If you have read some of my previous research, you already know well that the focus of my research is predominantly on “younger investors” with 20–30 years of compounding ahead— simply those with a long-term mindset.

As a younger investor myself, soon to turn 30, the key for me is total returns while seeking alpha to beat the market. Nevertheless, in my heart, I am a dividend growth investor, hence my nickname Millennial Dividends; although dividend growth investing might not be the most optimal strategy to accumulate as much wealth as possible, that’s why I decided to write this article, which certainly will face a reasonable degree of critique from fellow investors.

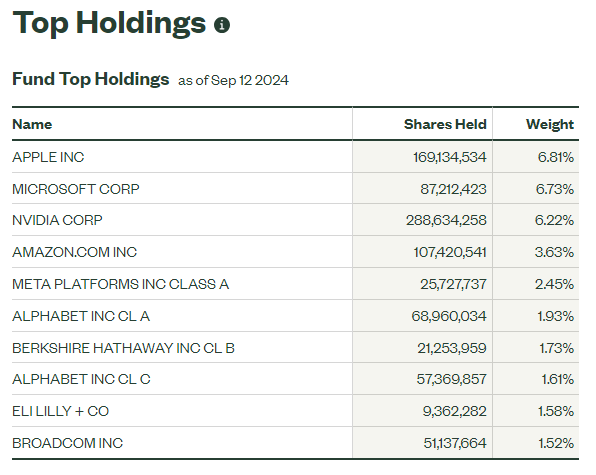

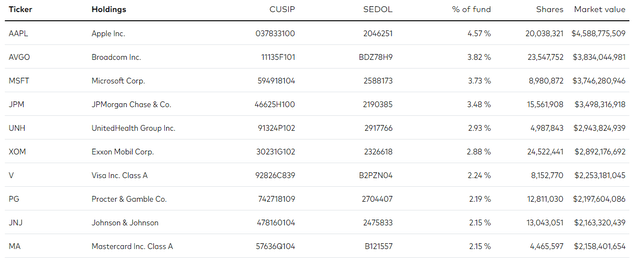

Let’s start by checking the top holdings of the market-weighted S&P 500 Index (SP500); the evidence immediately becomes evident: None of the top 10 stocks is a pure dividend, perhaps except for Broadcom (AVGO), whose dividend yield has fallen to 1.26% due to its own success with stellar capital appreciation.

VOO’s Top Holdings (Vanguard)

In theory, if you had built your portfolio purely around dividend-paying stocks with at least 2% dividend yield and 10% annual dividend growth ten years ago, you would have missed almost all of these successful businesses.

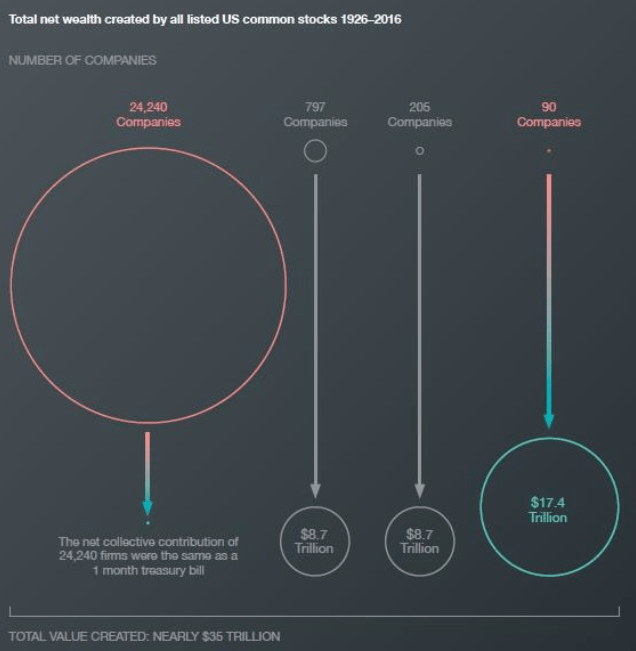

Now, maybe there is nothing wrong with missing a few success stories, but the evidence suggests that barely 4% (1,092 companies) of the stocks accounted for all the net wealth (roughly $35T) created by the US stock market.

