It has never happened so it will never happen. That is the mantra of those that stick their thumbs at warning signs. In this particular case we are talking about the fund known as DNP Select Income Fund (NYSE:DNP). The fund has been around for a long time and has maintained a large distribution through thick and thin. So the logic is that it won’t happen, ever. We are telling you that you are wrong.

The Fund

DNP invests in a diversified portfolio utilities, with some bonds and preferred shares at the edges. The fund like most others in the Closed End Fund space, focuses on current income. The fund has also mentioned potential growth of income as well as capital appreciation. As we shall see, the latter two will be impossible in today’s environment.

Holdings

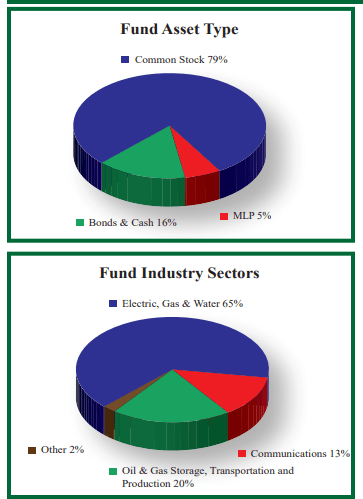

Equities and MLPs form about 84% of the fund total, with cash and bonds making up 16%. The fund is primarily focused on utilities and midstream assets with some exposure to the communication sector.

DNP Factcard

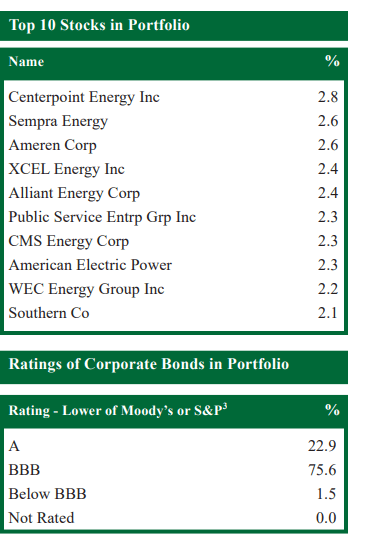

Looking at the percentage in individual holdings as well as the ratings of the corporate bonds, it is clear that the fund is not out to take risk.

DNP Factcard

So there are no red flags in the holdings and if we move on to the performance, again, there are none.

Performance

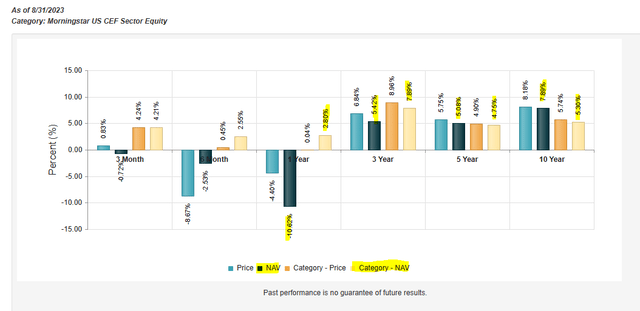

DNP has outperformed the sector equity benchmark on NAV over the past 10 and 5 years. It has lagged the same over the last 3 and 1 year timeframes.

