Investment Thesis

Rising interest rates in the U.S. are hurting dividend chips, which are not showing high growth in financial results. However, we expect the Fed’s rate hike cycle is over and Altria Group, Inc.’s (NYSE:MO) 9.5% dividend yield looks attractive.

Menthol cigarettes ban

In mid-October 2023, the FDA presented the final version of a proposed ban on menthol in cigarettes to the White House Office of Management and Budget after receiving support from public health groups that insist that it will particularly improve the health of Black communities and prevent young people from smoking.

According to the US Centers for Disease Control and Prevention, tobacco companies target their marketing of menthol cigarettes to such population groups as Black people, helping to create health disparities and making it harder for members of these groups to give up smoking. According to the CDC, 480,000 people die prematurely from a smoking-attributable disease each year.

Tobacco companies have opposed the ban on menthol cigarettes and will challenge the FDA’s decision in court if it goes into effect.

As has been mentioned above, a study by British American Tobacco in Europe showed that about 90% of people shifted to non-menthol cigarettes, and 70% of those who gave up cigarettes took to using electronic vaporizers.

Altria conducted research that showed a similar ban in California led to the spread of illegal products. In 3Q 2023 Altria filed 34 lawsuits against manufacturers, distributors, and online retailers, claiming they are selling illicit products, in a move that suggests FDA rules on the subject lack efficiency.

However, there are studies pointing to the opposite. A study of the menthol ban in Canada found that menthol smokers quit smoking more often than those who used menthol-free products. If the menthol ban in Canada has the same effect in the United States, it would mean that more than 1.3 million US smokers will quit lighting up.

We expect the menthol cigarette ban to pass and take a toll on the industry’s growth, so we are lowering our projections for the performance of the US smokeable tobacco market from -4.4% y/y to -5.5% y/y over the forecast period.

NJOY

Following the unsuccessful investment in JUUL, Altria has shifted focus toward another player in the e-vapor realm. In June 2023 Altria purchased the NJOY company for $2.75 bln (for a 100% stake), with additional expenses of up to $500 mln contingent on market authorization of certain additional products.

NJOY is one of a handful of companies that has market authorization for its products from US regulators. Based on the recently learned lesson, Altria decided to buy full ownership of the company, unlike it did with JUUL, where it bought a minority stake of 35% while that company was awaiting an FDA approval. NJOY already has market authorization for its product.

NJOY is the third-largest e-cigarette market player, but with a market share of a mere 3%. In comparison, JUUL makes up about 26% of the market, according to Nielsen.

We assess the deal as neutral for Altria, as NJOY now has a market valued at $7 bln, but Altria has the opportunity to distribute NJOY products through various retail networks. One of the main reasons why NJOY has a low market share is nothing else but a lack of broad access to store shelves.

Altria is now actively engaging with NJOY’s staff, providing help from its own sales force. Prior to the acquisition, NJOY had a small-scale sales force, which resulted in inventory volatility and significant distribution gaps at retail, according to Altria.

In 3Q, Altria’s efforts helped NJOY distribution to rise to about 42,000 stores. In 4Q 2023, Altria plans to push that number to 70,000 stores, which would represent 70% of total e-vapor volume and 55% of cigarette volume sold in the US.

We believe NJOY could capture 16% of the market by 2030, which would generate an additional $1.12 bln of revenue for Altria, and given Altria’s average EV/EBITDA multiple and the discount rate of 13%, the NJOY stake could be valued at $3.2 bln, which is comparable with the acquisition costs of $3.25 bln.

Financial results

The trend of smoking less tobacco continues in the US. In 3Q 2023 the total volume of the cigarette market reached 42 bln units (-10% y/y). Altria’s share also dropped, reaching 47% (-0.9 pp y/y).

The US smokable tobacco market has been falling by 8% y/y since the beginning of 2022. People are increasingly shifting to milder alternatives such as electronic vaporizers and oral tobacco.

However, the average revenue per user in the smokable tobacco segment has grown by an average of 8.7% y/y over the same period, which has fully offset the industry’s decline in terms of money.

Altria is the largest player in the market with a current share of 47%. However, the company’s share has been consistently decreasing by about 1 pp y/y in favor of new brands.