Even worse, only 0.3% (90 companies) of all US stocks are responsible for 50% of the wealth creation.

Net Wealth Created by US Stocks (SVN Capital)

Of course, few of the 90 companies could be classified as dividend-paying stocks at some stage of their life cycle; nevertheless, limiting your portfolio just to dividend-paying stocks significantly increases your chances of missing out on the next major success story, limiting your potential to accumulate capital quickly.

What’s more, during your prime earning years, when you contribute to your portfolio, earning dividend income is basically unnecessary, other than reinvesting the dividends back into your holdings. Yet, paid-out dividends (particularly those taxed) lower the power of the compounding effect.

Naturally, as one approaches retirement, shifting strategy towards companies that pay dividends is absolutely feasible. At the end of the day, if you focus on compounding your wealth early on, you will likely end up with a larger cash pile, allowing you to buy more shares of desired holdings, capable to pay more in dividends later on.

Don’t take me wrong, I love dividends, and many holdings in my portfolio pay attractive yields, being able to redirect the positive cash flow according to my wishes; however, the problem is that if you have, let’s say, $100,000 portfolio yielding 3%, that’s $3,000/annually. It’s great to have an extra $3,000, but chances are you do not need this extra cash, and you would be better off if the company simply did not pay out the cash and reinvested instead, particularly with businesses with high ROI.

Dividend vs. Growth Stocks

The comparison between dividend-paying and growth stocks is not as black and white as it might seem.

Some great growth stocks today, such as Visa (V), Nvidia (NVDA), or MSCI (MSCI), all pay dividends, but would you classify them as dividend-paying stocks for the sake of building passive income?

As long as you are not a multi-millionaire by now, most likely not…

| Stock | Dividend Yield | Target Passive Income | Investment Needed |

| NVIDIA Corporation | 0.03% | $50,000 | $166,666,666 |

| Visa Inc. | 0.70% | $50,000 | $7,142,857 |

| MSCI Inc. | 1.14% | $50,000 | $4,385,964 |

Generally, when speaking about dividend-paying stocks or simply dividend stocks for the sake of building passive income, investors understand mature businesses such as AGNC Investment Corp. (AGNC), Altria (O) or Johnson & Johnson (JNJ), whose yields allow building an income stream for ordinary investors, without having to “break the bank”.

| Stock | Dividend Yield | Target Passive Income | Investment Needed |

| Johnson & Johnson | 3.00% | $50,000 | $1,666,666 |

| Altria Group, Inc. | 7.70% | $50,000 | $649,350 |

| AGNC Investment Corp. | 13.91% | $50,000 | $359,453 |

Now, the main reason companies pay out dividends is that management can no longer find growth opportunities within the business to invest all the retained earnings or attractive external acquisition opportunities. Hence, management returns the cash to shareholders via dividends or, now increasingly, via buybacks, which prove to be more tax-efficient.

That’s why dividend-paying companies tend to be more mature businesses, with lower volatility, able to withstand better economic stocks, which are attractive to many (including me).

