At the end of 2022, I published a neutral view of General Motors (NYSE:GM) in “General Motors May Beat Tesla To An Electric Vehicle Future.” Though I was neutral on GM, I believed the stock might have some long-term value as many investors seem to underappreciate its gains in the EV market compared to more popular competitors like Tesla (TSLA). However, I was not bullish on GM because it seemed as though it was not well positioned in the economic cycle. Since then, GM has risen by around 14%, underperforming the S&P 500, thus confirming my neutral view.

The auto industry has generally performed poorly since the 2020 crisis. Car prices have risen dramatically, but production costs have also. Due to higher prices and borrowing costs, demand for vehicles has been under pressure. Overall revenues are increasing, but gross margins are typically falling, resulting in a long-term stagnation in operating income.

Hopes of a recovery run large today. One of the more common views is that auto sales will rise once the Federal Reserve cuts interest rates. I feel that argument is flawed, as the Fed will likely only cut interest rates once there is already a material increase in unemployment. Indeed, I think there is great evidence to suggest that employment stability is falling, as indicated by the declines in full-time employment, which I expect will lead to disinflation and rate cuts. Historically, a sharp rise in unemployment is terrible for the auto industry. Further, car maker profit growth was generally lackluster in 2021 because of increasing costs, which remain an issue.

Given what I feel is a sharp negative change to the consumer and labor market outlooks for both the US and Europe, it seems General Motors deserves an updated outlook. Much of my 2022 view regarding its potential long-term growth in the EV space remains essential. However, I think its short-term risks entirely overshadow that, particularly if we consider risks in its financing unit.

Vehicle Sales Are Not Going To Improve Soon

One of the most supportive statistics of the US auto industry is the average age of American cars. As of 2023, cars had an average age of 12.5 years, up from 11.7 in 2018, meaning each year, cars have gotten around two months older on average over the past five years.

Some point to this statistic as an implication that vehicle sales must inevitably rise. Of course, I could point to extreme outliers like Cuba, which has an average vehicle age of 60+ years. Of course, over the past decades, vehicle lifespans have grown dramatically. Today, most of the top SUVs have a lifespan of 250K, and the vast majority are expected to last over 200K. Electric vehicles should last well over 300K, as they lack the same issues with engines and transmissions, with their life largely limited by batteries that should last to the 300-500K range.

Thus, at a 15K annual expected mileage, modern vehicles should last 14 to 26 years. Of course, those lifespans can be extended by replacing key components. So, in most instances, vehicle sales are a voluntary economic decision to upgrade. Further, if someone replaces a relatively new car (3-7 years) with a new one, another will go on the used car market, indirectly competing with the new car market. Further, with more working from home, it may be argued that vehicle needs per household are lower today than in the past,

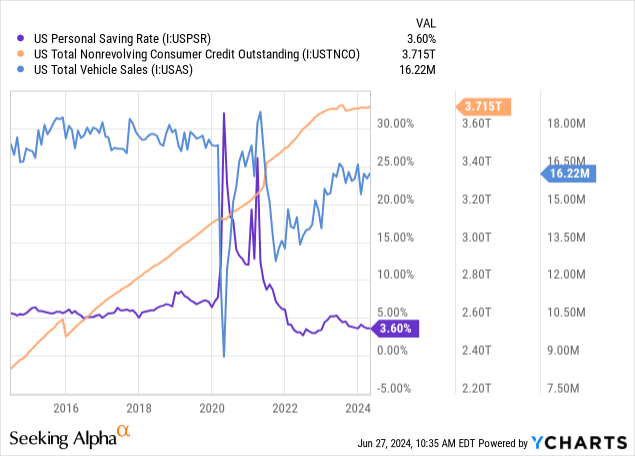

In other words, we should only expect a significant increase in new car sales if sufficient economic demand requires people to have excess disposable income. For most people today, compared to the past, excess disposable income is not common. The median savings account balance is around $8K today, which is likely not a month of needed savings for most households. Savings levels have plummeted in recent years, mirrored by increased consumer debt growth. See below:

Savings levels are abnormally low today. Nonrevolving consumer credit (primarily auto loans) was rocketing after the lockdowns, mirroring the sharp rebound in vehicle sales. However, nonrevolving debt has stagnated over the past year and a half. Revolving consumer credit has continued to rise sharply over this period. Still, it also shows signs of stagnation, indicating that many people cannot borrow more than they have. Thus, it is no surprise that vehicle sales have stagnated at a new low level.

