Raiffeisen Bank International AG (OTCPK:RAIFF) has reported a positive operating momentum in recent quarters, but its exit from Russia seems to be complicated, and it’s a major overhang for its shares.

As I’ve covered in a previous article, Raiffeisen is one of the cheapest European banks, which is largely explained by its significant reliance on Russia and the issue of returning capital from this country to its holding company in Austria, leading to negative investor sentiment toward its shares.

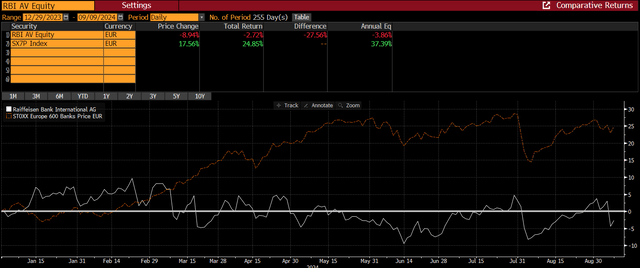

While its operational performance has been positive over the past few months, the Russia issue has been a significant headwind, leading to clear share price underperformance compared to the European banking sector during 2024, as shown in the next graph.

Share price (Bloomberg)

As I’ve not covered Raiffeisen for some time, I think it’s now a good time to update its most recent financial performance and discuss recent events related to its Russian operation.

H1 2024 Earnings Analysis And Russia Unit

Raiffeisen is an Austrian bank with significant operations across Central and Eastern European countries, of which Russia is the largest one within the group measured by profit.

While other European banks have decided to exit Russia following its invasion of Ukraine and economic sanctions imposed in 2022, such as Societe Generale (OTCPK:SCGLF) which rapidly sold its Russian bank, Raiffeisen has yet to exit the country. However, from an operating standpoint, this operation has been quite good for its overall financial performance because its profitability is above-average compared to other markets.

During the first six months of 2024, Raiffeisen has reported a very positive operating performance driven by all of its markets, even when excluding Russia and Belarus. This performance was supported by higher net interest income (NII) as the bank continued to benefit from higher interest rates, leading to NII growth of 5% YoY to nearly €2.9 billion in H1 2024.

On the other hand, its fees and commissions declined by 18% YoY to €1.4 billion, justified by a decline of 42% YoY in Russia, as the bank has decided over the past couple of years to de-risk its Russia operations and this has resulted in much less operating activity in the country.

Indeed, Raiffeisen is no longer taking new loans in the country and does not take time deposits from clients, with the exception of foreign subsidiaries of western banks. There is some loan and payment processing for large and international corporations, but generally speaking, its banking activities in Russia have been significantly reduced, explaining why fees and commissions have declined so much in recent months.

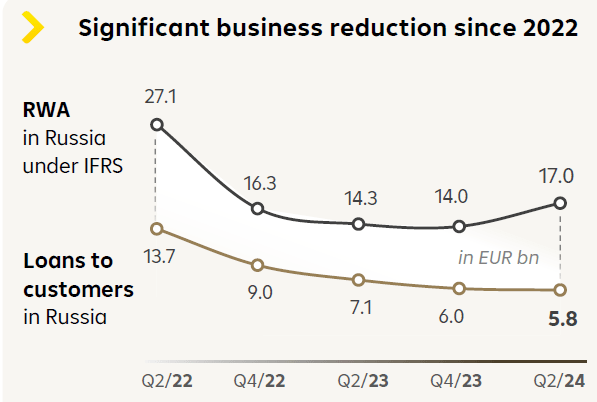

Regarding its loan book in its Russian unit, it has declined from €13.7 billion a couple of years ago to €5.8 billion at the end of Q2 2024, showing that Raiffeisen has been successful in reducing its exposure to the country following the start of the Ukraine war in 2022.

Russia loan book (Raiffeisen)

Given this background and the bank’s goal to eventually exit from the country in the near future, Raiffeisen no longer gives guidance that includes Russia and Belarus; thus investors should consider its operations excluding Russia and Belarus as its core business, and focus on its financial performance excluding these two countries.

Based on its ‘core business’, Raiffeisen’s NII increased by 6% YoY to €2.16 billion in the first half of 2024, and fees and commissions were up by 4% YoY to €882 million. Its operating expenses amounted to €1.6 billion, up by 6% YoY due to the inflationary environment and pressure on wage growth, leading to a sable cost-to-income ratio of 49%.