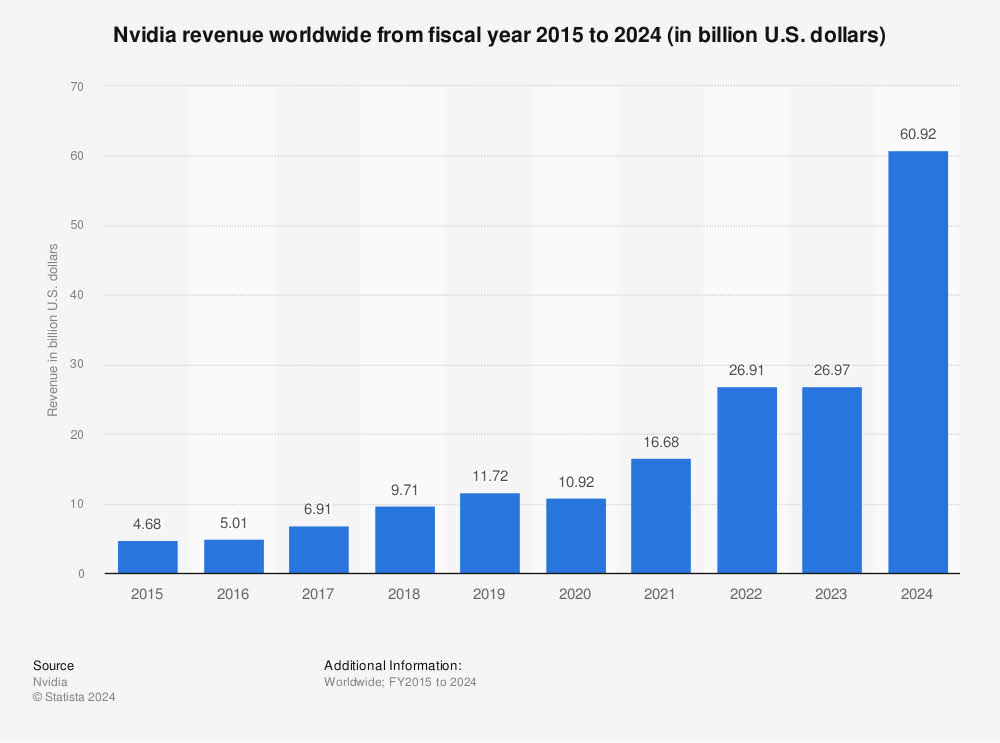

Let’s take Nvidia, for instance. The business has been on an absolute winning spree lately, thanks to the demand for GPU chips, which enable AI applications. Its revenue has increased 6x just from four years ago.

That’s a clear example of a growth stock at its finest. Of course, very few investors recognized the opportunity and bought the stock early on to capitalize on the compounding (neither myself).

NVDA Revenue Growth (Statista)

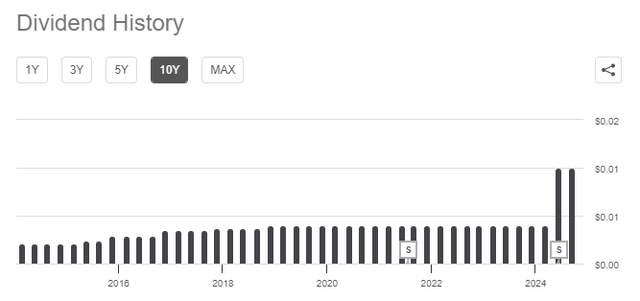

Despite its massive growth, Nvidia has paid a dividend since 2012. However, if we adjust the data by the stock splits, the dividend has been virtually flat over the past 12 years.

NVDA Dividend History (Seeking Alpha)

Now, of course, Nvidia is heavily reinvesting into its business to stay at the forefront of innovation with its aggressive one-year product cycle, so there is little incentive to increase its dividend payout because the business has better avenues to drive the compounding effect.

It’s true that in the last earnings call, Nvidia approved a fresh $50B buyback. However, that’s a pure result of the excessive cash the company started earning in a short period of time thanks to its 75% gross margin and having to park the money somewhere other than its balance sheet.

As Nvidia’s shareholder, would you want the company to start aggressively increasing its dividend and buyback if the company can instead invest in R&D to drive further growth and subsequent price appreciation? Naturally, the answer is no.

If you aim to maximize your wealth, you want the company to retain the cash and invest in the “next big thing” rather than pay a mere distribution. Nvidia’s ROI over the last five years stands at 34.4%; I doubt many investors will find investment opportunities with a similar rate of return.

Let’s look at a few realistic examples that all investors with a two—or three-decade horizon should consider.

One way to approach investing is by buying ETFs. This eliminates the need for due diligence and allows investors to earn market returns via a diversified portfolio, an approach that suits most passive investors.

