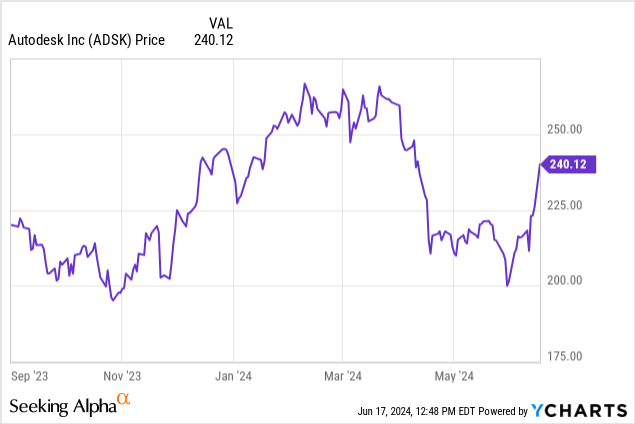

In my last article on Autodesk (NASDAQ:ADSK) from September 2023, I gave the stock a Hold rating, driven primarily by valuation concerns. Back then, Autodesk traded at about $200, much higher than the fair price based on the DCF analysis, which was $170-180 at the time.

Since then, the stock went through a volatile period, rising to more than $250 and falling back to $200 in just several months. The drop seemed to be primarily caused by the internal investigation which led to a delay in filing of the company’s annual report; it has been successfully cleared by now with no reinstatements needed.

The valuation was pretty much the only concern I had about the company at the time of my last article. Autodesk’s underlying business showed impressive potential with true AI opportunities, dominant market position with strong pricing power, and consistent financial performance. Now, reevaluating ADSK again after the recent quarterly report prompts me to upgrade the stock to Buy.

FQ1 2025 results show signs of continuing improvements on all fronts

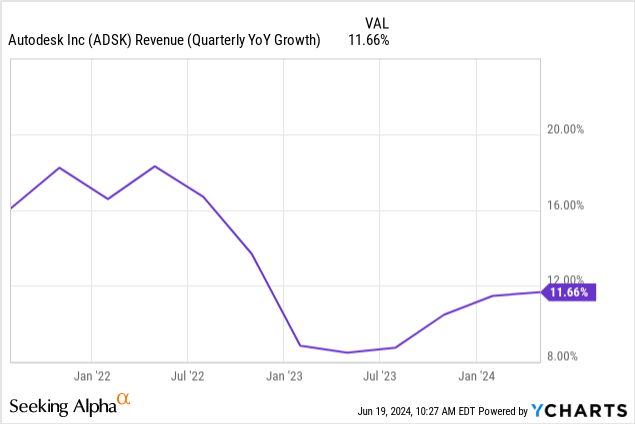

The recent quarterly report has brought much-needed certainty regarding Autodesk’s growth. The company demonstrated an 11.7% year-over-year revenue increase, with net income soaring 57% compared to the same period of fiscal 2024, based on ADSK’s latest 10-Q. Importantly, the revenue growth now shows signs of reaccelerating as the company’s sales went up by “only” 8.5% in FQ1 2024 and 11.5% in the previous quarter. From my point of view, this trend is crucial to justify the company’s valuation.

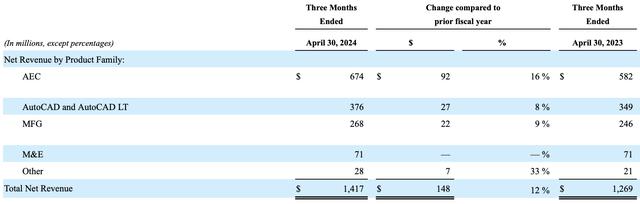

According to the company, the growth was driven by strong performance across all of Autodesk’s key segments: Architecture, Engineering, and Construction (AEC), Manufacturing, and products like AutoCAD and AutoCAD LT. Hence, looking at the revenue breakdown by product family, the revenue for these segments increased by 16%, 8%, and 9%, respectively, or 17%, 10%, and 11% in constant currency.

The company also mentioned during the earnings call that the results were still partly offset by worse-than-expected performance in Media and Entertainment (M&E) due to “lingering effects of the Hollywood strike.” Luckily, M&E revenue accounts for only about 5% of Autodesk’s total revenue.

Autodesk

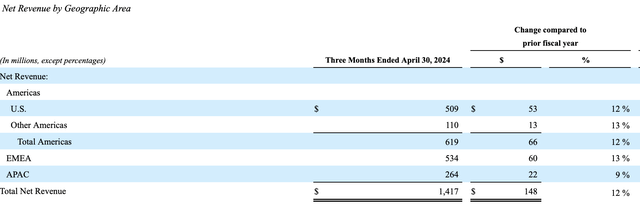

In terms of geography, all regions showed strong double-digit performance, except APAC. The company cites “softness in China” as the main impacting factor here, but there is also a significant impact of currency. If APAC grew similar to the rest of the world, ADSK’s revenue growth might have been closer to 13% in the quarter. Therefore, if China’s economic conditions improve in the future and demand returns to normal, Autodesk might see a solid boost to its revenue without any extra actions needed.

Autodesk

Diving deeper into financials for the quarter, there are a lot of positive signs. First of all, I always look at revenue growth relative to sales and marketing (S&M) expenses. Here, Autodesk demonstrated an 11.7% increase in sales with just 8.6% increase in S&M expenses, which shows the company’s revenue growth is not artificially fuelled by its marketing spend. This is also supported by the high net revenue retention rate, which remained “within 100 and 110 percentage range” during the quarter.

Moreover, recurring revenue from subscriptions remained on the level of 97% of total revenue, similar to 98% demonstrated in FQ1 2024. This makes Autodesk’s business notably safer and more predictable, and not many businesses out there can boast such a high percentage of recurring revenue.

