Investment Thesis:

Stellantis (NYSE:STLA) is a global automaker which designs, engineers, manufactures, distributes, and sells automobiles across the world. Stellantis was formed as a result of a merger between Peugeot (PSA) and Fiat Chrysler (FCA) in 2021. The prominent brands that Stellantis owns are Maserati, Alfa Romeo, Jeep, Doge, Ram, Chrysler, Citroën, Fiat, Opel, Peugeot, and a few more smaller names. Evidently, Stellantis owns a myriad of automobile brands that have widespread notoriety, primarily across the regions of North America, Europe, and the Middle East.

Stellantis Primary Brands (The Drive)

I believe that Stellantis’ arsenal of strong brands that are able to generate large amounts of cash are blatantly overlooked by the market, especially paired with the massive cash position that the company maintains. For instance, in the TTM Stellantis generated $25.3 billion in operating income and $13.6 billion in free cash flow while the businesses current market cap is $77 billion. Besides the fact the equity trades at just 3x operating come and 6x free cash flow, Stellantis also has over $52 billion in cash & ST investments with approximately $30 billion in total debt, meaning the company has about $22 billion in excess cash. An enterprise value of $55 billion for a business that generates such large sums of operating income and free cash flow signals the equity is being priced for a major contraction in the business, or the market has simply overlooked the equity. Stellantis has already begun to massively reward their shareholders through a large dividend yield of 8% which was raised in the past year, as well as a significant share buyback program in place. Although the business has faced some problems in the first half of 2024, the business is still priced at too cheap of levels to ignore, especially when considering how they generously reward their shareholders while the stock remains undervalued. Overall, I believe Stellantis’ ability to generate significant amounts of operating income and free cash flow paired with their large cash position will yield substantial returns over the next few years, despite the questionable nature of the underlying business.

Recent Problems:

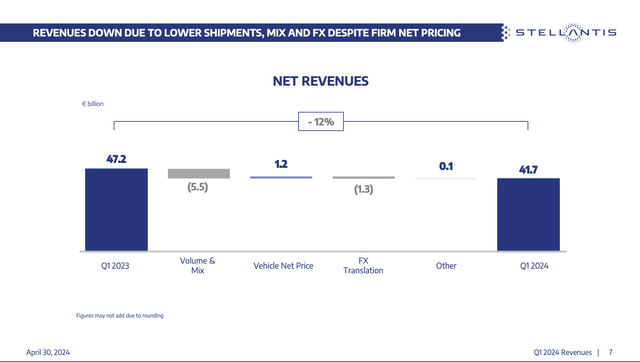

Stellantis has run into some problems recently, which has led to the price falling from almost $30 at its high to $20 at its low this year. The primary problems with Stellantis this year were reflected in the release of first quarter release of shipments and revenue. It was revealed that net revenues were down 12% compared to the previous year, while shipments were also down 10% to 1,355 thousand units.

Stellantis 1st quarter results (Stellantis investor relations)

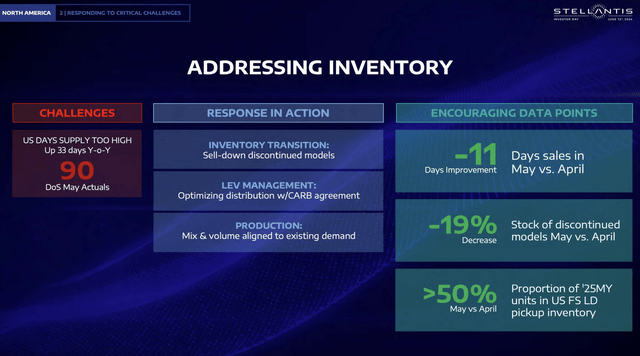

Another negative note was the elevated inventory levels that the company and its dealers have. Although in the first quarter, total new vehicle inventory had gone down compared to the previous year (1393 thousand units v. 1,459 thousand units), in the investor day Stellantis addressed how their inventory had grown exponentially YoY to an over 90-day supply which is significantly higher than the industry target of 45-60 days.

Stellantis inventory supply (Stellantis Investor Relations)

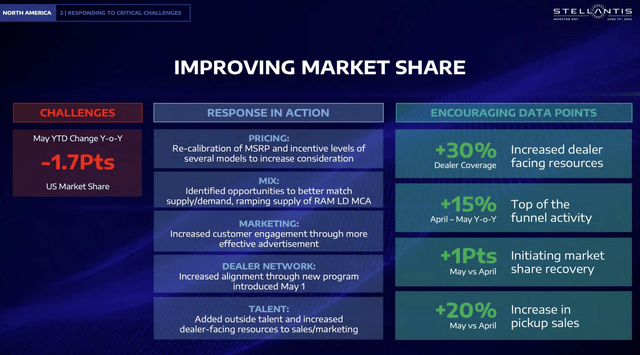

All of these problems came with market share pressures in North America as well as pricing pressures, which have contracted the sales of the business as well as led to crucial questions about whether Stellantis can compete in the U.S.