Let’s look at the data from the last ten years:

- Investor 1 bought shares worth $10,000 of Vanguard S&P 500 ETF (VOO)

- Investor 2 bought shares worth $10,000 of Vanguard Dividend Appreciation Index (VIG)

- Investor 3 bought shares worth of $10,000 of Schwab U.S. Dividend Equity ETF™ (SCHD)

Growth of $10,000 (Portfolio Visualizer)

After ten years, the results are the following:

The growth market-weighted index VOO turned $10,000 into $26,113, or a CAGR of 13.02%, with dividends reinvested.

The second investor’s purchase of shares of the dividend appreciation index turned $10,000 into $24,255, or a CAGR of 11.58%.

In fact, VIG’s top holdings, such as Apple (AAPL), Broadcom, Microsoft (MSFT), and JPMorgan Chase & Co. (JPM), are very similar to VOO’s, yet still underperforming, missing a few key growth players.

VIG’s Top Holdings (Vanguard)

The third investor, buying shares of SCHDs, where the companies tend to be more mature, with the ETF yielding over 3%, turned $10,000 into $24,857, or a CAGR of 11.71%.

Of course, we can argue that the last decade has heavily favored tech businesses or, perhaps, that higher interest rates of the past two years have negatively affected the returns of dividend-paying stocks; nevertheless, the currently more growth-oriented VOO outperformed both dividend-paying ETFs by a margin on roughly 1.5%.

Perhaps that does not seem like much, but consider that even a 1-2% change in ROR over as long a period as 30 years will lead to significantly different wealth.

| Invested | Annual ROR 8% | Annual ROR 10% | Annual ROR 12% |

| $100,000 | $1,006,265 | $1,744,940 | $2,995,992 |

The difference becomes even more alarming if we look at individual stocks.

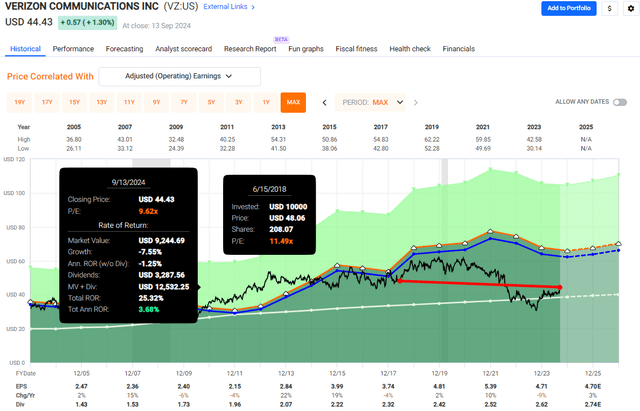

For instance, one of the first businesses I ever bought back in 2018 was Verizon (VZ); at the time, stock yielded around 5%; what an opportunity!

If I held the stock up to today (I do not), I would have earned a mere 3.68% annual ROR, significantly lower than simply by buying market-weighted VOO.

VZ Stock Performance (Fast Graphs)

Let’s look at another.

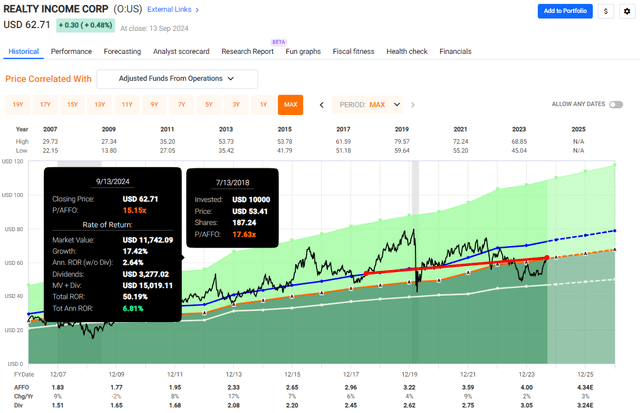

Realty Income (O) is discussed daily on Seeking Alpha. The monthly dividend company is excellent for people who depend on passive income, yet if you bought the stock in 2018 at its fair valuation of 17.5x P/AFFO, you would earn a meager 6.81% annual ROR.

That’s certainly not something younger investors should entertain.

