Arbutus Biopharma Corporation (NASDAQ:ABUS) is a clinical-stage biopharmaceutical company focused on developing chronic hepatitis B [cHBV] therapies. ABUS’ strategy is three-pronged: suppressing HBV DNA replication, reducing viral antigens like HBsAg with RNA interference drugs, and boosting the immune response using immune modulators. The company’s leading drug is Imdusiran [AB-729], and multiple phase 2 clinical trials are ongoing. Imdusiran has shown positive results, reducing HBV markers and enhancing immune response, with a good safety profile. Additionally, ABUS is defending its lipid nanoparticle [LNP] delivery technology IP against Moderna (MRNA), Pfizer (PFE), and BioNTech (BNTX). This could pave the way to COVID vaccine revenue settlements if successful. ABUS is among the best biotech stocks I’ve covered due to its diverse potential catalysts that could unlock significant shareholder value.

Imdusiran and Legal Potential: Business Overview

Arbutus Biopharma is a clinical-stage biopharmaceutical company based in Warminster, Pennsylvania. ABUS was founded in 2007 under the name Tekmira Pharmaceuticals Corporation and rebranded with its current name in July 2015 after a merger with OnCore Biopharma. Its innovative portfolio treats diverse viral conditions related to chronic hepatitis B [cHBV].

Source: Corporate Presentation. June 2024.

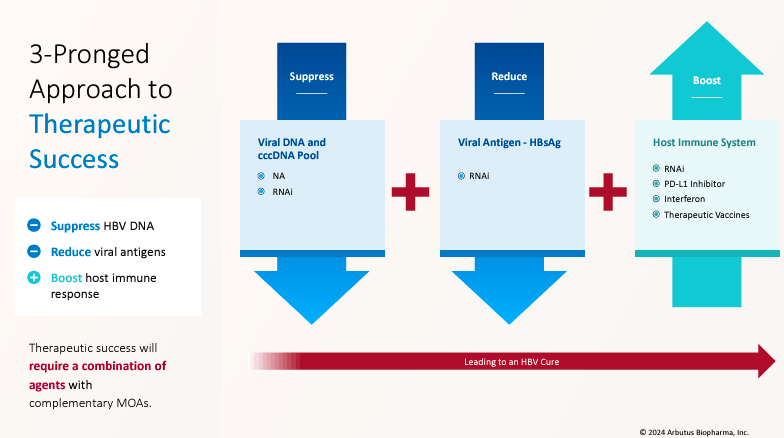

The company’s approach for cHBV has three objectives: Suppress, Reduce, and Boost. This means its treatments suppress HBV DNA reproduction and viral protein generation using antiviral therapies that target the HBV genome. ABUS also reduces viral antigen levels, such as hepatitis B surface antigen [HBsAg], with RNAi interference drugs. Finally, the company boosts the body’s immune response against HBV using immune modulators. Thus, ABUS’s approach hinges on combining therapies to deliver a functional cure.

Moreover, ABUS’s leading drug candidate is Imdusiran [AB-729]. This RNAi drug silences specific genes linked to HBV viral proteins and antigens. This effectively manages cHBV by reducing targeted protein levels in the liver, restoring the immune response against the virus. Additionally, ABUS’s system effectively delivers RNAi molecules to the target cells through lipid nanoparticles [LNPs] and reaches the liver, delivering its therapeutic effects.

Source: Corporate Presentation. June 2024.

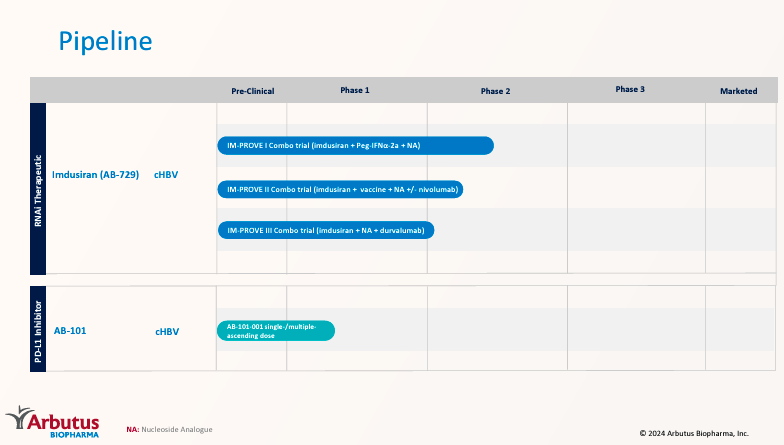

Currently, Imdusiran is undergoing three phase 2 trials. Such trials test Imdusiran’s effectiveness in combination with other therapies. First, the IM-PROVE I trial evaluates Imdusiran with pegylated interferon alfa-2a [Peg-IFNa-2a] (interferon) and NA. This combo boosts immune system response and nucleos(t)ide analogs [NA] with antiviral medications that block HBV reproduction. Second, the IM-PROVE II clinical trial combines Imdusiran with vaccine NA, testing it with and without nivolumab. This checkpoint inhibitor blocks specific immune response-modulating proteins. Lastly, the IM-PROVE III trial investigates Imdusiran with NA and durvalumab (another checkpoint inhibitor). This combo reduces viral load and reactivates the immune system, achieving a cHBV functional cure.

