Investment Thesis

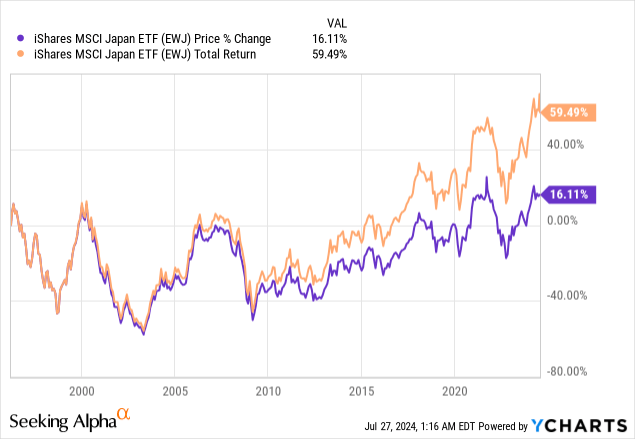

iShares MSCI Japan ETF (NYSEARCA:EWJ) owns a portfolio of about 200 Japanese stocks. The fund tracks the MSCI Japan index. The fund has an expensive expense ratio of 0.5% as other funds such as Franklin FTSE Japan ETF (FLJP) only has an expense ratio of 0.09%. EWJ has slightly underperformed the S&P 500 index in this bull market. Its growth outlook is quite good but still inferior to the S&P 500 index. With an attractive valuation, EWJ is still a good fund to own for investors seeking some exposures outside the U.S.

YCharts

Fund Analysis

Solid return in this bull market

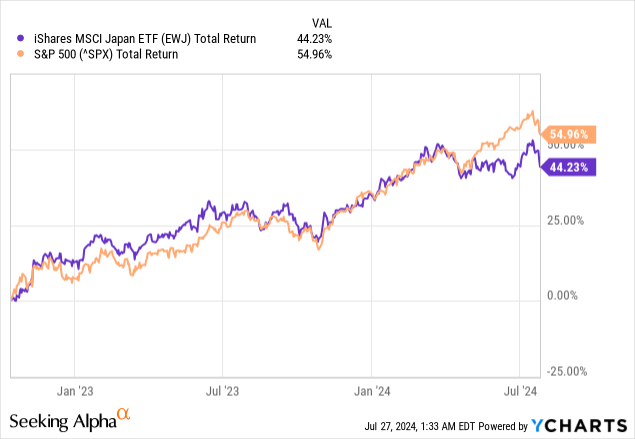

Let us first review how EWJ has performed in the past few years. The fund has done very well in this bull market. In fact, EWJ has delivered a total return of 44.2% since the broader market reached a cyclical low in October 2022, slightly inferior to the S&P 500 index’s 55.0%. As can be seen from the chart below, EWJ’s return has been in line with the S&P 500 index for most of the past few years but has underperformed in the past few months.

YCharts

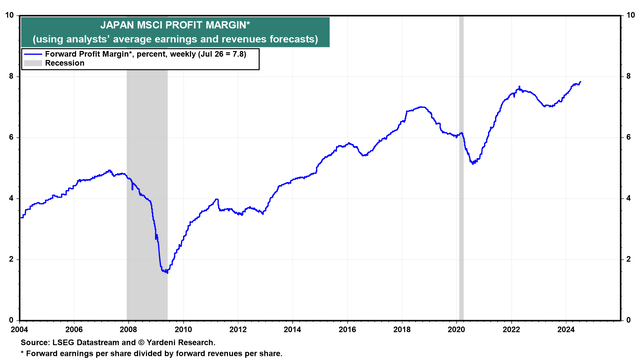

Good earnings growth outlook

Let us now review the profit margin trend of stocks in EWJ’s portfolio. Below is a chart that shows the average profit margin of stocks in the Japan MSCI Index. As can be seen from the chart, average profit margin has been on a rising trend, improving from the low of sub 2% during the Great Recession in 2009 to nearly 8% in 2024. The profit margin improvement is a sign that Japan’s economy is now in a much better shape than the first 10~20 years after the asset bubble burst in 1989. Both personal and corporate balance sheets are in much better shape and consumers and corporations are much more willing to spend and invest than 20~30 years ago.

Yardeni Research

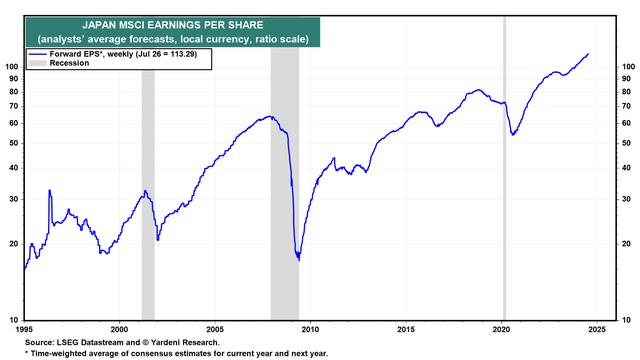

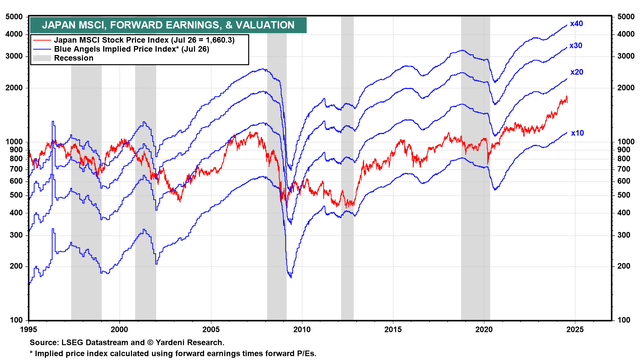

This profit margin improvement is also directly reflected in earnings growth for stocks included in the Japan MSCI Index. As can be seen from the chart below, earnings per share has increased from the low of about $16 per share in 1995 to $113.3 per share today.