CEF Connect

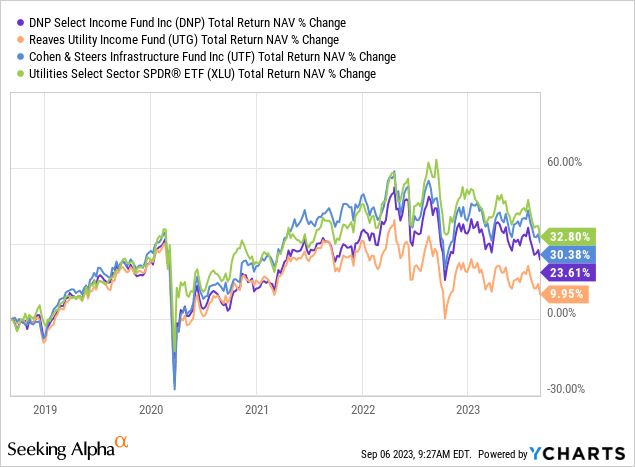

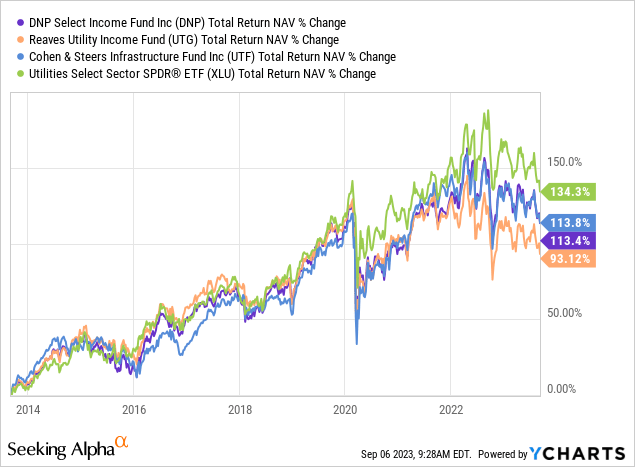

Those are not necessarily the best comparatives as “sector equity” category includes pretty much all sector focused funds. This will include real estate, technology, energy and even precious metal focused funds alongside utility funds. So those averages don’t tell the story. Better comparatives would be just funds that make their bread and better from the same segment. Here we used two closed end funds and one ETF, i.e.

1) Reaves Utility Income Trust (UTG)

2) Cohen & Steers Infrastructure Fund (UTF)

3) Utilities Select Sector SPDR Fund ETF (XLU)

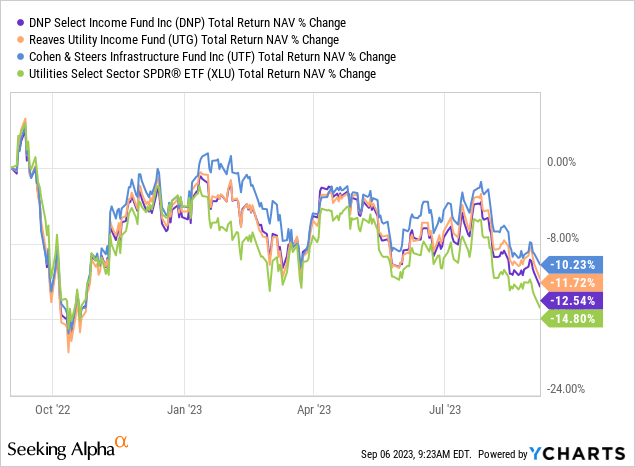

Over the past 1 year, DNP is near the bottom on a total return NAV basis, though it is close.

Over 5 years, DNP finds itself again in third place. Interestingly, here we see XLU rise to the top and we think that is where the unleveraged nature of XLU had the maximum effect on performance.

Finally, over the last decade, the placements are identical to what we saw over the last 5 years. DNP consistently coming in third in all three timeframes should first open your eyes that this is not a special fund.

With that said, let us look at three specific reasons why the distribution is likely to be cut.

1) Utilities are in a bad place

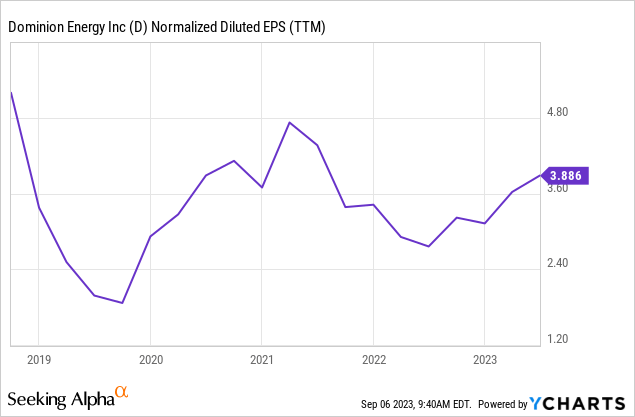

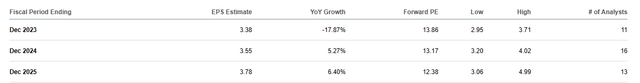

Utilities are in constant need of capex and a lot of that is not even remotely discretionary. Sure, they have a “cost plus” recovery model and that guarantees returns. But even that model is not exactly foolproof. The regulator can and do dictate how the returns on equity are shaped and can often reject return profiles they don’t like. This tendency increases during recessions (we think that we are about to go into one soon). The other side of the capex is that it is funded through debt and equity. Cost of both has been rising as interest costs go up and stock prices fall. Utilities are likely to generate poor to extremely poor returns over the next few years. Just see the example from Dominion Energy (D) which has been in full deleveraging mode over the last 5 years. Earnings are lower today than in 2019.

