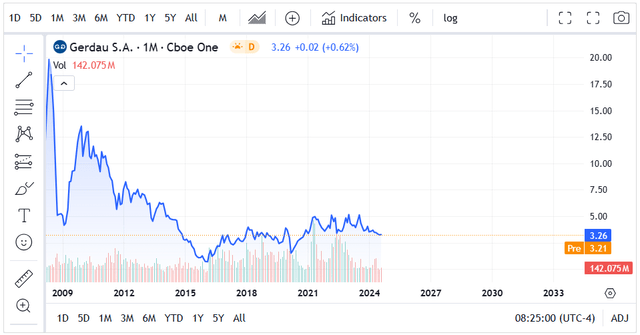

Gerdau S.A. (NYSE:GGB) offers more than 100 years experience of operating in the steel industry. It is the largest Brazilian producer of steel, and could benefit substantially from ongoing investments in the automotive industry, the development of the electric vehicles, and electrical transmission renovation all over the world. GGB also benefits from reallocating resources, and is making significant reductions in the total amount of debt. Given recent increases in the tangible book value per share, reduction in the share count, positive net income, and long-term free cash flow growth, in my view, GGB appears significantly undervalued. In my view, as soon as the company receives more coverage, and more investors make their own financial models about the future, GGB could see its stock price trending north.

Source: Seeking Alpha

GGB

Gerdau S.A. produces and sells steel products through the company’s mills in Brazil, Canada, the United States, Mexico, Argentina, Peru, and Uruguay.

I do appreciate that the company has operated for many years, and has accumulated a significant amount of know-how in the industry. According to the last annual report, GGB is the result of mergers and transactions that started in 1901.

It is also remarkable that Gerdau is the largest Brazilian producer of steel, a large producer of long steel in the Americas, and the largest recycling company in Latin America. In my view, the company’s geographic diversification and agreements with customers all over the world could protect the company from a global recession. In my view, the company’s financial statements would not suffer as much as that of smaller competitors operating in smaller target markets. In addition, GGB also works for a diversified list of customers in the construction, manufacturing, and agricultural industries.

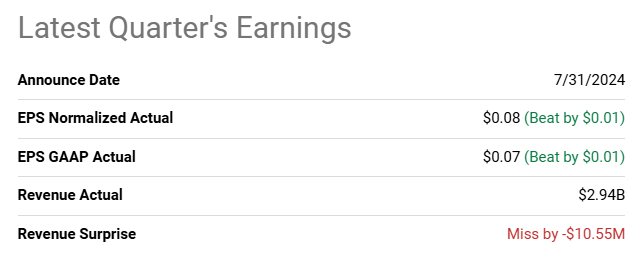

In the last quarterly report, GGB reported better than expected EPS GAAP of $0.07, but lower than expected quarterly revenue. With that, analysts out there are expecting revenue growth in 2026, 2027, and 2028. I think that making a long-term assessment of GGB makes sense here.

Source: Seeking Alpha Source: Seeking Alpha

#1 Assumption: Demand From The Growth In The Automotive Industry

Many European countries, the United States, and China are making large investments to accelerate the adoption of electric cars. Besides, they are also making large capital expenditures to make innovations with respect to electrical transmission as well as to promote renewable energies. In my opinion, these investments will most likely be drivers of steel demand, which could be ideal for the company’s business model.

Automotive Steel Market size valued at USD 112.93 billion in 2021 and is projected to expand at over 3% in terms of revenue from 2022 to 2030. Rising adoption of electric vehicles will augment the demand for automotive steel. Source: Gminsights

Results show a rapid growth in the demand for most materials in the electricity sector, as a consequence of increased electricity demand and a shift towards renewable electricity technologies, which have higher material intensities and drive the expansion of transmission infrastructure and electricity storage capacity. Source: Projected material requirements for the global electricity infrastructure from ScienceDirect.

In particular, in the last annual report, the company made several references about the clients in the North America Business Segments. In my view, many of these clients are operating in sectors that could receive significant demand in the coming years.

North America Business Segment’s products are generally sold to steel service centers, steel fabricators or directly to original equipment manufacturers for use in a variety of industries. Source: 20-F

#2 Assumption: Further Increase In Tangible Book Value Per Share

I studied the balance sheet reported in the last ten years to understand the direction of management. GGB seems to be reducing the total amount of assets as well as the total list of liabilities and debt.

Source: Seeking Alpha

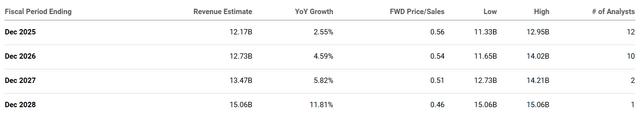

In the last decade, I also saw a small decrease in the total share count, which leads to a small increase in the book value per share and the tangible book value per share. Currently, the stock price does not seem to trade far from the book value per share. In my view, considering the book value per share price and recent reallocation of resources, there is certain undervaluation in my opinion.

