Shares of M&T Bank (NYSE:MTB) have not been immune to the challenges facing the regional bank sector, losing over one third of their value. Last October, over concerns about deposit flight, I recommended investors sell the stock, and shares have fallen by a quarter since. Earlier this year as Silicon Valley Bank failed, deposit flight became an even larger challenge for the industry. As such, even with shares down, MTB does not yet strike me as an attractive opportunity.

Seeking Alpha

In the company’s second quarter, the company earned $4.11, adjusting for one-time items. This was up $0.10 sequentially, but there were multiple signs in the report that earnings will decline from here. Overall, the credit quality of the bank’s loan portfolio appears strong, though there were some warning signs this quarter. However, it is net interest income that is of the greater concern to me.

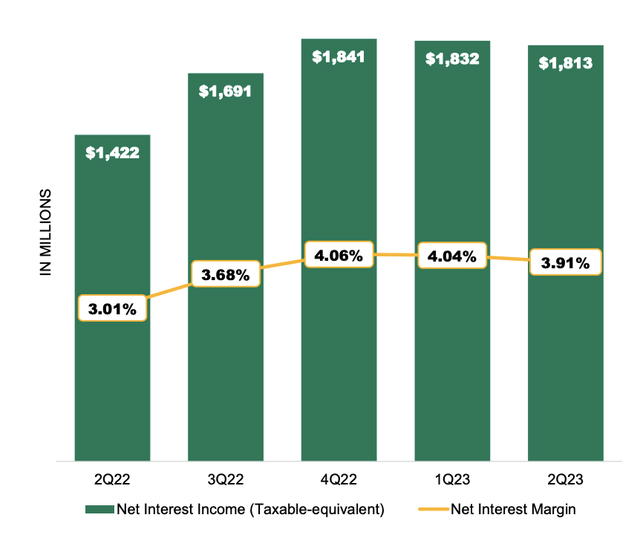

As you can see below, net interest income fell by 13bp during the quarter to $1.813 billion as funding costs rose 18bp and loan yields rose just 4bp. Typically, rising interest rates helps banks expand their net interest margin (NIM), which is what we saw in 2022 because they generally raise deposit rates more slowly than the Federal Reserve raises rates. However, the regional bank failures caused a significant competition for deposits, pushing those rates up. Given MTB had already been seeing deposit losses last year, it had to be more aggressive in protecting its franchise.

M&T Bank

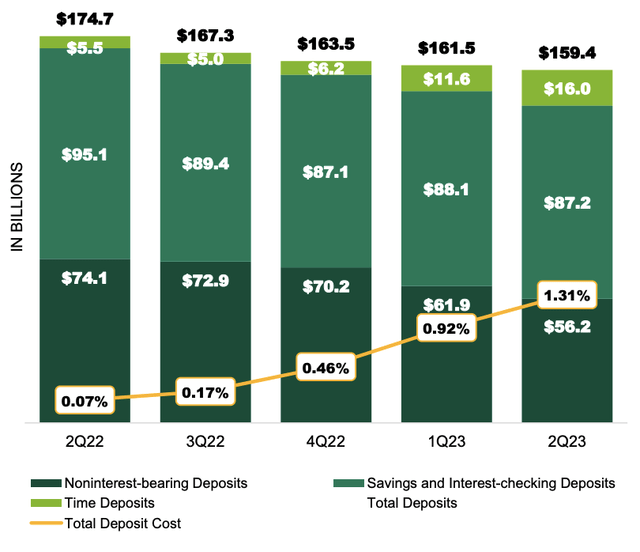

As you can see below, deposits have fallen by about 8% over the past year, with noninterest-bearing deposits falling the most sharply. After raising deposit rates just 39bp last year, its deposit costs have jumped by 85bp this year to 1.31%. This is still well below the Fed’s 5.33% rate. As a consequence, I am not certain that we have seen deposit funding costs peak for MTB.

