Summary

Following my coverage on AMADF IT Group (OTCPK:AMADF) in Mar’24, which I recommended a buy rating as I believed AMADF was going to continue being an important part of the value chain and benefit from air passenger growth, this post is to provide an update on my thoughts on the business and stock. I believe there is still more upside from here. AMADF should see strong adoption rates for its Nevio and vNext products as airlines invest in solutions to meet IATA 2030 targets. Additionally, as AMADF acquires more NDC (new distribution capability) content from airlines, it should be able to further consolidate market share in the GDS (global distribution system) space.

Investment thesis

AMADF

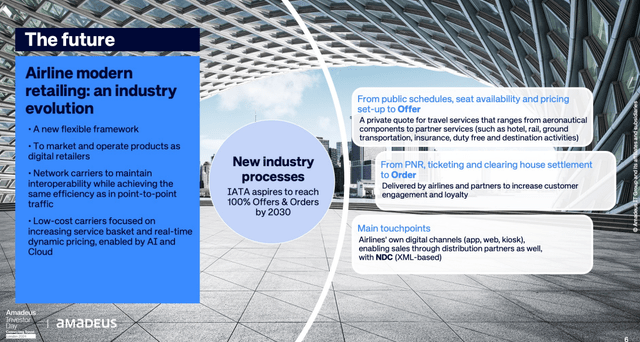

The major growth catalyst over the course of this decade is the modern retailing IATA standards, which require 100% offers and orders by 2030 (5.5 years left). While this concept was first made known in the early 2020s, it was only until late 2023 that IATA developed a high-level roadmap to achieve the 100% target by 2030. The remaining tight timeline available should put pressure on airlines to step up and adopt relevant solutions to meet this target.

For a brief introduction to this new standard, Offers and Orders basically has two parts. The idea behind Offer is to consolidate all of a costs into one private quote, rather than relying on multiple public schedules, seat availability, and prices for various services (such as flights, hotels, trains, ground transportation, insurance, etc.). For Order, the goal is to have airlines and partners handle the delivery directly, eliminate the need for clearing houses, and replace individual passenger name records. As you can imagine, this is a rather big transformation that has huge implications on underlying operations and the technology architecture to support this change.

AMADF

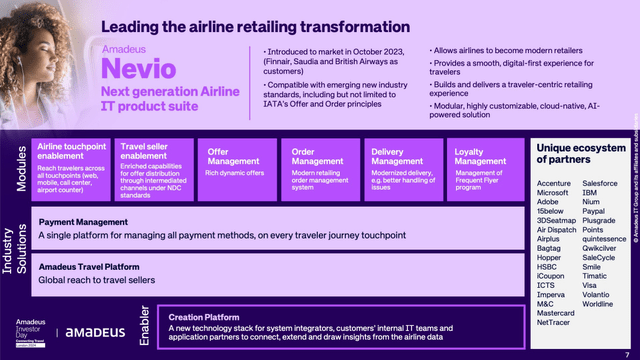

I expect AMADF to benefit from this via its Nevio product (launched last year) (I urge readers to read this blogpost for more details on this product), which offers a much broader suite of modules than AMADF’s current Altea Passenger Services System [PSS] and is compatible with the new standard. On top of being able to meet the new standards, I believe an important factor that will drive airlines to adopt AMADF’s Nevio is the modular approach. What this means is that airlines can pick and choose which modules they want to use, adding them one by one. An important aspect of modules is their ability to integrate with legacy systems or to facilitate a gradual migration implementation, both of which help overcome airlines’ fears of the disruption caused by a large implementation. Operational disruption is a big risk for airlines because utilization (getting planes in the air) is extremely important not only from a financial standpoint (high fixed cost nature) but also because it has a strong ripple effect. Delays in flights at one end of the globe can impact multiple airlines’ flight timings, which negatively impacts the customer experience.

The other reason that should push Airline to adopt Nevio is the potential for revenue uplift from the AI-powered Air Dynamic Pricing solution. A good case study is Finnair (the first Nevio customer), which saw a 3% revenue uplift post-adoption. My understanding is that this revenue uplift is only from air tickets, and AMADF is working on extending this dynamic pricing solution to ancillary services, which could potentially help airlines increase revenue by ~14%.

AMADF

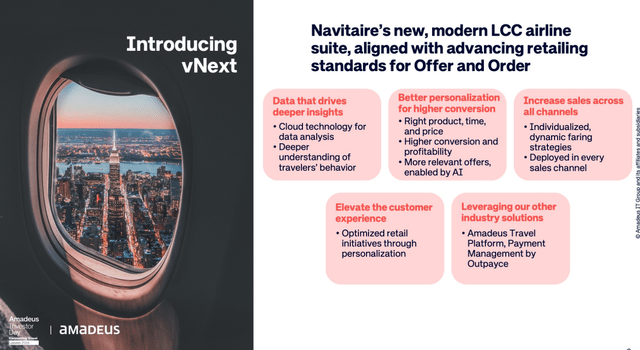

In order to target the full spectrum of airlines, AMADF has also released a low-cost version of Nevio, vNext, to target the low-cost carriers [LCC]. The current solution provided by AMADF, Navitaire, is designed for direct distribution. I expect indirect distribution to be an increasing mix of LCC businesses as modern retailing will simplify connectivity for airlines. Hence, vNext should see good adoption as it addresses the problem that LCC faces with Navitare by simplifying selling into indirect channels.