Additionally, there are significant improvements in the company’s GAAP margins, which went up 4 percentage points, driven by lower stock-based compensation and reduced costs as a percentage of revenue. The company expects this tailwind to continue through fiscal 2025, with tight control thereafter. The switch to annual billings and multiyear contracts should also amplify this and lead to continuing improvements in free cash flow in the coming years.

Notably, with these financial improvements, Autodesk still continued to invest in R&D, increasing this expense category by a solid 6%. The company also emphasized its commitment to investing in technology during the earnings call.

Overall, the improvements seen in the quarter bring the certainty that was not evident last year at the time of my previous analysis.

Update on AI opportunities

Looking ahead, Autodesk is rightfully seen as one of unique beneficiaries of the developments in AI. I have reviewed the company’s approach in my previous article, and you can read more about it from other Seeking Alpha authors.

Now, during the earnings call, the company provided an update on its Bernini project, which uses generative AI to “quickly generate functional 3D shapes from a variety of inputs.” The technology was unveiled at the beginning of May this year, and it seems especially exciting and promising for Autodesk’s growth due to a number of reasons:

- Bernini is trained on unique 3D data, which Autodesk has access to thanks to its product portfolio;

- The technology is applicable across a wide spectrum of workflows, which should lead to significant addressable market;

- Bernini can be fine-tuned on customers’ existing 3D data to solve unique customer needs, which should become a strong selling point;

- The approach promises to automate a wide range of low-level tasks, thus offering concrete savings to the customers.

From the earnings call:

It will automate low-value and repetitive tasks and generate more high-value, complex designs more rapidly and with greater consistency. Over time, Autodesk Platform Services will enable greater engineering velocity and efficiency and support a much broader developer ecosystem and marketplace. Autodesk is ahead of its peers in 3D AI and industry cloud, platform, and business model evolution that will be needed to deliver 3D AI products and services at scale. We are well on the way to reasoning about all CAD geometry.

Overall, the management appears committed to investing in the cloud, data, and AI technologies, promising “the next generation of generative AI products and services” in the coming years. From what I see, Autodesk’s unique products and vast amount of data they possess should enable the company to quickly roll out product features that have a solid value proposition, somewhat similar to Adobe’s (ADBE) situation.

Update on valuation

In light of the recent performance and new quarterly data, I have updated my DCF model, which I used in the previous article about Autodesk. The major changes are:

- EBITDA margin should increase to at least 25% and remain stable over the next five years, based on the management’s commentary regarding margins during the earnings call;

- Revenue growth assumptions were increased slightly to an average of ~13% in the next five years;

- The WACC decreased to 16.5% thanks to the slightly lower 10-year treasury yield.

From there, ADSK’s fair price range is now about $200-211, which is where I initiated my position. Admittedly, the stock has increased surprisingly fast in the five trading days after the earnings to about $240, but I expect a pullback should occur in the near future.

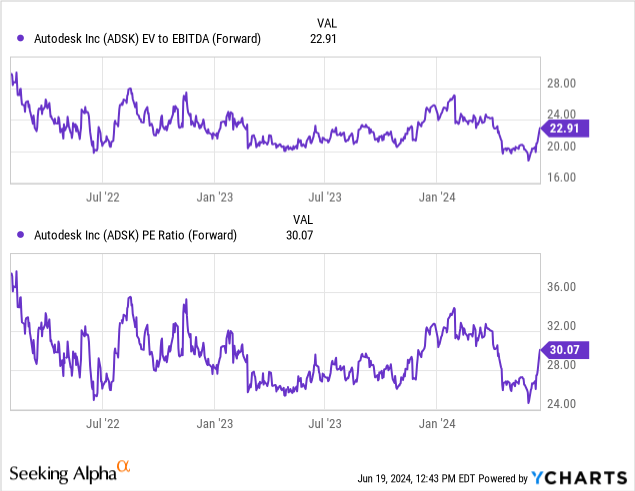

Additionally, it should be noted if the FED starts cutting interest rates, it should positively impact the fair stock price. For instance, with a 2% risk-free rate, ADSK’s fair price range goes up to $215-230. In any case, with increased certainty and valuation multiples in the middle of their 3-year ranges, ADSK seems to be a solid long-term investment at the moment, even if the margin of safety is low.

Risks

Despite solid overall performance, there are still some risks we should acknowledge.

First of all, Autodesk continues to invest in its cloud and data technologies, which requires significant capital commitments or increased infrastructure expenses if Autodesk will use external cloud providers like Google (GOOG), Microsoft (MSFT), or Amazon (AMZN). While Autodesk’s capital expenditures seem under control at the moment, (about $30 million in fiscal 2024) the situation might change in the future.

Secondly, while the company states the current shift in its billing structure and the move to annual billings with multi-year commitments will positively influence free cash flow, the actual results of this transformation are still yet to see.

Additionally, in FQ1 2025, general and administrative expenses did go up by a significant 17.4% YoY. This expense category is among the smallest and tends to fluctuate over time, not to mention the increase was likely driven by the two major acquisitions (Payapps and PIX) Autodesk made in the quarter. However, the surge is still something investors should watch out for.

Finally, as mentioned earlier, the stock has experienced notably high volatility in recent months, which might deter some large investors and thus negatively impact the stock price.

Key takeaways

Overall, almost 10 months after my previous article on ADSK, the stock appears significantly more appealing for investment. Accelerating revenue growth, higher financial certainty with a more predictable billing model, and a clear AI strategy justify the admittedly premium valuation. While the margin of safety improves around the $200-210 range, the stock remains a Buy, especially on pullbacks.

Read the full article here