Source: Ycharts

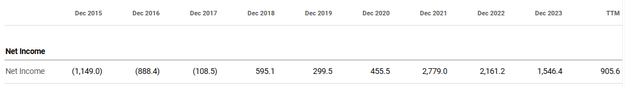

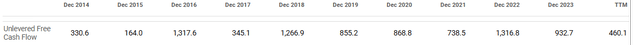

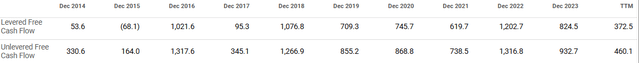

#3 Assumption: Further Positive And Growing Net Income, And Unlevered Free Cash Flow

If we look at the cash flow statements reported in the last ten years, I think that the net income and the unlevered free cash flow indicate growth. The net income was positive for the last six years, and the unlevered free cash flow was also positive.

Source: Seeking Alpha Source: Seeking Alpha

In 2024, the numbers declined a bit, however if we look at the long-term trend that started in 2015, GGB does seem to be more and more profitable every year. Given the financial figures reported in the past, I believe it is not very difficult to make positive forecasts about the future. My free cash flow expectations are linked to these figures. I really did not think out of the box, and maintained very conservative assumptions.

#4 Assumption: Sale Of Business Interests Could Bring Cash In Hand

In 2024, the company sold its equity interest of 49.85% in the joint venture Diaco S.A. and 50.00% in the joint venture Gerdau Metaldom Corp. As a result, GGB received a total value of $325 million, and recorded a gain of R$ 808.4 million. In my view, GGB is trying to sell non-performing business interests in order to invest in assets with greater business potential. In my opinion, further sale of assets could bring new cash to the balance sheet, which could enhance the company’s fair valuation.

#5 Assumption: Decline In The Brazilian Reais

GGB receives payments in dollars, euros, and other strong currencies, and pays a lot of expenses by using Brazilian reais. In the most recent months, I saw a decrease in the Brazilian real as compared to other currencies in North America and Europe. With many employees receiving their money in Brazilian reais, in my view, the company could see an improvement in its financials.

Source: Seeking Alpha

In addition, if investors perceive that the downward trend in the Brazilian real could continue, GGB could see an increase in the demand for the company’s stock. I am not a person who makes investments based on changes in currency markets, however in this case, this is another good reason, among many others, that supports the investment thesis about GGB.

I Am Not Concerned About The Total Amount Of Debt

There are two reasons not to worry about the company’s total amount of debt. First of all, GGB uses some of the debt to finance property and equipment, which the company could sell in the future. In addition, GGB promised investors to maintain a certain level of financial leverage and debt management.

In the last quarterly report, the company mentioned that it expects the net debt/EBITDA to remain less or equal to 1.5x. Besides, the average maturity would be more than six years, and the gross debt limit would not be larger than R$12 billion. In my opinion, if these parameters are respected, investors would most likely not sell shares because of financial risks.

According to the last quarterly report, GGB reported debt agreements including nominal weighted average cost close to 5.4%. The WACC I used is larger than 5%. Most of the company’s total amount of debt is also in dollars, not in Brazilian reais.

As of June 30, 2024, the nominal weighted average cost of debts denominated in US dollars is 5.45% p.a. (5.68% p.a. on December 31, 2023), for debts denominated in Real of 106.7% of the CDI p.a. (104.9% of the CDI p.a. on December 31, 2023) and for other currencies 5.46% p.a. (6.49% p.a. on December 31, 2023). Source: 6-k

Financial Model, And My Assumptions about Perpetuity Growth Rates

The design of my financial model includes assumptions obtained from the most recent annual report. In particular, I included perpetuity growth rates close to 3% because the company has used these figures to assess the valuation of intangible assets. The perpetuity growth rate in North America stands at 3%, growth rate for special steel is 3%, and this rate is also 3% in Brazil and South America.

The perpetuity growth rates considered in the 2023 test were: a) North America: 3% (3% in December 2022); b) Special Steel: 3% (3% in December 2022); c) South America: 3% (3% in December 2022); and d) Brazil: 3% (3% in December 2022). Source: 20-F

The discount rates that GGB uses are also close to 10%, which is applied in North America, 19%, which is applied in South America, and 11.75%, which is applied in Brazil. Given these figures, I used a WACC close to 15%, which is higher than what GGB uses to assess the valuation of assets in Brazil, North America, and other regions. The following text was obtained from the last annual report.

The post-tax discount rates used were: a) North America: 10.25% (9.75% in December 2022); b) Special Steel: 11.00% (10.75% in December 2022); c) South America: 19.00% (18.00% in December 2022); and d) Brazil: 11.75%, (11.75% in December 2022). Source: 20-F

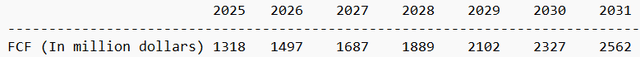

For the assessment of future free cash flow, I pretty much studied previous free cash flow reported from 2015. The company delivered growing free cash flow. Other investors may come with different figures. However, I think that most analysts would be expecting FCF growth.