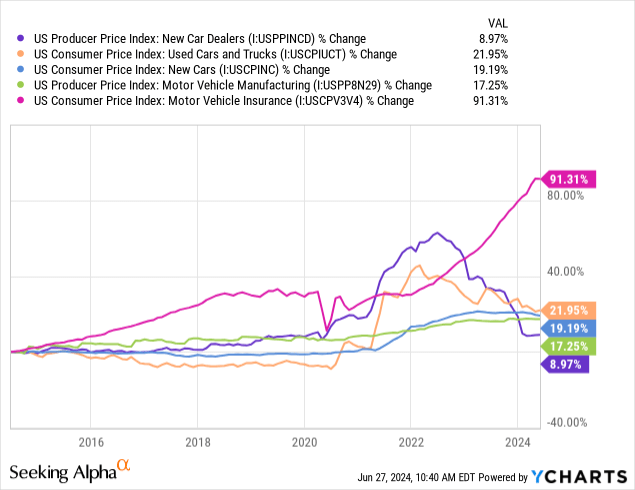

Car prices also remain an issue. The dealer PPI has plummeted, indicating that prices from dealers are falling as the acute shortage ends and likely reverses. Used car prices are also on a relative decline. More recently, we’ve seen some indications of declines in the new car CPI and the manufacturer PPI (which is vital for GM). Further, vehicle insurance costs continue to soar:

Today, most dealers and car producers likely have a small but growing glut, particularly in specific segments. Hence, prices are falling across the board. Notably, vehicle insurance and auto loan rates have both surged since 2022. Auto financing costs are about twice as high as before, and insurance is around 50% more expensive. Likely, these rising cost factors more than offset any benefits from the declines in car prices, as a growing number of people are paying over $1K monthly for auto loans.

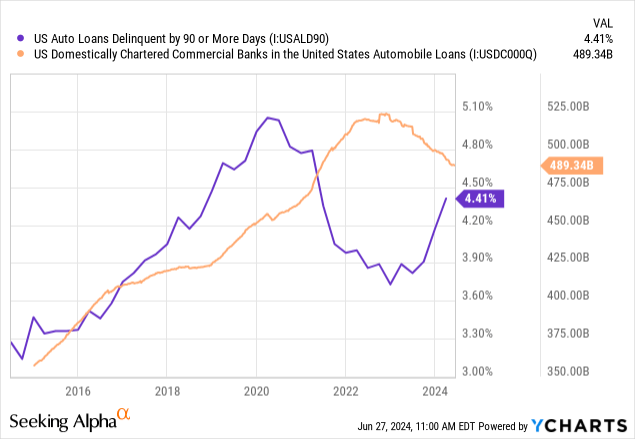

It should be no surprise that auto loan delinquency levels are rising, and banks are racing to divest themselves of the market:

Certainly, delinquencies are not at crisis levels, but the rate of increase is notable. I imagine this trend will increase, as indicated by the stagnation in revolving debt growth, pointing to a growing number of people who have reached their borrowing capacity. While vehicle prices are slipping, payments are still rising due to higher interest rates and insurance costs.

Of course, if we take my view that unemployment is likely to rise much higher over the coming six to eighteen months, as detailed here, we’d expect a much more significant surge in auto loan delinquencies and even lower sales. Again, most Americans do not have a month’s worth of savings, so if they lose their job and cannot find similar employment, they’ll likely default on their auto loans first.

Significantly, new and used car prices are falling, and many outstanding auto loans today were made at abnormally high post-pandemic prices. Thus, I argue these auto loans have an added risk of not being nearly as securitized as they should be.