Stellantis NA Market Share (Stellantis Investor Relations)

Although there are numerous issues with Stellantis that have developed over the past year, they have also outlined many improvements which have developed going into the second half of the year, which I will discuss later.

Fundamental Risks:

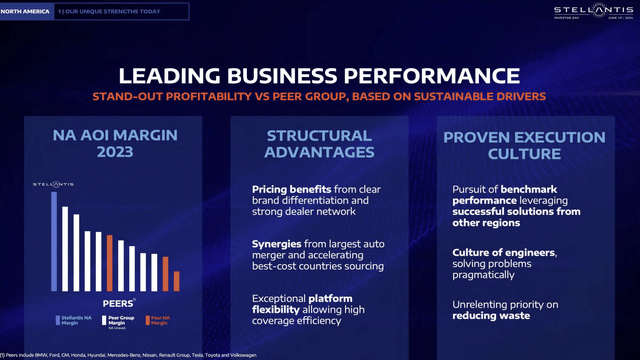

My primary problem with Stellantis and the reason I have not bought more aggressively as it has fallen is because it is an automotive company. Historically, this has been an industry I would avoid at all costs due to the difficulty businesses have in differentiating themselves, widespread competition, major capital intensity, and the large revamp the industry as a whole is incurring with the pivot towards electrification. For instance, since the formation of Stellantis, capital expenditures have begun growing as they continue to position their business for electrification, therefore clearly impacting cash flows (capital expenditures increased from $9.8 billion in 2021 to $11.2 billion in the TTM). More importantly, the UAW strike will also cause Stellantis’ labor costs to increase, thus further impacting the business. These upward pressures on costs and capital expenditures are exemplified in the context of what is an extremely low margin industry. Stellantis has maintained some of the best margins in the industry besides luxury automakers such as Ferrari (NYSE:RACE) at a 12.1% operating margin in the TTM.

STLA AOI Margins v Peers (Stellantis Investor Relations)

Relative to their other competitors such as General Motors (NYSE:GM) and Ford (NYSE:F) who have 6.14% and 2.67% operating margins respectively, Stellantis is trouncing them in terms of their profitability, but they sacrificed some market share and may face major downward pressures on their margins over the long term as these costs increase, and they have to bring down prices.

Investor Day Highlights:

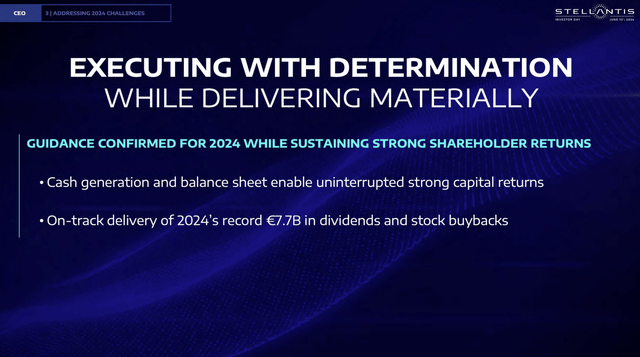

Within Stellantis’ investor day, they highlighted many components of the business and their strategy that address many of the concerns I have raised and showcase their massive upside potential. First, Stellantis re-iterated their dedication to returning capital to their shareholders.

Stellantis Capital Returns (Stellantis Investor Relations)

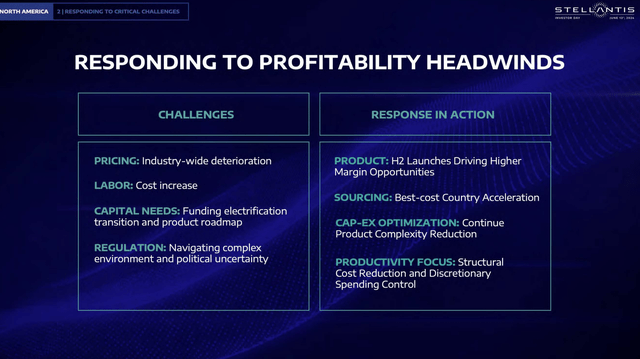

As we can see, Stellantis is returning €7.7 billion or USD $8.24 billion in the form of dividends and buybacks, which represents 10.3% of their current market cap. Their strong capital returns are amazing for shareholders as they are buying back shares at cheap levels while also paying a hefty dividend. If the stock goes lower, the dividend serves as an upside catalyst due to management’s dedication towards maintaining and raising it. Therefore, large buying pressure is likely to occur if the dividend yield becomes too high. Typically, I would prefer a business that I view to be extremely undervalued to buy back more shares rather than pay a dividend. Furthermore, many of the challenges I have highlighted about Stellantis have emerged in the first half of the year. Fortunately, Stellantis has begun showcasing how they are positioning themselves for a phenomenal second half of the year, which will be able to offset some of the negative effects of the first half.