Source: Seeking Alpha

I also assumed that further sale of assets could enhance the company’s fair valuation. Besides, I assumed that demand for steel coming from the automotive industry, and other industries could accelerate FCF growth.

The following are my free cash flow expectations. Using a WACC of 15% and perpetuity growth of 3%, the implied enterprise value would be $15.7 billion, the implied equity would be close to $13 billion, and the implied stock price would stand at $6.28 per share.

Source: My Expectations

- NPV of FCF @ WACC of 15%: $7,481.32 million

- NPV of TV @ WACC 15% and perpetuity growth rate of 3%: $8,267.66 million

- Total EV: $15,748.98 million

- Net Debt: $2,496 million

- Equity: $13,252 million

- Shares Outstanding: 2110 million

- Target Price: $6.28

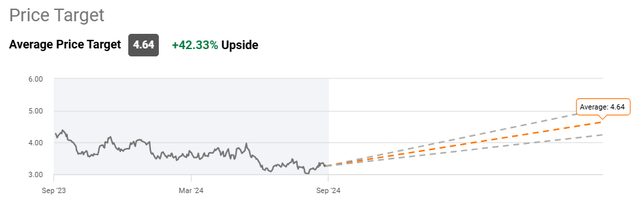

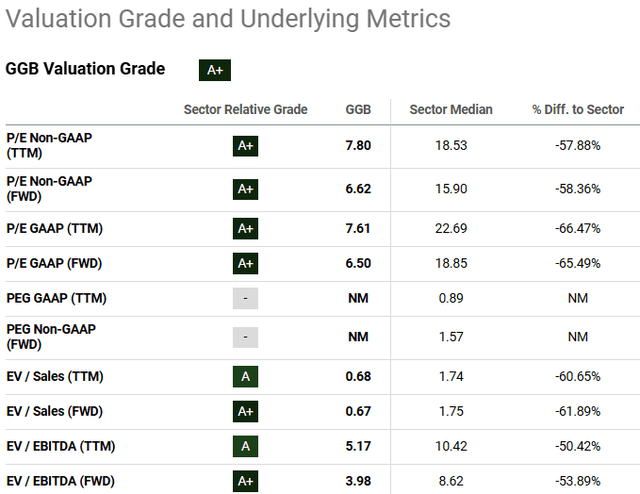

Other analysts reported a target price of $4.6, and many delivered buy ratings about Gerdau. GGB is also quite undervalued as compared to competitors. Other competitors report larger P/E TTM GAAP ratio than GGB. Besides, the company’s Ev/FWD EBITDA is lower as compared to that of peers.

Source: Seeking Alpha Source: Seeking Alpha

Risks

The company reports a significant amount of goodwill from acquisitions made in North America, Brazil, and other regions. In the future, changes in the interest rates or commodity prices, changes in the exchange rates, future revenue growth, expectations, and other assumptions about the valuation of companies acquired could change. As a result, accountants inside GGB could decide to lower the company’s goodwill total value. Goodwill impairments would push the company’s book value per share down.

Expectations about the company’s ability to generate free cash flow could lower, which may lead to a reduction in the company’s fair price. In the second quarter of 2024, the company noted lack of expectation of future use of some assets of its industrial plants, and identified losses due to non-recoverability of the amount of R$199,627 in the Brazil segment. In sum, the company reported impairments, and may report again.

The company operates in the steel industry, which is cyclical. It means that the company could, in the future, suffer from changes in the demand for steel products and changes in the price of steel. In the worst-case scenario, FCF expectations may lower, but GGB may also lower its inventory, which could lead to decreases in the stock price. Besides, the economic environment could also change, or certain industries like construction or the automotive sector could change their steel requirements.

With the new elections coming in the United States and political movements all over the world, we may see new trade agreements in the United States, China, Europe, or other regions. If governments increase their import or export taxes, or they protect local companies, GGB could also see a decrease in the demand for its products.

For instance, some countries like Mexico, Turkey, countries from the European Union, and the United States incorporated certain laws to protect their markets from subsidized Chinese steel. I believe that the new changes in the laws could lower the company’s production and demand. Besides, banks in certain regions could limit or lower the lending to the company or customers. As a result, some of the company’s clients could stop their announced capital investment programs, or decrease the amount of dollars that they expect to invest. Under certain circumstances, I think that GGB could see a significant reduction in its free cash flow expectations. Resultantly, the stock price could decline.

Conclusion

Gerdau S.A. is a long-time company with a significant amount of know-how accumulated for more than 100 years in the industry. In my view, the company could receive significant demand for steel from clients in Europe, North America, and China. In my view, clients in the automotive industry and electrical transmission could receive a lot of demand for their products because of the growing support for new smart transportation and renewable sources of energy. The company’s sale of assets, reallocation of resources, and overall increase in the book value per share could also bring demand for the stock. I think the company trades significantly undervalued. Previous positive free cash flow, FCF growth, and positive net income are a clear indication of beneficial performance. In my view, as soon as more investors have a look at the company’s current valuation and FCF growth, and make their own financial models, we may see an increase in the demand for the stock.

Read the full article here