LCCs expect 25% of their overall indirect sales to be made using NDC within the next 12 months, with the figure anticipated to rise to 30% by 2026 and 38% by the end of the decade. Travel technology investment trends 2024 airlines report

When LCC uses vNext, it also opens up more revenue opportunities for itself as it integrates better with its own GDS (the current Navitaire solution was not optimized for indirect distribution). Furthermore, this will also create more payment touchpoints, which means more opportunity to upsell other services.

AMADF

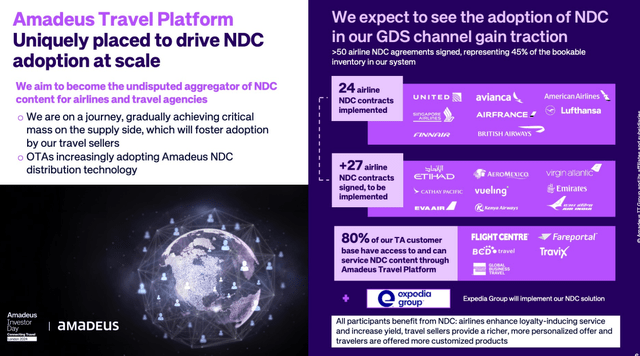

Touching more on GDS, AMADF seems to be on the right track to consolidate further market share (wining share from travel aggregators) as well. As per the investor day, AMADF already has around 50 airlines that have outsourced their NDC API to AMADF. This is an important datapoint because the more NDC content that AMADF has, the bigger its competitive advantage against aggregators in terms of cost and offerings.

When airlines outsource their NDC API to AMADF, it makes it easier for AMADF to integrate that NDC content into its own indirect channels, and this allows AMADF to potentially offer more than what travel aggregators can provide (e.g., choosing inflight meals, booking baggage, etc.). Since the NDC is outsourced to AMADF, it has a lower cost structure compared to travel aggregators that can only acquire this content via an API, and hence, it can be more aggressive on pricing. This gives AMADF an advantage when it comes to convincing travel agents to opt into AMADF NDC content and move away from aggregators.

Valuation

AMADF

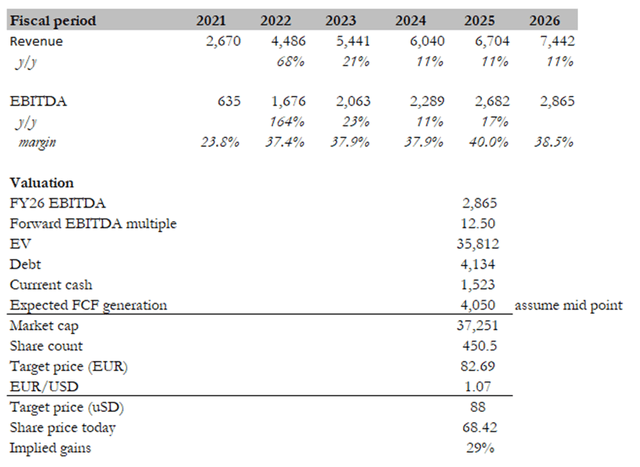

Overall, I am becoming more bullish on AMADF than I was previously, and I expect AMADF to achieve its FY26 guidance (management has a good track record of meeting EBITDA guidance). Per the guidance provided during the investor day, management is guiding for FY26 EBITDA of around EUR2.86 billion, assuming revenue grows at 11% CAGR through FY26 and the adj EBITDA margin remains stable at 38.5%. The variable here is what AMADF will trade at, and I think AMADF should have no problem sustaining the current EBITDA multiple of 12.5x today. Its key peer, Sabre Corp., has a much lower growth profile of mid-single-digits but is already trading at 9x forward EBITDA. AMADF, on the other hand, is expected to grow at double that rate.

Own calculation

Applying 12.5x to EUR2.86 billion equates to an enterprise value of ~EUR36 billion, and this translates to a share price of ~EUR83 or USD88.

Risk

A decline in growth recovery in airline traffic volumes could be caused by political events or a weaker-than-expected macro-environment, which would have an effect on AMADF’s growth potential. Disintermediation and intensified competition from other GDSs or airlines attempting to drive more volumes through the direct channel is another potential risk. The distribution of travel could also see increased competition by companies like Google (Google Flight offering).

Conclusion

In conclusion, my rating for AMADF is a buy rating. The major growth catalyst I see ahead is airlines compliance with IATA’s new standards by 2030. AMADF’s Nevio and vNext products cater to airlines of all sizes and address the challenges of NDC adoption. Additionally, AMADF is strategically acquiring more NDC content, strengthening its position against travel aggregators. Lastly, AMADF is not trading at an expensive multiple today when compared to where its peer is trading at.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here