ABUS’ pipeline also includes the drug candidate AB-101, a phase 1 PD-L1 inhibitor. PD-L1 inhibitors stop interactions between the protein Programmed Death-Ligand 1 [PD-L1] on 1) cells in chronic viral infections. Likewise, the Programmed Death [PD-1] receptor performs similarly on T-cells. These interactions dampen immune responses. Thus, by blocking them, T-cells’s ability to fight against viruses effectively is restored. This means AB-101’s action mechanism is liver-centric, and ABUS hopes to demonstrate its superiority over standard monoclonal antibodies.

ABUS Catalysts: Clinical Trials and IP Defense

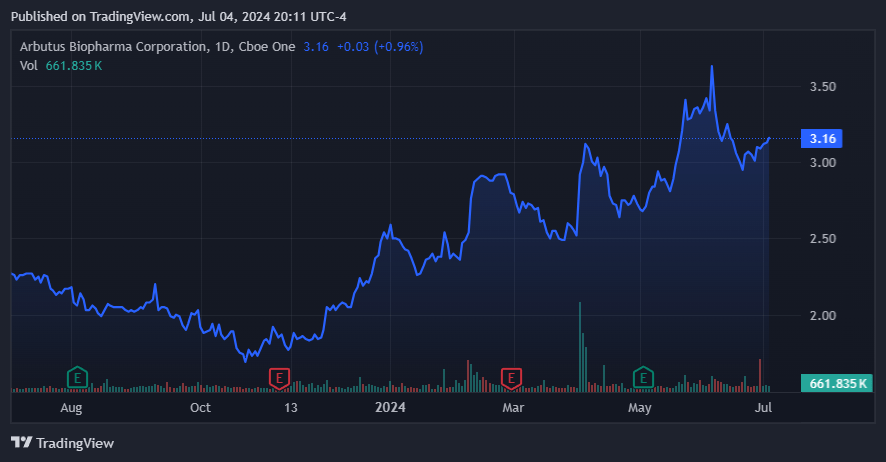

More recently, in April 2024, ABUS’s stock price jumped 19% after a favorable court decision against Moderna, alleging several patent infringements in Moderna’s COVID-19 vaccine. ABUS defended its lipid nanoparticle [LNP] delivery system IP, and the court agreed with ABUS, with a likely trial by 2H2025. This supports ABUS’ IP value related to its LNP delivery technology because MRNA made a fortune partly based on this mechanism. Additionally, ABUS filed IP litigations against Pfizer and BioNTech, which were also related to its LNP technology in mRNA vaccine delivery. Essentially, ABUS is seeking damages for unauthorized use of its IP, and if successful, it could entitle ABUS to significant compensation because COVID vaccines generated massive revenues.

Furthermore, ABUS’s latest earnings call highlighted its strategy to explore HBV combination therapies that suppress viral DNA. The idea is to reduce surface antigens and increase effectiveness through these combinations. The company’s executives noted that multiple phase 2a Imdusiran trials have shown positive preliminary results.

Source: ABUS’s press release.

