Honda Motor (OTCPK:HNDAF)(NYSE:HMC) had a great year on the basis of a weak Yen and solid scaling of the business into deep post-COVID markets, continuing trends we discussed in our last article. As experts on the corporate governance changes in Japan, we have concerns though about the performative aspects of Honda’s plans to address the low PBR, particularly this new focus on R&D which we expect will be cash thrown into the EV money pit. We think this is quite a tone-deaf approach and that value creation will be limited to the improvements in tangible shareholder payout from current valuations.

Latest Earnings

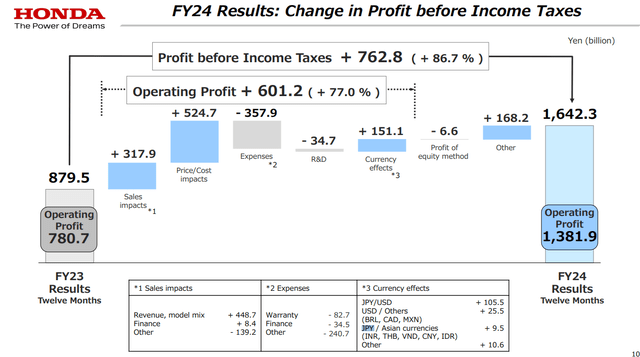

The FY earnings look like this.

FY Developments in Operating Profit (FY pres)

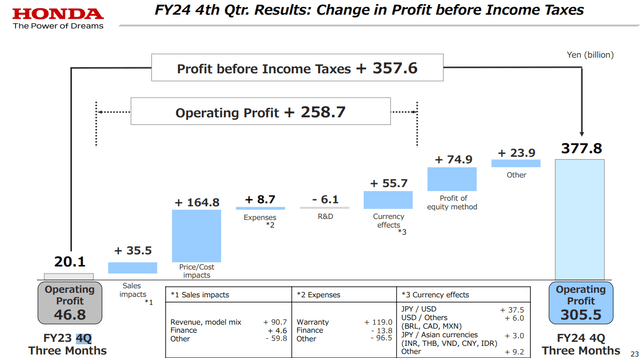

The Q4 shows similar dynamics but reflect the trend of volume impacts being less prominent incrementally and price and cost impact, related also to real impacts from the Yen not contained in the FX broken out effects, being the primary driver of profit growth.

Q4 Developments (FY Pres)

As discussed at length in our previous coverage of Japanese automotive, the large local presence of automotive parts manufactures in Japan, where even the independent ones make up a meaningful part of the Japanese stock market, means parts are sourced quite cheaply as they’re Yen denominated, then transformed and resold after manufacturing in Japan in global markets, mostly the US and Europe, at a decent industrial margin plus the bigger spread between Yen and developed market currencies captured in the broken out currency effects in the waterfall.

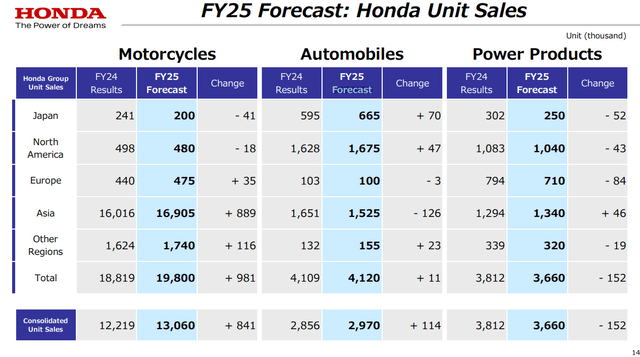

Next year will be similar in that the Yen continues to declines. Many of these effects will persist. Moreover, the trend in falling YoY unit sales will also continue, with the pent-up demand waning after some post-pandemic years have now passed.

Unit Forecasts (FY Pres)

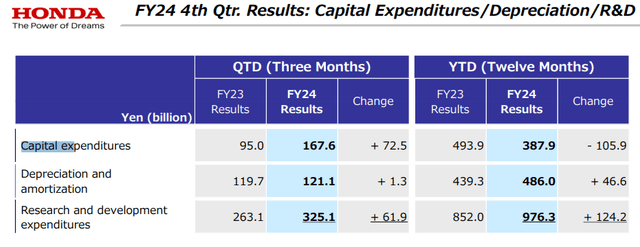

Forecast operating profit is however limited in growth, due to the fact that the company is expecting a significant ramping in its R&D expenses. CAPEX increases are significant as well.

Bottom Line

Honda, like quite a few other of the Japanese large caps, have been benefiting from major fund flows from foreigners looking to profit from the fact that these companies are going to imminently deploy excess cash balances. To that end, Honda are picking up with buybacks, continuing in 2025 with a planned 300 billion JPY programme, around 3-4% yield, as well as continuing with their dividend policy currently yielding around 4%. This is not bad, however payout ratios are still quite low relative to what is sustainable for a mature company like Honda.

We’ve had dozens of conversations with Japanese C-suite executives, and the professional management class is nothing like that of Europe and America. They are not shareholder oriented. These major payout increases are mostly because of top down action by the TSE. Part of the measures implemented by the TSE is a request to release some sort of shareholder value creation plan in the context of modern capital allocation principles. The understanding of these principles can be quite limited, and it is common for companies now reporting these management plans to make some sort of promises of investments in emerging technologies as a means to limit their need to payout more capital than they are comfortable with.

CAPEX and R&D (FY Pres)

With plateauing sales growth, it is worrying that the company is talking about reaching a stable state earnings point, where they intend on investing excess profits in the EV and hybrid initiative, marked by higher R&D expenses and CAPEX, which will become more depreciation expenses later. While hybrid is somewhat established and less of a concern, it’s the EV pivot that we worry about, since Honda are not ahead in the EV race.

Mibe, the CEO and previous leader of the R&D division and Honda, promised to give some more clue about their investment plans in EV, which are also part of the low PBR and shareholder value creation initiatives. The cumulative investment over the next 10 year period is 10 trillion JPY, which is 2 trillion more than the Honda market cap. We are relatively unconcerned with their industrial ability to develop a good EV, but we do not like that they’ve decided this is going to be their primary cash sink. Cumulatively, if you annualise current FCF, we can expect Honda to generate maybe 15 trillion JPY if automotive markets remain entirely solid without any demand side issues. The remaining 5 trillion or so about covers run-rate shareholder payouts, including both dividends and the new buyback programme. But the issue is that if the company doesn’t plan on seeing earnings growth because they want to invest in EV R&D, that payout won’t be growing. 8% per year is alright, with 4% being the dividend yield, but it’s not exceptional by equity market standards.

The problem is we have misgivings around EV adoption. Early adopters were all in, but we’re all out of early adopters. Markets are slowing, and major capital outlays for EV are mostly getting delayed by automotive majors. Many companies, like Fiat within Stellantis (STLA), never had any serious intention of even beginning an EV programme, which may turn out to be the right decision. EVs are very cool, and electric powertrain makes a lot of engineering sense, but the infrastructural challenges remain, and these technologies are by no means exponential.

In light of everything, we consider only tangible payouts from Honda as shareholder earnings, and the earnings yield there is just about fair for an equity, so it’s not particularly compelling.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here