Given the faster shift in people’s preferences from smokeable tobacco products to vaping devices and oral tobacco, along with the ban on menthol cigarettes that we expect to go into force, we are lowering the forecast for the cigarette market volume from 168.3 bln units (-7% y/y) to 164.9 bln units (-9% y/y) for 2023, and from 161.6 bln units (-4% y/y) to 155.8 bln units (-6% y/y) for 2024.

We are maintaining the forecast for the price of one cigarette pack at $5.59 (+7.3% y/y) for 2023 and $5.87 (+5.2% y/y) for 2024.

As a result, we are lowering the forecast for the segment’s revenue from $21 956 mln (-2.3% y/y) to $21 568 mln (-4% y/y) for 2023, and from $21 658 mln (-1.4% y/y) to $20 995 mln (-2.7% y/y) for 2024.

The oral tobacco market has expanded slightly to 462.7 million pouches (+6% y/y). Altria’s share reached 42.1% (-4.1 pp y/y). The company is developing slightly better than we estimated in this market due to the strong expansion of the on! brand, which will be launched abroad next year.

We are slightly raising the revenue forecast for the oral tobacco segment from $2 656 mln (+3% y/y) to $2 696 mln (+4.5% y/y) for 2023, and from $2 735 mln (+3% y/y) to $2 878 mln (+6.7% y/y) for 2024 on the back of a minor acceleration of price growth in the segment.

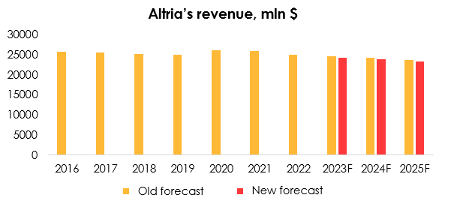

As a result, we are lowering the forecast for Altria’s revenue from $24 621 mln (-1.9% y/y) to $24 297 mln (-3.2% y/y) for 2023, and from $24 393 mln (-0.9% y/y) to $23 873 mln (-1.7% y/y) for 2024.

Invest Heroes

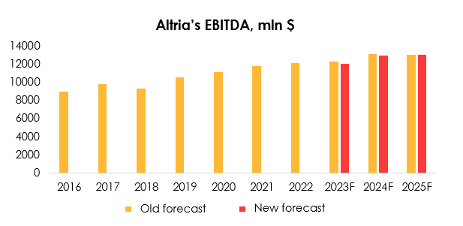

We are also lowering the EBITDA forecast from $12 293 mln (+1.2% y/y) to $12 035 mln (-1% y/y) for 2023, and from $13 126 mln (+6.8% y/y) to $12 933 mln (+7.5% y/y) for 2024.

Invest Heroes

Valuation

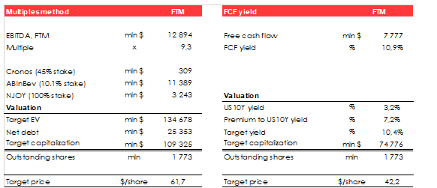

We are lowering the target price of the shares from $53.6 to $51.9 due to:

- the reduced EBITDA and FCF forecasts for 2023 and 2024;

- the reduction of net debt from $26.4 bln to $25.4 bln;

- the shift of the FTM valuation period.

Based on the new assumptions, we are maintaining the rating for the shares at BUY.

We are evaluating Altria’s target price based on FTM EV/EBITDA multiple & FCF Yield.

Invest Heroes

The company’s target price and outlook haven’t changed much from our last article. A potential ban on menthol cigarettes prompted us to lower our forecast for future cigarette shipments, but higher inflation has led to an upward reassessment of cigarette packaging costs.

That said, the company has finally moved away from the negative sentiment around JUUL and acquired a growing asset, NJOY, whose market successes will create growth drivers for the paper.

Conclusion

Altria continues to develop in the area of smokeless products. In addition, despite the headwinds for the industry, the company raises dividends and repurchases its shares.

The current dividend yield of 9.5% looks attractive to the long-term investor.

The key risk for the company is the potential failure to gain market share in the e-cigarette market. Also, risk is increased government pressure on the industry due to the high budget deficit in the US, which may require a tax hike.

Read the full article here