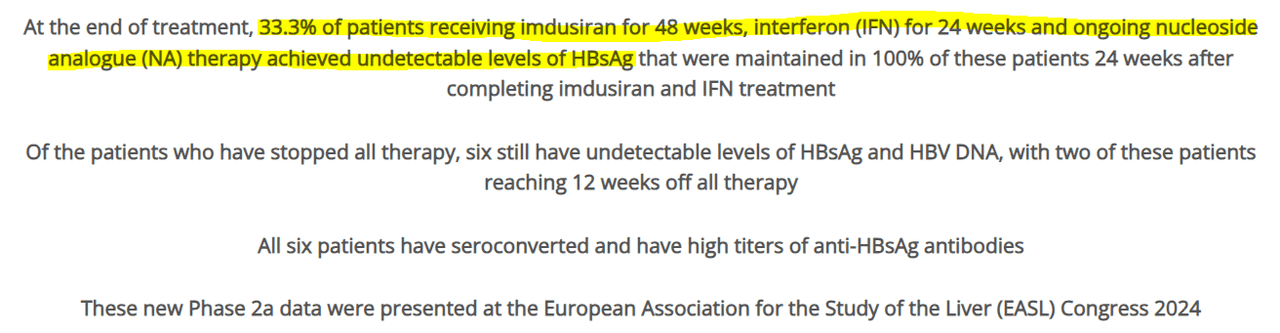

In fact, at the EASL Congress 2024 held in June, ABUS presented what I consider the most significant Imdusiran data. ABUS showed that Imdusiran, interferon, and NA combined lead to undetectable levels of HBsAg in 33.3% of patients. Moreover, the treatment was well-tolerated, with no serious adverse events [SAEs]. Low HBsAg levels indicate that the HBV virus is no longer actively replicating or likely eliminated, which is why this Imdusiran combo could effectively be considered a “functional cure” for chronic hepatitis B. Such reductions in hepatitis B surface antigens and HBV DNA also help the immune system’s effectiveness against the virus, even if it remains. This phase 2a data suggests that ABUS has a clear path to a phase 3 trial with larger populations. If so, I see a clear FDA-approval pathway for Imdusiran.

Source: Corporate Presentation. June 2024.

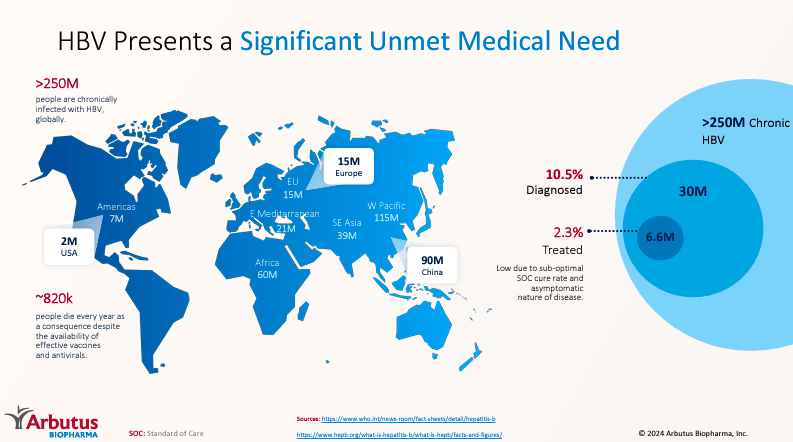

Imdusiran is particularly significant because more than 250 million people worldwide live with chronic hepatitis B. Usually, the hepatitis B vaccine is the best preventive measure against it, but for those suffering from chronic hepatitis B, there are few treatment alternatives and no cure.

So, if ABUS proves in a phase 3 trial that Imdusiran leads to a functional cure for 33.3%, it would be a revolutionary breakthrough. Approximately 83.3 million people worldwide would be free from this disease. The rest would still see significant improvement. ABUS could soon tap into an enormous TAM and address a critically unmet need. I think ABUS is in a good position with its IP defense and has promising trial results for cHBV. HBV treatments have substantial potential to address this infectious disease’s impact worldwide.

Value Drivers: Valuation Analysis

From a valuation perspective, ABUS trades at a market cap of $596.4 million. ABUS’s balance sheet currently holds $129.2 million in cash and short-term investments. The company has $35.7 million in total liabilities, no financial debt, only operating lease obligations, and a contingent consideration related to its 2014 acquisition of Enantigen Therapeutics. I estimate the company’s latest quarterly cash burn was $19.4 million by adding its CFOs and Net CAPEX. This means ABUS burns roughly $77.6 million yearly, implying a cash runway of 1.7 years. This aligns with management’s expectations of having enough cash until Q2 2026.

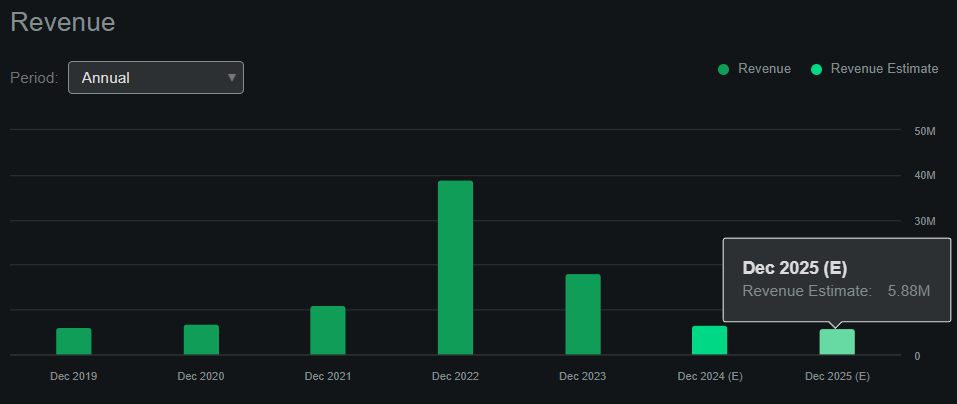

Source: Seeking Alpha.