O Stock Performance (Fast Graphs)

Many of these bond-like businesses are great buys when their valuation is depressed. For instance, I bought Realty Income at around $50/share when the REIT got crushed last year and earned 30% on capital appreciation alone, but that’s another story.

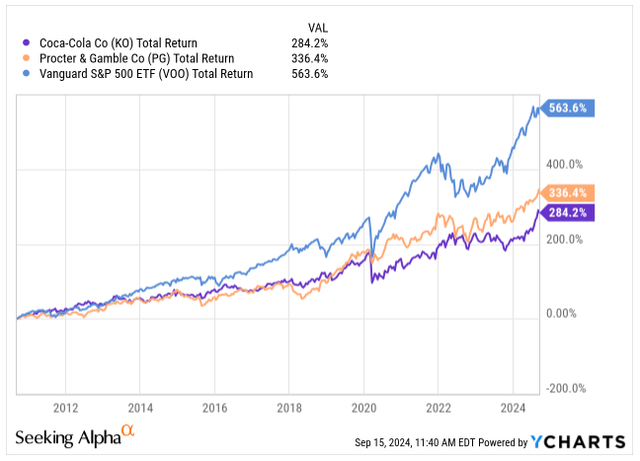

There are countless stories of quality dividend companies such as Coca-Cola (KO) or Procter & Gamble (PG) simply not providing enough return to justify buying them for younger investors.

KO, PG, VOO Performance (Seeking Alpha)

Why Are Dividends Not Superior?

Many investors think dividends are a free lunch, yet in fact, dividends lower the amount of cash on a company’s balance sheet, which in turn lowers the company’s equity value.

Whenever you buy a dividend-paying company a day before its ex. dividend date, very often on the following day, the company’s stock price drops by a similar amount to that of the dividend that is expected to be paid out.

So, in essence, dividend distribution is withdrawing money from the business, which could have otherwise been compounded if it had been invested into opportunities with attractive ROI.

That’s assuming you invest in a business with healthy cash flows, capable of paying dividends for a prolonged period.

However, if you find yourself holding on to a company that has announced a dividend cut or complete elimination of dividends, you might experience a significantly worse outcome, with capital loss, either temporary or permanent.

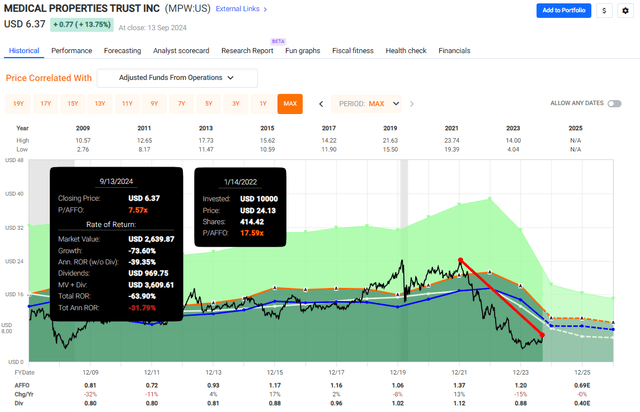

Similar to what happened with Medical Properties Trust (MPW)…

MPW Stock Performance (Fast Graphs)

Growth Stocks are Superior, But Riskier As Well

Whenever I look at my own personal portfolio, which you can find here, all the multi-baggers of the previous past 7 years of my investment career are growth stocks.

Businesses such as Visa, Google (GOOGL), Booking.com (BKNG), and MSCI (MSCI) all at least doubled in value in my portfolio, and none of them is what I would refer to as a dividend stock, even though all now pay a small distribution.

That’s precisely what I want to own in my portfolio, as I have three decades to go before withdrawing any funds from my investment portfolio, with the hope the gains will further compound.

There are a few common attributes with big winners:

- Big winners compound their gains over long periods

- The gains of the big winners offset the losers in one’s portfolio, by far

- The volatility of these big winners (particularly if smaller companies) might be large, but over the long term, that won’t matter

Now, we need to establish that not all growth stocks are winners of tomorrow.