Stellantis H2 Initiatives (Stellantis Investor Relations)

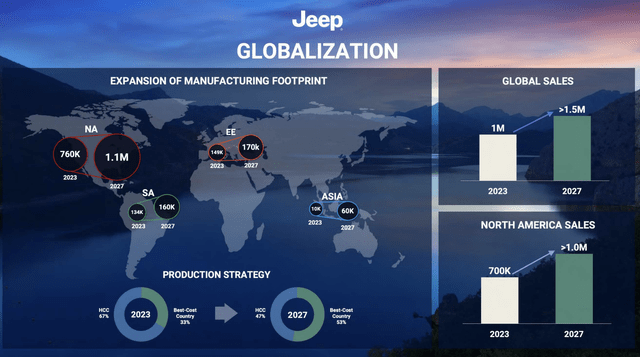

Evidently, Stellantis has planned countless product launches for the H2 of higher margin opportunities, while they are also continuing to focus on their cost-cutting initiatives to preserve their high margins. Lastly, highlighted through Stellantis’ objectives to rapidly grow the Jeep brand and expand their product offerings, Stellantis’ management seems confident in their ability to grow their top and bottom line over the next few years and offset any potential declines that may happen in some of their brands as a result of the transition towards electrification.

Jeep Expansion (Stellantis Investor Relations)

Valuation:

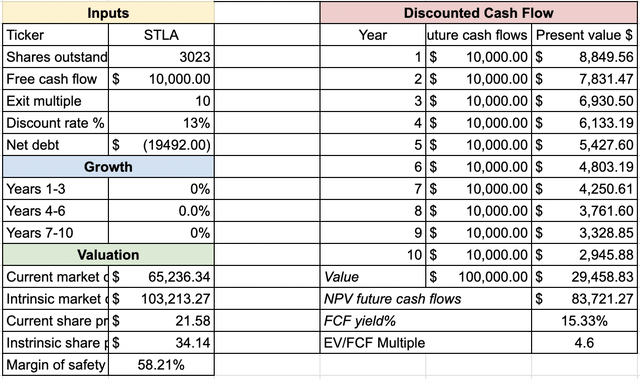

To value Stellantis, I used a discounted cash flow model with the most conservative assumptions possible. First, I input $10 billion as the base free cash flow number to account for the drop in industrial free cash flows that the business expects this year. When Stellantis re-iterated full year 2024 guidance, the guidance they give is very broad, but they said that the business will produce 10-11% AOI margins and positive industrial free cash flows. Considering Stellantis did $12.9 billion in industrial free cash flows in 2023, $10 billion serves as a great conservative estimate for their industrial free cash flows in 2024. Then, I used 10 as the exit multiple to account for the lack of growth prospects and poor quality of the underlying business. I then used my standard 13% discount rate to get a market-beating return and input the excess cash of the business. For the growth assumptions, although management guided towards long-term growth of the business in their DARE 2030 presentation, I assumed flat growth for the next 10 years to remain conservative in my assumptions and essentially simulate a worst-case scenario.

STLA DCF Model (Rasoli Research: Seeking Alpha Financials)

As we can see, even with very safe assumptions about the business and its growth prospects, the equity still appears undervalued and poised to deliver market-beating returns with an intrinsic value of $34 while the stock trades at $20 today.

Macroeconomic Risks & Final Thoughts:

One of the primary risks I think Stellantis faces is that of a major macroeconomic downturn. First, it’s important to note that persistently high rates have not significantly harmed the business yet, which I find somewhat surprising considering the vast majority of vehicles bought are financed. The effects of an economic downturn could be detrimental as automobiles are historically the second most expensive purchase consumers make besides their homes, therefore, when discretionary income becomes contracted, individuals can extend the amount of time they take before purchasing a car, which would severely harm Stellantis’ business. Overall, Stellantis appears tremendously undervalued as they trade at cheap multiples relative to their operating income and free cash flows, while the challenges they have faced in the first half of 2024 should be mitigated as the company finishes off the year.

Read the full article here