Truth will rise above falsehood as oil above water. – Miguel de Cervantes

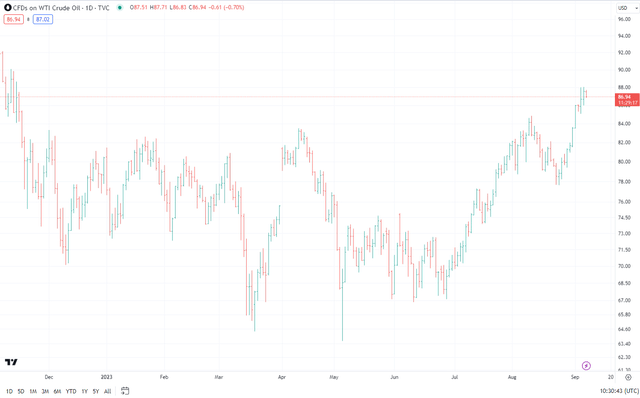

Oil has been on a tear as of late, with many now calling for another surge higher raising the risks of stagflation just as it looked like inflation is finally breaking. I’m more of the opinion this won’t happen, but in the event that it does, the question becomes how to play it as a trader. There are a number of solid funds that closely track, from a factor-perspective, the performance of Oil. I’m going to argue here that a levered ETN is not one of them.

Tradingview.com

The MicroSectors U.S. Big Oil Index 3X Leveraged ETNs (NYSEARCA:NRGU) is an exchange-traded note that provides investors with a unique opportunity to leverage their investments in the big oil industry. It’s crucial to understand the mechanics, benefits, and risks associated with investing in leveraged ETNs like NRGU. Spoiler alert – it’s a dangerous structure, particularly if a credit event occurs.

Understanding NRGU: An Overview

NRGU seeks to track 3 times the daily performance of the Solactive MicroSectors U.S. Big Oil Index. This index comprises the ten largest and most liquid U.S. stocks in the energy sector. The ETN is designed for sophisticated investors who actively manage their portfolios and are comfortable with daily trading risks. It’s important to note that NRGU is not intended for “buy and hold” strategies. The performance of NRGU is reset daily, aligning with its design to achieve its stated investment objectives on a daily basis.

I’ve talked about this before, but it bares repeating. When you use a daily reset levered vehicle, whether it’s an ETF or an ETN, what will drive a significant amount of performance is daily volatility and streaks. If volatility is high in an uptrend, you might gain, but you won’t perform that well relative to leverage because successive big up and down says, with leverage, causes decay.

There’s more than that though. NRGU is issued by the Bank of Montreal, making it a senior, unsecured debt obligation of the bank. Hence, investing in NRGU inherently involves exposure to the bank’s credit risk. This is an underappreciated aspect of ETNs. Because it’s unsecured, if a bank runs into trouble, you are actually loaning capital through the Note to an entity that may not be able to pay it back.

Diving Deeper: The Solactive MicroSectors U.S. Big Oil Index

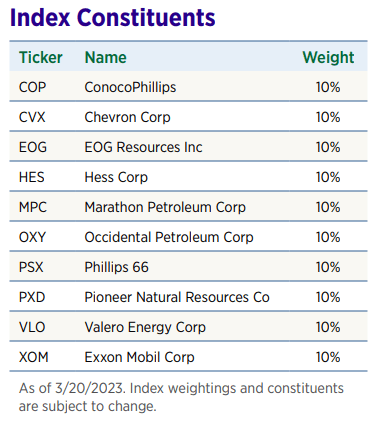

The Solactive MicroSectors U.S. Big Oil Index, which NRGU tracks, is an equally weighted index comprising the ten largest U.S. stocks in the energy sector. This equal-weighting approach provides a balanced representation of the sector, unlike market capitalization-weighted indices, where a few large stocks can dominate the performance. The index was launched in March 2019 and has been providing a unique performance benchmark for the U.S. big oil sector.

The constituents of this index are industry-leading companies, including Exxon Mobil Corporation, Chevron Corporation, EOG Resources Inc., Hess Corp., Marathon Petroleum, Occidental Petroleum Corporation, Phillips 66, Pioneer Natural Resources, Valero Energy Corporation, and ConocoPhillips. Each of these companies has a weight of 10% in the index as of the last rebalancing date.

bmoetns.com

Comparing NRGU with Peers

Comparing NRGU with other similar investment vehicles can provide valuable insights. For instance, the Energy Select Sector SPDR Fund (XLE) is a prominent ETF in the energy sector. However, unlike NRGU, XLE is significantly overweight on Exxon and Chevron. This concentration can impact the performance of XLE, particularly when these companies face challenges. On the other hand, the equal-weighted approach of NRGU ensures a balanced representation of the sector, which can lead to better performance in certain scenarios. That, combined with leverage, can either be a good thing or a bad thing purely dependent upon timing.

Technical Analysis and Performance of NRGU

The performance of NRGU can be influenced by various factors, most notably overall equity volatility, the price of crude oil and the performance of the stocks in the underlying index. For instance, in 2020, NRGU experienced a significant drop in value when the price of crude oil briefly turned negative due to the COVID-19 pandemic’s impact. However, as oil prices recovered, NRGU demonstrated a strong comeback, highlighting the potential for high returns in favorable market conditions.

Tradingview.com

Conclusion: Navigating the Oil Investment Landscape with NRGU

Investing in the oil sector can be rewarding, but it also comes with its share of risks. Leveraged ETNs like NRGU offer a unique opportunity to amplify returns, but they also increase the potential for losses. If we are indeed on the verge of a global credit event, the last thing you want to do is hold onto a leveraged product that is an unsecured debt obligation. If we are indeed on the verge of a global credit event, oil prices can fall sharply.

For me, this is one to avoid here. Yes, it’s interesting for tactical traders, but it’s a challenging time.

Read the full article here