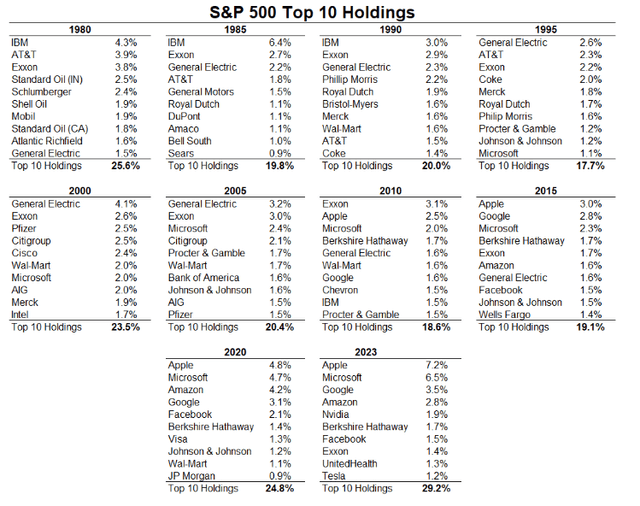

Let’s look at the top 10 holdings of the S&P 500 over the past 40 years. We can immediately see that companies such as International Business Machines (IBM), AT&T (T), and Exxon (XOM), which dominated the index between 1980 and the early 2000s, are no longer among the top holdings.

S&P 500 Top Holdings Evolution (Author’s Graph)

Growth companies face life cycles as well; not every company can continuously innovate and stay at the forefront of its industry, or simply, its industries are no longer considered the industries of tomorrow, such as Oil or Telcos.

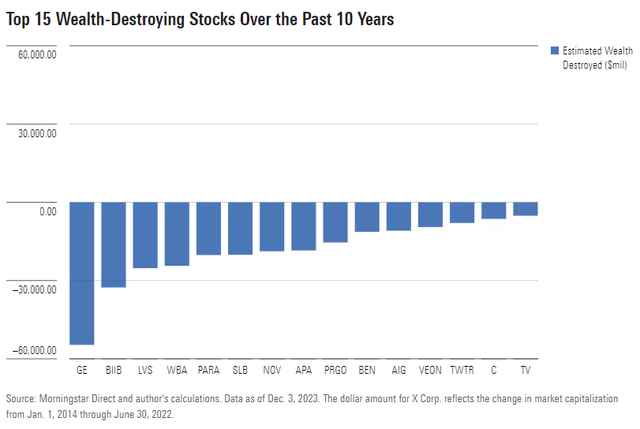

There are countless companies that went bust as well, completely wiping out capital and their shareholders with a permanent capital loss. Ouch!

Top 15 Wealth-Destroying Stocks (Morningstar)

That’s why when I say growth stocks are a superior choice for younger investors, I do not mean to go out there and buy any growth stock. Not at all.

Instead, due diligence of the business is an absolute must, and one should not overpay for the business because as growth slows, stocks get repriced. Even if you bought the next Apple, but at a premium valuation, you might face years of underperformance even as fundamentals improve.

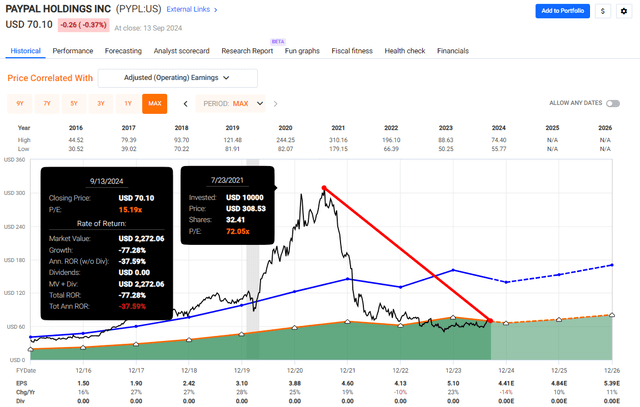

As an example, we can look at PayPal Holdings (PYPL), a superb growth stock from 2015 to 2020. However, as competition heated up in the fintech space and growth slowed, the company’s shares got crushed, leaving investors who bought the shares at 2021 high with a 77% loss in three years, even though 2024 EPS of $4.41 is expected to be just a shy away from 2021 peak.