General Motors Has Signficant Recession Risk

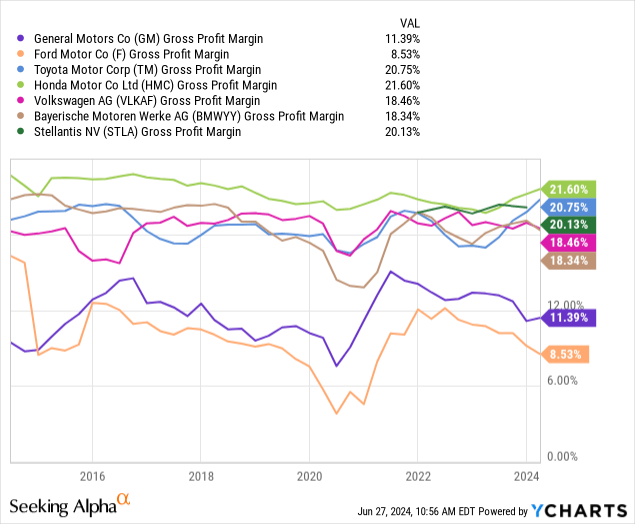

Car prices may be falling, but production costs are still rising. This is indicated by the falling gross margins of General Motors and Ford (F), indicating the US market is particularly weak:

The margin gap for GM and F is notable and yet another signal that car manufacturing costs are a major supply-side issue hampering the market. I do not expect manufacturing costs to decline, as much of that is based on international labor costs, fuel prices, and commodity prices, most of which are not falling today and may not decline significantly in a recession due to global trade and infrastructure issues.

Overall, I expect General Motors to see continued cost growth, lower unit sales, and increased delinquency in its financing unit. Last quarter, GM had $86.4M in financing receivables, less $2.3M in allowance for loan losses. These loans are mainly retail ($73M), with most originating in 2023 and 2022 at higher interest rates. Around three-quarters of these loans carry prime FICO scores over 680. We should remember that FICO scores jumped in 2020 due to pandemic stimulus, averaging ~717. General Motor’s lending profile mirrors that of most Americans. Of course, most Americans only have a month of savings, so I’d argue FICO scores are not as strong an indicator of credit risk as they were.

General Motor’s has a market value of $52B and an enterprise value of $153B, so its financing unit is not likely to be a considerable risk to its equity under normal circumstances. Still, I would not personally be surprised to see $10B in loan losses in the event of a sizeable recessionary increase in unemployment and auto loan defaults. Of course, this is hard to calculate as it is unclear how much of its loan value it could recoup in the event of repossession. In my view, that figure is likely lower than many may expect, given the potential for an increase in used car inventories.

The Bottom Line

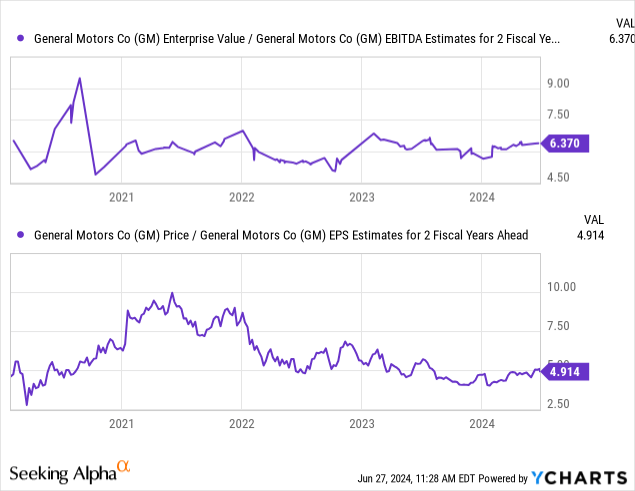

In my view, given its economic risk profile, General Motors is overvalued today. Although its two-year ahead forward “P/E” may seem low at 5X, one recessionary year may deliver a year or more worth of losses. Further, its forward “EV/EBITDA” is not below its level since 2021 despite a likely rise in macroeconomic risks. See below:

Is GM so overvalued that I’d short it? Absolutely not. The stock is not expensive if we assume a recovery in vehicle sales may occur over the coming years. Indeed, a recovery in the auto market would be very bullish for GM and is not impossible, given demand for cars would be higher if not for a lack of disposable income.

However, at today’s costs, most US households lack the excess monthly income required to buy a new car. Most key auto sales and lending data points to a negative outcome today, which could be exacerbated by a rise in unemployment, which I expect. It is difficult to predict the downside GM could face in this scenario, as that depends not only on economic changes but also on the performance of its competitors like Ford, which I believe is in an even worse fundamental position. Its performance also depends on the potential for a prolonged glut and higher input costs associated with geopolitical issues in global trade.

Overall, investors would be wise to avoid GM today unless they have a bullish economic outlook. GM would likely be fairly valued if current “stagnant” macroeconomic conditions remain. However, because I believe a consumer-driven recession will occur by next year, I expect GM to see considerable downside.

Read the full article here