at some point this year and continue in 2025, could also contribute to the company’s both top and bottom lines. As the business is not capital-intensive, the estimated net Income should be sufficient to cover the projected buybacks and dividends.

Moreover, it seems the company could easily increase the dividend by 10% each year throughout the projected period. The average stock price, except for between 2024 and 2025 where I raised it by $20 as I believe the stock is currently substantially undervalued, was raised by $10 each year.

With such projected growing profitability and resilient balance sheet, expected return on equity should not be higher than 10%, which is roughly the very long-term yield of the S&P 500. The current forward P/E ratio of 6.44 (based on mid-range of management’s guidance), without even taking into consideration additional buybacks, seems simply inadequate and the fair price, based on what I believe to be conservative assumptions is $38.50 per share, as demonstrated in the table above.

Risks To My Thesis

The company demonstrated its ability to keep on growing its top and bottom lines in the last three years, even though the markets were stricken by extraordinary inflationary pressures and high interest rates during much of that time. Nevertheless, should macro headwinds persist much longer, these may eventually weigh in on the company’s financial performance.

The company has a strong and unique brand, which, as noted in the company’s latest 10-K, management views as a distinct combination of entertainment and retail, and therefore sees direct competition as being limited. Recently, management has been focusing heavily on strengthening its brand even further and enhancing awareness among potential customers.

The fact that this brand has been around for more than 25 years, plus the company’s impressive financial performance in the last three years, is a testimony to its growing appeal to consumers. Further, its strong balance sheet likely allows it to withstand even a mighty unexpected storm.

All these support the presumption that this brand is here to stay. Nevertheless, there is always a chance that an existing player in the plush toy industry or a new player entering this market may come up with a completely new idea or a twist to existing products, perhaps even at attractive prices, which may appeal to consumers, gradually gaining market share at the expense of other players in the industry, including the company.

Conclusion

Build-a-Bear had three record-breaking years in a row and as per management’s expectations, it is on its way to the fourth. The company’s balance sheet is extremely solid with a strong cash position, record high shareholders equity and retained earnings, at least in the last ten years, and almost no long-term debt other than lease liabilities. The financial metrics presented above, which are commonly used to gauge a company’s durability, paint a rosy picture. Management’s focus on online presence and digital experience, omnichannel capabilities and the enhancement of brand awareness are encouraging and would likely contribute to increased sales. Having achieved superb financial performance in the last three years, the company is now, probably more than ever, at a place where it can substantially expand its international presence without taking any meaningful risks, while intensively continuing to buy back shares and paying growing dividends. The recent slump of roughly 21% in the company’s stock price, taking down FW P/E (based on mid-range of management’s guidance) to ~6.44, and that is even without taking into consideration highly probable additional buybacks (which would pull the FW P/E down even further), offers a fantastic opportunity to get one’s foot in the door, or adding to an existing position. Therefore, I rate BBW a buy.

Read the full article here