ABUS remains pre-revenue (it doesn’t sell any products yet), generating sales mostly from collaborations and licenses. Seeking Alpha’s dashboard on ABUS projects, the company will make $5.9 million in revenues by 2025, but this likely omits the potential legal payouts and other collaborations that might arise through its IP. Naturally, Imdusiran sales would be considerably higher if FDA-approved, but that won’t probably occur until 2026 at the earliest, in my opinion.

Therefore, a good valuation approach is through its book value of $114.6 million. This means ABUS’s P/B ratio is 5.2, slightly higher than its sector’s median P/B of 2.3. However, most of ABUS’s value lies in Imdusiran, LNP, AB-101, and its potential litigation payouts. So, while conventional metrics slightly overvalue it, I think ABUS is undervalued when considering its overall assets and potential.

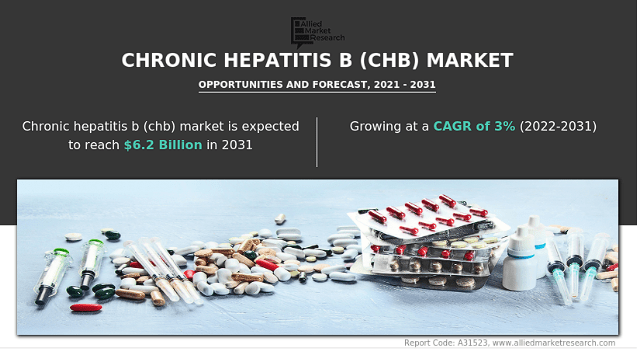

I see four main value drivers for the stock: 1) Imdusiran, 2) its LNP technology for applications in multiple RNA-based therapies, 3) the AB-101 pipeline, and 4) potential litigation payouts from its IP-infringement lawsuits. It’s difficult to quantify the value of each value driver I’ve identified. However, Imdusiran could potentially address a critically unmet need worldwide in chronic hepatitis B. If successfully researched and commercialized, this should be a multibillion-dollar market.

Source: Allied Market Research.

As for its LNP technology, I think it could generate substantial royalty income if ABUS defends its IP against MRNA, PFA, and BNTX. The AB-101 pipeline remains in the early stages but could also be a promising revenue vertical for longer-term investors. If ABUS wins the upcoming trial against MRNA, it will probably result in considerable compensation for ABUS because COVID vaccines generate massive revenues. So I think these last three value drivers should be worth hundreds of millions together, at the very least.

On balance, I believe ABUS is significantly undervalued based on Imdusiran’s potential alone. However, ABUS also potentially holds rights to some of the COVID vaccine revenues generated by mRNA (and likely others), which adds considerable optionality to the stock. Moreover, its LNP technology appears useful across many potential applications, so further royalties and agreements remain possible. It’s, overall, a fantastic collection of catalysts with enough cash for the foreseeable future but still well below the billion-dollar valuation. Hence, I rate ABUS as a “strong buy.” I consider ABUS among the best biotech stock picks I’ve covered.

Investment Caveats: Risk Analysis

Naturally, there are risks embedded in my buy thesis. Clinical trials for Imdusiran could become inconclusive or show diminished effectiveness and safety in more robust phase 3 clinical trials. This would undoubtedly detract from ABUS’s overall value, but as long as it still delivers a functional cure for some cHBV patients, it would still be valuable nonetheless. Also, the legal side of ABUS’s investment equation is much more speculative.

Source: TradingView.

IP legal battles sometimes take a long time to resolve, often years. It could drag on for many years unless ABUS reaches a favorable settlement quickly. The longer this takes to settle, the lower the present value of such cash flows. Moreover, ABUS is not guaranteed to win this battle, and it’s going up against pharma giants with much more cash and resources to defend themselves against ABUS’s claims. Lastly, its early stages of research with AB-101 could also fail in the long run and be discontinued. Nevertheless, these risks are largely justified by the diverse and meaningful potential catalysts that could favor ABUS. If that happens, its valuation still has ample room for the upside, so I think such risks are justified overall.

Compelling Strong Buy: Conclusion

Overall, I think ABUS is among the best biotech stocks I’ve covered. It has diverse potential catalysts that could unlock significant shareholder value. Imdusiran alone could be a multibillion-dollar drug if approved, and I think it justifies ABUS’s investment alone. Additionally, ABUS’s recent favorable court ruling paves the way for potentially sizeable payouts from pharma giant COVID vaccine sales. This would also be a huge win for investors. Lastly, ABUS’s LNP technology and upcoming pipeline are also valuable assets. So, I don’t think ABUS should be less than a billion dollars at this stage. Far too many considerably valuable catalysts could quickly unlock significant shareholder value in the next few years. Hence, I consider ABUS a “strong buy” despite the inherent biotech and legal risks.

Read the full article here