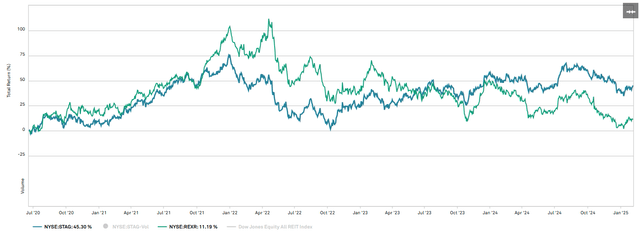

In the trading activity following Rexford Industrial Realty, Inc.’s (NYSE:REXR) Q4 2024 earnings report, it dropped another 2+% taking it to more than 50% below its 2022 peak.

SA

Is REXR now a bargain?

Are the fundamentals broken?

This article will dig into the factors underlying the success and struggle of Rexford to discern what opportunities and risks lie ahead.

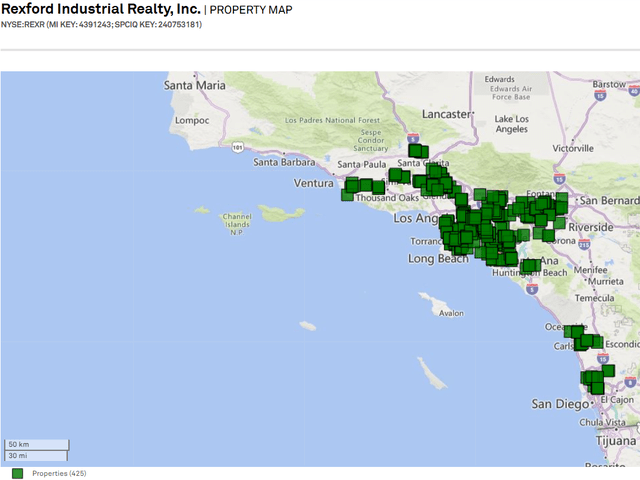

Brief overview of assets

Rexford owns a concentrated portfolio of premium warehouses in the Inland Empire. It charges a whopping $16.71 per square foot of annual rent to tenants. These are the highest caliber warehouses in cost of location and property level functionality.

S&P Global Market Intelligence

With a $9 billion market cap, REXR has achieved efficient scale, and the company is broadly regarded as well managed.

The quarter

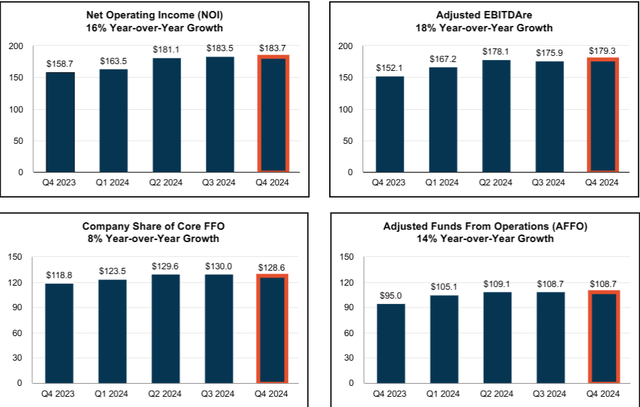

REXR’s growth rate has been slowing for a while, but this quarter put an exclamation point on it. Headline metrics all came in fairly strong with 8%-18% year over year growth in FFO, AFFO, EBITDA and NOI.

REXR

However, much of this was due to the still remaining mark-to-market. Vintage leases were still at rates of the 10 years ago market environment when rent per foot was much lower. As such, REXR was able to get sizable rent spreads on re-leasing which was a main contributor of growth in the above metrics.

Market rents are a different concept from mark-to-market because market rents compare asking rates to asking rates rather than asking rates to vintage lease rates.

It is in market rental rates that REXR’s submarkets are showing weakness as explained on their earnings call by Laura Elizabeth Clark (Rexford’s COO).

“Regarding market rents, we observed a decline in taking rents for quality products comparable to the Rexford portfolio of 1.5% sequentially and 8% year-over-year. This compares favorably to the broader infill markets which are down 12.5% year-over-year and even more favorably when compared to the larger box market in the Inland East and West, where rents have declined approximately 25% year-over-year according to CBRE.”

Rexford is doing the equivalent of producing alpha in a down stock market. They had strong asset selection, but in a really rough submarket.

East Group Properties (EGP) also reported Q4 2024 earnings, and their report made it evident just how challenging the Inland Empire industrial market is right now. EGP operates primarily in the sunbelt and their numbers came in quite strong.

Brent Wood (EGP’s CFO) noted:

“We still are seeing strength in our rental rates, running that 50% GAAP increase”

Marshall Loeb (EGP’s CEO) described his perspective on the rough southern California markets:

“That’s been the unique factor for the California markets that we just haven’t seen in our other work Dallas and Atlanta have had 40 and 50 consecutive quarters of positive absorption. They’ve had a few quarters of negative absorption in California.”