Earnings will be lower in 2026 than they were in 2019.

Seeking Alpha

Most utilities are on track for a similar lost decade as interest rates and cost of equity crush all “growth”.

2) Deleveraging Will Magnify DNP’s Pain

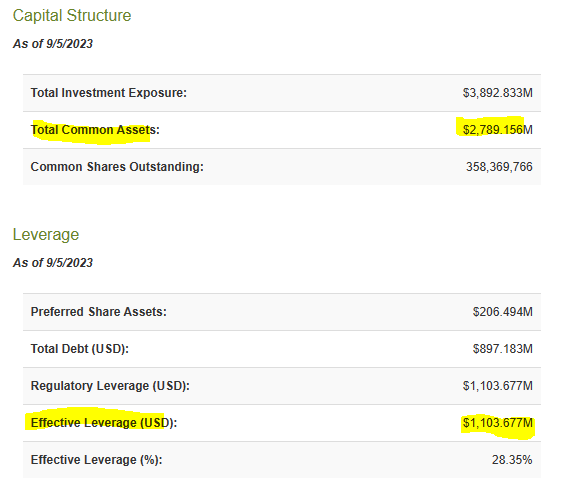

Like almost all closed end funds, DNP is leveraged. Unlike the candy coated 28.35% figure shown below, which looks at leverage as a percentage of total assets, we prefer looking at leverage as a percentage of total assets.

CEF Connect

That works out to about 40% and is what we believe to be dangerous territory. If you assume that XLU declines 20% in a recession then DNP likely declines 28% on NAV. Maintaining the same distribution likely forces NAV declines near 35%. To maintain even these same levels of leverage, DNP would have to sell a lot of its holdings in that scenario. A buy high, sell low situation.

3) Leverage Costs At Fund Level Likely To Explode

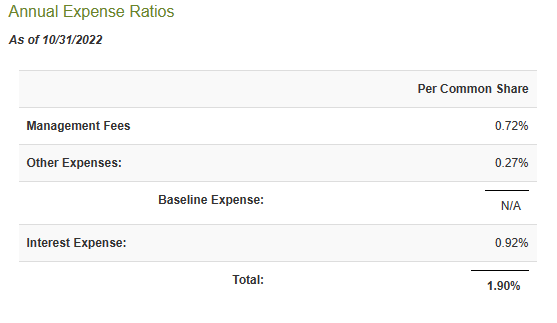

DNP’s biggest problem is likely to be its leverage costs. The last shown annual expense ratios were at 1.90%.

CEF Connect

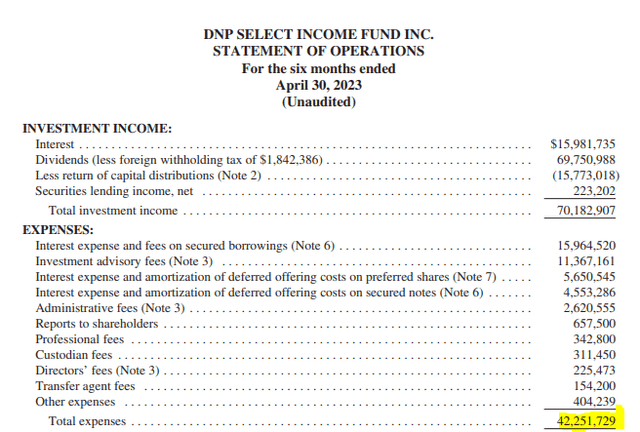

The semi-annual report shows that expenses were $42.25 million on $3.18 billion of net assets.

DNP Semi-Annual Report

That works to 2.65% annualized.

About $600 million of debt is on a floating rate.

Interest is charged at daily Secured Overnight Financing Rate (“SOFR”) plus an additional percentage rate of 0.95% on the amount borrowed. Prior to December 1, 2022, interest was changed at 1 month LIBOR plus an additional percentage rate of 0.85% on the amount borrowed. The Bank has the ability to require repayment of the Facility upon 179 days’ notice or following an event of default. For the six months ended April 30, 2023, the average daily borrowings under the Facility and the weighted daily average interest rate were $598,000,000 and 5.31%, respectively. As of April 30, 2023, the amount of such outstanding borrowings was $598,000,000 and the applicable interest rate was 5.76%.