Regarding its credit quality, it remained at good levels given that its cost of risk ratio was 32 bps in H1 2024, which is an acceptable ratio considering that Raiffeisen has significant exposure to Eastern European countries, plus Raiffeisen continues to boost its provisions related to litigation on Polish forex mortgages. For the full year, the bank expects a cost of risk ratio around 35 bps, which means credit quality is not expected to deteriorate much in the second half of the year, which seems sensible as the rate cycle is switching to cuts, leading to lower pressure on individual and commercial customers income ahead.

Regarding its net profit, it amounted to €705 million in H1 2024, up by 21% YoY, and its ROE ratio was 9.5%, an improvement of about 150 bps compared to the same period of last year. While this is an acceptable level of profitability, it’s much lower than its reported ROE including Russia (14.6%), showing that its Russian unit is quite profitable.

However, due to strong earnings, Raiffeisen’s capital in the Russian unit has increased in recent quarters, but the bank is not allowed to return capital to its holding company in Austria due to economic sanctions. Its CET1 ratio in Russia was about 48% at the end of Q2 2024, showing that it has an excess capital position, which in ‘normal’ times Raiffeisen would receive through dividends from its Russian unit, something that it can’t currently do.

To extract some capital from Russia, Raiffeisen announced a few months ago a ‘creative’ deal with a Russian oligarch, to exchange shares of its local unit with shares of an Austrian construction group called Strabag (OTCPK:STBBF), which potentially would allow the bank to extract about €1.5 billion through a ‘dividend in kind’.

However, a few days ago, a Russian court has blocked this deal, by placing a preliminary injunction on selling the shares in its Russian unit. This is an important setback for Raiffeisen’s plans to gradually exit the country, which means the odds of a nationalization or a sale to a domestic competitor have increased, which will certainly lead to a lower valuation.

While an exit seems now more complicated, Raiffeisen continues to maintain its strategy of business reduction in Russia and de-risk its balance sheet, which means its loan book is expected to shrink in the next few quarters and its banking operations will remain limited in the country.

Despite that, this process will take some time to materially reduce its exposure to Russia, given that Raiffeisen expects its loan book to be reduced by around 55% over the next couple of years. On the liabilities side, the bank does not want to take deposits and intends to charge high maintenance fees, to make its products unappealing to customers, as the bank aims to change its business mix into equity in one side and only liquidity applications and loans in the asset side.

The bank is pursuing this strategy to comply with U.S. and European authorities regarding economic sanctions against Russia, reducing the overall compliance risk for the group as a whole. However, it’s also seeking an orderly exit from the country, something that has been challenging and is not easy to execute in the short term.

While a successful sale, or partial sale, is still possible in the future, I think investors should be conservative and assume that Raiffeisen will not be able to recover any equity from its Russian unit and that it will deconsolidate at some point this unit at zero book value. This would result in a reduction of €5.6 billion in its equity, impacting negatively its CET1 ratio by around 300 basis points (bps), reducing its CET1 from the reported level of 17.8%, at the end of last June, to 14.7% adjusted for the deconsolidation of Russia.

This is still a good capital position and well above its capital requirements, showing that Raiffeisen is well capitalized and can return a good part of its annual earnings to shareholders in the near future.

Regarding its valuation, Raiffeisen is currently one of the cheapest European banks considering that it is trading at only 0.3x book value, at a discount to its historical average of 0.42x book value over the past five years. Compared to some of its closest peers, such as Bawag (OTCPK:BWAGF) or Erste Bank (OTCPK:EBKDY), Raiffeisen is trading at a deep discount given that its competitor’s trade near book value, but this seems to be justified by Raiffeisen’s high-risk profile related to its Russian unit.

Conclusion

Raiffeisen has been reporting a positive operating performance, even when excluding Russia, but its risk profile and headwinds to exit from Russia have been quite negative for its share price in the recent past. While a deal was announced some months ago to sell a large part of its Russian unit, this was recently blocked, and a solution doesn’t seem to be easy to reach. Therefore, while its valuation is cheap compared to its peers, I think investors should stay on the sidelines until Raiffeisen is able to exit Russia and significantly reduces its risk profile.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here