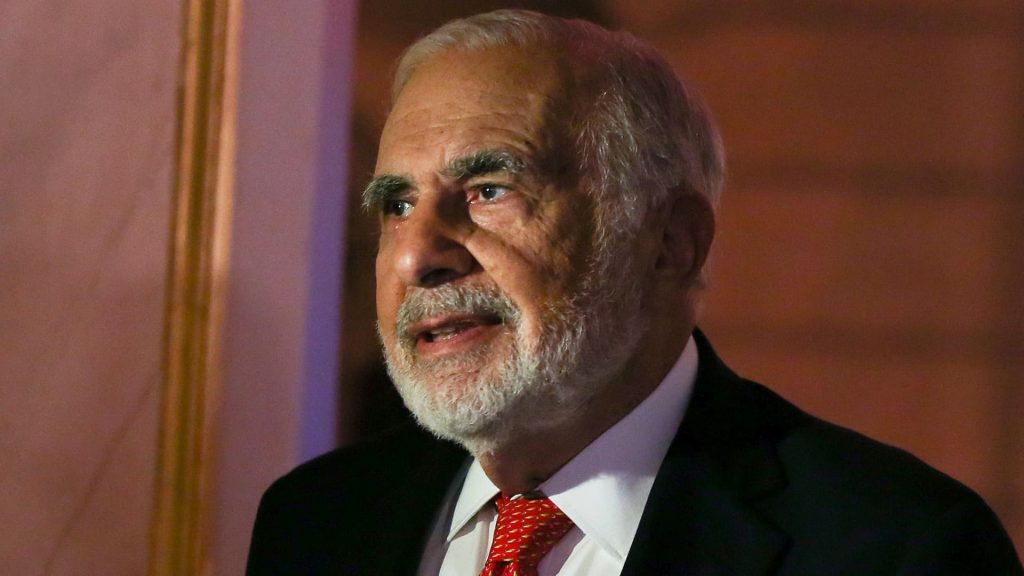

Here are the stocks making notable moves on Monday: PDD Holdings — Shares of the Temu parent company plunged nearly 30% on disappointing second-quarter results. The China-based online retailer posted revenue of 97.06 billion yuan, or $13.6 billion, versus consensus estimates of 100.17 billion yuan, according to analysts polled by FactSet. Management said pressures on revenue growth are likely to continue due to increased competition. Icahn Enterprises — Carl Icahn’s investment firm saw shares drop nearly 10% after Icahn Enterprises filed with the U.S. Securities and Exchange Commission to sell up to $400 million depository units through an “at-the-market” offering program. The filing said the firm intends to use any net proceeds from the offering to fund potential acquisitions and for company purposes. Icahn settled charges with the regulators last week, paying a combined $2 million in fines over the failure to disclose as much as $5 billion in personal margin loans pledged against the value of his Icahn Enterprises stock. SolarEdge Technologies — The green energy stock fell about 8% after announcing a change of CEO. Previous CEO Zvi Lando has stepped down and Chief Financial Officer Ronen Faier will become the interim CEO, effective Monday, while the board searches for a permanent replacement. Petrobras — U.S.-listed shares of the Brazilian oil company jumped 6% following an upgrade from Morgan Stanley . The firm said the company’s dividends sweeten its investment case. Boeing — The aerospace stock dipped more than 1% after NASA announced over the weekend that it will leave two astronauts at the International Space Station until February, when they will be able to return via a SpaceX spacecraft. Boeing’s Starliner capsule, which was supposed to carry the astronauts, will instead return to earth empty. Planet Fitness — Shares of the gym chain edged about 1% higher after Baird analyst Jonathan Komp kept his overweight rating and added a ” bullish fresh pick ” designation through year-end for the stock. Komp said Planet Fitness is an attractive play in a slowing growth environment. Warner Bros. Discovery — Shares of the entertainment company rose 4% on Monday, building on a 7% rally from Friday. There did not appear to be a clear catalyst for the move. Warner Bros. Discovery is in a legal fight with National Basketball Association over a new media rights deal. Micron Technology — The chip stock slid 3%. Needham on Monday lowered its price target on Micron Technology to $140 from $150, a move that nevertheless implies roughly 36% upside from Friday’s close. Analyst Quinn Bolton attributed the move to Micron’s recent comments suggesting bit shipments would be flat in the fall, a potential risk to November consensus estimates. Still, Bolton maintained a buy rating on the stock. Super Micro Computer — Shares of the chipmaker fell more than 7% on Monday, part of a broader sell-off for semiconductor stocks. Super Micro is on track for its fourth negative session in six. — CNBC’s Yun Li, Alex Harring, Pia Singh, Sarah Min and Hakyung Kim contributed.

Read the full article here