Summary

-

Carbon offsets are a hot trend in green investing, and it may be a good time to get in.

-

The voluntary offset market has seen dynamic growth in the past few years, and it is only expected to grow as companies reevaluate their carbon footprint.

-

By investing in carbon offset futures, KRBN is looking to capture the upswing in the market.

-

KRBN is the first US-listed fund that tracks Carbon Credit futures.

-

As an infant industry, the Voluntary Carbon Credit market is subject to minimal global regulation which can effect both positive and negative trends in the market.

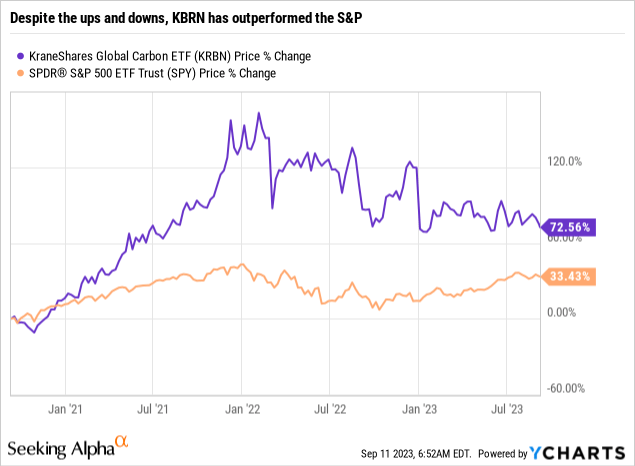

Introduction: KraneShares Global Carbon ETF (NYSEARCA:KRBN) tracks an index of some of the world’s largest cap and trade markets. The fund was founded in 2020, and to date has over 500 million in assets under management. Since its inception, the fund has an average annualized return of 33.69% While it peaked in February of 2022, since then it has been a very consistent fund.

50% of the fund’s invested assets are committed to one European holding, the European Union Allowance 2023 Future, while two California funds, the California Carbon Allowance 2023, and 2024, comprise another 33% of the fund.

The Carbon Credit industry that the fund tracks is a relatively new but dynamic element of the overall green revolution. For a deep dive into the Voluntary Carbon Credit Market, read here.

Strengths – The Voluntary Carbon Credit market as a whole is growing at fantastic rates. What is currently a $2 billion industry, is expected to grow to between $10-40 billion by 2030. While short-term, the market has seen some volatility. Overall, it has shown a steady growth path as reflected by KRBN’s annual average return. By tracking only a few of the biggest players in the industry, the fund avoids a lot of the risk inherent to startup industries.

Weaknesses – KRBN’s limited portfolio puts itself in a potentially precarious situation. The industry is for the most part self-regulated, and potentially very lucrative. As a result, it has its share of bad actors. This is an industry with literally billions of dollars being poured into it very quickly, and not all that money can be accounted for, nor can the projects always be completely verified. Thus, by putting its eggs in only a few baskets, KRBN is running the risk of catastrophic failure should one of those investments turn out to not be above board.

Opportunities – The carbon offset market continues to grow, with more and more banks and private equity funds looking to invest in project development. As a result, futures contracts can potentially be extremely lucrative. It is no secret that companies are looking to reduce carbon footprints, and until technology improves to the point where carbon zero is a real thing, carbon offsets will be a key driver in carbon reduction.

Threats – A few years ago, crypto was the new big thing. Understood by a few, but invested in by many. Everywhere you turned, ads for this exchange and that currency were everywhere. Then the market collapsed. It all came tumbling down like a house of cards. The two biggest challenges facing the carbon market right now are transparency and supply. As stated, the industry’s lack of a global enforcement program has led to a fair share of illegitimate actors selling non-existent credits, or double and triple selling credits. This occurs because the demand for carbon credits far exceeds the supply. In the short term, prices may soar, but only because of a scarcity of supply. This could potentially lead to greater volatility in the market.

Summary – The carbon credit market is expanding at an extremely high rate, and eventually supply will catch up with demand. However, as that happens, some of the smaller companies will be consumed by larger ones. By investing in only the largest exchanges, KRBN has positioned itself well to capture this industry’s upside growth. As a result, I rate it a buy for anyone looking to add a carbon credit fund to their portfolio, or even as part of a broader green portfolio.

Read the full article here