Browsing: Taxes

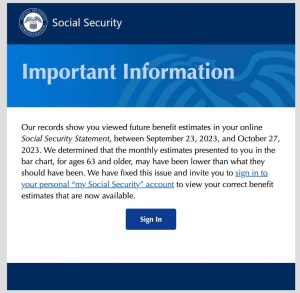

In this October 20th Forbes column, I claimed that Social Security’s website was projecting lower benefits for worker than it…

The IRS just released the 2024 contribution limits on qualified retirement plans, such as your 401(k). That’s crucial info for…

Corporations report their total cash payments of income tax — federal, state, and foreign combined — but they don’t identify,…

This episode of What’s Ahead discusses the newly released State Business Tax Climate Index from the renowned, nonpartisan Tax Foundation.…

Judge David Gustafson injected a good dose of common sense into the ongoing struggle between the IRS and the syndicators…

The United States has long seen itself as an open-for-investment free-market bastion. But concerns about national security–and some political grandstanding–…

The Internal Revenue Service on Wednesday opened the portal for car sellers to register with Energy Credits Online – a…

In the second of a two-episode series, Tim Jacobs of Hunton Andrews Kurth continues his discussion of the energy credits…

Many people are baffled about the status of conservation easement donations, which is logical given all that has happened recently.…

There is nothing inherently wrong with forming and utilizing a charitable remainder annuity trust (“CRAT”) for tax-planning purposes; people do…

Finance

Subscribe to Updates

Get the latest finance and business news and updates directly to your inbox.