European Union leaders are considering a new proposal to use about $3 billion a year in windfall profits generated by frozen Russian assets to help fund Ukraine’s war effort.

The European Commission said the proposal would be discussed at a summit of EU heads of government on Thursday.

Speaking as he arrived at the meeting, German Chancellor Olaf Scholz said he was confident fellow European leaders would agree on the plan.

“First and foremost (those profits should) be used to acquire the weapons and ammunition that Ukraine needs for its defense,” he told reporters.

The latest proposal goes further than a previous EU plan — crafted in late 2023 and agreed in principle last month — to use the interest payments and other profits accumulating in accounts in Brussels to help rebuild the war-torn country, according to a senior EU official.

A “growing majority” of European countries are now “pleading” for these funds to be used for the European Peace Facility, the official told reporters Tuesday. The facility was launched in 2021 to finance the EU’s defense and military measures globally. Unlike the general EU budget, it can be used to buy arms.

“In December, it (the EU plan) was very much about reconstruction and supporting financially the government (in Kiev) to survive. Now we are in an even more dire situation, so delivery of weapons is even more important,” the official said.

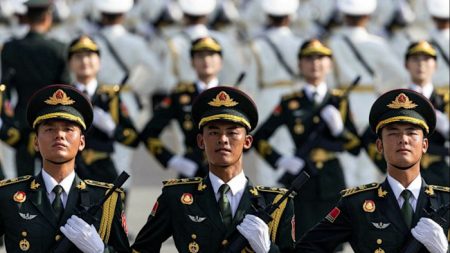

Pressure on EU states to do more to support Ukraine militarily has increased in recent months as the flow of aid from the United States has stalled and Russia has made advances on the battlefield.

The US Senate approved a supplemental bill last month that would have unlocked $60 billion of military aid for Ukraine, but House of Representatives Speaker Mike Johnson refused to bring it to the floor for a vote.

After Russia’s full-scale invasion of Ukraine in February 2022, Western countries froze nearly half of Moscow’s foreign reserves — some €300 billion ($327 billion). Around €200 billion ($218 billion) sits in the EU — mostly at Euroclear, a financial institution that keeps assets safe for banks, exchanges and investors.

Euroclear is accumulating vast amounts of cash because of payments associated with frozen Russian assets. These payments include, for example, interest paid on bonds, known as coupons, or the proceeds generated by securities that mature and are reinvested.

Last month, the group said it had earned €5.2 billion ($5.6 billion) in interest on income generated by sanctioned Russian assets since they were frozen by EU and Group of Seven countries in 2022.

The European Commission’s proposal would involve using a special levy to collect the windfall interest income on frozen Russian assets. According to EU foreign policy chief Josep Borrell, the revenue generated from these immobilized assets will be around €3 billion ($3.3 billion) a year.

“I hope that we can reach an agreement soon, and change banknotes into weapons… soldiers don’t fight with banknotes,” Borrell told reporters in Brussels Wednesday. “They need physical arms, they need physical instruments in order to defend (their) people.”

The EU and its allies are determined to make Russia foot part of the colossal bill for rebuilding Ukraine, which official figures published by the Commission in February estimated at $486 billion over the next decade.

Ukrainian authorities estimate the country will need around $15 billion this year alone to rebuild energy and transport infrastructure, as well as housing, among other priorities.

Separately, the EU agreed a €5 billion ($5.5 billion) top-up of the European Peace Facility Monday, which will be ringfenced in a dedicated Ukraine Assistance Fund that will also support the country’s military needs.

James Frater and Benjamin Brown contributed reporting.

Read the full article here