PYPL Price Performance (Fast Graphs)

Ultimately, the formula for total ROR is: Change in Valuation + Dividends + Earnings Growth

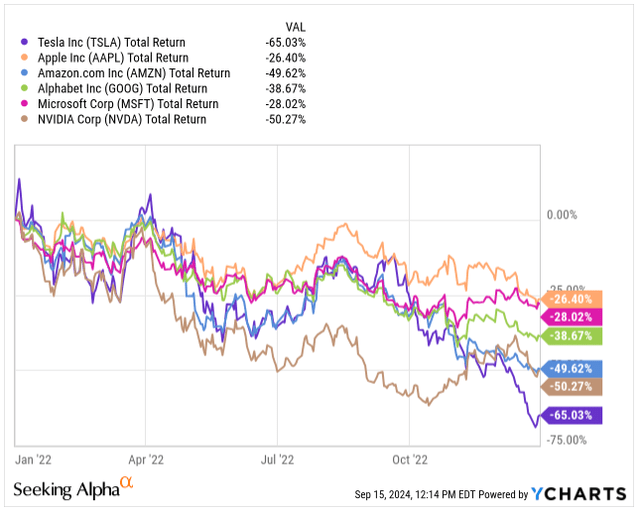

Take 2022, for instance. As the FED started hiking rates, with economists widely expecting a recession, growth stocks plummeted, giving up most of their 2020–2021 gains. Investors had the opportunity to buy companies discounted.

Stock Price Performance (Seeking Alpha)

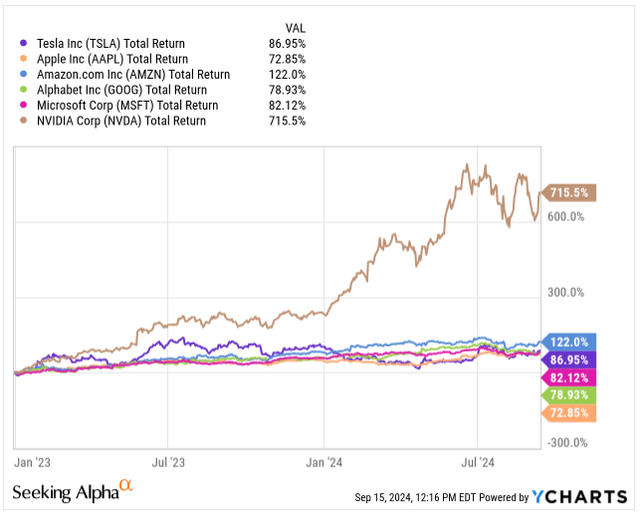

However, in 2023 and 2024, as the recessionary fears subsided and GDP growth accelerated, the top growth stocks returned and recovered all their losses and then some.

Stock Price Performance (Seeking Alpha)

This shows us that while quality growth stocks offer higher return potential, they also come with significantly higher volatility, which might perhaps not be for everyone to stomach.

Investor’s Takeaway

All in all, as a younger investor, you might want to own growth stocks during bull markets to capture the greater returns these companies may offer.

However, during economic drawdowns, it might be wise to reduce exposure to growth stocks and lower portfolio volatility by rotating some of the gains to more mature and stable dividend-paying companies.

Otherwise, for those with a stomach for volatility, market corrections and crashes present a great opportunity to add quality growth holdings to your portfolio at a fraction of the cost, especially if your investment time horizon is another 20–30 years.

The downside is that you might need to sell some of the stocks as a growth investor to realize some of the returns.

As you approach retirement and the investment time horizon shrinks, rotating towards more stable and mature businesses might be wise, reducing volatility and building a passive income from the wealth you accumulate throughout your lifetime.

The last thing anyone wants is to lose all the capital gains on a growth stock as growth slows, or the company is repriced.

Read the full article here