M&T Bank

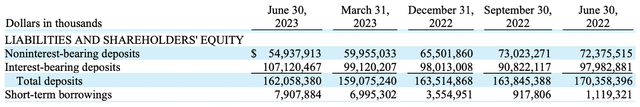

Looking at deposits in more detail, Q2 end of period deposits were $162 billion ($54 billion in noninterest-bearing and $108 billion in interest-bearing). The composition shift is quite dramatic. Since the end of the year, deposits are down just $1.5 billion, but noninterest-bearing deposits are down $10.5 billion and interest-bearing are up $9 billion. MTB is seeing significant deposit churn, paying up to replace no-cost deposits. It has also had to rely on increased short-term borrowings, which tend to be more expensive than deposits as they do not come with FDIC insurance.

M&T Bank

Management expects deposits to average $161 billion for the year, with this unfavorable mix shift persisting. This implies that deposits remain flat from here. Given that 1/3 of its deposits offer no interest, and its average deposit rate is 100bp below other banks like Capital One (COF), this strikes me as an optimistic forecast, unless MTB raises deposit rates further, which will strain net interest income. Ultimately, I expect either MTB’s funding cost or deposit level assumptions prove too optimistic.

Given the strains on deposits, I was surprised to see the bank increase the size of its securities portfolio by $1 billion sequentially to $28.6 billion. The portfolio is now $6.2 billion larger than last year, even as deposits have fallen by $8 billion. This does reduce the bank’s liquidity, and it explains why after letting deposits leave last year rather than raise rates, it has been forced to raise rates to stem outflows.

Given it has just a 3.9 year duration, MTB could allow maturities to run-off and generate substantial liquidity, which I would view as a prudent move in the face of pressure on the deposit base, but management has not chosen this path. In addition to its securities portfolio, its loan portfolio rose by 1% to $133.5 billion, up $5.9 billion last year.

Its loan and security portfolios are a combined $162.1 billion or 100% of deposits from $155.2 billion or 91% of deposits last year. This is not an unsustainable level, given its access to wholesale funding, but that funding is more expensive, as noted above. Growing the asset side of the balance sheet while your primary liability is facing pressure is an aggressive stance, and it is forcing MTB to pay more to attract deposits.

Seeing this pressure, management is guided to net interest income of just above $7 billion this year. That implies a 5-7% sequential decline in the second half vs the first half, despite having more interest-earning assets. Even if deposit rates have to move up just another 10-15bp, that could bring the sequential decline closer to 10%. Given the competition for deposits and pressure on its noninterest-bearing balances, a decline of this magnitude does not seem unlikely.

While funding costs are my primary concern, I would also note that in Q2, provisions for credit losses were $150 million. Charge-offs rose from $70 million to $127 million, but still are just a modest 0.38%. MTB has a history of very limited loan losses with sturdy underwriting standards. As a consequence, it tends to fare well during periods of credit stress. Additionally, losses can be lumpy quarter to quarter, particularly off such a low base. However, that was a substantial rise in charge-offs, and it bears watching. For now, I would assume it to be a one-off, but increasing credit losses would be another headwind for shares.

As it is retaining earnings to rebuild capital following the acquisition of People’s United last year, its tier 1 common equity capital ratio rose 42bp in the quarter to 10.6%. This is a solid level of capitalization, given its relatively low-risk lending orientation. Again, the challenges facing MTB are not on capital adequacy or credit quality so much as concerns around the funding cost and stability of its deposit base.

At the company’s guidance for funding costs, it should earn about $14-14.75 over the next year. I view the risks as being to the downside relative to this level given my concerns that deposit rates may rise further and squeeze net interest income. As such, I would look for $13-$14 in earnings, giving shares about an 8.8x PE multiple. In a vacuum, this is not expensive but with other banks trading at similar multiples that have weathered the deposit storm better, like Capital One, MTB strikes me as offering a relatively unattractive risk/reward profile. If there is another round of deposit stress, MTB is likely to be one of the banks that gets particular attention. I would sell shares here and rotate into other banks, and I would not be a buyer until about $100 or 1.1x tangible book value of $91.58.

Read the full article here