Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Pakistan has reached a deal for $7bn in medium-term financing from the IMF, offering the government a reprieve as it seeks to navigate the crisis-hit country out of soaring public debts and weak economic growth.

The IMF announced on Friday that it had reached a staff-level, or preliminary, agreement with Prime Minister Shehbaz Sharif’s government for a 37-month financing programme under a so-called extended fund facility.

The deal, which is Pakistan’s 24th bailout with the multilateral lender, will now go to the IMF’s executive board, which is expected to approve the loan, though it did not specify a date that it would do so.

“The programme aims to capitalise on the hard-won macroeconomic stability achieved over the past year by furthering efforts to strengthen public finances, reduce inflation, rebuild external buffers and remove economic distortions to spur private sector led growth,” the lender said in a statement.

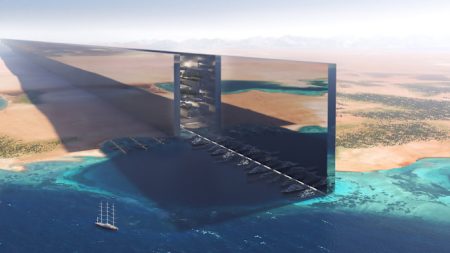

As part of the deal, Pakistan agreed to phase out incentives for its special economic zones, which were launched in 2012 to attract international investment, and expand the tax net to include more of the country’s agricultural sector, a politically sensitive issue.

Pakistan has suffered one of Asia’s worst recent economic crises, with the country of 240mn teetering on the brink of default last year before the IMF granted a short-term $3bn rescue package. Inflation surged as high as 38 per cent as Islamabad struggled to bring down a ruinous debt burden, which swallowed 57 per cent of government revenue in interest payments.

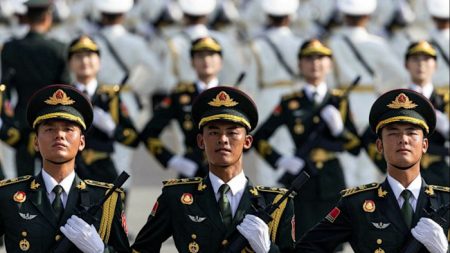

China, Saudi Arabi and the UAE, to whom Pakistan owes about half of its debt repayments for this year, are expected to roll over the terms of their loans for another year, said Muhammad Aurangzeb, the finance minister.

Inflation has fallen to 12.6 per cent in June and central bank reserves — which dipped in February 2023 below $3bn, less than three weeks’ worth of imports — are now above $9bn. The economy contracted last year, but has returned to growth.

To meet the IMF’s conditions, Sharif’s government has announced a rash of politically unpopular reforms, including tax rises that primarily fell on salaried workers and increases to household energy tariffs. Aurangzeb previously told the Financial Times that the loan would not be Pakistan’s last programme with the IMF if the government failed to significantly boost tax revenues.

The fund praised Pakistan’s plans in its latest budget approved last month to increase government revenue by 1.5 per cent of GDP in this fiscal year and by 3 per cent by the end of the programme.

But measures have generated a backlash, including from the government’s coalition partners, on which it depends to remain in power after a disputed election in February.

Khurram Husain, a business and economics commentator in Karachi, said that the deal would help put to rest concerns about a default and “anchor expectations for continued stability”. But its success depend on the government maintaining the political will to stick with its reforms, he added.

“The possibility that the government will develop cold feet and start backpedalling on some of the measures that they have announced is very real and it should not be underestimated.”

“The conditionality is now tougher and the authorities will have to sustain the policy effort for longer,” said Krisjanis Krustins, a director in Fitch. “As economic and financing conditions improve, the temptation to loosen policies will increase, as in the past.”

Read the full article here