Source: DNP Semi-Annual Report

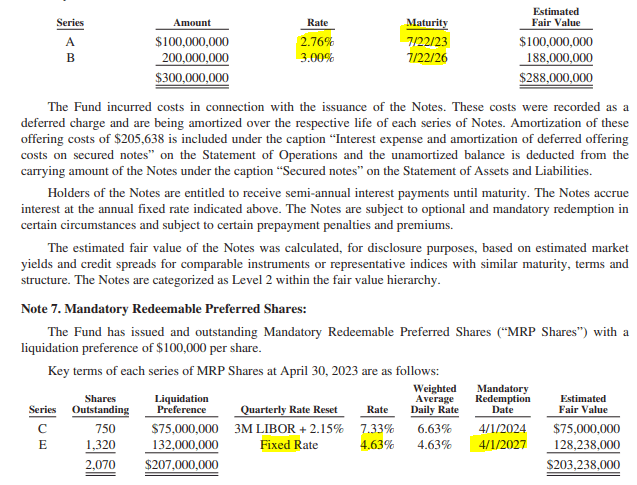

Some additional low cost debt/equity will be refinanced far higher.

DNP Semi-Annual Report

All of this likely pushes total returns far into negative territory and eventually forces a cut.

Verdict

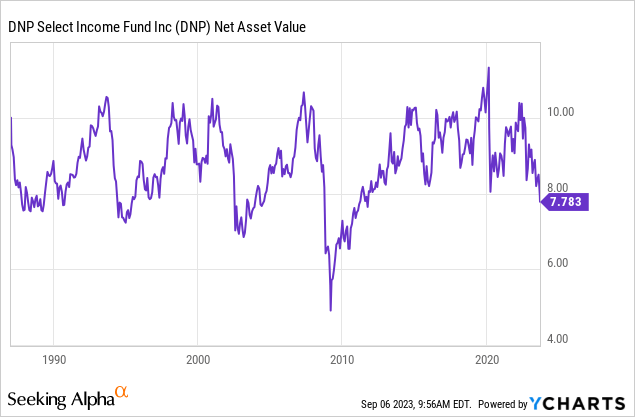

But it has never cut! One problem with extrapolating the past here is that we have never had such a massive reset on so much debt at the same time. So while the NAV has been in this neighborhood, it has not done so with so many headwinds. At the bottoms in 1995, 2002 and 2009, Utilities traded near 10X earnings. Today we are still at 15X.

So the headroom we had in the past has gone.

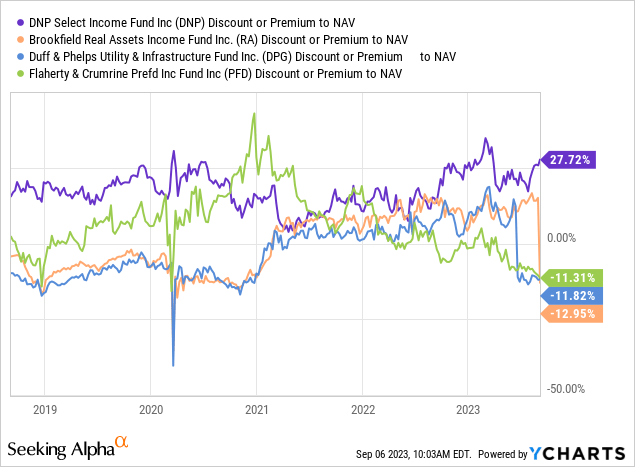

Of course the biggest problem for DNP is that it is not just riding on hopes and dreams of that distribution being maintained. It is levitating on the most egregious premium to NAV. Over the last year, three other fund investors found out just how expensive it was to pay these kind of premiums.

Investors in Brookfield Real Assets Income Fund (RA), Duff & Phelps Utility and Infrastructure Fund Inc (DPG) and Flaherty & Crumrine Preferred Income Fund (PFD) all lost massive amounts of capital chasing the butterfly.

The most instructive thing about the chart above is risk-management.

For every 1 hit you take chasing a silly premium like this, you need at least 9 others to work out flawlessly to justify paying the premium.

In other words, risk-management always pays off collectively, even though there will be the occasional exceptions. We maintain DNP at a Strong Sell.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Read the full article here