When I last looked at DraftKings Inc. (NASDAQ:DKNG) back in June, I wrote that in the near term I’d make the bet that DKNG would hit adjusted EBITDA positive in Q2 and that the stock would jump on the news, but from a long-term investment perspective, the stock’s valuation would keep me on the sidelines outside that trade opportunity. Let’s catch up on the name and see if that still holds true.

Company Profile

As a refresher, DKNG offers sports betting, online casino games, and daily fantasy sports through its online sports betting platform. The company operates under the DraftKings and Golden Nugget brands.

The company makes money in a few different ways. With sports betting, it takes a piece of the action and tries to have bets even out by adjusting the spread so as not to take a side. With fantasy sports, it collects more money in entry fees than it pays out. On the online casino side, it either sets the odds in its favor or has a set return that goes to players.

Near-Term Bet Pays Off

Keeping with the betting theme, I said there was a good probability that DKNG would hit adjusted EBITDA profitability in Q2, excluding stock-based comp, and that the stock would pop. On that front, the trade would have paid off.

For Q2, DKNG did indeed turn adjusted EBITDA positive, posting adjusted EBITDA of $73.0 million compared to a loss of -$118.1 million a year ago. The stock rose 5% on the news, and the stock is up 20% since my write-up.

For the quarter, DKNG continued to put up solid numbers, with revenue surging 88% to $875.0 million. That easily topped analyst estimates at the time for revenue of $762.8 million. Adjusted EPS came in at 14 cents versus an expectation for adjusted EPS of -14 cents.

Monthly Unique Payers (MUP) jumped 44% to 2.1 million, while average revenue per MUP climbed 33% to $137.

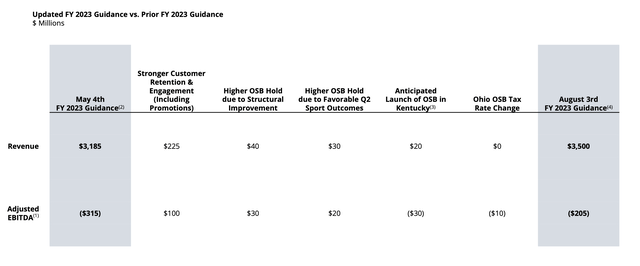

Looking ahead, DKNG upped its full-year revenue guidance to a range of between $3.46-3.54 billion, up from prior guidance of between $3.135-3.235 billion. That equates to growth of 54-58%.

The company now expects to post full-year adjusted EBITDA of between -$190 million to -$220 million, an improvement from a previous forecast of -$290 to -$340 million.

For Q4, the company is forecasting revenue of nearly $1.2 billion and adjusted EBITDA of between $150-175 million.

DKNG credited improved customer retention, acquisition, and engagement for $225 million of the improved revenue forecast and $100 million towards the EBITDA improvement. The introduction of in-house same game parlay capabilities and new live betting markets have helped increase its hold percentage, which accounts for $40 million of the revenue improvement and $30 million of EBITDA improvement.

Company Presentation

On its Q2 earnings call, CFO Jason Park said:

“We have seen significantly better-than-expected engagement on MLB, due to our enhanced product. Structural hold was also above expectations at approximately 9% for the quarter, while promotional intensity improved together supporting more than 550 basis point year-over-year improvement in our adjusted gross margin rate to 47%. Fixed expenses were slightly better than expected as we manage vendor-related costs and exerted discipline on our compensation expense. We were particularly pleased with the results in our more mature online sportsbook, iGaming States. In our states that launched from 2018 through 2021, combined handle growth accelerated quarter-over-quarter and increased more than 35% compared to the same period in 2022. In these states, revenue increased more than 70% year-over-year. Adjusted gross margin rate increased more than 800 basis points and external marketing declined more than 10%, while total unique customers increased approximately 25%. These strong results and our visibility into continued improvement have enabled us to raise our full year 2023 revenue guidance.”

