Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Chevron and private equity firm Quantum Capital Group are teaming up on a bid to buy the international assets of sanctioned Russian oil company Lukoil.

If a deal is clinched, Chevron and Quantum plan to divvy up the assets between them, valued at $22bn by Lukoil, according to people familiar with the matter.

The bid, which is spearheaded by Quantum, is for the whole portfolio of Lukoil’s international assets, including oil and gas production, refining facilities and more than 2,000 filling stations across Europe, Asia and the Middle East.

Quantum and Chevron would own and operate the assets for the long term, a promise that was likely to win favour with the Trump administration, the people said. Quantum is buying the assets in collaboration with its London-based portfolio company Artemis Energy.

The offer price of the Quantum-led bid could not immediately be established. Quantum declined to comment.

A Chevron spokesperson said the company had a diverse portfolio and continues to assess potential opportunities. “As a matter of policy, we do not comment on third-party statements, nor do we comment on commercial matters.”

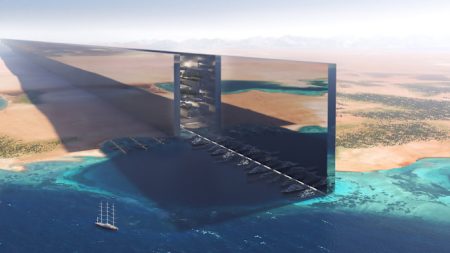

The pair are the latest bidders to enter the battle for Lukoil’s non-Russian assets, which have drawn bids from Carlyle and Abu Dhabi conglomerate International Holding Company.

The auction process was kick-started in November when Swiss commodities trader Gunvor backed out of a deal with Lukoil for the assets after the Trump administration said it would block the transaction and labelled Gunvor the “Kremlin’s puppet”.

Quantum, which was founded by Texan oil tycoon Wil VanLoh, had already engaged with Trump administration officials about its bid and had argued that its proposal would cement American ownership over strategically important energy assets, the people said.

A senior US government official welcomed the Quantum-Chevron proposal.

“We are looking for a divestment that places ownership of these assets into the hands of an American owner and operator ad infinitum. We do not want a buy-and-flip situation, so this is a compelling option,” the official told the Financial Times, referring to the companies’ bid.

Chevron, which previously considered its own bid for part of Lukoil’s assets, could be interested in the Russian company’s 5 per cent stake in Kazakhstan’s Tengiz oilfield, which the US company partially owns and operates.

The US Treasury department has given a dispensation for companies to negotiate with Lukoil until January 17. Any deal would require US regulatory approval, handing President Donald Trump an effective veto.

Gunvor’s deal to buy Lukoil’s international business collapsed in November when the Treasury said it would not grant the Swiss trading house a licence to operate the asset because of its alleged ties to the Kremlin.

Gunvor, which has sought to distance itself from Russia, was co-founded by Gennady Timchenko, a close ally of Russian President Vladimir Putin who left the company 11 years ago and no longer holds a stake.

Additional reporting Malcolm Moore in London

Read the full article here