It’s not that the California markets are bad industrial markets. They had truly explosive growth earlier in the cycle. Rexford was signing new leases at more than double expiring leases. These markets are just boom and bust.

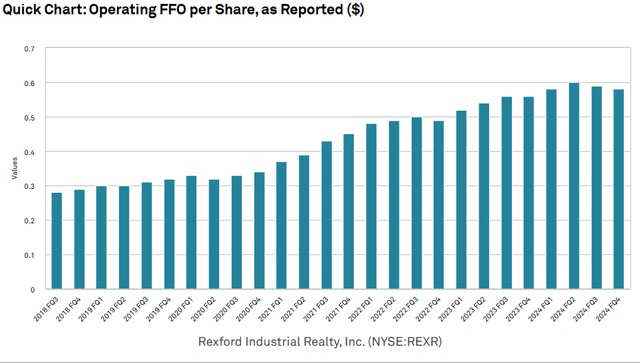

Rexford is a well managed company and they used the boom period to massively increase their FFO/share. REXR essentially doubled its earnings in the last 6 years.

S&P Global Market Intelligence

Given this success, it is hard to fault Rexford for concentrating its assets where it did. They know the submarkets better than anyone and have legitimately outperformed.

So why is Rexford stock down 50%?

That, in my opinion, is not Rexford’s mistake, but rather the stock market’s mistake.

At its peak, REXR was trading at multiples in the mid-30s. The market treated the boom in Inland Empire industrial as if it were secular growth even as there were clear fundamental signs of its cyclical nature.

One of the most persistent mistakes of the market is the presumption that the premium level product is the better product. REITs with higher rent per foot almost universally trade at higher multiples, but multiple should be related to forward growth rate rather than current rent levels. The market saw Rexford’s luxury segment price point and treated it as infallible.

The coastal industrial markets are not necessarily better or worse than other markets, they are just more boom and bust because the supply is not as quick to adjust to demand levels.

Fundamentals have been turning in favor of middle American industrial submarkets since mid-2020.

In a June 2020 article we noted the flip in 2 trends that had previously benefitted coastal locations:

“There were 2 factors disproportionately helping [industrial REITs] located in big cities and by seaports.

Urbanization – a trend of populations moving toward city centers

Outsourcing – more U.S. manufacturing moving overseas.

Each of these seems to be reversing with the moves catalyzed by side effects of the COVID shutdown.”

Fundamentals continued to shift in favor of inland industrial as onshoring and nearshoring of manufacturing have ramped up. It can take a long time for fundamentals to drive market pricing, but fundamentals win in the end with inland industrial REIT, STAG Industrial (STAG), significantly outperforming the coastal Rexford.

S&P Global Market Intelligence

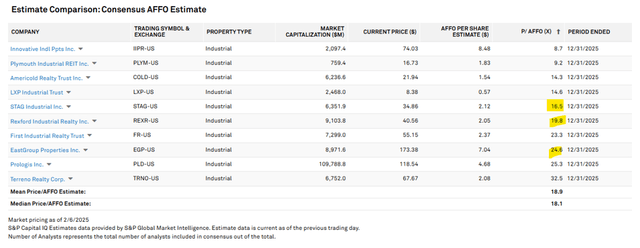

STAG used to trade at about half the AFFO multiple of REXR. EGP traded significantly lower as well despite having the best balance sheet in the sector.

In the last few quarters, organic growth rates of sunbelt industrial markets have remained quite strong while coastal markets slowed materially. As noted earlier, net absorption has been significantly negative in So. Cal. With so much evidence in the earnings reports, the market is finally catching on. Multiples have tightened considerably with STAG now only 3 turns below REXR and EGP actually above it.

S&P Global Market Intelligence

The 50% drop in Rexford’s market price was not the company failing, it was a correction of extreme optimism in the market.

At 19.8X AFFO, Rexford is trading much closer to fair value.

AFFO/share is likely to continue growing due to mark-to-market. While leasing rates are down from where they were in 2023, they are still well above where they were in 2014 so as REXR’s leases roll they will continue to gain NOI.

Overall take

Rexford Industrial Realty, Inc. is a good company trading at a fair price. I rate the stock at neutral.

Being priced near fair value makes REXR unexciting today, but it is well worth following because of the erratic way in which the market prices the stock.

Just as the market extrapolated the boom of their submarket to perpetuity, the market may extrapolate the bust. Downward momentum could take the stock well below fair value at which point we would be happy to scoop it up.

REXR is a strong company with good assets, good management and a healthy balance sheet. It is merely going through the rough parts of the natural cycle.

Read the full article here