The company expects to launch in Kentucky September 28th. It will also enter North Carolina, Vermont, and Puerto Rico once it gets licensure and regulatory approval.

Not only did a bet on DKNG hitting adjusted EBITDA profitability pay off, but metrics across the board were strong in Q2. Engagement is improving, which bodes well for football season, which is one of the most popular sports people bet on. Its introduction of different types of parlay bets is also bringing in money and increasing its hold rate, which is a nice combination.

Meanwhile, as markets mature, it doesn’t have to be as aggressive promoting its offerings to obtain new customers. However, it still has new markets coming online, as states continue to legalize online sports betting.

More Competition Coming

PENN Entertainment, Inc. (PENN) made a big new last month when is announced a new strategic partnership with ESPN ahead of football season. The casino operator will pay the sports broadcaster, owned by Disney (DIS), $1.5 billion in cash and $500 million in warrants, to use the ESPN brand for its sportsbook and marketing and branding support. The deal is for ten years, and puts PENN’s sportsbook front and center across ESPN’s broadcast, website, social media, and streaming users. PENN thinks the deal can eventually generate $500 to $1 billion in EBITDA a year from the deal.

This deal could ramp up competition for online sports bettors and fantasy players. Similar partnerships haven’t also lived up to the initial hype, although none of the other deals had the same brand power as ESPN. PENN’s sportsbook will now be called ESPN Bet, and bettors will be able to make wagers through ESPN’s digital sites.

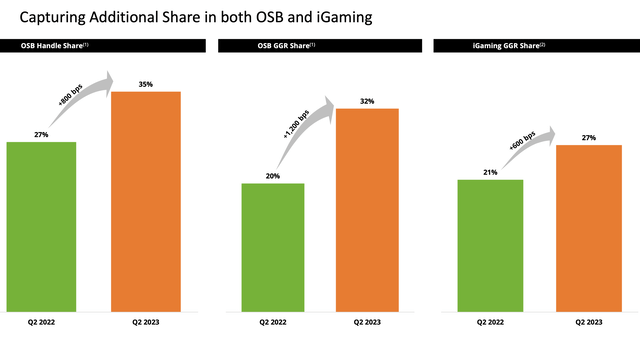

While the deal certainly ups the competition, DKNG is still one of the most recognizable brands around, and its built-in fantasy sports user base makes adding new customers a smooth transition as online sports gambling is legalized in various states. The advantage that it and FanDuel have in this area and their tried and true method of enticing new gamblers has made it difficult for other companies to find a ton of success. DKNG has been taking share, and I’m not sure if this deal changes that.

Company Presentation

Valuation

DKNG is not expected to turn EBITDA positive until 2024, when it is forecast to generate a $250.7 million in adjusted EBITDA. Analysts project adjusted EBITDA will increase to $1.58 billion in 2027. Based on 2024 estimates, it trades at 57x, while on 2027 estimates, it trades at 9x.

Revenue is forecast to grow 57% this year to $3.5 billion, getting to $6.9 billion in 2027.

I previously thought that DKNG would have trouble getting to the 2027 EBITDA consensus, which in now considerably higher when I first looked at it. That was largely due to expenses, but the company has been able to reduce its G&A by -26.5% in the first half of this year. It will pretty much have to keep expenses steady (excluding stock comp) to be able to get 2027 EBITDA margins to reach that adjusted EBITDA target (excluding stock comp) based on current revenue forecasts.

Conclusion

The “easy money” was made betting on DraftKings Inc. stock in the near term and that it would reach being EBITDA positive. The longer term becomes more difficult, as forecasting a few years out is never easy, as there are always a lot of moving parts. If the company can get close to achieving its 2027 targets, or exceed them, and still have solid growth ahead of it, it looks pretty reasonably priced.

Overall, I’d take some profits on the Q2 quarter bet and let some proceeds ride. DraftKings Inc. looks to be hitting on all cylinders, and I think the ESPN Bet threat is likely overstated. The stock is just riskier due to basing it on longer-term numbers.

Read the full article here