Yardeni Research

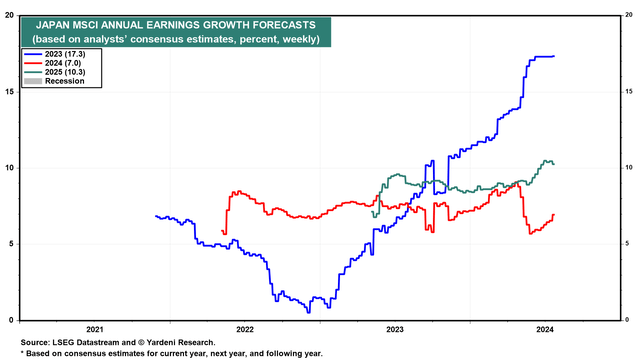

Looking forward, EWJ also has a good earnings growth outlook. As can be seen from the chart below, stocks in the Japan MSCI Index delivered a total earnings growth rate of 17.3% in 2023. Although consensus earnings growth rates are expected to decelerate in 2024, it is still expected to increase the earnings by 7.0%. This earnings growth rate will accelerate again in 2025 with a consensus growth rate of 10.3%. While quite good, these growth rates are still inferior than the S&P 500 index’s growth rate. For reader’s information, consensus earnings growth rates for stocks in the S&P 500 index are expected to be 10.3% in 2024 and 14.9% in 2025.

Yardeni Research

Valuation not expensive

Below is a chart that shows the average forward P/E ratio of stocks in the Japan MSCI Index. As can be seen from the chart, the forward P/E ratio of 15.2x is in the middle of the historical range between 10x and 20x in the past 20 years. We view this valuation as cheap, especially when we consider EWJ’s profit margin improvement in the past 15 years.

Yardeni Research

This may be a good time to buy

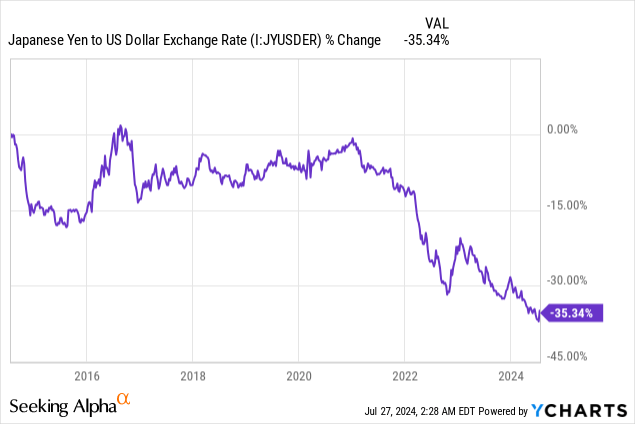

Despite EWJ’s good earnings growth outlook and attractive valuation, investors should keep in mind of the currency risk. As can be seen from the chart below, Japanese Yen to US dollar has fallen by about 35% since 2021. This can cause some pressure on EWJ’s fund price.

YCharts

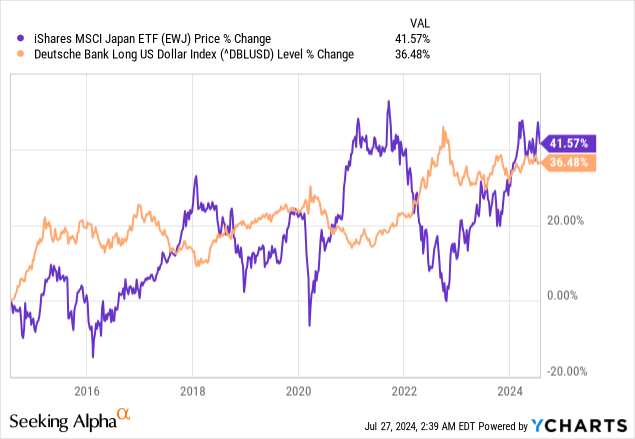

Nevertheless, we view this decline in Japanese currency as a good opportunity for long-term investors. The weak Japanese Yen in the past 3 years was primarily due to the Federal Reserve’s tight monetary policy and the current elevated rate. However, U.S. inflation has subsided substantially since the peak reached in mid-2022. Therefore, U.S. dollar may gradually weaken as the Federal Reserve eventually start a new rate cut cycle. In a lower rate environment, investment capitals has a higher likelihood to flow towards Japanese stock market. As can be seen from the chart below, EWJ’s fund price has an inverse correlation to the strength of the U.S. dollar. Therefore, we think a weakening U.S. dollar should be positive to EWJ’s fund price.

YCharts

Investor Takeaway

EWJ has a good growth outlook and an attractive valuation. The Federal Reserve’s eventual rate cut cycle should also act as a catalyst to EWJ’s fund price appreciation. We think this is a good satellite holding for investors seeking some exposures outside of the U.S.

Additional Disclosure: This is not financial advice and that all financial investments carry risks. Investors are expected to seek financial advice from professionals before making any investment.

Read the full article here